1. What is the projected Compound Annual Growth Rate (CAGR) of the Two-Wheeled Vehicle RFID Tags?

The projected CAGR is approximately 8.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Two-Wheeled Vehicle RFID Tags

Two-Wheeled Vehicle RFID TagsTwo-Wheeled Vehicle RFID Tags by Type (Low Frequency, High Frequency, World Two-Wheeled Vehicle RFID Tags Production ), by Application (Motorcycle, Electric Bicycle, Others, World Two-Wheeled Vehicle RFID Tags Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

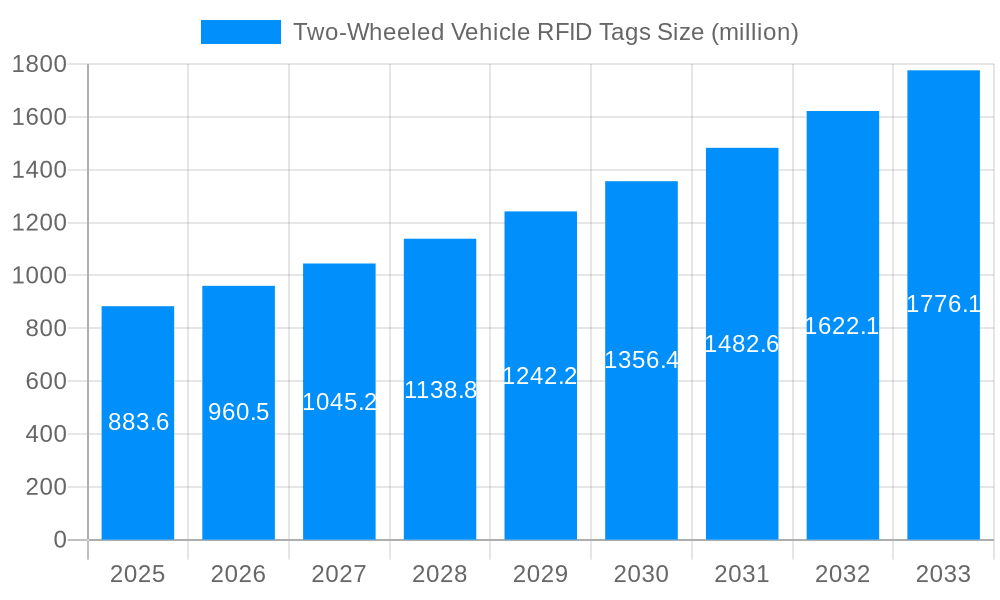

The global market for Two-Wheeled Vehicle RFID Tags is poised for substantial growth, projected to reach an estimated market size of $883.6 million in 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 8.6% from 2019 to 2033. The increasing adoption of smart technologies in the automotive sector, particularly for enhancing security, logistics, and vehicle identification, is a primary catalyst. The integration of RFID tags in motorcycles and electric bicycles offers significant advantages, including streamlined inventory management, improved anti-theft measures, and efficient maintenance tracking. The "World Two-Wheeled Vehicle RFID Tags Production" segment is expected to witness a strong upward trajectory as manufacturers and consumers alike recognize the benefits of automated data capture and management solutions.

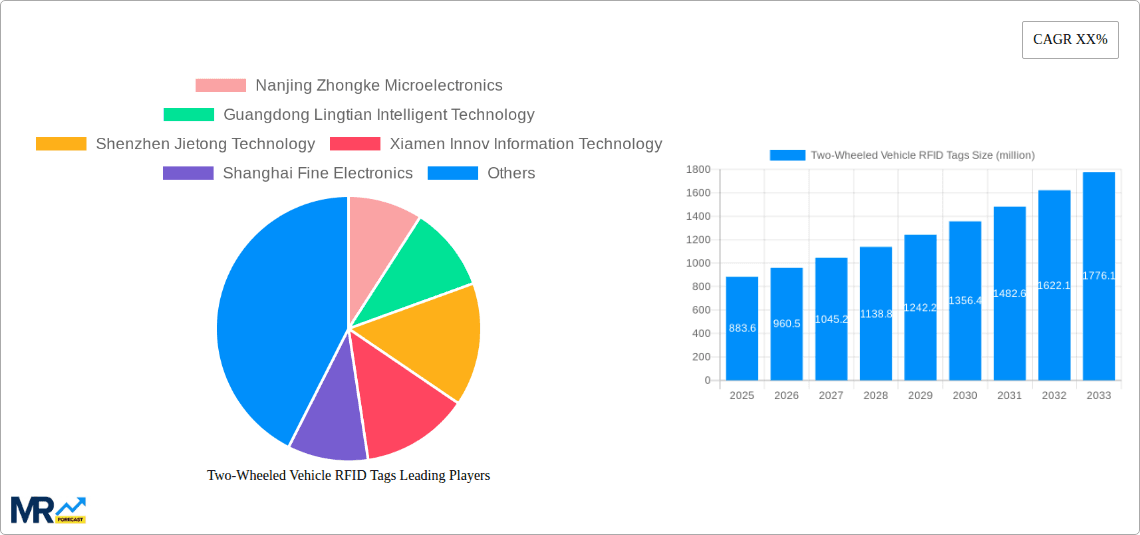

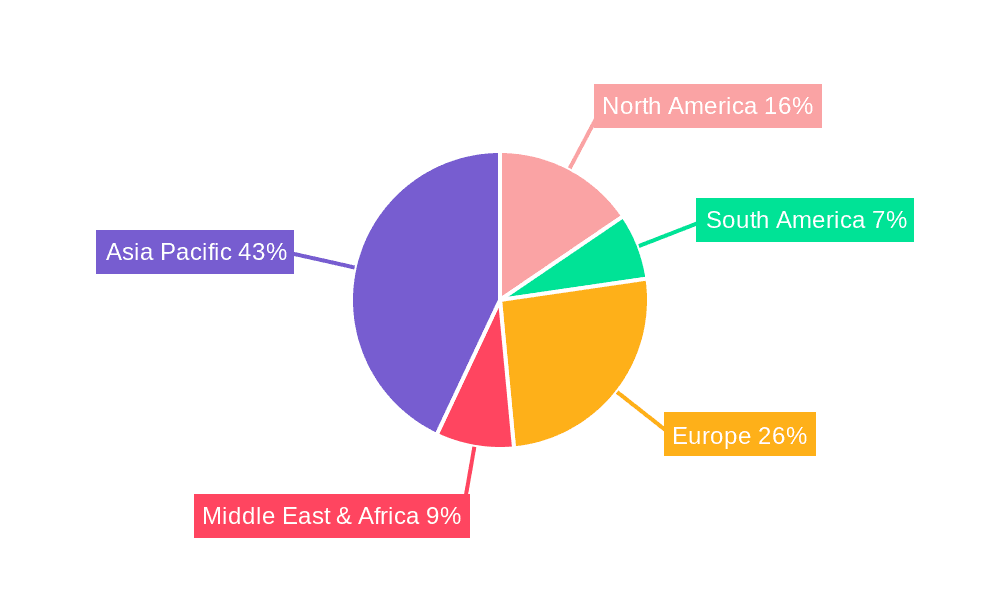

The market segmentation into Low Frequency and High Frequency RFID tags caters to diverse application needs. Low-frequency tags are often utilized for basic identification and access control, while high-frequency tags enable more complex data transfer and real-time tracking. The application spectrum, encompassing motorcycles, electric bicycles, and other two-wheeled vehicles, highlights the widespread applicability of this technology. Key market players, including Nanjing Zhongke Microelectronics, Guangdong Lingtian Intelligent Technology, and Shenzhen Jietong Technology, are actively innovating and expanding their product portfolios to capture market share. Geographically, the Asia Pacific region, particularly China, is anticipated to be a dominant force due to its large manufacturing base and increasing demand for smart mobility solutions. Emerging economies in other regions also present significant growth opportunities as governments and industries invest in smart infrastructure and connected transportation systems.

Here's a comprehensive report description for "Two-Wheeled Vehicle RFID Tags," incorporating your specified elements:

The global market for Two-Wheeled Vehicle RFID Tags is on an impressive upward trajectory, with a projected market size in the tens of millions of units for the base year 2025. This surge is underpinned by a confluence of technological advancements and evolving consumer and regulatory demands. During the historical period of 2019-2024, the market witnessed steady growth, driven by early adoption in fleet management and anti-theft applications for motorcycles and electric bicycles. However, the forecast period (2025-2033) is poised to see an acceleration in this expansion. This growth will be fueled by increasing government initiatives promoting vehicle traceability and security, particularly in emerging economies. The integration of RFID tags into the manufacturing process of two-wheeled vehicles is becoming a standard practice, moving beyond aftermarket solutions. This widespread adoption is a direct response to the growing need for efficient inventory management, streamlined manufacturing processes, and enhanced vehicle lifecycle tracking. Furthermore, the increasing sophistication of RFID technology, including advancements in read range, data storage capacity, and tamper-proof features, is making these tags a more compelling proposition for manufacturers and consumers alike. The market is also benefiting from the declining cost of RFID components, making them more accessible for a wider range of two-wheeled vehicle segments. As smart city initiatives gain momentum, the demand for connected vehicles, including two-wheelers, is expected to rise, further solidifying the importance of RFID for identification and data exchange. The emphasis on vehicle security, driven by rising theft rates in certain regions, is a significant catalyst, pushing manufacturers to implement robust tracking solutions. The market will see a diversification in application, extending beyond basic identification to encompass performance monitoring, maintenance scheduling, and even personalized rider experiences. The ongoing evolution of high-frequency (HF) and ultra-high frequency (UHF) RFID technologies will play a crucial role in unlocking new functionalities and driving broader market penetration, with low-frequency (LF) tags continuing to hold a strong position in specific niche applications demanding extreme durability and proximity reading. The projected market value in the millions of units for 2025 signifies a mature yet dynamic market poised for sustained expansion.

The global Two-Wheeled Vehicle RFID Tags market is experiencing a robust upswing, driven by a multifaceted array of factors. Paramount among these is the increasing emphasis on vehicle security and anti-theft measures. As the number of motorcycles and electric bicycles continues to grow globally, so too do concerns surrounding theft. RFID tags offer a cost-effective and reliable method for identifying and tracking vehicles, making them a crucial tool for law enforcement and manufacturers aiming to deter theft and aid in recovery. Furthermore, government regulations and initiatives are playing a significant role. Many countries are mandating or encouraging the use of RFID for vehicle registration, licensing, and roadworthiness checks, thereby streamlining administrative processes and improving data accuracy. This regulatory push is particularly strong in regions with large two-wheeler populations. The expanding electric bicycle segment is another major catalyst. With the rapid adoption of e-bikes for commuting and leisure, the need for efficient management, ownership verification, and battery tracking is paramount, all of which can be facilitated by RFID technology. Finally, advancements in RFID technology itself, including improved durability, smaller form factors, and enhanced data storage capabilities, are making these tags more suitable for the demanding environment of two-wheeled vehicles.

Despite the promising growth trajectory, the Two-Wheeled Vehicle RFID Tags market is not without its hurdles. One significant challenge is the initial cost of implementation, particularly for smaller manufacturers or for retrofitting older vehicles. While the cost of RFID tags is declining, the associated infrastructure, such as readers and integration software, can still represent a substantial investment. Another restraint is the standardization of RFID protocols and frequencies across different regions and vehicle types. A lack of universal standards can lead to interoperability issues, hindering widespread adoption and requiring manufacturers to develop solutions for multiple frequency bands (e.g., Low Frequency and High Frequency). Furthermore, consumer awareness and acceptance of RFID technology in two-wheeled vehicles are still developing. Educating consumers about the benefits of RFID, such as enhanced security and convenience, is crucial to overcoming potential privacy concerns or resistance to new technologies. The durability of RFID tags in harsh environmental conditions, including exposure to moisture, extreme temperatures, and physical impact, also remains a concern for certain applications, necessitating the development of more robust tag designs. Lastly, data security and privacy concerns associated with the vast amounts of data that can be collected and transmitted by RFID systems need to be addressed proactively to ensure continued market growth and consumer trust.

The global Two-Wheeled Vehicle RFID Tags market is projected to witness significant dominance from the Asia-Pacific region, particularly China, due to its unparalleled manufacturing capacity and the sheer volume of two-wheeled vehicle production and consumption. Within this region, the Electric Bicycle segment is poised for extraordinary growth and is expected to be a primary driver of market expansion.

Asia-Pacific Region (Dominant Region):

Electric Bicycle Segment (Dominant Segment):

The Two-Wheeled Vehicle RFID Tags industry is being significantly propelled by a surge in government mandates for vehicle identification and traceability, aimed at enhancing security and streamlining administrative processes. The escalating concern over vehicle theft, particularly for higher-value motorcycles and electric bicycles, is a major catalyst, driving the demand for robust tracking solutions. Furthermore, the rapid expansion of the electric bicycle market, coupled with the increasing integration of smart technologies in all two-wheeled vehicles, creates a substantial need for efficient data management and identification.

This comprehensive report offers an in-depth analysis of the global Two-Wheeled Vehicle RFID Tags market, providing detailed insights into its current landscape and future trajectory. The study meticulously covers the market from the historical period of 2019-2024 through to a robust forecast extending to 2033, with the base year of 2025 serving as a pivotal point for estimations. It delves into the intricate dynamics of market trends, identifying key drivers such as evolving security needs and government regulations, while also examining the significant challenges that may impede growth. The report scrutinizes dominant regions and pivotal market segments, offering a granular understanding of where and how the market is expanding. Leading players are identified, alongside a timeline of significant industry developments, to provide a holistic view of the competitive environment and technological advancements. This detailed coverage is essential for stakeholders seeking to capitalize on the burgeoning opportunities within this vital sector of the transportation industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.6%.

Key companies in the market include Nanjing Zhongke Microelectronics, Guangdong Lingtian Intelligent Technology, Shenzhen Jietong Technology, Xiamen Innov Information Technology, Shanghai Fine Electronics, Shenzhen jinruida Electronics, Shenzhen Vanch Intelligent Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Two-Wheeled Vehicle RFID Tags," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Two-Wheeled Vehicle RFID Tags, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.