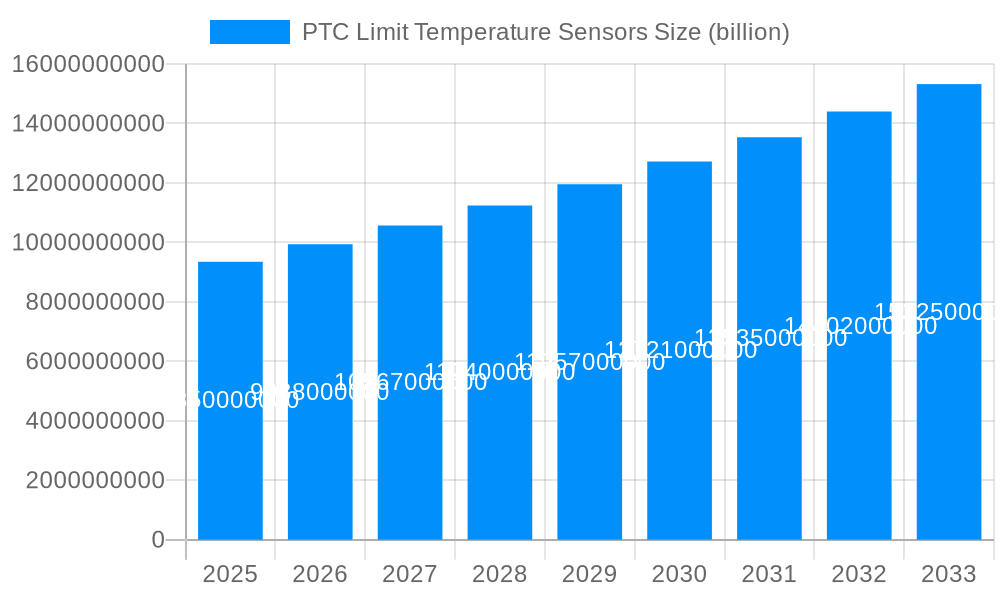

1. What is the projected Compound Annual Growth Rate (CAGR) of the PTC Limit Temperature Sensors?

The projected CAGR is approximately 6.28%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

PTC Limit Temperature Sensors

PTC Limit Temperature SensorsPTC Limit Temperature Sensors by Type (PTC Thermistor, PTC Resettable Fuse, World PTC Limit Temperature Sensors Production ), by Application (Consumer Electronics, Automotive, Medical, Home Appliance, Industrial, Aerospace, Others, World PTC Limit Temperature Sensors Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global market for PTC Limit Temperature Sensors is poised for robust expansion, projected to reach an estimated \$9.35 billion by 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 6.28% through 2033. This significant growth trajectory is fueled by the increasing adoption of advanced temperature control and safety mechanisms across a wide spectrum of industries. The inherent advantages of PTC (Positive Temperature Coefficient) technology, such as self-regulation, overcurrent protection, and precise temperature sensing capabilities, are driving demand. Key drivers include the burgeoning consumer electronics sector, with its insatiable need for miniaturized and reliable thermal management solutions in devices like smartphones, laptops, and wearable technology. The automotive industry's transition towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) further amplifies the demand for accurate and durable temperature sensors for battery management, motor control, and cabin comfort. Similarly, the expanding healthcare sector, with its reliance on sophisticated medical devices requiring stringent temperature monitoring, and the continuous innovation in home appliances and industrial automation, are contributing significantly to market growth.

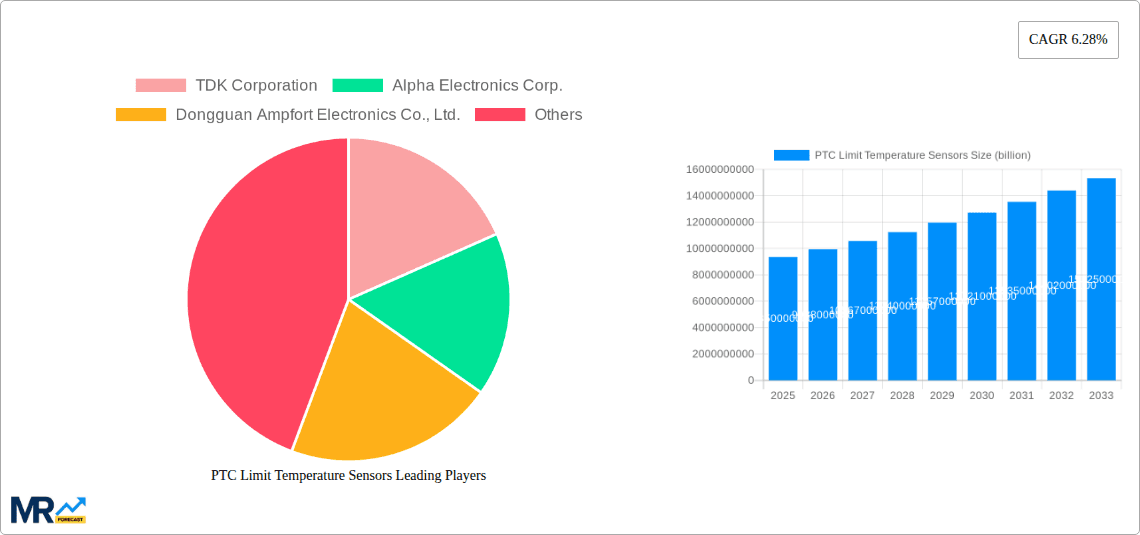

The market is segmented into PTC Thermistors and PTC Resettable Fuses, with both types witnessing escalating adoption due to their distinct protective and sensing functionalities. The "World PTC Limit Temperature Sensors Production" encompasses a diverse range of applications, underscoring the versatility of these components. While market growth is strong, potential restraints may arise from the increasing complexity of supply chains, the need for continuous technological innovation to keep pace with evolving industry standards, and the potential for alternative sensing technologies to emerge. However, the established reliability and cost-effectiveness of PTC sensors position them favorably. Major players like TDK Corporation, Alpha Electronics Corp., and Dongguan Ampfort Electronics Co., Ltd. are actively investing in research and development to enhance product performance and expand their market reach across key regions such as Asia Pacific, North America, and Europe, which are expected to dominate consumption due to their strong industrial and technological bases.

This report provides an in-depth analysis of the global PTC Limit Temperature Sensors market, examining its trajectory from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, the study leverages historical data from 2019-2024 to deliver a robust market outlook. The report delves into critical aspects including market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments. Projections are made in the billions of US dollars, offering valuable insights for stakeholders navigating this dynamic sector.

The global PTC Limit Temperature Sensors market is poised for substantial growth, driven by an ever-increasing demand for sophisticated thermal management solutions across a multitude of industries. The intricate interplay of technological advancements, stringent safety regulations, and the proliferation of electronic devices is shaping the market landscape significantly. From the burgeoning Internet of Things (IoT) ecosystem, where reliable temperature monitoring is paramount for device longevity and performance, to the automotive sector's relentless pursuit of enhanced safety features and electric vehicle component protection, PTC Limit Temperature Sensors are becoming indispensable. The historical period from 2019 to 2024 witnessed a foundational expansion, largely fueled by the increasing adoption of consumer electronics and the initial waves of smart home integration. As we move into the base year of 2025 and beyond into the forecast period of 2025-2033, the market is expected to accelerate. The projected market value is anticipated to cross the several billion dollar mark, showcasing a compound annual growth rate that reflects the escalating importance of these components. Key trends include the miniaturization of sensors for more seamless integration into compact devices, the development of higher operating temperature variants to cater to demanding industrial and aerospace applications, and the increasing integration of smart functionalities, enabling predictive maintenance and remote monitoring. Furthermore, the growing emphasis on energy efficiency and preventing thermal runaway in battery systems, particularly in electric vehicles and renewable energy storage, is a significant tailwind for PTC Limit Temperature Sensors. The adoption of advanced materials and manufacturing techniques is also contributing to improved sensor performance and cost-effectiveness, further broadening their application scope. The discerning consumer and the demanding industrial landscape alike are recognizing the critical role these seemingly small components play in ensuring safety, reliability, and operational efficiency, thus cementing their indispensable status in the modern technological panorama.

Several interconnected forces are collectively propelling the global PTC Limit Temperature Sensors market forward at an impressive pace. The most significant driver is the unwavering global demand for enhanced product safety and reliability. As electronic devices become more complex and powerful, the risk of thermal runaway and overheating increases, necessitating robust protection mechanisms. PTC Limit Temperature Sensors, with their inherent ability to automatically limit current when a predefined temperature threshold is exceeded, offer a cost-effective and highly reliable solution for preventing such incidents. This is particularly crucial in high-growth sectors like consumer electronics, where product recalls due to safety concerns can be financially devastating and damage brand reputation. The automotive industry's rapid transition towards electric vehicles (EVs) represents another monumental growth engine. EVs rely heavily on sophisticated thermal management systems to ensure the safe and efficient operation of batteries, power electronics, and charging infrastructure. PTC Limit Temperature Sensors are integral to these systems, safeguarding against overheating and potential hazards. Furthermore, the pervasive adoption of IoT devices across all facets of life, from smart homes and wearable technology to industrial automation and smart cities, creates a vast and expanding market. Each connected device, from a smart thermostat to an industrial sensor network, requires reliable temperature monitoring and protection, thereby fueling the demand for PTC Limit Temperature Sensors. The increasing stringency of safety regulations and compliance standards globally further bolsters this demand, as manufacturers are mandated to incorporate effective thermal protection measures into their products. This regulatory push, coupled with the intrinsic benefits of PTC technology in preventing damage and ensuring operational continuity, creates a compelling market environment for continued expansion.

Despite the robust growth prospects, the PTC Limit Temperature Sensors market is not without its challenges and restraints, which warrant careful consideration by industry stakeholders. One of the primary hurdles is the increasing competition from alternative thermal sensing technologies. While PTC sensors offer distinct advantages, other technologies like NTC thermistors, RTDs, and thermocouples, as well as more advanced digital temperature sensors, are continuously evolving and offering improved accuracy, faster response times, or specialized functionalities for specific applications. This necessitates continuous innovation and cost optimization within the PTC sensor market to maintain a competitive edge. Another significant challenge lies in the price sensitivity of certain high-volume application segments, particularly in consumer electronics. While PTC sensors are generally cost-effective, manufacturers in highly competitive markets are constantly seeking ways to reduce Bill of Materials (BOM) costs, which can put pressure on profit margins for sensor suppliers. Furthermore, the perception and understanding of PTC technology can sometimes be a limiting factor. While widely used, some engineers may not be fully aware of the nuances of PTC behavior or the optimal selection criteria for different applications, potentially leading to suboptimal component choices or a preference for more familiar, albeit less suitable, technologies. The complexity of integration in highly miniaturized or space-constrained applications can also pose a challenge. While miniaturization is a trend, ensuring reliable performance and proper thermal contact in extremely compact designs requires careful engineering and can add to development costs. Lastly, global supply chain disruptions and raw material price volatility, as experienced in recent years, can impact production costs and lead times, posing a risk to market stability and consistent supply.

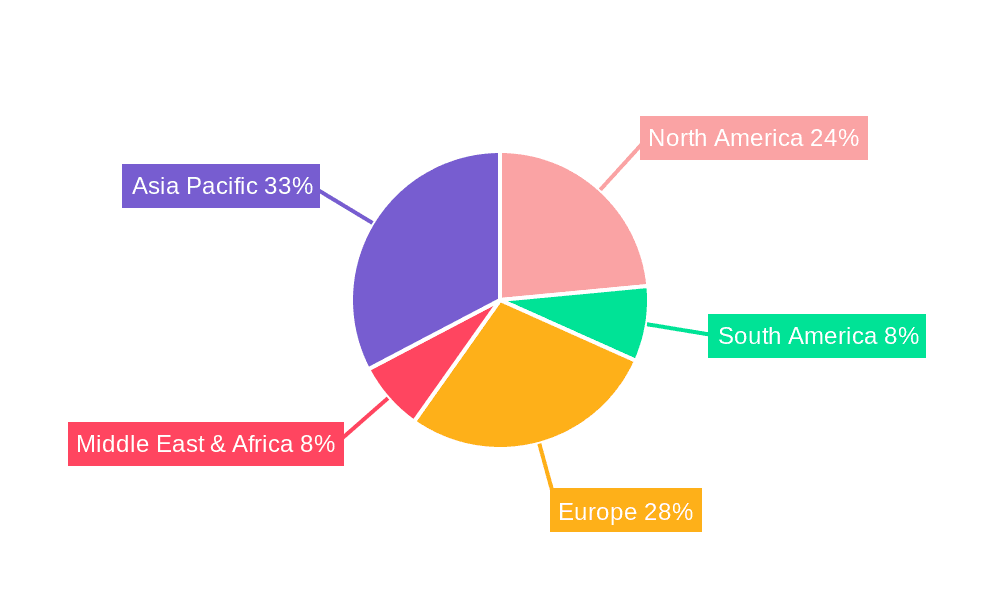

Within the dynamic global PTC Limit Temperature Sensors market, the Consumer Electronics segment, particularly in conjunction with the Asia Pacific region, is poised to exert significant dominance throughout the study period (2019-2033). The Asia Pacific region, encompassing countries like China, South Korea, Japan, and Taiwan, has long been the undisputed manufacturing hub for consumer electronics, and this trend is projected to continue and intensify. This region accounts for an enormous volume of production and consumption of devices such as smartphones, laptops, tablets, televisions, gaming consoles, and a myriad of other electronic gadgets. The sheer scale of this industry, coupled with the relentless pace of product launches and the consumer's demand for newer, more feature-rich devices, directly translates into a colossal requirement for PTC Limit Temperature Sensors. These sensors are critical for ensuring the safety and reliability of these ubiquitous devices, preventing overheating in processors, battery packs, charging circuits, and other sensitive components. The proliferation of smart home devices and the burgeoning wearables market, which are heavily concentrated in Asia Pacific's manufacturing ecosystem, further amplifies this demand.

The Consumer Electronics segment itself will be a primary growth engine due to several factors:

Beyond consumer electronics, the Automotive segment, particularly the burgeoning Electric Vehicle (EV) sub-segment, will also be a significant contributor to market growth. The global push towards electrification in the automotive industry has created an unprecedented demand for advanced thermal management solutions. EVs generate significant heat from their batteries, power inverters, motors, and charging systems. PTC Limit Temperature Sensors play a vital role in monitoring and controlling these temperatures, ensuring optimal performance, extending battery life, and, most importantly, guaranteeing passenger safety. The stringent safety regulations being implemented by governments worldwide for electric vehicles further underscore the importance of reliable thermal protection.

While other regions like North America and Europe are significant markets for consumer electronics and automotive, their manufacturing dominance in these sectors is relatively less pronounced compared to Asia Pacific. However, these regions will continue to be major consumers of PTC Limit Temperature Sensors due to their advanced technological landscapes and high disposable incomes. Therefore, the synergistic combination of the Asia Pacific region's manufacturing prowess and the Consumer Electronics segment's sheer volume, augmented by the rapidly growing Automotive sector's demand for safety, will firmly establish these as the dominant forces shaping the global PTC Limit Temperature Sensors market.

The PTC Limit Temperature Sensors industry is fueled by several potent growth catalysts. The relentless drive towards miniaturization across all electronic applications necessitates smaller, more integrated thermal protection solutions, a forte of advanced PTC designs. The accelerating adoption of electric vehicles (EVs) represents a monumental growth opportunity, as EVs require sophisticated thermal management for batteries, power electronics, and charging systems, areas where PTC sensors are indispensable for safety and performance. Furthermore, the pervasive expansion of the Internet of Things (IoT) ecosystem, with billions of connected devices requiring reliable temperature monitoring and protection, creates an ever-growing demand. The increasing stringency of global safety regulations and standards for electronic devices and automotive applications also acts as a significant catalyst, mandating the use of effective thermal protection measures.

This comprehensive report offers an all-encompassing view of the global PTC Limit Temperature Sensors market from 2019 to 2033, with a focused analysis on the base year of 2025 and an extended forecast period. It meticulously dissects market trends, identifies the critical driving forces behind its expansion, and analyzes the inherent challenges and restraints. The report pinpoints key regions and dominant market segments, providing a detailed regional and sectoral breakdown. It further elucidates the significant growth catalysts that are poised to shape the industry's future trajectory and identifies the leading players within the market. Furthermore, it chronicles significant industry developments and technological advancements, offering stakeholders an invaluable resource for strategic decision-making and market navigation. The report's projections, presented in the billions of US dollars, are grounded in robust historical data and forward-looking analysis, providing a reliable roadmap for understanding and capitalizing on opportunities within this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.28% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.28%.

Key companies in the market include TDK Corporation, Alpha Electronics Corp., Dongguan Ampfort Electronics Co., Ltd..

The market segments include Type, Application.

The market size is estimated to be USD 9.35 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "PTC Limit Temperature Sensors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the PTC Limit Temperature Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.