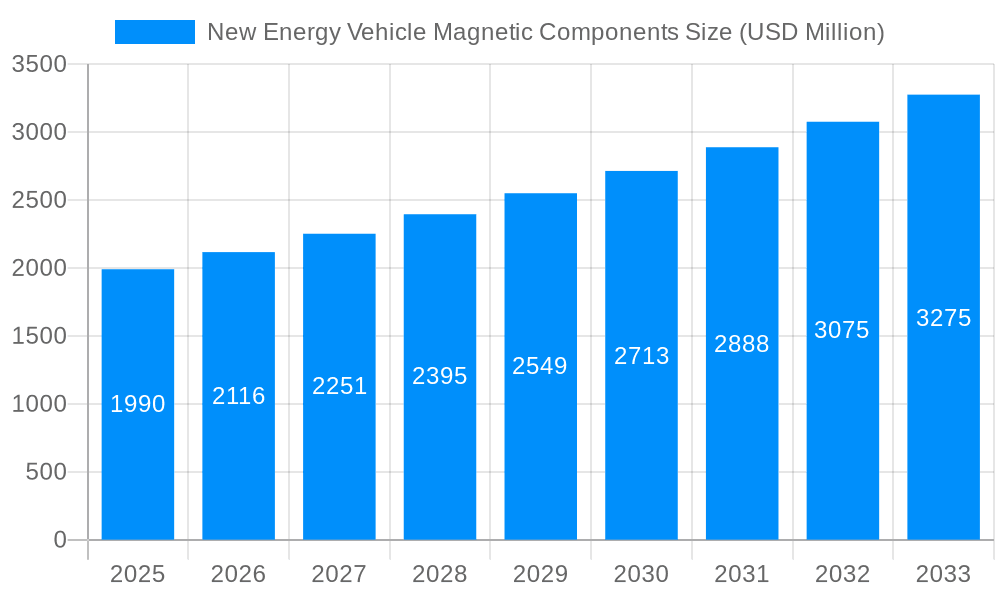

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Energy Vehicle Magnetic Components?

The projected CAGR is approximately 6.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

New Energy Vehicle Magnetic Components

New Energy Vehicle Magnetic ComponentsNew Energy Vehicle Magnetic Components by Type (Inductors, Transformer, Others, World New Energy Vehicle Magnetic Components Production ), by Application (Passenger Vehicles, Commercial Vehicles, World New Energy Vehicle Magnetic Components Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

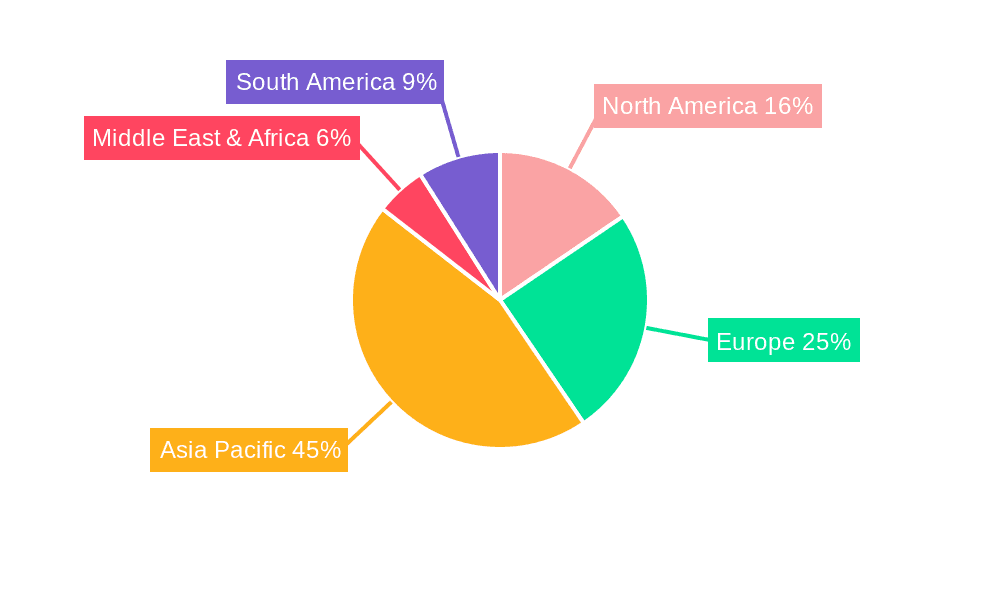

The global New Energy Vehicle (NEV) Magnetic Components market is poised for significant expansion, projected to reach approximately USD 1.99 billion in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 6.3% through 2033. This impressive growth trajectory is primarily fueled by the accelerating adoption of electric vehicles (EVs) worldwide, driven by increasing environmental consciousness, supportive government policies, and advancements in battery technology. Magnetic components, including inductors and transformers, are critical for the efficient operation of NEVs, playing vital roles in power conversion, energy storage, and electromagnetic interference (EMI) suppression. The demand for these components is directly correlated with the surging production of NEVs, making this sector a key enabler of the green transportation revolution. Asia Pacific, particularly China, is expected to dominate the market due to its strong NEV manufacturing base and substantial investments in the sector.

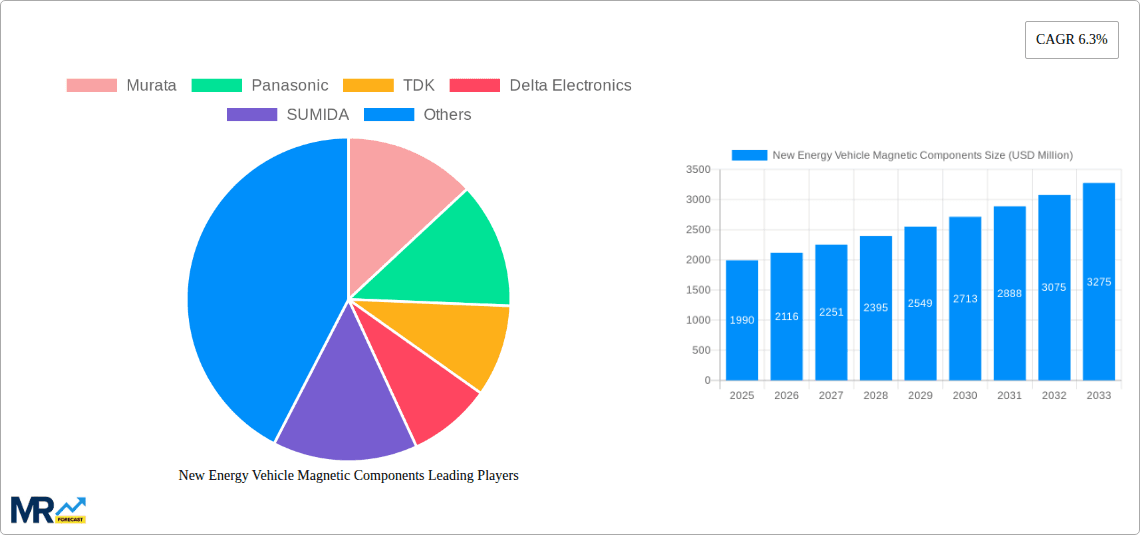

Further analysis reveals that the market segmentation by component type will see Inductors and Transformers as leading categories, owing to their ubiquitous use across various NEV subsystems such as onboard chargers, DC-DC converters, and motor drives. The application segment will be dominated by Passenger Vehicles, which represent the largest share of NEV sales. However, the Commercial Vehicles segment is anticipated to witness a higher growth rate as fleet operators increasingly transition to electric alternatives for cost savings and regulatory compliance. Key players like Murata, Panasonic, and TDK are actively investing in research and development to create more compact, efficient, and high-performance magnetic components, addressing the industry's need for miniaturization and improved thermal management. While the market presents substantial opportunities, challenges such as supply chain disruptions and the need for standardized technological solutions could pose moderate restraints.

This report offers an in-depth analysis of the New Energy Vehicle (NEV) Magnetic Components market, spanning a crucial Study Period of 2019-2033, with a Base Year and Estimated Year of 2025. It meticulously examines the Historical Period of 2019-2024 and provides a robust Forecast Period of 2025-2033. The report delves into the intricate landscape of NEV magnetic components, including key segments like Inductors, Transformers, and Others, alongside global production insights. It also analyzes the market through the lens of Application segments, namely Passenger Vehicles and Commercial Vehicles.

The global market for New Energy Vehicle (NEV) magnetic components is undergoing a significant transformation, driven by the relentless pace of electrification in the automotive industry. With projections indicating a World New Energy Vehicle Magnetic Components Production volume that will see substantial growth from hundreds of billions in the Historical Period (2019-2024) to potentially trillions by the Forecast Period (2025-2033), the importance of these seemingly small yet critical components cannot be overstated. The increasing adoption of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) is directly fueling demand for sophisticated magnetic solutions. These components are indispensable for power management, energy conversion, and signal integrity within NEVs. Key trends include a heightened focus on miniaturization and higher power density to accommodate increasingly compact and efficient vehicle architectures. There's also a pronounced shift towards advanced materials and manufacturing techniques to enhance performance, reliability, and thermal management, crucial for the demanding operating conditions within vehicles. Furthermore, the integration of intelligent functionalities and the pursuit of lower electromagnetic interference (EMI) are shaping the product development roadmap. The drive towards higher efficiency in power electronics, such as DC-DC converters and onboard chargers, is directly translating into a greater need for highly optimized inductors and transformers. The market is also witnessing a growing demand for specialized magnetic components tailored for specific NEV subsystems, including drivetrains, battery management systems (BMS), and advanced driver-assistance systems (ADAS). The increasing complexity of NEV powertrains, with multiple motors and intricate power distribution networks, necessitates a diverse range of magnetic components to ensure optimal performance and energy utilization. As the NEV sector matures, there is an ever-present pressure to reduce costs without compromising quality, leading to innovation in material science and automated manufacturing processes. The competitive landscape is characterized by a mix of established global players and emerging regional specialists, all vying to capture a significant share of this rapidly expanding market. The regulatory environment, with its emphasis on emissions reduction and energy efficiency, continues to be a powerful impetus for the widespread adoption of NEVs, thereby cementing the importance of their supporting magnetic components.

The burgeoning demand for New Energy Vehicle (NEV) magnetic components is propelled by a confluence of powerful drivers, primarily stemming from the global imperative to decarbonize transportation. Government mandates and incentives worldwide, aimed at curbing greenhouse gas emissions and promoting sustainable mobility, are a significant catalyst for NEV adoption. This surge in NEV sales directly translates into an increased need for the essential magnetic components that facilitate their operation. The continuous advancements in battery technology, leading to greater energy density and faster charging capabilities, are further accelerating the shift towards electric mobility. As NEVs become more appealing due to improved range and reduced charging times, the market for their intricate electrical systems, including magnetic components, expands in tandem. Technological innovation plays a pivotal role, with manufacturers constantly striving to enhance the efficiency, performance, and reliability of magnetic components. Developments in materials science have enabled the creation of more effective magnetic cores and winding technologies, leading to smaller, lighter, and more powerful solutions. The decreasing cost of NEV production, influenced by economies of scale and ongoing research and development, is making electric vehicles more accessible to a wider consumer base. This increasing affordability is unlocking new market segments and expanding the overall potential for magnetic component suppliers. Furthermore, growing consumer awareness and preference for environmentally friendly transportation options are creating a pull effect for NEVs, indirectly bolstering the market for their constituent components.

Despite the robust growth trajectory, the New Energy Vehicle (NEV) magnetic components market faces several significant challenges and restraints that could temper its expansion. The high cost of raw materials, particularly rare earth elements and specialized magnetic alloys, can impact the overall cost-effectiveness of NEV production and, consequently, the affordability of magnetic components. Fluctuations in the prices of these critical inputs can create volatility and uncertainty within the supply chain. Supply chain disruptions, exacerbated by geopolitical events, natural disasters, and global pandemics, pose a persistent threat to the consistent availability of essential materials and finished components. The automotive industry's reliance on just-in-time manufacturing makes it particularly vulnerable to such disruptions. The stringent quality and reliability standards demanded by the automotive sector, especially for safety-critical components, necessitate extensive testing and validation, which can increase development timelines and costs for magnetic component manufacturers. Furthermore, the rapid pace of technological evolution in the NEV space requires continuous innovation and adaptation. Companies that fail to keep pace with advancements in power electronics, battery management systems, and charging technologies risk obsolescence. The intense competition within the market, with numerous players vying for market share, can lead to price pressures and reduced profit margins for manufacturers. Finally, the development of alternative technologies, although currently less prevalent, could pose a long-term challenge if they offer significant advantages in terms of performance, cost, or integration.

The global New Energy Vehicle (NEV) Magnetic Components market is characterized by a dynamic interplay of regional strengths and segment dominance, with certain areas poised to lead the charge in the coming years.

Dominant Segments:

Transformers: Within the Type segment, Transformers are projected to command a significant market share. This dominance is driven by their critical role in various NEV power electronics systems.

Inductors: While transformers are expected to lead, Inductors represent another substantial and rapidly growing segment within the Type categorization.

Passenger Vehicles (Application): The overwhelming majority of NEV sales globally are currently in the Passenger Vehicles segment. This trend is expected to continue, making it the dominant application area for NEV magnetic components.

Key Dominant Region/Country:

While China is expected to maintain its leading position, other regions like Europe and North America are also significant contributors to the global NEV magnetic components market, driven by stringent emission standards and increasing consumer interest in sustainable transportation. However, China's sheer scale of production and consumption, combined with its comprehensive industrial capabilities, solidifies its dominance in both production and market share for NEV magnetic components.

The New Energy Vehicle (NEV) magnetic components industry is poised for substantial growth, significantly propelled by several key catalysts. The escalating global commitment to climate change mitigation and the subsequent stringent government regulations on vehicle emissions are powerful drivers pushing automakers towards widespread NEV adoption. This, in turn, creates an insatiable demand for the critical magnetic components that power NEV systems. Continuous advancements in battery technology, leading to enhanced energy density and faster charging capabilities, are making NEVs more practical and appealing, further fueling market expansion. Furthermore, the ongoing innovation in power electronics for NEVs, focusing on higher efficiency and miniaturization of components, directly translates to increased demand for advanced magnetic solutions.

This report provides a holistic view of the New Energy Vehicle (NEV) Magnetic Components market, encompassing its intricate dynamics and future trajectory. It offers granular insights into market segmentation by Type (Inductors, Transformers, Others) and Application (Passenger Vehicles, Commercial Vehicles), alongside a comprehensive analysis of World New Energy Vehicle Magnetic Components Production. The study meticulously dissects the Historical Period (2019-2024), utilizes a Base Year and Estimated Year of 2025, and extends its projections through the Forecast Period (2025-2033), with a broad Study Period of 2019-2033. It delves into the driving forces, challenges, and crucial growth catalysts shaping this vital sector. The report identifies dominant regions and segments, offering a clear picture of market leadership. Furthermore, it lists the leading industry players and highlights significant developments, providing stakeholders with the essential intelligence to navigate and capitalize on the opportunities within this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.3%.

Key companies in the market include Murata, Panasonic, TDK, Delta Electronics, SUMIDA, Taiyo Yuden, Vishay, Schaffner Holding AG, Goudsmit Magnetics, Nagano Japan Radio, Cyntec, Shenzhen Click Technology, Shenzhen Jingquanhua Electronics, Eaglerise Electric & Electronic, Dongguan Mentech Optical & Magnetic, Shenzhen Microgate Technology, Shenzhen Oswee Technology, Shenzhen Highlight Electronic, Shenzhen Sunlord Electronics, Anhui Sinomag Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "New Energy Vehicle Magnetic Components," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the New Energy Vehicle Magnetic Components, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.