1. What is the projected Compound Annual Growth Rate (CAGR) of the OHT for Semiconductor Manufacturing Lines?

The projected CAGR is approximately 9.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

OHT for Semiconductor Manufacturing Lines

OHT for Semiconductor Manufacturing LinesOHT for Semiconductor Manufacturing Lines by Application (300mm Wafer FAB, 200mm Wafer FAB, World OHT for Semiconductor Manufacturing Lines Production ), by Type (Single Track OHT, Double Track OHT, World OHT for Semiconductor Manufacturing Lines Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

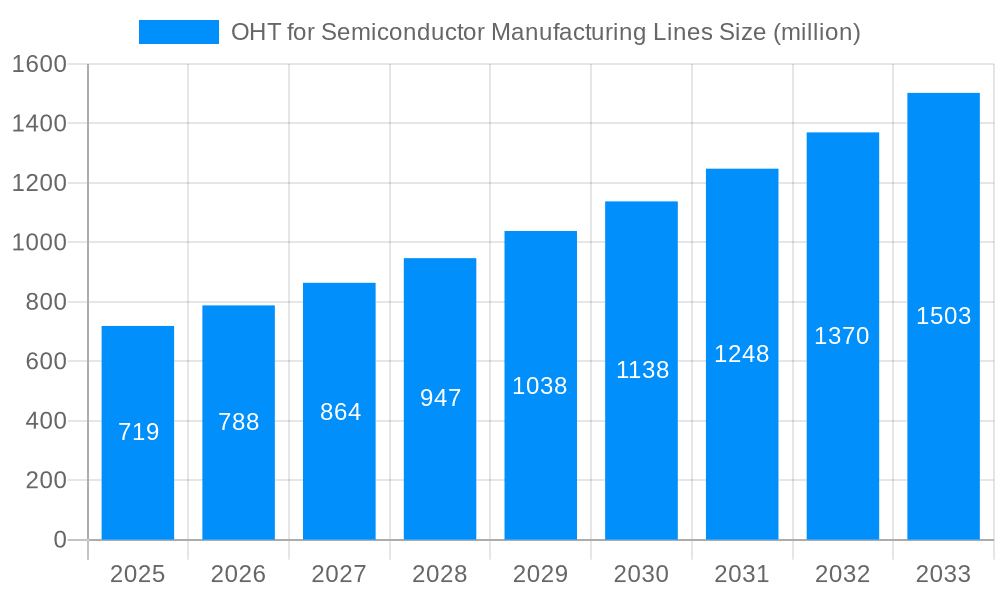

The global market for Overhead Hoist Transport (OHT) systems in semiconductor manufacturing lines is poised for significant expansion, driven by the relentless demand for advanced microchips and the increasing complexity of wafer fabrication processes. Valued at an estimated $719 million in 2025, the market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 9.6% through 2033. This growth is primarily fueled by the escalating investment in new fab construction and expansion, particularly for 300mm wafer fabrication, which requires highly automated and efficient material handling solutions. The push towards miniaturization and higher performance in semiconductors necessitates pristine manufacturing environments, where OHT systems excel by minimizing human intervention and particulate contamination. Furthermore, the industry's focus on enhancing throughput, reducing cycle times, and improving overall operational efficiency directly translates to a stronger adoption of sophisticated OHT solutions. Key applications within the semiconductor industry, such as 300mm Wafer FAB and 200mm Wafer FAB, are the primary beneficiaries and drivers of this OHT market growth, underscoring the critical role of automated material handling in modern semiconductor production.

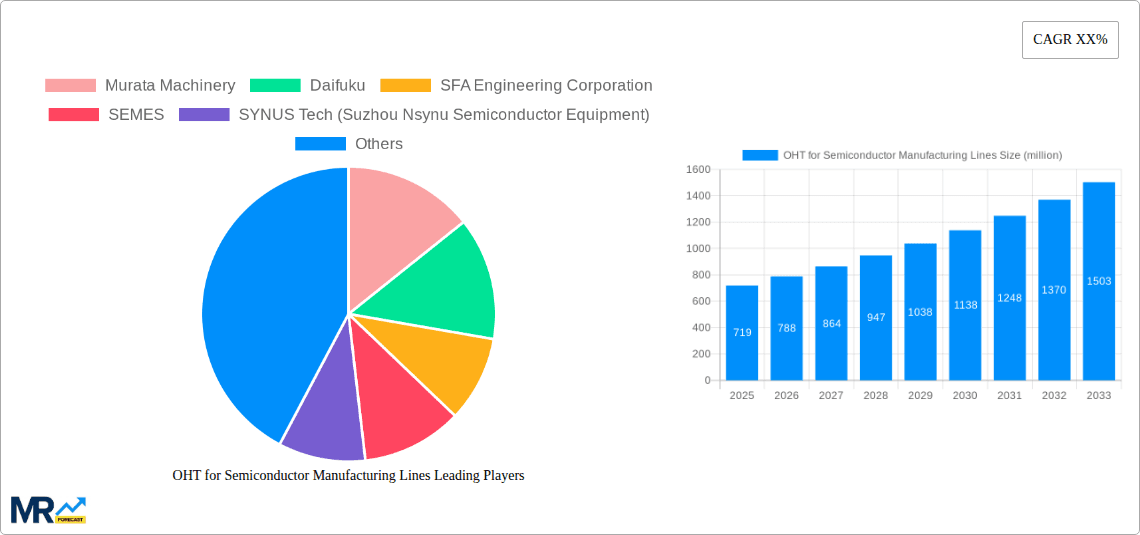

The OHT market for semiconductor manufacturing lines is characterized by dynamic trends, including the increasing integration of AI and machine learning for predictive maintenance and optimized routing, enhancing the intelligence and efficiency of these systems. Innovations in OHT technology, such as multi-track configurations and higher payload capacities, are addressing the growing needs of high-volume manufacturing environments. However, the market also faces certain restraints, including the substantial upfront capital investment required for OHT system deployment and the specialized skill sets needed for installation, maintenance, and operation. The complex supply chain for semiconductor equipment and the geopolitical factors influencing global semiconductor production can also introduce variability. Despite these challenges, the industry's ongoing commitment to technological advancement and the strategic importance of robust, automated material handling in securing semiconductor supply chains are expected to propel sustained growth in the OHT market. Companies like Murata Machinery, Daifuku, and SEMES are at the forefront, innovating and expanding their offerings to meet the evolving demands of semiconductor manufacturers worldwide.

This report offers an in-depth analysis of the Over Head Transport (OHT) market within the semiconductor manufacturing landscape. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, it delves into the historical trajectory (2019-2024) and future potential of this critical automation technology.

The semiconductor industry, a cornerstone of the global economy, is characterized by its relentless pursuit of efficiency, precision, and contamination control. Within this demanding environment, OHT systems have emerged as indispensable solutions for the automated material handling of sensitive semiconductor wafers. These systems, comprising overhead tracks, automated carriers, and sophisticated control software, orchestrate the seamless movement of wafers between various process tools and cleanroom areas. The market for OHT in semiconductor manufacturing is experiencing robust growth, driven by several interconnected factors.

The escalating demand for advanced semiconductors, fueled by the proliferation of 5G technology, artificial intelligence, the Internet of Things (IoT), and electric vehicles, necessitates a significant expansion of wafer fabrication capacity. This expansion directly translates into a heightened need for highly automated and efficient material handling solutions like OHT. As wafer sizes increase, particularly with the dominant adoption of 300mm wafer FABs, the complexity and weight of wafer lots increase, making manual handling impractical and prone to errors. OHT systems are uniquely positioned to address these challenges by providing a reliable, clean, and precise method for transporting these valuable materials. Furthermore, the imperative for stringent contamination control in semiconductor cleanrooms drives the adoption of OHT, as it minimizes human intervention and the associated risk of particulate contamination. The inherent design of OHT systems keeps the transport path above the critical processing areas, further safeguarding wafer integrity. The increasing sophistication of semiconductor manufacturing processes, with more steps and greater interconnectivity between tools, demands a highly integrated and intelligent material flow system. OHT, with its advanced tracking and routing capabilities, is crucial for optimizing this flow, reducing bottlenecks, and improving overall fab productivity. The global nature of semiconductor supply chains also plays a role, with OHT being deployed across various geographical locations to support the expanding manufacturing footprint. The continuous innovation in OHT technology, including advancements in sensing, AI-driven routing, and energy efficiency, is also contributing to its growing adoption. Moreover, as fabs become more complex and automated, the integration of OHT with other manufacturing execution systems (MES) and factory automation software becomes paramount, leading to a more holistic and optimized production environment. The industry's focus on reducing operational costs and improving throughput further solidifies the value proposition of OHT, as it demonstrably contributes to these objectives by minimizing manual labor, reducing wafer breakage, and accelerating process cycle times. The ongoing miniaturization of semiconductor components and the increasing complexity of their manufacturing processes are also indirectly driving the demand for OHT, as it provides the necessary precision and control for handling increasingly delicate and valuable wafer lots. The growing emphasis on Industry 4.0 principles within semiconductor manufacturing, with its focus on data-driven decision-making and interconnected systems, further aligns with the capabilities of modern OHT solutions, which generate valuable data on material flow and system performance.

The OHT for Semiconductor Manufacturing Lines market is poised for significant expansion, driven by a confluence of technological advancements, increasing demand for semiconductors, and the inherent need for enhanced automation in cleanroom environments. The market is projected to witness a compound annual growth rate (CAGR) of approximately XX% from 2025 to 2033, reaching an estimated market size of $XXX million by 2033, up from $XXX million in 2025. This growth is underpinned by substantial investments in new fab constructions and expansions globally, particularly in regions like Asia-Pacific. The dominant application segment is expected to be the 300mm Wafer FAB, which will account for a substantial share of the market, driven by the increasing production of high-end processors, memory chips, and advanced logic devices. The transition towards larger wafer diameters necessitates more sophisticated and robust material handling systems, making OHT the preferred choice. In terms of OHT type, Single Track OHT systems will continue to hold a significant market share due to their cost-effectiveness and suitability for less complex fab layouts. However, the Double Track OHT segment is anticipated to witness higher growth, especially in high-volume manufacturing facilities requiring increased throughput and redundancy. The increasing adoption of automated material handling in advanced packaging facilities also presents a nascent but rapidly growing opportunity for OHT solutions. The global demand for semiconductor devices continues its upward trajectory, propelled by emerging technologies such as artificial intelligence, 5G communication, and the Internet of Things (IoT). This surge in demand directly translates into increased wafer production, necessitating the expansion of existing fabrication plants and the construction of new ones. Consequently, the need for efficient, reliable, and contamination-free material handling solutions like OHT systems becomes paramount. OHT systems are intrinsically designed to minimize human intervention within the highly sensitive cleanroom environments of semiconductor fabs. This reduction in human presence directly mitigates the risk of particulate contamination, a critical concern in wafer fabrication where even microscopic dust particles can render complex integrated circuits useless. The increasing complexity and number of processing steps involved in modern semiconductor manufacturing further amplify the importance of OHT. With multiple tools and intricate workflows, manual material handling becomes a significant bottleneck, prone to errors and delays. OHT systems, with their automated routing and tracking capabilities, ensure a seamless and optimized flow of wafers, thereby enhancing overall fab productivity and reducing cycle times. The increasing adoption of Industry 4.0 principles, emphasizing data-driven decision-making and interconnected manufacturing processes, further favors the deployment of OHT. These systems generate vast amounts of data related to material movement, system performance, and potential bottlenecks, enabling real-time monitoring and proactive optimization of production. Moreover, the evolving landscape of semiconductor manufacturing, including the rise of advanced packaging technologies and the development of specialized chips for niche applications, is also creating new opportunities for OHT solutions. These evolving demands underscore the critical role of OHT in enabling the next generation of semiconductor innovation and production.

The OHT for Semiconductor Manufacturing Lines market is characterized by a dynamic interplay of technological advancements, evolving manufacturing strategies, and the relentless pursuit of enhanced operational efficiency. A primary trend is the increasing adoption of intelligent and autonomous OHT systems. These systems are moving beyond basic point-to-point transportation, incorporating advanced AI algorithms for predictive maintenance, dynamic routing optimization, and enhanced fleet management. This allows fabs to adapt more readily to changing production demands and proactively address potential disruptions. The integration of OHT with other factory automation systems, such as Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP), is another significant trend. This seamless integration enables a holistic view of the production process, allowing for better planning, scheduling, and real-time control of material flow. The data generated by OHT systems becomes a valuable asset for optimizing overall fab performance. The escalating demand for higher throughput and reduced cycle times is driving the development of faster and more efficient OHT designs, including Double Track OHT systems and higher-speed single-track solutions. This is crucial for meeting the growing global demand for semiconductors across various applications. The emphasis on contamination control and wafer integrity remains a cornerstone of OHT development. Innovations in carrier design, track cleaning technologies, and the use of specialized materials are continuously improving the ability of OHT systems to protect sensitive wafers from particulate contamination. The growing importance of flexibility and scalability in OHT solutions is also evident. Manufacturers are seeking systems that can be easily reconfigured and expanded to accommodate changes in fab layout, production volumes, and the introduction of new process tools. This adaptability is essential in the fast-paced semiconductor industry. Furthermore, the advancement in sensor technologies and onboard diagnostics is enabling OHT systems to perform self-monitoring and provide real-time status updates, thereby enhancing reliability and reducing downtime. The global expansion of semiconductor manufacturing capacity, particularly in Asia-Pacific, is a significant driver for OHT adoption, leading to increased demand for these automated material handling solutions in new fab constructions and expansions. The increasing complexity of wafer processing with a higher number of steps and interdependencies between tools necessitates highly integrated and intelligent material flow, which OHT excels at providing. The focus on reducing operational costs and improving yield through automation further solidifies the value proposition of OHT. The continuous innovation in battery technology and energy management for OHT vehicles is also a key trend, leading to longer operational times and reduced energy consumption. The emergence of smart fabs and Industry 4.0 initiatives are fostering an environment where OHT systems are seen as integral components of a connected and data-driven manufacturing ecosystem. This interconnectedness allows for optimized decision-making and improved overall fab efficiency.

The semiconductor industry's relentless pursuit of higher yields, increased throughput, and stringent contamination control serves as the primary engine driving the adoption of OHT systems. The escalating global demand for advanced semiconductors, fueled by the burgeoning 5G, AI, IoT, and automotive sectors, necessitates a significant expansion of wafer fabrication capacity. This expansion directly translates into a heightened need for sophisticated and reliable material handling solutions, with OHT emerging as a preferred choice due to its inherent efficiency and precision. The inherent complexity of modern semiconductor manufacturing processes, involving numerous intricate steps and a vast array of specialized tools, makes manual material handling impractical and prone to errors. OHT systems provide an automated, precise, and contamination-free pathway for wafer transport, minimizing human intervention and the associated risks of particulate contamination and wafer breakage. As wafer sizes continue to grow, particularly with the widespread adoption of 300mm wafer FABs, the weight and sensitivity of wafer lots increase, further amplifying the need for robust OHT solutions. The critical need for ultra-clean environments within semiconductor cleanrooms is a paramount concern, and OHT systems play a vital role in maintaining this pristine condition by minimizing human presence and ensuring a controlled transport environment. Moreover, the increasing focus on Industry 4.0 principles and the development of smart factories are pushing semiconductor manufacturers to adopt more automated and data-driven operations, where OHT systems are indispensable for seamless material flow and real-time operational insights.

Despite the significant growth potential, the OHT for Semiconductor Manufacturing Lines market faces several challenges and restraints that could temper its expansion. A key challenge is the high initial capital investment required for the implementation of OHT systems, including infrastructure development, track installation, vehicle procurement, and software integration. This can be a significant barrier for smaller manufacturers or those in regions with less developed economies. The complexity of integration with existing fab infrastructure and legacy systems can also pose a hurdle. Seamlessly integrating new OHT systems with existing process tools and factory automation software requires considerable planning, expertise, and potential retrofitting, which can be time-consuming and costly. Maintaining and servicing OHT systems requires specialized technical expertise and ongoing maintenance programs, which can add to operational costs and may be difficult to secure in some regions. The potential for system downtime and the impact of failures are also significant concerns. Any disruption in the OHT system can halt the entire production line, leading to substantial financial losses. Therefore, robust redundancy and rapid troubleshooting capabilities are essential, but not always easily achieved. The evolving nature of semiconductor manufacturing processes and the increasing diversity of wafer handling requirements can also present a challenge. OHT systems need to be flexible and adaptable to accommodate new wafer sizes, handling protocols, and the integration of new types of process equipment, which may require system modifications. The reliance on a stable and high-quality power supply is crucial for the continuous operation of OHT systems, and power outages or fluctuations can disrupt production. Furthermore, regulatory compliance and safety standards for automated material handling systems in cleanroom environments can add complexity to the design, installation, and operation of OHT solutions. The shortage of skilled personnel capable of designing, installing, operating, and maintaining these sophisticated systems can also be a restraint in certain geographical markets. The increasing adoption of alternative material handling technologies in specific niche applications, although not a direct replacement for OHT in core wafer transport, could also present indirect competition in certain segments of the broader semiconductor manufacturing automation market.

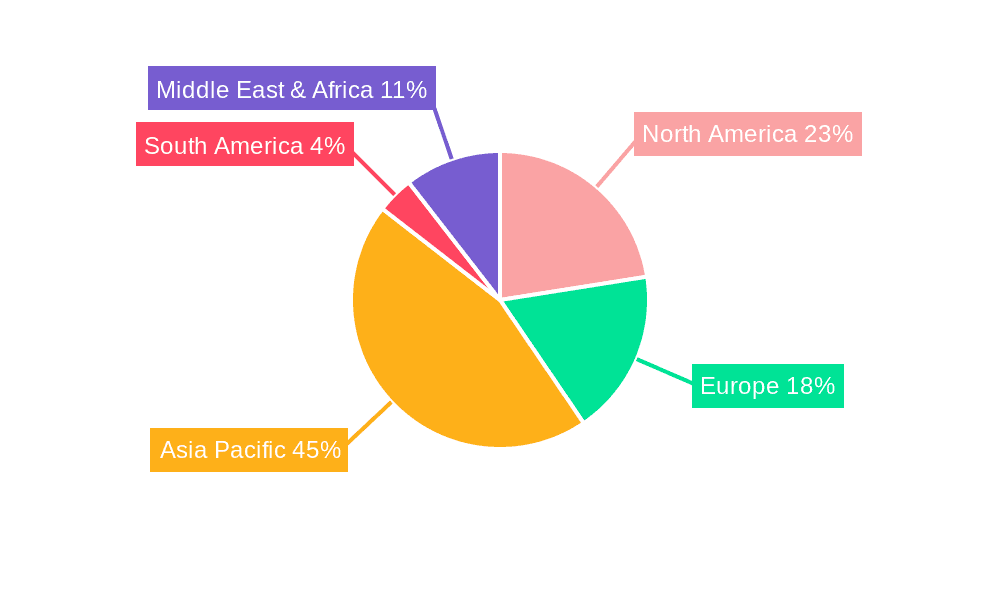

The OHT for Semiconductor Manufacturing Lines market is expected to witness significant dominance from specific regions and application segments, driven by a combination of established manufacturing prowess, ongoing investment, and the inherent technological requirements of advanced wafer fabrication.

Dominant Region: Asia-Pacific is poised to be the leading region in the OHT for Semiconductor Manufacturing Lines market. This dominance is attributed to several factors:

Dominant Application Segment: Within the application segments, the 300mm Wafer FAB segment is expected to hold a commanding market share and drive significant growth in the OHT for Semiconductor Manufacturing Lines market.

The OHT for Semiconductor Manufacturing Lines industry is experiencing robust growth propelled by several key catalysts. The ever-increasing global demand for semiconductors across diverse sectors like 5G, AI, IoT, and automotive is driving substantial investments in new fab constructions and expansions, directly boosting the need for OHT systems. The imperative for enhanced contamination control in cleanroom environments, where even microscopic particles can compromise wafer integrity, positions OHT as a vital solution for minimizing human intervention. Furthermore, the transition to larger wafer diameters, particularly 300mm, necessitates more sophisticated and reliable material handling solutions, which OHT systems expertly provide due to their precision and automated capabilities. The ongoing push towards Industry 4.0 and smart manufacturing principles, emphasizing data-driven operations and seamless integration of automated systems, further fuels the adoption of intelligent OHT solutions for optimized material flow.

This report provides a holistic and in-depth analysis of the OHT for Semiconductor Manufacturing Lines market, offering invaluable insights for stakeholders. It meticulously examines market trends, driving forces, and challenges, providing a granular understanding of the industry's dynamics. The report details key regional market shares and dominant application segments, highlighting the strategic importance of Asia-Pacific and the 300mm Wafer FAB sector. Leading players are identified, along with their contributions to market evolution. Significant developments and technological advancements are cataloged chronologically, showcasing the industry's innovation trajectory. The report's comprehensive nature ensures that readers gain a complete picture of the OHT market's current landscape, future projections, and the strategic imperatives for success in this critical segment of semiconductor manufacturing. This in-depth coverage empowers stakeholders to make informed decisions regarding investments, technological adoption, and market positioning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.6%.

Key companies in the market include Murata Machinery, Daifuku, SFA Engineering Corporation, SEMES, SYNUS Tech (Suzhou Nsynu Semiconductor Equipment), Mirle Automation, Shinsung E&G Co., Ltd, Stratus Automation, MFSG, Kenmec Mechanical Engineering, MeetFuture Technology (Shanghai), Jiangsu Ruixinku Intelligent Technology, Zooming Intelligent Technology (Suzhou), Linkwise Technology, Huaxin (Jiaxing) Intelligent Manufacturing, Hefei Sineva Intelligent Machine, Jiangsu Tota Intelligent Technology, SUPER PLUS TECH, BriteLab.

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "OHT for Semiconductor Manufacturing Lines," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the OHT for Semiconductor Manufacturing Lines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.