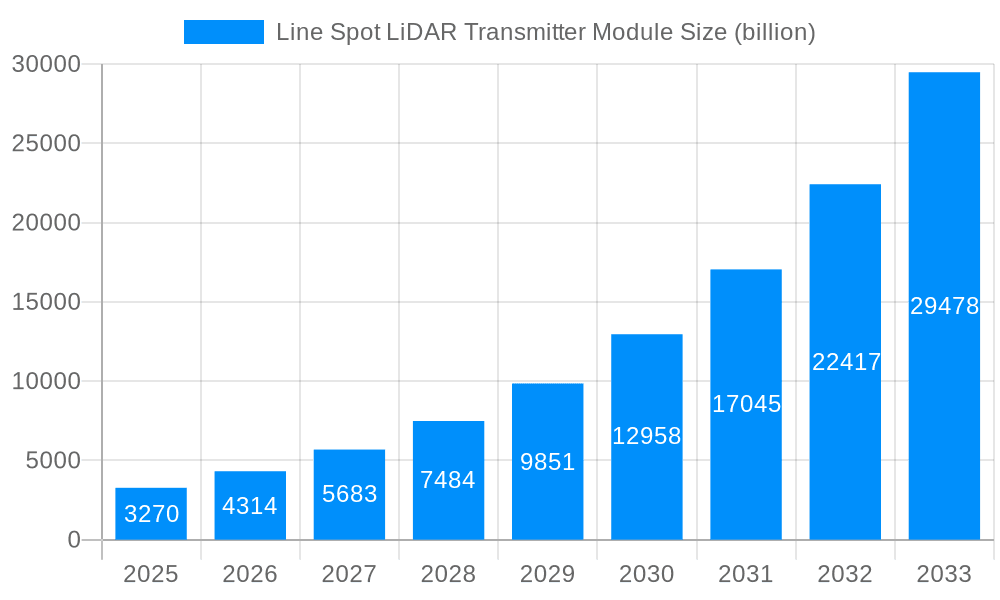

1. What is the projected Compound Annual Growth Rate (CAGR) of the Line Spot LiDAR Transmitter Module?

The projected CAGR is approximately 31.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Line Spot LiDAR Transmitter Module

Line Spot LiDAR Transmitter ModuleLine Spot LiDAR Transmitter Module by Type (VCSEL, EEL), by Application (Automotive, Industrial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Line Spot LiDAR Transmitter Module market is poised for explosive growth, projected to reach a substantial USD 3.27 billion in 2025, driven by an astonishing CAGR of 31.3%. This meteoric rise is primarily fueled by the escalating demand across automotive and industrial applications, where advanced sensing capabilities are becoming indispensable. In the automotive sector, the widespread adoption of Advanced Driver-Assistance Systems (ADAS) and the ongoing development of autonomous driving technologies are creating a significant need for precise and reliable LiDAR solutions. These modules are critical for environmental perception, enabling vehicles to accurately detect objects, measure distances, and navigate complex scenarios, thus enhancing safety and functionality. Simultaneously, industrial sectors are increasingly integrating LiDAR for applications such as sophisticated robotics, automated logistics, smart manufacturing, and high-precision surveying, where enhanced automation and data accuracy are paramount for operational efficiency and innovation.

The market's trajectory is further shaped by key technological advancements and prevailing trends. Innovations in Vertical Cavity Surface-Emitting Lasers (VCSELs) and Edge-Emitting Lasers (EELs) are leading to more compact, cost-effective, and higher-performance LiDAR transmitter modules. This technological evolution directly supports the increasing integration of LiDAR into a wider array of devices and vehicles. However, the market is not without its challenges. High manufacturing costs associated with cutting-edge LiDAR components and the complexity of system integration can act as restraints, potentially slowing adoption in price-sensitive segments. Furthermore, the development of robust regulatory frameworks and industry standards for LiDAR deployment, especially in safety-critical automotive applications, is an ongoing process that will influence market dynamics. Despite these hurdles, the overwhelming demand for enhanced spatial awareness and automation across diverse industries, coupled with continuous innovation, strongly indicates a sustained period of robust expansion for the Line Spot LiDAR Transmitter Module market.

This comprehensive report delves into the dynamic landscape of the Line Spot LiDAR Transmitter Module market, offering an in-depth analysis of trends, drivers, challenges, and opportunities shaping its trajectory from 2019 to 2033. With a base year of 2025, the study meticulously examines the historical period of 2019-2024, provides an estimated outlook for 2025, and forecasts future growth through 2033. The report highlights the pivotal role of key manufacturers such as Focuslight, and scrutinizes the adoption of VCSEL and EEL technologies across critical application segments including Automotive and Industrial sectors. The global market is poised for substantial expansion, with valuations expected to reach hundreds of billions of dollars by the end of the forecast period, driven by an accelerating demand for advanced sensing solutions.

The Line Spot LiDAR Transmitter Module market is undergoing a significant transformation, fueled by an escalating demand for sophisticated object detection and environmental mapping capabilities across a myriad of applications. The market's trajectory is characterized by a rapid evolution in technology, with a pronounced shift towards higher performance, greater reliability, and more cost-effective solutions. For instance, the Automotive segment is witnessing an unprecedented surge in demand for LiDAR, not merely for advanced driver-assistance systems (ADAS) but increasingly for fully autonomous driving capabilities. This has spurred innovation in transmitter modules, pushing for higher resolutions, extended ranges, and improved robustness against diverse environmental conditions such as fog, rain, and dust. The increasing integration of LiDAR into passenger vehicles, driven by regulatory advancements and consumer acceptance, is a primary trend. The estimated market size in the Automotive segment alone is projected to reach tens of billions of dollars by 2025, with significant growth anticipated throughout the forecast period.

Concurrently, the Industrial segment is emerging as another powerful growth engine. Automation in manufacturing, logistics, and robotics necessitates precise spatial awareness for tasks ranging from warehouse navigation to intricate assembly processes. Line Spot LiDAR transmitter modules are becoming indispensable for creating digital twins, optimizing operational efficiency, and ensuring safety in industrial environments. The increasing adoption of Industry 4.0 principles and the proliferation of smart factories are directly contributing to this trend. Furthermore, the development of miniaturized and lower-power transmitter modules is expanding their applicability to a wider range of industrial equipment. The Industrial segment's market share is expected to grow substantially, contributing billions of dollars to the overall market value by 2033.

The technological landscape is also witnessing a bifurcation, with both VCSEL (Vertical-Cavity Surface-Emitting Laser) and EEL (Edge-Emitting Laser) technologies carving out distinct niches. VCSELs are increasingly favored for their ability to be manufactured in large arrays, enabling high-resolution scanning and offering advantages in cost-effectiveness and mass production, particularly for automotive applications where scalability is paramount. Their compact form factor and suitability for 2D or 3D beam steering also contribute to their growing adoption. Conversely, EELs continue to offer superior performance in terms of power output and range, making them suitable for demanding industrial applications or long-range automotive sensing requirements. The interplay between these two technologies, each with its unique strengths, is a defining characteristic of the market's evolution. The competition and co-existence of these technologies are driving innovation and offering a wider array of solutions to meet diverse application needs.

Beyond these core segments, emerging applications in areas like smart city infrastructure, advanced mapping for surveying, and even consumer electronics are beginning to contribute to the overall market growth. The report provides a granular analysis of these trends, quantifying their impact on market size and growth rates. The continuous pursuit of higher resolution, extended detection ranges, and enhanced performance under challenging environmental conditions remains a constant across all applications. The increasing sophistication of signal processing and data interpretation further amplifies the demand for more advanced and reliable LiDAR transmitter modules. The market is not just about the hardware itself but also the ecosystem of software and algorithms that leverage the data generated by these modules.

The global Line Spot LiDAR Transmitter Module market is experiencing an unprecedented surge, primarily propelled by the relentless pursuit of enhanced safety and automation across critical sectors. The Automotive industry stands as a cornerstone driver, with governments and manufacturers alike prioritizing the integration of advanced driver-assistance systems (ADAS) and the eventual realization of fully autonomous vehicles. The inherent ability of LiDAR to provide precise, 3D environmental mapping in real-time, irrespective of ambient light conditions, makes it a crucial component for perception in these complex scenarios. The ever-increasing number of vehicles equipped with ADAS features, from adaptive cruise control to automatic emergency braking, directly translates into a burgeoning demand for reliable and high-performance LiDAR transmitter modules. Projections indicate that the automotive segment will account for a significant portion of the market's growth, with tens of billions of dollars in revenue expected annually by the end of the forecast period.

Furthermore, the widespread adoption of Industry 4.0 principles and the subsequent explosion in industrial automation are creating a robust demand for LiDAR solutions. Manufacturing plants, warehouses, and logistics operations are increasingly relying on autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and sophisticated robotic arms for improved efficiency, precision, and safety. Line Spot LiDAR transmitter modules are instrumental in enabling these automated systems to navigate complex environments, identify obstacles, and perform intricate tasks with unparalleled accuracy. The need for enhanced productivity, reduced operational costs, and minimized human error in these industrial settings is a powerful impetus for LiDAR adoption. The industrial sector is anticipated to contribute billions of dollars to the market's overall expansion.

Beyond these primary sectors, the growing interest in smart city initiatives, which aim to leverage technology for better urban management, traffic control, and public safety, also represents a significant driving force. LiDAR's capability for detailed environmental surveying and real-time monitoring makes it an ideal tool for creating smart infrastructure. Moreover, advancements in the miniaturization and cost reduction of LiDAR transmitter modules are making them more accessible and attractive for a broader range of applications, including surveying, robotics beyond industrial settings, and potentially even in emerging consumer electronics. The synergistic effect of these diverse demand drivers is creating a highly dynamic and expanding market for Line Spot LiDAR Transmitter Modules.

Despite the overwhelmingly positive growth trajectory, the Line Spot LiDAR Transmitter Module market is not without its formidable challenges and restraints. One of the most significant hurdles remains the cost of production and integration. While prices have been declining, LiDAR transmitter modules, particularly those with advanced capabilities, still represent a substantial investment for many applications, especially for mass-market consumer electronics or cost-sensitive industrial deployments. The intricate manufacturing processes, sophisticated optics, and high-purity materials required for optimal performance contribute to these costs. The drive to reduce the overall bill of materials for LiDAR systems is a constant challenge for manufacturers.

Another considerable restraint is the performance limitations under adverse weather conditions. While LiDAR excels in many environments, heavy fog, dense snow, or severe rainfall can still significantly degrade performance, leading to a reduction in range and accuracy. This necessitates the development of more robust and resilient LiDAR technologies, or the integration of multiple sensor modalities (e.g., radar, cameras) to compensate for these limitations, which in turn can add to system complexity and cost. The ongoing research and development efforts are focused on overcoming these environmental challenges, but they remain a significant factor influencing adoption in certain regions or applications.

The standardization and regulatory landscape also presents a complex challenge. As LiDAR technology matures and its adoption increases, the need for standardized performance metrics, safety regulations, and interoperability protocols becomes more critical. The lack of unified standards can lead to fragmented markets, increased development efforts for system integrators, and potential compatibility issues between different LiDAR systems and platforms. For instance, in the automotive sector, evolving safety standards and approval processes for autonomous driving systems directly impact the pace of LiDAR adoption.

Finally, technical complexity and the availability of skilled personnel can also act as restraints. The design, calibration, and integration of LiDAR transmitter modules into complex systems require specialized expertise. A shortage of engineers and technicians with the necessary skills can slow down development cycles and limit the adoption of these advanced technologies, especially in newer or rapidly expanding markets. Overcoming these challenges will require continued innovation in manufacturing processes, ongoing research into advanced materials and signal processing, and concerted efforts towards standardization and workforce development.

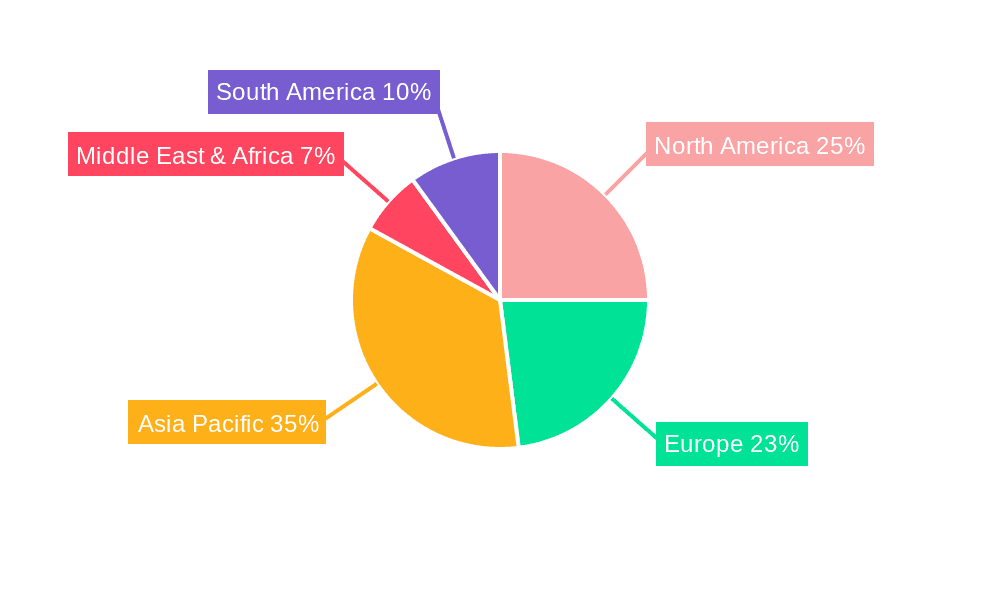

The global Line Spot LiDAR Transmitter Module market is characterized by a powerful concentration of demand and innovation, with certain regions and segments poised to lead the market's expansion.

Key Region to Dominate the Market:

North America: This region is a significant frontrunner, driven by substantial investments in autonomous vehicle development and a strong presence of leading automotive manufacturers and technology innovators. The United States, in particular, has been a hub for LiDAR research and development, with numerous startups and established companies pushing the boundaries of this technology. Government initiatives supporting smart city development and the adoption of advanced sensing in infrastructure also contribute to North America's dominance. The region's advanced technological infrastructure and a high consumer appetite for cutting-edge automotive features further solidify its leading position. The market size in North America is projected to reach tens of billions of dollars by the end of the forecast period.

Europe: With a robust automotive industry and stringent safety regulations, Europe is another critical region for LiDAR adoption. Countries like Germany, Sweden, and France are at the forefront of integrating ADAS and pursuing autonomous driving technologies. The focus on vehicle safety and the commitment to reducing traffic fatalities are strong catalysts for LiDAR deployment. Furthermore, Europe's emphasis on industrial automation and smart manufacturing, coupled with a growing interest in sustainable urban development, also fuels the demand for LiDAR transmitter modules in industrial and smart city applications. The market in Europe is also expected to contribute billions of dollars to the global market.

Key Segment to Dominate the Market:

Application: Automotive: The Automotive segment is unequivocally the most dominant force shaping the Line Spot LiDAR Transmitter Module market. The relentless drive towards vehicle autonomy and the increasing implementation of advanced driver-assistance systems (ADAS) have created an insatiable demand for LiDAR.

Type: VCSEL: Within the technological landscape, VCSEL (Vertical-Cavity Surface-Emitting Laser) technology is rapidly gaining prominence and is projected to dominate the Line Spot LiDAR Transmitter Module market, particularly for automotive applications.

The synergy between these dominant regions and segments, driven by technological advancements and an expanding application base, is expected to propel the Line Spot LiDAR Transmitter Module market to unprecedented heights, with the overall global market value anticipated to reach hundreds of billions of dollars by 2033.

The Line Spot LiDAR Transmitter Module industry is being propelled by several significant growth catalysts. Firstly, the relentless advancement in autonomous driving technology and the widespread adoption of ADAS in vehicles are creating an exponential demand for reliable perception systems, where LiDAR plays a crucial role. Secondly, the ongoing digitalization of industrial processes and the rise of smart factories are driving the need for automation and precise spatial awareness, leading to increased integration of LiDAR in robotics and automated guided vehicles. Furthermore, advancements in VCSEL technology, offering cost-effectiveness and scalability for mass production, are making LiDAR more accessible and attractive for a broader range of applications. The continuous drive for improved performance and miniaturization of LiDAR modules, coupled with supportive government initiatives and a growing consumer acceptance of advanced automotive features, also acts as powerful catalysts for market expansion.

This report offers a holistic understanding of the Line Spot LiDAR Transmitter Module market, providing comprehensive coverage that extends beyond mere market size estimations. It meticulously dissects the technological evolution of both VCSEL and EEL technologies, analyzing their respective strengths, weaknesses, and adoption trends across various applications. The report delves into the intricate interplay of market drivers and restraints, offering a nuanced perspective on the factors influencing growth and potential roadblocks. Furthermore, it presents an in-depth regional analysis, identifying key growth pockets and understanding the unique market dynamics within each geographical territory. The competitive landscape is thoroughly examined, highlighting the strategies and market positions of leading players like Focuslight, and offering insights into potential mergers, acquisitions, and collaborative efforts. This comprehensive approach ensures that stakeholders receive actionable intelligence to navigate the complexities and capitalize on the burgeoning opportunities within the Line Spot LiDAR Transmitter Module industry. The report is an indispensable resource for industry professionals, investors, and researchers seeking to understand the present state and future potential of this transformative technology, with a projected market value reaching hundreds of billions of dollars by 2033.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 31.3%.

Key companies in the market include Focuslight.

The market segments include Type, Application.

The market size is estimated to be USD 3.27 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Line Spot LiDAR Transmitter Module," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Line Spot LiDAR Transmitter Module, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.