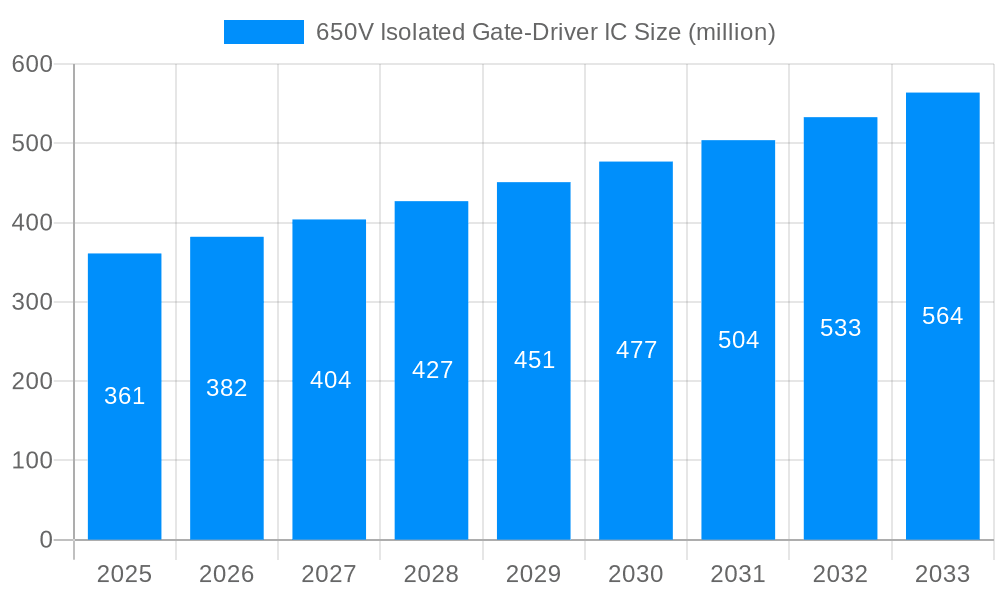

1. What is the projected Compound Annual Growth Rate (CAGR) of the 650V Isolated Gate-Driver IC?

The projected CAGR is approximately 5.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

650V Isolated Gate-Driver IC

650V Isolated Gate-Driver IC650V Isolated Gate-Driver IC by Type (1 Channel, 2 Channels), by Application (Motor Drives, Inverters, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

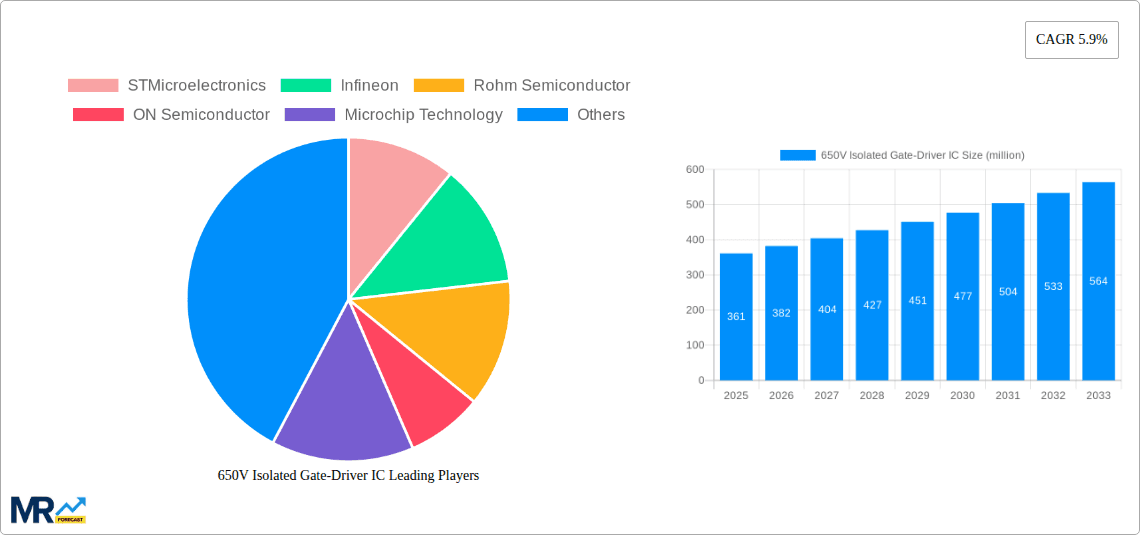

The global market for 650V Isolated Gate-Driver ICs is poised for robust expansion, with a projected market size of $361 million in 2025, growing at a compound annual growth rate (CAGR) of 5.9% through 2033. This significant growth is primarily fueled by the escalating demand for advanced power management solutions across various industries, including electric vehicles (EVs), renewable energy infrastructure, and industrial automation. The increasing adoption of high-efficiency power converters and the stringent regulatory push towards energy conservation are key drivers propelling the market forward. Furthermore, the continuous innovation in semiconductor technology, leading to more compact, reliable, and performance-driven gate-driver ICs, will further stimulate market penetration. The market is segmented by type, with 2-channel drivers anticipated to witness higher demand due to their suitability for complex motor control applications, and by application, where motor drives and inverters represent the dominant segments. Leading companies such as STMicroelectronics, Infineon, and ON Semiconductor are at the forefront of this technological evolution, investing heavily in research and development to cater to the evolving needs of the power electronics landscape.

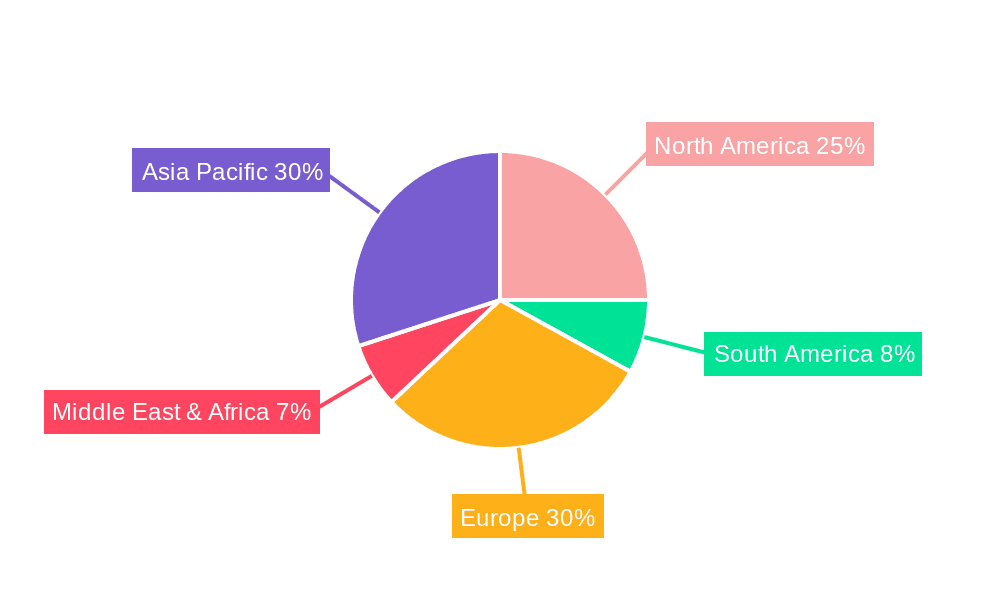

The competitive landscape features a dynamic interplay of established players and emerging innovators, all vying for market share through product differentiation and strategic partnerships. While the market benefits from strong growth drivers, certain restraints such as the complexity of manufacturing high-voltage isolation and the potential for supply chain disruptions in the semiconductor industry need to be carefully managed. However, the growing demand for GaN and SiC based power devices, which often necessitate high-performance gate drivers, presents a significant opportunity for market expansion. Regions like Asia Pacific, particularly China, are expected to lead in terms of market size and growth, driven by its substantial manufacturing base and rapid adoption of electric mobility and renewable energy. North America and Europe also represent significant markets, driven by technological advancements and supportive government initiatives for green energy. The continuous drive for miniaturization, improved thermal management, and enhanced safety features in isolated gate-driver ICs will shape the market's trajectory in the coming years.

The global 650V Isolated Gate-Driver IC market is poised for substantial expansion, projected to reach $1.2 billion by the end of 2025, with a robust compound annual growth rate (CAGR) of 14.5% during the forecast period of 2025-2033. This upward trajectory is fueled by the increasing demand for high-efficiency power conversion solutions across a myriad of industries, driven by stringent energy regulations and the relentless pursuit of optimized performance. The market, which stood at an estimated $600 million in the historical base year of 2025, has witnessed consistent growth throughout the study period of 2019-2033. Key insights reveal a significant shift towards higher voltage and higher current density gate drivers, catering to the evolving needs of next-generation power electronics. The integration of advanced safety features and enhanced isolation capabilities are becoming paramount, addressing concerns related to reliability and system integrity in demanding applications. Furthermore, the proliferation of electric vehicles (EVs), renewable energy systems, and advanced industrial automation are creating sustained demand for these critical components. Innovations in packaging technologies and manufacturing processes are also contributing to cost reductions and improved performance, further accelerating market penetration. The market is characterized by a dynamic competitive landscape, with established players continuously innovating to capture market share and emerging technologies offering novel solutions. The transition towards GaN and SiC power semiconductors is also a significant trend, necessitating gate drivers capable of handling their superior switching characteristics and higher operating frequencies, thus creating new avenues for growth within the 650V isolated gate-driver IC sector. The increasing complexity of power management systems in modern electronics also mandates sophisticated control and protection mechanisms, which are effectively provided by advanced isolated gate drivers.

The accelerated growth of the 650V Isolated Gate-Driver IC market is propelled by a confluence of powerful technological and economic forces. Foremost among these is the global imperative for enhanced energy efficiency. As governments worldwide enact stricter energy consumption standards and environmental regulations, industries are compelled to adopt power solutions that minimize energy loss. 650V isolated gate drivers play a crucial role in enabling the high-frequency switching of power semiconductors like GaN and SiC, which are inherently more efficient than traditional silicon-based devices. This improved efficiency translates directly into reduced operational costs and a smaller carbon footprint, making them indispensable for sectors striving for sustainability. The burgeoning electric vehicle (EV) market represents another monumental driver. The onboard chargers, inverters, and DC-DC converters within EVs all rely heavily on high-voltage isolated gate drivers to manage the power flow efficiently and safely. As EV adoption rates soar, the demand for these components is projected to skyrocket. Similarly, the expansion of renewable energy sources, particularly solar and wind power, requires robust and efficient inverters for grid integration. These inverters, often operating at higher voltages to minimize current and associated losses, necessitate advanced isolated gate drivers for their optimal functioning. The industrial automation sector is also a significant contributor, with advancements in robotics, variable speed drives, and power supplies demanding more compact, reliable, and high-performance power electronics, all of which are facilitated by the capabilities of 650V isolated gate drivers.

Despite the promising growth trajectory, the 650V Isolated Gate-Driver IC market is not without its hurdles. A significant challenge revolves around the complexity of design and manufacturing. Achieving robust isolation at 650V while maintaining high switching speeds and minimal propagation delay requires sophisticated design techniques and specialized manufacturing processes. This can lead to higher development costs and a longer time-to-market for new products, potentially hindering rapid adoption in price-sensitive applications. The increasing demand for miniaturization and higher power density also presents a continuous design challenge. Engineers are constantly tasked with packing more functionality into smaller footprints without compromising thermal performance or isolation integrity, demanding innovative packaging and integration solutions. Stringent reliability and safety standards in applications like automotive and industrial control necessitate rigorous testing and certification, adding to the overall cost and complexity of bringing products to market. Furthermore, the evolving landscape of power semiconductor technologies, particularly the rapid advancements in Wide Bandgap (WBG) semiconductors like GaN and SiC, requires gate drivers to adapt quickly. While WBG devices offer superior performance, they also present unique driving requirements and potential challenges related to parasitic inductance and electromagnetic interference (EMI), which gate driver designers must meticulously address. The global supply chain volatility, exacerbated by geopolitical factors and raw material shortages, can also impact the availability and cost of critical components required for the manufacturing of these ICs, posing a potential restraint on market growth. Finally, competition from existing, albeit less efficient, technologies in certain legacy applications can slow down the transition to 650V isolated gate drivers.

The Asia-Pacific region, particularly China, is projected to be the dominant force in the 650V Isolated Gate-Driver IC market, driven by its unparalleled manufacturing prowess, extensive industrial base, and burgeoning demand from key application segments. This dominance will be further solidified by its significant role in the global electric vehicle (EV) supply chain, where a vast number of EVs are manufactured and consumed. China's aggressive push towards renewable energy adoption, coupled with its leadership in industrial automation, creates a fertile ground for the widespread implementation of 650V isolated gate drivers. The region's robust ecosystem of semiconductor foundries and assembly facilities, supported by substantial government initiatives and investments in advanced manufacturing, allows for scaled production and cost efficiencies, which are crucial for capturing market share.

Within the application segments, Motor Drives are expected to be the primary market dominator for 650V Isolated Gate-Driver ICs. This segment's growth is intrinsically linked to the rapid industrialization and automation trends witnessed globally. Electric motors are the workhorses of modern industry, powering everything from factory assembly lines and robotics to HVAC systems and electric pumps. The increasing adoption of variable frequency drives (VFDs) to optimize motor efficiency and control, coupled with the electrification of industrial machinery, directly fuels the demand for high-performance gate drivers. 650V isolated gate drivers are critical for enabling the efficient and precise control of high-power electric motors used in industrial applications, where energy savings and precise torque control are paramount. The continuous innovation in motor control algorithms and the growing need for smaller, more integrated motor drive solutions further bolster the demand for these advanced gate drivers.

In terms of Type, the 2 Channels segment is anticipated to witness substantial growth and potentially lead the market. This is primarily due to its versatility and widespread applicability across numerous power conversion topologies. Many modern power inverters and motor drives employ half-bridge or full-bridge configurations that necessitate driving two MOSFETs or IGBTs independently and with precise timing. The integrated nature of a 2-channel gate driver simplifies the design, reduces component count, and improves reliability by minimizing discrete component interconnections. This allows for more compact and cost-effective power modules. For applications like solar inverters, EV charging stations, and industrial power supplies, the ability to control complementary switches in a bridge topology with high precision is essential for efficient operation and minimizing switching losses. The development of advanced features such as desaturation detection and fault protection integrated within these 2-channel drivers further enhances their appeal in demanding applications.

The 650V Isolated Gate-Driver IC industry is experiencing significant growth catalysts driven by the relentless pursuit of energy efficiency and the rapid expansion of electrification across multiple sectors. The increasing adoption of Wide Bandgap (WBG) semiconductors like Gallium Nitride (GaN) and Silicon Carbide (SiC) is a prime catalyst, as these materials necessitate gate drivers capable of handling their higher switching frequencies and lower on-resistance, leading to more efficient power conversion. The exponential growth of the Electric Vehicle (EV) market, demanding robust and efficient power electronics for onboard chargers and inverters, further fuels demand. Furthermore, the global push towards renewable energy sources, such as solar and wind power, requires advanced inverters that leverage the capabilities of 650V isolated gate drivers for seamless grid integration.

This comprehensive report provides an in-depth analysis of the global 650V Isolated Gate-Driver IC market, encompassing detailed market sizing and forecasts from 2019 to 2033, with a base year of 2025. The study delves into the intricate dynamics of market drivers, challenges, and opportunities, offering insights into the strategic initiatives of leading players. It meticulously examines key regional trends and segment-specific growth patterns, with a particular focus on the dominance of the Asia-Pacific region and the Motor Drives application segment. Furthermore, the report highlights significant technological developments and industry advancements, providing a holistic view of the market's evolution and future prospects. This in-depth coverage ensures stakeholders are equipped with the necessary intelligence to navigate this dynamic and rapidly expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.9%.

Key companies in the market include STMicroelectronics, Infineon, Rohm Semiconductor, ON Semiconductor, Microchip Technology, Renesas Electronics, NXP Semiconductors, Power Integrations, Skyworks, Analog Devices.

The market segments include Type, Application.

The market size is estimated to be USD 361 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "650V Isolated Gate-Driver IC," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 650V Isolated Gate-Driver IC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.