1. What is the projected Compound Annual Growth Rate (CAGR) of the OLED Display Power Supply?

The projected CAGR is approximately 5.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

OLED Display Power Supply

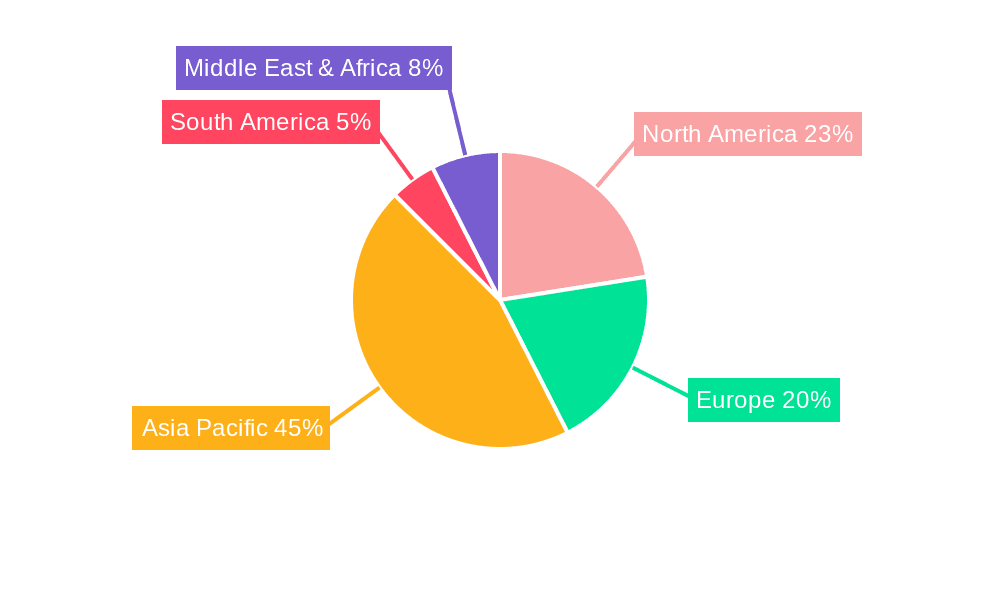

OLED Display Power SupplyOLED Display Power Supply by Application (Smartphone, TV, Tablet, Automotive Display, Computer Display, Others), by Type (Low Power Supply, High Power Supply), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

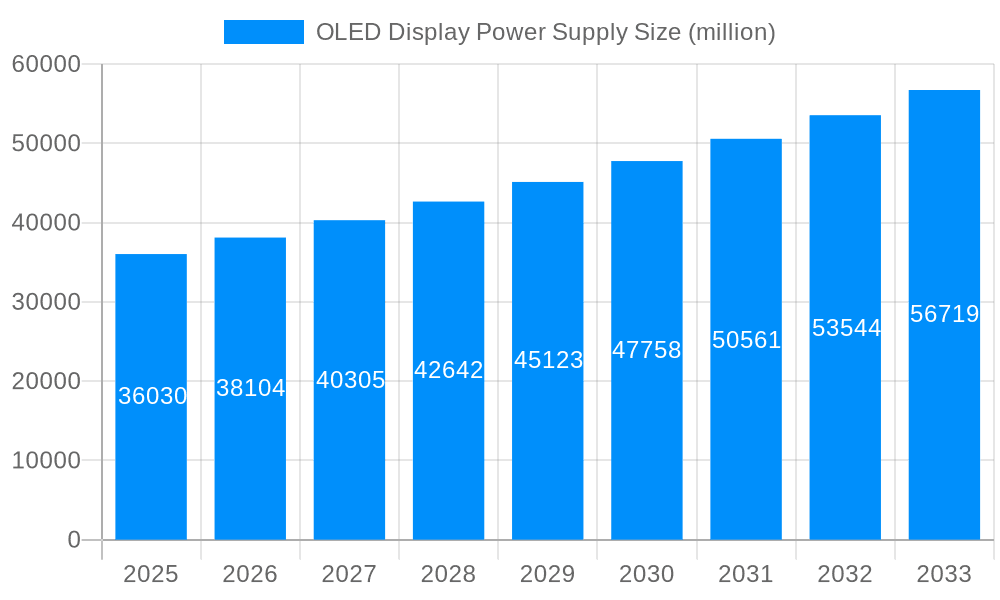

The global OLED display power supply market is poised for substantial growth, projected to reach approximately $36,030 million by 2025. This impressive market size is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 5.8% expected between 2025 and 2033. This sustained expansion is primarily driven by the escalating demand for high-performance, energy-efficient power solutions across a diverse range of electronic devices. The increasing adoption of OLED technology in smartphones, televisions, and tablets, owing to their superior picture quality and flexibility, is a significant catalyst. Furthermore, the burgeoning automotive sector's integration of sophisticated OLED displays for infotainment and driver information systems is opening new avenues for market penetration. Emerging applications in wearables and augmented/virtual reality devices are also contributing to this robust growth trajectory.

The market is characterized by a dynamic interplay of technological advancements and evolving consumer preferences. While low power supply solutions are crucial for portable devices like smartphones and wearables, the growing size and power requirements of OLED TVs and automotive displays are fueling the demand for high power supply variants. Key trends shaping the market include the development of highly integrated and miniaturized power management integrated circuits (PMICs) that offer enhanced efficiency and reduced form factors. Innovations in power conversion technologies and advanced thermal management solutions are also critical. However, the market faces certain restraints, including the high initial cost of OLED panel manufacturing and the complexity of power delivery systems required for optimal performance. Intense competition among established players and the continuous need for research and development to stay ahead of technological curves also present challenges, albeit ones that foster innovation and drive market evolution.

This comprehensive report offers an in-depth analysis of the global OLED Display Power Supply market, spanning a critical study period from 2019 to 2033, with a base year of 2025. The report meticulously examines historical trends, current market dynamics (Estimated Year: 2025), and forecasts future growth trajectories through the Forecast Period (2025-2033), building upon the Historical Period (2019-2024). The analysis delves into the intricate interplay of technological advancements, evolving consumer demands, and strategic initiatives undertaken by leading industry players. With a focus on providing actionable intelligence, the report quantifies market sizes in the millions of USD, offering a granular view of segment-specific opportunities and challenges.

The OLED Display Power Supply market is experiencing a robust expansion, driven by the insatiable demand for vibrant, energy-efficient, and aesthetically superior displays across a multitude of consumer electronics and automotive applications. The market size for OLED display power supplies is projected to reach $2,500 million by the end of the forecast period in 2033, a significant leap from its estimated valuation of $1,200 million in the base year of 2025. This impressive growth underscores the transformative impact of OLED technology. During the historical period (2019-2024), the market witnessed a steady increase, propelled by the initial adoption of OLED in premium smartphones and televisions. As manufacturing costs have gradually declined and display performance has continued to improve, OLED technology has successfully penetrated a broader spectrum of devices, including tablets, wearables, and increasingly, automotive infotainment systems and digital instrument clusters. The report highlights a discernible shift towards more sophisticated power management solutions, emphasizing higher power densities, improved thermal efficiency, and enhanced voltage regulation capabilities to meet the demanding requirements of larger and brighter OLED panels. Furthermore, the burgeoning interest in foldable and rollable displays, which present unique power delivery challenges, is fostering innovation in flexible and compact power supply designs. The increasing emphasis on Extended Reality (XR) devices, such as VR and AR headsets, is also a significant trend, requiring highly efficient and compact power solutions to drive their advanced displays. The report anticipates a growing demand for intelligent power management ICs (PMICs) that can dynamically adjust power consumption based on content and ambient light conditions, thereby optimizing battery life and overall user experience. This evolution is not merely about supplying power but about intelligently managing it to unlock the full potential of OLED technology. The integration of advanced materials and manufacturing techniques in OLED panels directly influences the power supply requirements, pushing for solutions that can handle higher current densities and tighter voltage tolerances. The market is also seeing a move towards integrated power solutions that combine multiple functionalities, reducing component count and overall system size, which is particularly critical for space-constrained devices. The trend towards higher refresh rates and resolutions in OLED displays is also a key driver, necessitating power supplies capable of delivering stable and high-amplitude voltage and current. The competitive landscape is characterized by continuous innovation, with companies striving to develop power solutions that offer superior performance, efficiency, and cost-effectiveness, thereby fueling the overall growth trajectory of the OLED display power supply market. The global market size for OLED display power supplies is estimated to reach $1,250 million in 2025 and is projected to grow at a CAGR of approximately 8.5% during the forecast period (2025-2033), reaching an estimated $2,450 million by 2033.

The market for OLED Display Power Supplies is being propelled by a confluence of powerful drivers, chief among them being the escalating consumer appetite for superior visual experiences. OLED technology, with its unparalleled contrast ratios, true blacks, vibrant colors, and rapid response times, has become the benchmark for premium display quality. This consumer preference directly translates into increased adoption across a wide array of devices, from the flagship smartphones that dominate the market to the increasingly sophisticated televisions gracing living rooms. Furthermore, the persistent pursuit of energy efficiency by both manufacturers and end-users is a significant catalyst. OLED pixels can be individually switched off, leading to substantial power savings, particularly for dark content, which aligns perfectly with the growing global focus on sustainability and reduced energy consumption. This inherent efficiency makes OLED power supplies an attractive proposition. Beyond consumer demand, the automotive sector is emerging as a pivotal growth engine. The integration of larger, more visually engaging OLED displays in vehicles for infotainment, navigation, and driver information systems requires robust and highly reliable power solutions. The safety-critical nature of automotive applications necessitates power supplies that offer exceptional stability and thermal management capabilities, pushing the boundaries of current technology. The report anticipates that the automotive display segment alone will contribute significantly to the overall market growth, with projected revenues in the hundreds of millions of USD by 2033. The continuous innovation within the semiconductor industry, particularly in the development of advanced power management integrated circuits (PMICs), also plays a crucial role. These ICs are becoming increasingly sophisticated, offering higher integration, improved efficiency, and more precise voltage and current regulation, all of which are essential for driving complex OLED panels. The ongoing miniaturization of electronic devices, coupled with the demand for thinner and lighter form factors, further incentivizes the development of compact and highly efficient OLED power supplies. The rise of foldable and flexible displays, while presenting unique engineering challenges, also opens up new avenues for power supply innovation, driving the market towards novel solutions.

Despite the robust growth trajectory, the OLED Display Power Supply market is not without its hurdles. A primary challenge revolves around the cost of OLED technology, particularly for larger display formats. While prices have been steadily declining, the initial investment for OLED panels can still be higher compared to traditional LCD counterparts, especially in the mass-market television segment. This cost differential can act as a restraint, limiting widespread adoption in price-sensitive markets. Furthermore, the complex driving requirements of OLED displays, which necessitate precise voltage and current control for individual pixels to ensure optimal performance and longevity, pose significant engineering challenges for power supply manufacturers. Achieving the necessary level of accuracy and stability while maintaining high efficiency and compact form factors requires advanced semiconductor design and manufacturing capabilities. The thermal management of OLED displays also presents a critical concern. As display brightness and resolution increase, so does the potential for heat generation, which can impact display lifespan and performance. Power supply designs must therefore incorporate effective thermal dissipation strategies, adding complexity and cost to the overall solution. Another significant restraint stems from the limited availability of raw materials and the intricate manufacturing processes associated with OLED technology. Disruptions in the supply chain or geopolitical factors can impact production volumes and drive up component costs, creating volatility in the market. The stringent reliability and safety standards, particularly in automotive and industrial applications, demand extensive testing and validation, which can prolong development cycles and increase product costs. The rapid pace of technological evolution in the display industry also presents a continuous challenge. Power supply solutions need to be adaptable and scalable to accommodate future advancements in OLED technology, such as higher refresh rates, improved color accuracy, and enhanced power efficiency, without becoming obsolete quickly. The need for highly specialized power management ICs, capable of intricate control algorithms and high integration, can also limit the number of capable suppliers and increase dependency on a few key players. The increasing complexity of OLED panel architectures, with the integration of advanced driver ICs and touch layers, further complicates the power delivery network, requiring more sophisticated and integrated power supply solutions.

The global OLED Display Power Supply market is anticipated to witness significant dominance from both specific geographical regions and key application segments.

Dominant Regions:

Dominant Segments:

The OLED Display Power Supply industry is experiencing robust growth fueled by several key catalysts. The relentless innovation in OLED panel technology, leading to improved brightness, color accuracy, and energy efficiency, directly stimulates demand for advanced power solutions. The accelerating adoption of OLED across various applications, especially in premium smartphones, high-definition televisions, and increasingly in automotive displays, creates a substantial and growing market base. Furthermore, the continuous advancements in semiconductor technology, enabling the development of more compact, efficient, and intelligent power management integrated circuits (PMICs), are crucial enablers. Growing consumer demand for immersive and high-quality visual experiences, coupled with a global emphasis on energy conservation, further amplifies the appeal of OLED technology and its associated power supplies.

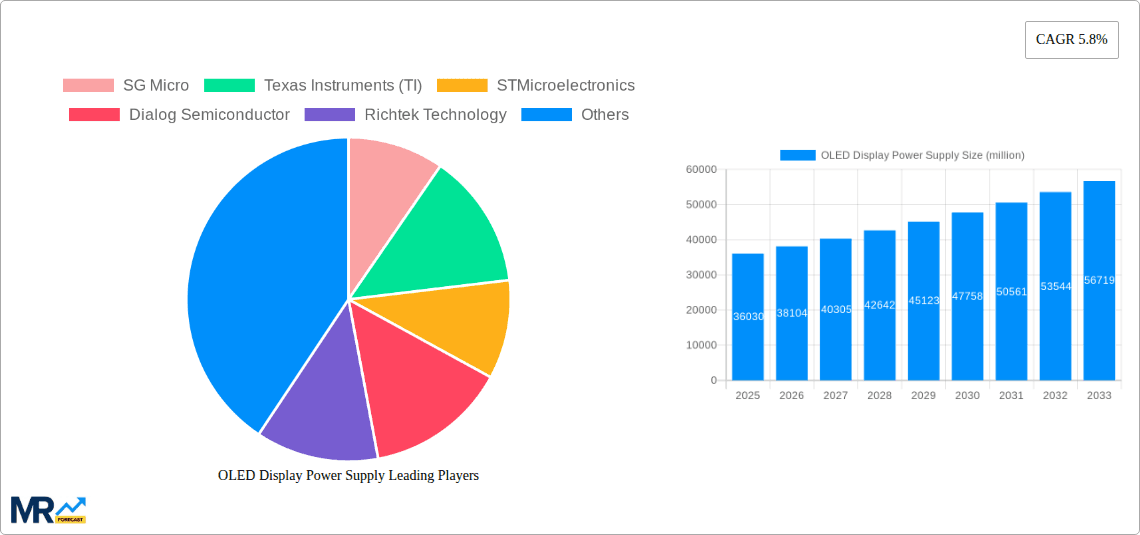

The following companies are identified as key players in the OLED Display Power Supply market:

This report offers unparalleled coverage of the OLED Display Power Supply market, providing stakeholders with a 360-degree view of industry dynamics. It meticulously dissects market size and segmentation across applications like Smartphones, TVs, Tablets, Automotive Displays, Computer Displays, and Others, and by Type, including Low Power Supply and High Power Supply. The analysis extends across key global regions and countries, identifying areas of dominant influence and emerging opportunities. Detailed insights into industry developments, including technological innovations and strategic alliances, are presented with precise timelines, offering a historical perspective from 2019 to 2024 and future projections up to 2033. The report quantifies market valuations in millions of USD, with a base year of 2025, enabling precise financial planning and investment decisions. The comprehensive nature of this report ensures that all crucial aspects, from market trends and driving forces to challenges and leading players, are thoroughly examined, equipping readers with the knowledge to navigate this dynamic and rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.8%.

Key companies in the market include SG Micro, Texas Instruments (TI), STMicroelectronics, Dialog Semiconductor, Richtek Technology, Maxim Integrated, Monolithic Power Systems, Rohm Semiconductor, Infineon, NXP Semiconductors, Renesas Electronics.

The market segments include Application, Type.

The market size is estimated to be USD 36030 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "OLED Display Power Supply," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the OLED Display Power Supply, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.