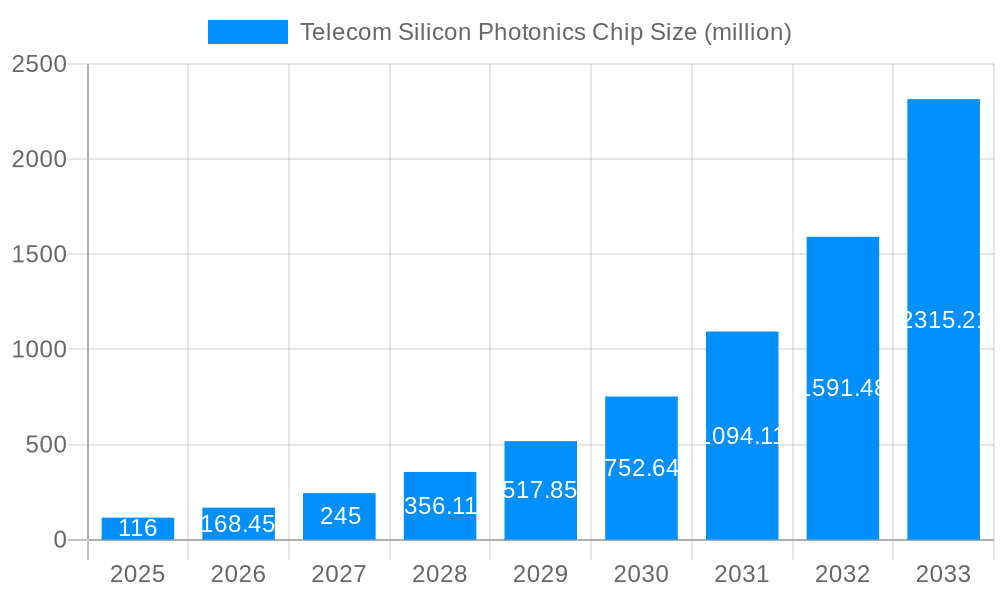

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Silicon Photonics Chip?

The projected CAGR is approximately 44.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Telecom Silicon Photonics Chip

Telecom Silicon Photonics ChipTelecom Silicon Photonics Chip by Type (100G, 400G, 800G, Others), by Application (Fiber Optic Access, Mobile Communication Network, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Telecom Silicon Photonics Chip market is poised for extraordinary expansion, projected to reach approximately $116 million by 2025, with a staggering Compound Annual Growth Rate (CAGR) of 44.5% through 2033. This robust growth is primarily fueled by the insatiable demand for higher bandwidth and faster data transmission speeds across telecommunications networks. The relentless evolution of 5G and the nascent stages of 6G deployment necessitate advanced optical solutions, positioning silicon photonics as a critical enabler. Furthermore, the increasing adoption of fiber optic access networks for both residential and enterprise connectivity, coupled with the burgeoning requirements of mobile communication infrastructure, are significant drivers. The market's trajectory is also influenced by the continuous innovation in chip design and manufacturing, leading to more cost-effective and higher-performance silicon photonics components.

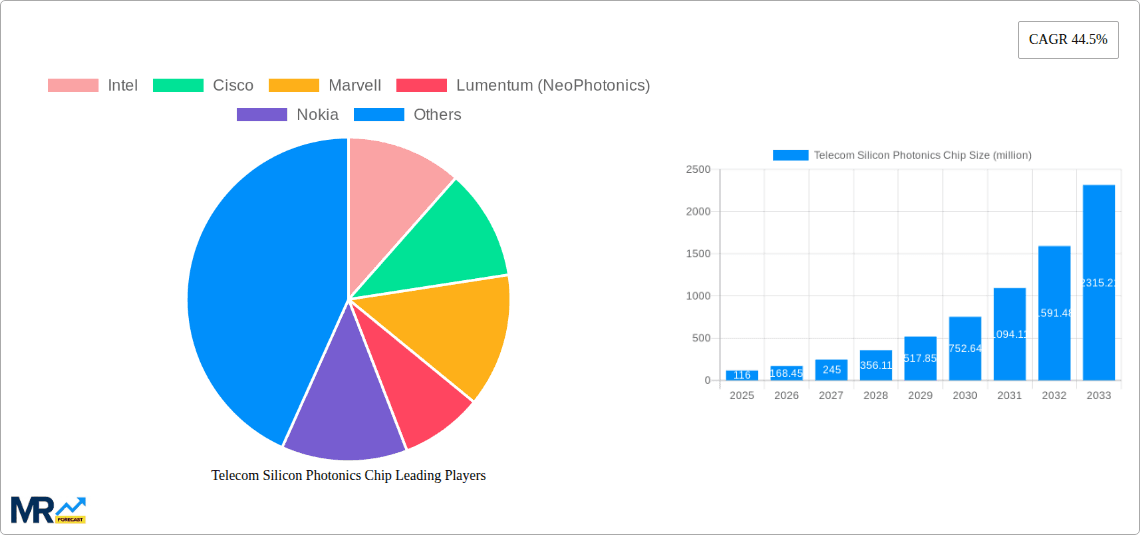

Despite the promising outlook, certain factors could moderate this rapid ascent. The high initial investment required for silicon photonics fabrication facilities and the complexity of integrating these chips into existing infrastructure present significant restraints. Moreover, the development of alternative optical technologies and the ongoing need for standardization across the industry could pose challenges. However, the inherent advantages of silicon photonics, including its compatibility with existing semiconductor manufacturing processes, scalability, and potential for miniaturization, strongly favor its widespread adoption. The market is segmented by type, with 100G, 400G, and 800G chips dominating the current landscape, while applications span fiber optic access, mobile communication networks, and other emerging areas. Key players like Intel, Cisco, Marvell, and Lumentum are at the forefront, driving innovation and market penetration through strategic investments and product development.

Here is a unique report description for Telecom Silicon Photonics Chips, incorporating the requested elements:

The global Telecom Silicon Photonics Chip market is poised for remarkable expansion, projected to surge from approximately $4,500 million in the base year 2025 to an estimated $15,000 million by the end of the forecast period in 2033. This substantial growth, spanning a study period from 2019 to 2033 and a forecast period of 2025-2033, underscores the transformative impact of silicon photonics on telecommunications infrastructure. The historical period, from 2019-2024, laid the foundational advancements, witnessing the gradual integration of optical functionalities onto silicon platforms. Key market insights reveal a decisive shift towards higher bandwidth demands, driven by the proliferation of 5G networks, cloud computing, and the burgeoning Internet of Things (IoT). This necessitates faster data transmission rates, where silicon photonics excels. The transition from 100G to 400G and increasingly 800G technologies is a dominant trend, with these high-speed interfaces becoming standard in data centers and core network deployments. Fiber optic access remains a critical application, benefiting from the cost-effectiveness and scalability offered by silicon photonics for delivering high-speed internet to end-users. Furthermore, mobile communication networks are a significant driver, as the infrastructure required to support advanced mobile services heavily relies on high-capacity optical interconnects. The integration of photonic components onto silicon wafers allows for miniaturization, lower power consumption, and mass manufacturability, ultimately reducing the cost per bit of data transmission. This report delves into these evolving trends, analyzing the market dynamics and technological advancements that are reshaping the telecom landscape. The estimated market size in 2025 stands at a robust $4,500 million, signaling a strong present and a promising future for this technology.

Several powerful forces are propelling the Telecom Silicon Photonics Chip market forward. The insatiable demand for higher data rates, fueled by the exponential growth of video streaming, online gaming, AI workloads, and the ever-expanding IoT ecosystem, is a primary catalyst. As networks grapple with this increasing data traffic, traditional electronic interconnects are reaching their physical limits. Silicon photonics offers a compelling solution by leveraging light for data transmission, enabling speeds that are orders of magnitude faster than electrical signals. The ongoing global rollout and densification of 5G mobile networks represent another monumental driver. These networks demand massive bandwidth and low latency, necessitating advanced optical interconnects within base stations, aggregation points, and data centers. Furthermore, the rapid expansion of hyperscale data centers, crucial for supporting cloud computing and AI services, is a significant market influencer. These facilities require vast numbers of high-speed optical transceivers for internal and external connectivity, and silicon photonics is proving to be a cost-effective and scalable solution for meeting these demands. The increasing integration of optical components onto silicon platforms, leading to smaller footprints, lower power consumption, and improved performance, further strengthens the market's growth trajectory. The ability to manufacture these complex devices using established semiconductor fabrication processes also contributes to cost reduction and widespread adoption.

Despite its immense potential, the Telecom Silicon Photonics Chip market faces several challenges and restraints that could temper its growth. One significant hurdle is the high initial investment required for research, development, and manufacturing of silicon photonics components. Establishing foundries and developing proprietary processes can be capital-intensive, potentially limiting the entry of smaller players. Integration complexity also poses a challenge. Seamlessly integrating photonic components with existing electronic integrated circuits (ICs) and packaging them effectively for mass production requires sophisticated engineering expertise and can lead to yield issues. Standardization efforts are ongoing but are crucial for widespread interoperability and market adoption. A lack of unified standards across different vendors could create compatibility issues and hinder seamless network upgrades. Performance limitations at extreme conditions for certain applications, such as very high temperatures or specific environmental factors, may also necessitate specialized solutions, adding to costs and complexity. Moreover, while cost-effectiveness is a long-term goal, the current cost of silicon photonics solutions compared to mature electrical interconnects can still be a barrier for some cost-sensitive applications or segments. Finally, talent acquisition and retention of skilled engineers with expertise in both photonics and semiconductor fabrication is a continuous challenge for companies operating in this specialized field.

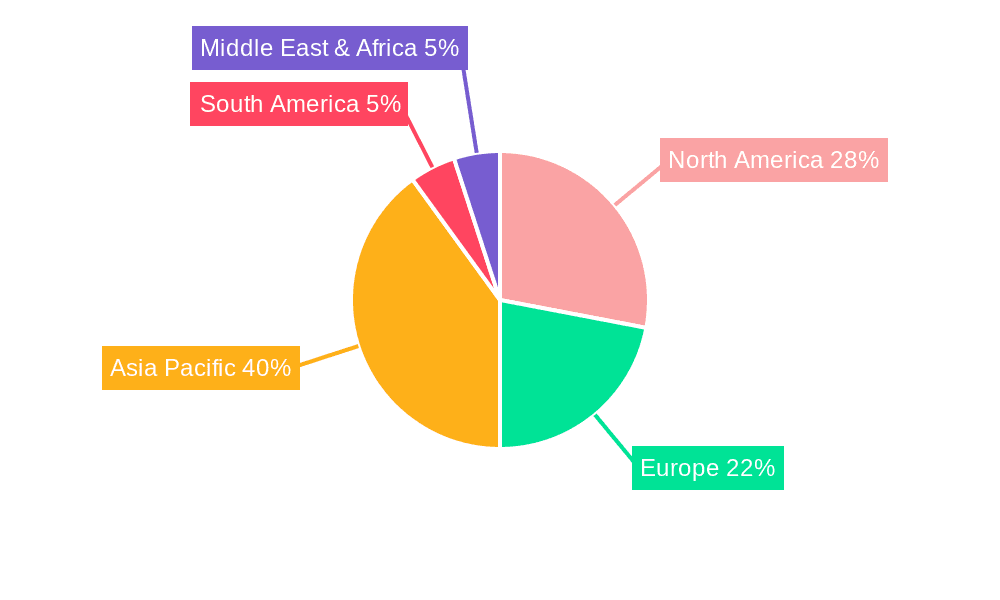

The 400G segment, within the broader Fiber Optic Access and Mobile Communication Network applications, is anticipated to be a dominant force in the Telecom Silicon Photonics Chip market. This dominance will be most pronounced in regions with advanced telecommunications infrastructure and a strong focus on technological innovation, particularly North America and Asia-Pacific.

Dominance of the 400G Segment:

Dominance of Fiber Optic Access and Mobile Communication Network Applications:

Regional Dominance:

The Telecom Silicon Photonics Chip industry is experiencing robust growth due to several key catalysts. The insatiable demand for higher bandwidth, driven by 5G deployment, cloud computing, and AI, is a primary accelerant. Silicon photonics offers a scalable and cost-effective solution for achieving these high speeds. Advances in manufacturing processes, enabling mass production and cost reduction, are making silicon photonics more accessible. Furthermore, the increasing integration of optical functionalities onto single chips reduces power consumption and form factor, making them ideal for space-constrained applications. The continuous innovation by leading players, such as Intel and Lumentum, in developing next-generation silicon photonics solutions further fuels market expansion.

This comprehensive report offers an in-depth analysis of the Telecom Silicon Photonics Chip market, providing critical insights for stakeholders. It meticulously covers market dynamics from 2019 to 2033, with a detailed focus on the base year of 2025 and the forecast period of 2025-2033. The report dissects key industry trends, including the rapid ascent of 400G and 800G technologies, and their impact on applications like Fiber Optic Access and Mobile Communication Networks. It illuminates the driving forces behind market expansion, such as the relentless demand for higher bandwidth and the ongoing 5G rollout. Furthermore, the report addresses the challenges and restraints, offering strategic perspectives on overcoming them. It identifies key regions and segments poised for dominance, providing a roadmap for strategic investment and market entry. With its detailed segmentation, growth catalysts analysis, and profiles of leading players, this report is an indispensable resource for understanding the present and future of the Telecom Silicon Photonics Chip industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 44.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 44.5%.

Key companies in the market include Intel, Cisco, Marvell, Lumentum (NeoPhotonics), Nokia, SiFotonics, MACOM, ACCELINK, Coherent(II-VI), HTGD, BROADEX TECHNOLOGIES, HGTECH, Yuanjie Semiconductor Technology.

The market segments include Type, Application.

The market size is estimated to be USD 116 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Telecom Silicon Photonics Chip," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Telecom Silicon Photonics Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.