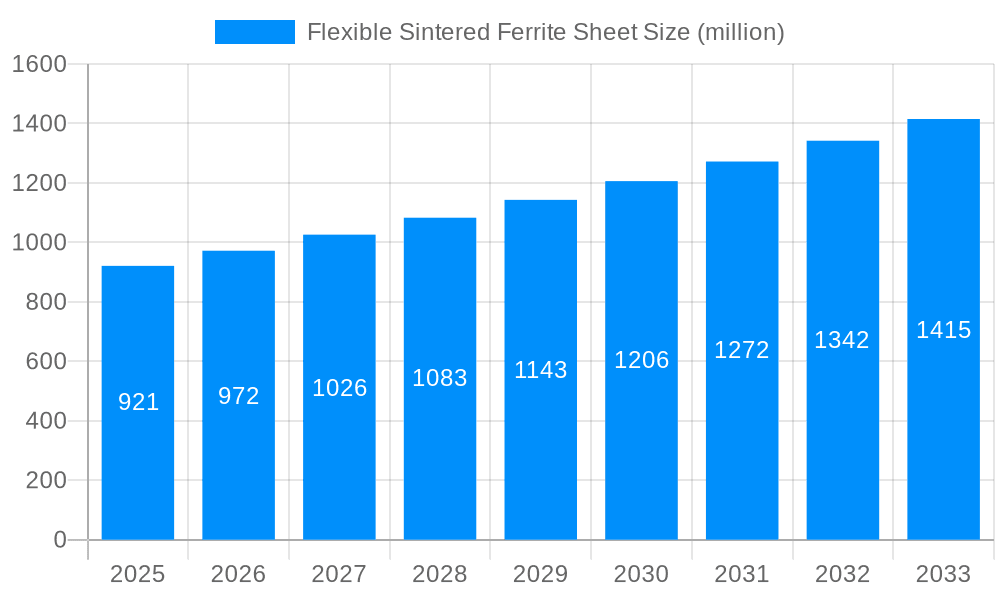

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Sintered Ferrite Sheet?

The projected CAGR is approximately 5.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Flexible Sintered Ferrite Sheet

Flexible Sintered Ferrite SheetFlexible Sintered Ferrite Sheet by Type (13.56MHz Type, 100kHz Type, Other), by Application (NFC, RFID, Wireless Power Systems, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Flexible Sintered Ferrite Sheet market is poised for robust expansion, with a current market size estimated at USD 921 million and projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% over the forecast period of 2025-2033. This growth is primarily fueled by the increasing integration of wireless technologies across diverse sectors. The rising demand for miniaturized electronic components and advanced shielding solutions in consumer electronics, automotive, and telecommunications is a significant driver. Furthermore, the burgeoning field of Internet of Things (IoT) devices, requiring efficient wireless communication and power transfer, is creating substantial opportunities for flexible sintered ferrite sheets. The market's expansion is also bolstered by advancements in material science, leading to improved performance characteristics and cost-effectiveness of these ferrite sheets.

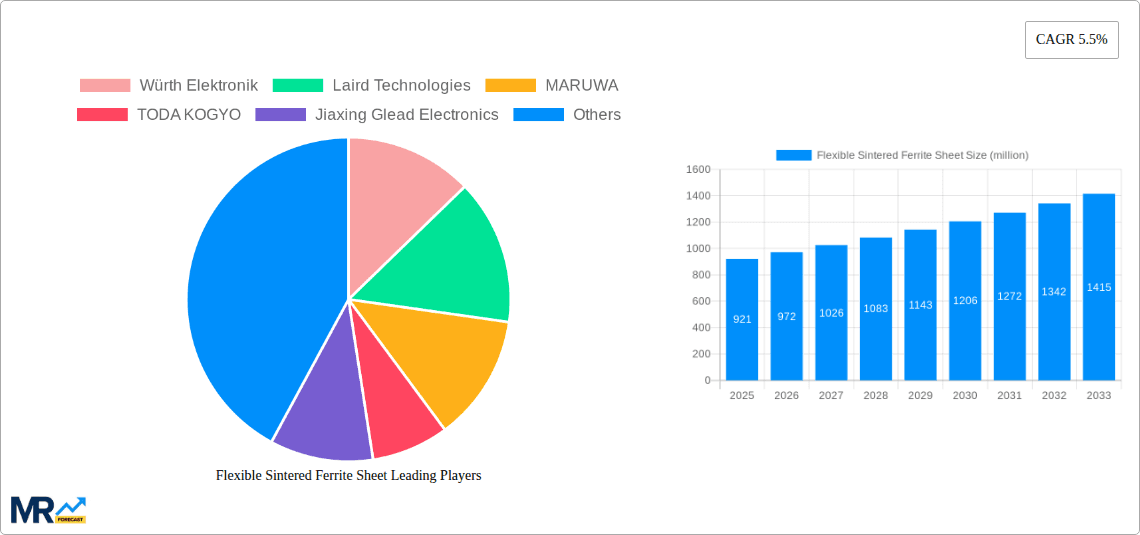

The market segments, categorized by type and application, highlight key areas of innovation and adoption. The 13.56MHz type and NFC applications are expected to witness particularly strong growth due to their widespread use in contactless payments, access control, and smart devices. Wireless Power Systems represent another burgeoning segment, driven by the consumer preference for cable-free charging solutions in smartphones, wearables, and electric vehicles. While the market benefits from strong demand, potential restraints include the complexity of manufacturing processes and the need for specialized infrastructure. However, the continuous innovation by key players like Würth Elektronik, Laird Technologies, and MARUWA, coupled with strategic collaborations and R&D investments, are expected to overcome these challenges and sustain the market's upward trajectory, particularly within the dynamic Asia Pacific region.

This report provides an in-depth analysis of the Flexible Sintered Ferrite Sheet market, encompassing a comprehensive study period from 2019 to 2033, with 2025 serving as the base and estimated year, and the forecast period spanning from 2025 to 2033. The historical period covers 2019-2024, offering a foundation for understanding market dynamics.

The Flexible Sintered Ferrite Sheet market is experiencing a robust expansion, driven by an increasing demand for advanced electromagnetic interference (EMI) shielding and magnetic component solutions across a multitude of industries. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 10.5% between 2025 and 2033, reaching an estimated market size of USD 2.3 billion by the end of the forecast period. A significant trend is the growing adoption of these sheets in miniaturized and portable electronic devices, where space constraints necessitate flexible and high-performance shielding materials. The continuous innovation in material science is leading to the development of ferrite sheets with enhanced magnetic permeability, improved flexibility, and superior thermal stability, catering to the evolving needs of high-frequency applications. The increasing prevalence of Internet of Things (IoT) devices, wearable technology, and advanced automotive electronics, all of which rely heavily on efficient wireless communication and power management, are key influencers of this growth trajectory. The 13.56MHz Type segment, particularly crucial for NFC and RFID applications, is expected to maintain its dominance, accounting for an estimated 45% of the market share. Furthermore, the integration of flexible sintered ferrite sheets into wireless power systems is gaining significant traction, as the demand for convenient and wire-free charging solutions continues to surge. The market is also witnessing a geographical shift, with emerging economies in Asia Pacific demonstrating substantial growth potential due to a burgeoning electronics manufacturing sector and increasing investments in smart technologies. The report anticipates a total market value of USD 1.1 billion in the base year of 2025.

Key market insights include:

The market for Flexible Sintered Ferrite Sheets is being propelled by several interconnected factors, primarily centered around the escalating demand for wireless connectivity and miniaturization in the electronic device landscape. The pervasive adoption of NFC and RFID technologies in applications ranging from contactless payments and access control to inventory management and supply chain tracking has created a substantial demand for effective magnetic shielding solutions. As these applications become more integrated into everyday life, the need for compact, efficient, and flexible ferrite sheets to manage magnetic fields and prevent interference is paramount. Moreover, the burgeoning market for Wireless Power Systems, encompassing everything from smartphone chargers to electric vehicle charging pads, presents another significant growth avenue. Flexible sintered ferrite sheets play a critical role in these systems by improving energy transfer efficiency and reducing electromagnetic radiation, thereby enhancing user safety and device performance. The increasing trend towards the miniaturization of electronic components across all sectors, including consumer electronics, automotive, and industrial automation, further fuels the demand for flexible and space-saving solutions like sintered ferrite sheets. Manufacturers are continuously striving to reduce the form factor of their products, and flexible ferrite materials offer a compelling advantage in achieving these design goals without compromising on performance. The continuous advancements in material science and manufacturing processes are also contributing to the development of more cost-effective and higher-performing ferrite sheets, making them an attractive choice for a broader range of applications.

Despite the promising growth trajectory, the Flexible Sintered Ferrite Sheet market is not without its hurdles. One of the primary challenges is the inherent cost of production for high-quality sintered ferrite materials. The manufacturing process involves complex sintering techniques and precise material formulations, which can lead to higher unit costs compared to some alternative shielding solutions. This can be a significant restraint for applications with tight cost margins, particularly in mass-produced consumer electronics. Furthermore, performance limitations in certain extreme environments, such as very high temperatures or strong corrosive atmospheres, can restrict the application scope of standard flexible sintered ferrite sheets. While advancements are being made, specialized formulations are often required for such conditions, adding to the cost and complexity. Competition from alternative materials, such as mu-metal, specialized polymers with embedded magnetic particles, and advanced composite materials, also poses a challenge. These alternatives may offer certain unique advantages, such as higher permeability in specific frequency ranges or better mechanical flexibility, forcing ferrite sheet manufacturers to continuously innovate and differentiate their offerings. Regulatory compliance, especially concerning the electromagnetic compatibility (EMC) of electronic devices, can also present a challenge, as it necessitates the precise tuning of shielding materials to meet stringent standards, which can be complex and time-consuming. Lastly, supply chain disruptions and the availability of raw materials, particularly rare earth elements used in some advanced ferrite formulations, can impact production volumes and pricing stability.

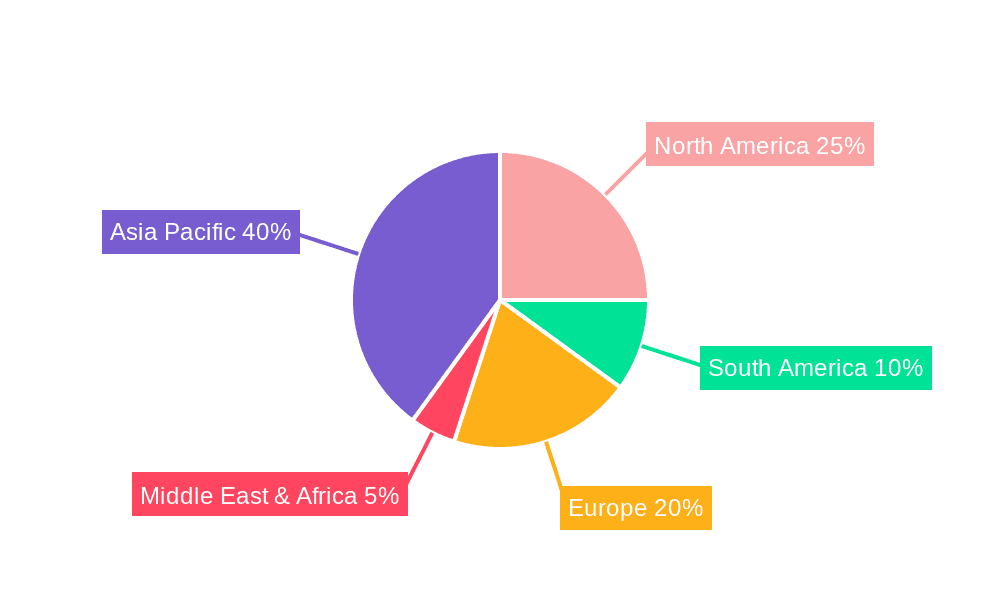

The Asia Pacific region is poised to dominate the Flexible Sintered Ferrite Sheet market, driven by its robust electronics manufacturing ecosystem, significant investments in research and development, and the rapid adoption of advanced technologies across various industries. Countries such as China, South Korea, Japan, and Taiwan are at the forefront of this dominance, owing to their established manufacturing capabilities for consumer electronics, automotive components, and telecommunications equipment. The sheer volume of electronic devices produced in this region, coupled with the increasing demand for miniaturization and enhanced wireless functionalities, directly translates into a substantial market for flexible sintered ferrite sheets.

Within the application segments, NFC and RFID are projected to be the leading drivers of market growth, with the 13.56MHz Type being the most prominent. This is attributed to the widespread implementation of NFC and RFID technologies in a myriad of applications, including:

The 13.56MHz Type of flexible sintered ferrite sheets is particularly favored for these applications due to its optimal performance characteristics at this specific frequency, offering effective magnetic shielding and signal enhancement without excessive signal loss. The ability of these ferrite sheets to be manufactured in thin, flexible formats makes them ideal for integration into the compact designs of modern electronic devices where traditional rigid shielding materials would be impractical.

The Wireless Power Systems segment is also expected to witness significant growth, driven by the increasing adoption of wireless charging for smartphones, wearables, and other electronic gadgets. Flexible sintered ferrite sheets are crucial for improving the efficiency and safety of these systems by directing magnetic flux and reducing eddy current losses. As the demand for convenient and clutter-free charging solutions continues to rise, this segment will become an increasingly important contributor to the overall market.

The Flexible Sintered Ferrite Sheet industry is experiencing robust growth fueled by several key catalysts. The exponential rise of the Internet of Things (IoT) ecosystem, with its ever-increasing number of connected devices, necessitates advanced EMI shielding and magnetic field management solutions, directly benefiting ferrite sheet manufacturers. Furthermore, the growing adoption of 5G technology, which relies on higher frequencies and denser device deployments, further amplifies the need for effective electromagnetic compatibility solutions. The continuous innovation in material science leading to enhanced permeability, flexibility, and thermal resistance in ferrite sheets is opening up new application avenues. The increasing demand for wireless charging systems and electric vehicles, where efficient magnetic flux management is critical, also acts as a significant growth catalyst.

This comprehensive report offers an exhaustive analysis of the Flexible Sintered Ferrite Sheet market, delving deep into its intricate dynamics and future potential. It provides detailed insights into market segmentation, identifying the dominant types (e.g., 13.56MHz Type, 100kHz Type) and applications (e.g., NFC, RFID, Wireless Power Systems) that are shaping the industry landscape. The report meticulously examines the growth catalysts, including the proliferation of IoT devices, the advent of 5G technology, and advancements in wireless power systems, all of which are propelling the market forward. Furthermore, it addresses the challenges and restraints faced by the industry, such as production costs and competition from alternative materials, offering a balanced perspective on the market's trajectory. The report provides detailed market size estimations and forecasts for the study period 2019-2033, offering a clear roadmap for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.5%.

Key companies in the market include Würth Elektronik, Laird Technologies, MARUWA, TODA KOGYO, Jiaxing Glead Electronics, Suzhou Gaotai.

The market segments include Type, Application.

The market size is estimated to be USD 921 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Flexible Sintered Ferrite Sheet," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Flexible Sintered Ferrite Sheet, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.