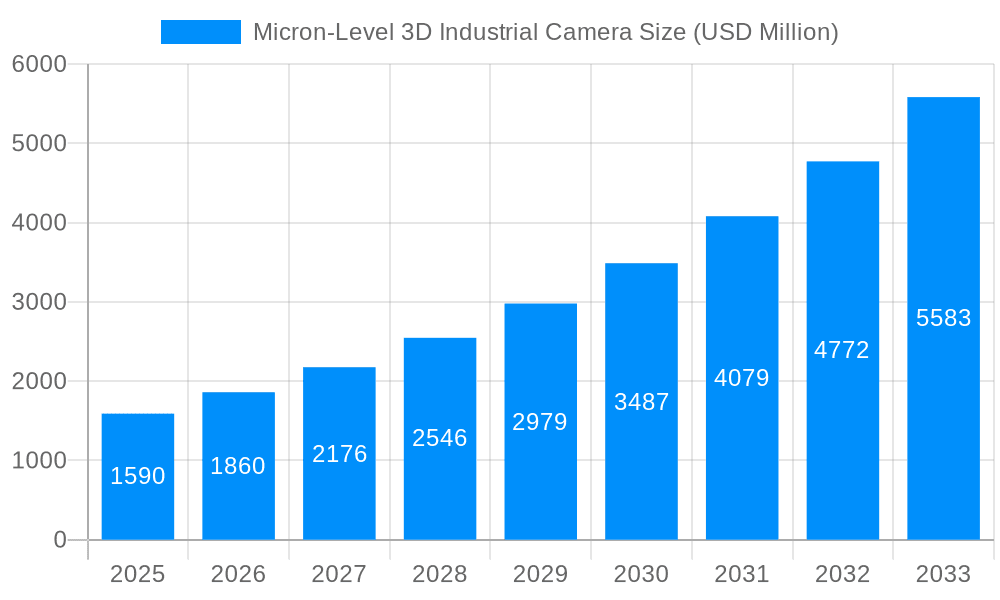

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micron-Level 3D Industrial Camera?

The projected CAGR is approximately 17%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Micron-Level 3D Industrial Camera

Micron-Level 3D Industrial CameraMicron-Level 3D Industrial Camera by Type (Line Scan Camera, Area Scan Camera, World Micron-Level 3D Industrial Camera Production ), by Application (Industrial Automation, Intelligent Manufacturing, Quality Control, Others, World Micron-Level 3D Industrial Camera Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Micron-Level 3D Industrial Camera market is poised for substantial growth, projected to reach approximately $1.59 billion by 2025. This rapid expansion is driven by an impressive Compound Annual Growth Rate (CAGR) of 17% between 2025 and 2033. The burgeoning adoption of industrial automation and the increasing demand for intelligent manufacturing solutions are the primary catalysts behind this surge. As industries worldwide strive for enhanced precision, efficiency, and quality control, the need for high-resolution 3D imaging capabilities becomes paramount. Micron-level 3D industrial cameras offer the precision required for intricate tasks, from detailed inspection of electronic components to the complex assembly of advanced machinery. The development of more sophisticated imaging sensors and algorithms is further fueling innovation and broadening the application scope for these cameras across diverse sectors.

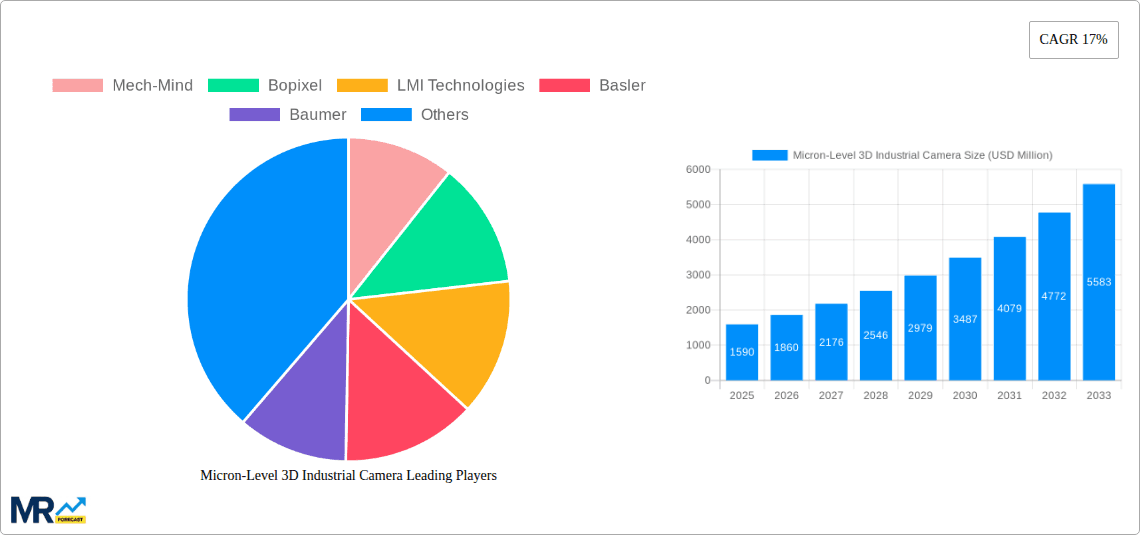

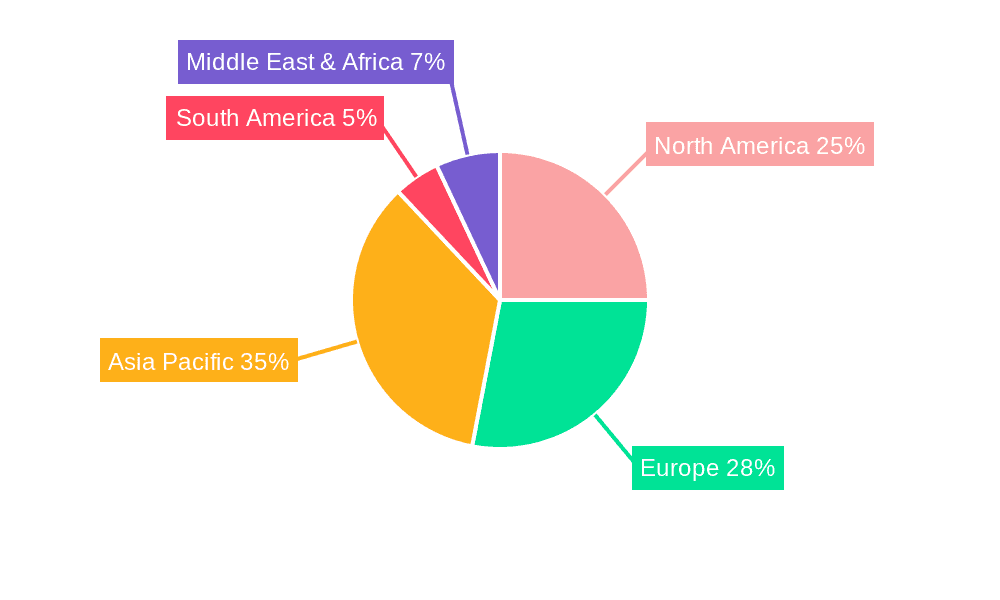

The market is segmented into two primary types: Line Scan Cameras and Area Scan Cameras, with the "World Micron-Level 3D Industrial Camera Production" encompassing both. Applications are predominantly found in Industrial Automation, Intelligent Manufacturing, and Quality Control, with "Others" representing emerging use cases. Leading companies like Cognex, LMI Technologies, Basler, and Sony are at the forefront of developing and supplying these advanced imaging solutions. Geographically, Asia Pacific, particularly China and Japan, is expected to be a major hub for production and consumption due to its strong manufacturing base and rapid technological adoption. North America and Europe also represent significant markets, driven by advanced industrial economies and a strong focus on Industry 4.0 initiatives. The growth trajectory suggests a dynamic market where technological advancements and evolving industrial demands will continue to shape the landscape of micron-level 3D industrial camera solutions.

Here's a report description for Micron-Level 3D Industrial Cameras, incorporating your specified elements:

This comprehensive report delves into the intricate landscape of the Micron-Level 3D Industrial Camera market, projecting its trajectory from the historical period of 2019-2024 through to a robust forecast extending to 2033, with a base and estimated year of 2025. The market is poised for substantial growth, with global revenues anticipated to surge into the tens of billions of dollars by the end of the forecast period. This analysis provides an in-depth examination of market dynamics, identifying key drivers, formidable challenges, and emergent growth opportunities. We dissect the competitive environment, highlighting the strategies and innovations of leading players, and explore the burgeoning applications across critical industrial sectors.

The global market for micron-level 3D industrial cameras is undergoing a transformative evolution, driven by an insatiable demand for ultra-precise measurement and inspection in advanced manufacturing and quality control. From a market value in the billions of dollars in the base year of 2025, the industry is projected to witness a compound annual growth rate that will push its valuation into the tens of billions by 2033. A significant trend is the increasing sophistication of sensor technology, enabling higher resolutions and faster acquisition rates, crucial for capturing intricate details at the micron level. The proliferation of artificial intelligence and machine learning algorithms is also playing a pivotal role, allowing these cameras to move beyond simple data acquisition to intelligent analysis and decision-making. This is particularly evident in the shift from basic defect detection to predictive maintenance and process optimization. The adoption of advanced illumination techniques, such as structured light and laser triangulation, is further enhancing the accuracy and reliability of 3D reconstructions, making them indispensable for complex assembly verification and sub-millimeter tolerance checks. Furthermore, the integration of these cameras into collaborative robot (cobot) systems is enabling more flexible and adaptable automation solutions, particularly in the automotive and electronics industries. The growing need for end-to-end traceability and the stringent quality standards imposed by regulatory bodies are also fueling the adoption of these high-precision imaging systems. The market is also seeing a rise in specialized camera designs tailored for specific applications, such as narrow-field-of-view cameras for micro-component inspection and wider-view cameras for large-scale surface scanning. The interoperability of these cameras with existing factory automation infrastructure, facilitated by industry standards like GigE Vision and USB3 Vision, is another key trend that is simplifying integration and accelerating deployment across diverse manufacturing environments.

The burgeoning demand for micron-level 3D industrial cameras is intrinsically linked to the relentless pursuit of enhanced precision and efficiency across a spectrum of industrial applications. The foundational driver is the escalating complexity of manufactured goods, particularly in sectors like electronics, semiconductors, and pharmaceuticals, where even microscopic imperfections can lead to significant functional failures. Intelligent manufacturing initiatives, underpinned by Industry 4.0 principles, are heavily reliant on high-fidelity data acquisition, and 3D industrial cameras are at the forefront of this revolution, providing the granular visual intelligence needed for automated processes. The increasing stringency of quality control standards globally acts as a powerful impetus, compelling manufacturers to invest in technologies that can detect and rectify defects with unparalleled accuracy. Furthermore, the miniaturization trend in consumer electronics and medical devices necessitates inspection capabilities that can operate at the micron scale. The economic imperative of reducing waste, rework, and scrap by identifying issues early in the production cycle is a significant commercial driver. The development of more compact, robust, and cost-effective 3D camera solutions, including advancements in CMOS sensor technology and integrated processing capabilities, is democratizing access to this technology, making it viable for a broader range of businesses. The growing implementation of robotics and automation, especially in hazardous or repetitive tasks, requires sophisticated vision systems for navigation, manipulation, and inspection, further bolstering the market.

Despite the compelling growth trajectory, the micron-level 3D industrial camera market faces several inherent challenges and restraints that temper its unbridled expansion. The significant upfront investment required for acquiring and integrating these high-precision systems can be a substantial barrier, particularly for small and medium-sized enterprises (SMEs) with limited capital expenditure budgets. The complexity of the underlying technology, coupled with the need for specialized expertise in data processing and algorithm development, can lead to longer implementation cycles and higher operational costs. The sensitivity of some 3D imaging techniques to environmental factors such as ambient light variations, surface reflectivity, and vibrations can pose challenges in certain industrial settings, requiring careful calibration and environment control. The standardization of data formats and interoperability across different vendor solutions remains an ongoing area for development, which can hinder seamless integration into heterogeneous manufacturing environments. Furthermore, the rapid pace of technological innovation, while beneficial, also presents a challenge in terms of obsolescence of existing systems and the continuous need for upgrades, adding to the total cost of ownership. The availability of skilled personnel capable of operating, maintaining, and troubleshooting these sophisticated systems is also a concern in certain regions. The cybersecurity implications of connecting these advanced imaging devices to networked systems also require careful consideration and robust security protocols.

The global micron-level 3D industrial camera market is anticipated to see dominance from specific regions and segments, driven by distinct economic and technological factors.

Dominant Regions/Countries:

Dominant Segments:

Several factors are acting as significant growth catalysts for the micron-level 3D industrial camera industry. The accelerating trend of miniaturization in product design, particularly in consumer electronics, medical devices, and semiconductors, directly translates to a need for inspection technologies capable of discerning features at the micron level. Furthermore, the global push towards Industry 4.0 and smart manufacturing is a monumental driver, with 3D vision systems being a cornerstone for intelligent automation, data-driven decision-making, and enhanced quality control. The increasing complexity of supply chains and the demand for greater product reliability are compelling manufacturers to adopt more advanced metrology solutions. The continuous innovation in sensor technology, AI algorithms, and computational imaging is making micron-level 3D cameras more accurate, faster, and cost-effective, broadening their accessibility.

This report offers an exhaustive examination of the micron-level 3D industrial camera market, providing deep insights and actionable intelligence for stakeholders. It meticulously analyzes market size and growth projections, detailed segmentation by camera type, application, and technology, and a thorough competitive landscape with strategic profiling of key players. The report includes an in-depth discussion of market drivers, restraints, opportunities, and emerging trends, supported by historical data from 2019-2024 and forecasts up to 2033. Regional analysis highlights dominant markets and their contributing factors, while the impact of significant technological advancements and industry developments is thoroughly assessed. The objective is to equip industry participants with a comprehensive understanding to make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 17%.

Key companies in the market include Mech-Mind, Bopixel, LMI Technologies, Basler, Baumer, Cognex, Teledyne, Toshiba, Sony.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Micron-Level 3D Industrial Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Micron-Level 3D Industrial Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.