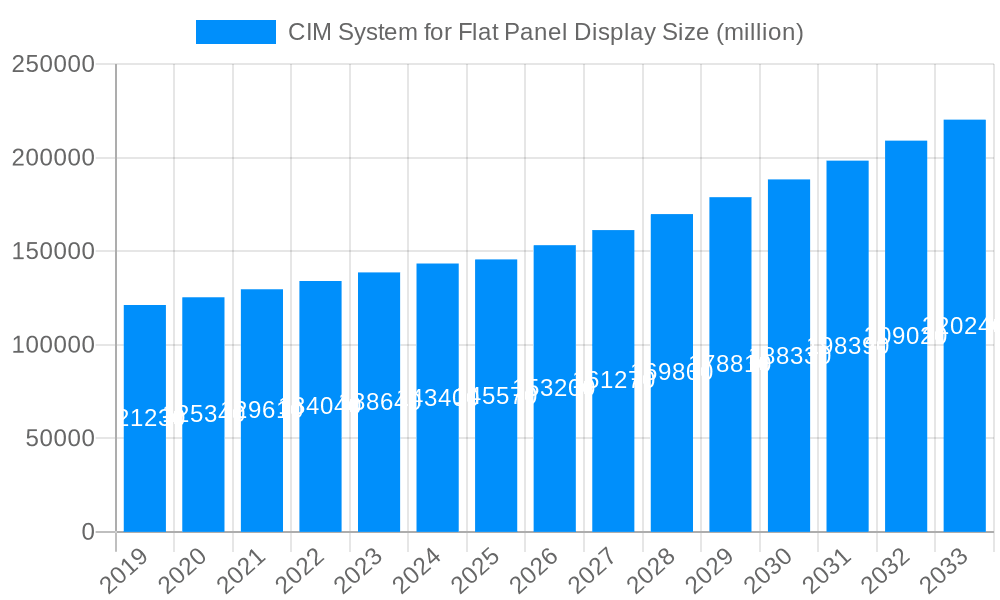

1. What is the projected Compound Annual Growth Rate (CAGR) of the CIM System for Flat Panel Display?

The projected CAGR is approximately 5.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

CIM System for Flat Panel Display

CIM System for Flat Panel DisplayCIM System for Flat Panel Display by Type (/> Manufacture Execution System (MES), Equipment Automation Program (EAP), Material Control System (MCS/MCO), Others), by Application (/> LCD, OLED), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global market for Computer Integrated Manufacturing (CIM) systems in the flat panel display (FPD) industry is experiencing robust growth, projected to reach approximately $145.57 billion in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.3% through 2033. This expansion is primarily fueled by the escalating demand for advanced display technologies like LCD and OLED across a multitude of applications, including smartphones, televisions, tablets, and wearables. The relentless pursuit of higher manufacturing efficiency, improved product quality, and reduced operational costs within the highly competitive FPD sector is driving the adoption of sophisticated CIM solutions. These systems integrate various manufacturing processes, from equipment automation and material control to production execution, enabling real-time data acquisition and analysis for informed decision-making and process optimization. Key market drivers include the increasing complexity of display manufacturing, the need for enhanced yield management, and the growing trend towards smart manufacturing and Industry 4.0 principles within the electronics industry.

The market's trajectory is further shaped by significant trends such as the increasing adoption of AI and machine learning for predictive maintenance and quality control, the development of flexible and modular CIM architectures to accommodate evolving production needs, and the growing importance of robust data security and connectivity solutions. While the market presents substantial opportunities, potential restraints include the high initial investment costs associated with implementing comprehensive CIM systems and the shortage of skilled personnel capable of managing and operating these advanced solutions. Nonetheless, the strategic importance of CIM systems in achieving operational excellence and maintaining a competitive edge in the rapidly evolving FPD landscape ensures sustained market development. Leading companies are actively investing in research and development to offer innovative solutions that address these challenges and capitalize on emerging opportunities across key regions like Asia Pacific, which dominates FPD production.

Here's a unique report description for CIM Systems in the Flat Panel Display market, incorporating the requested elements:

The global CIM (Computer Integrated Manufacturing) System for Flat Panel Display market is poised for significant growth and transformation, projected to reach $42.5 billion by the end of the Forecast Period (2025-2033), with the Base Year (2025) already witnessing substantial activity valued at $18.2 billion. This growth trajectory is fundamentally shaped by the insatiable demand for increasingly sophisticated display technologies, particularly in the OLED segment, which is rapidly capturing market share from traditional LCD technologies. The historical period (2019-2024) laid the groundwork, characterized by incremental advancements in automation and data integration, driven by the need for higher yields and reduced manufacturing costs in a highly competitive landscape. As we move into the Study Period (2019-2033), the trends are clearly shifting towards more intelligent, AI-driven CIM solutions. Manufacturers are investing heavily in systems that offer real-time predictive maintenance, advanced process control, and seamless integration across the entire production lifecycle. The increasing complexity of advanced packaging techniques, such as microLED and flexible displays, further necessitates robust CIM solutions that can manage intricate workflows and ensure stringent quality control. Furthermore, the growing emphasis on sustainability and energy efficiency in manufacturing operations is also influencing CIM system development, with an increasing demand for solutions that optimize resource utilization and minimize waste. The convergence of IoT technologies with CIM platforms is also a defining trend, enabling unprecedented levels of visibility and control across geographically dispersed manufacturing facilities.

The escalating demand for high-performance, feature-rich flat panel displays across a multitude of consumer electronics and burgeoning industrial applications is the primary propellant behind the growth of CIM systems. As display technologies evolve at an unprecedented pace, with consumers and industries demanding larger, thinner, more vibrant, and more energy-efficient screens, manufacturers are compelled to enhance their production capabilities. This necessitates sophisticated CIM solutions that can manage the intricate manufacturing processes, ensure consistent quality, and achieve higher production volumes while minimizing defects. The inherent complexity of manufacturing advanced display technologies, particularly OLEDs and emerging microLEDs, requires an unparalleled level of precision and control that only integrated CIM systems can provide. Furthermore, the fierce global competition within the flat panel display industry forces companies to continuously innovate and optimize their operations. CIM systems are instrumental in achieving these objectives by enabling real-time monitoring, automated decision-making, and seamless data flow between different manufacturing stages, ultimately leading to improved efficiency, reduced downtime, and a stronger competitive edge. The increasing adoption of automation and robotics in display manufacturing lines further amplifies the need for robust CIM systems to orchestrate and manage these advanced tools effectively.

Despite the robust growth potential, the CIM System for Flat Panel Display market faces several significant challenges and restraints that could temper its expansion. A primary hurdle is the substantial initial investment required for the implementation and integration of advanced CIM solutions, which can be a significant barrier for smaller manufacturers or those operating on tighter margins. The complexity of integrating disparate legacy systems with new CIM platforms often presents significant technical hurdles, requiring specialized expertise and considerable time for seamless data flow and interoperability. Furthermore, the rapid evolution of display technologies means that CIM systems must be continuously updated and adapted to accommodate new manufacturing processes and materials, leading to ongoing development and maintenance costs. The shortage of skilled personnel capable of designing, implementing, and managing these sophisticated CIM systems also poses a considerable challenge, limiting the rate of adoption and efficient utilization. Finally, concerns regarding data security and intellectual property protection within highly interconnected manufacturing environments can lead to hesitancy in adopting fully integrated digital solutions, necessitating robust cybersecurity measures.

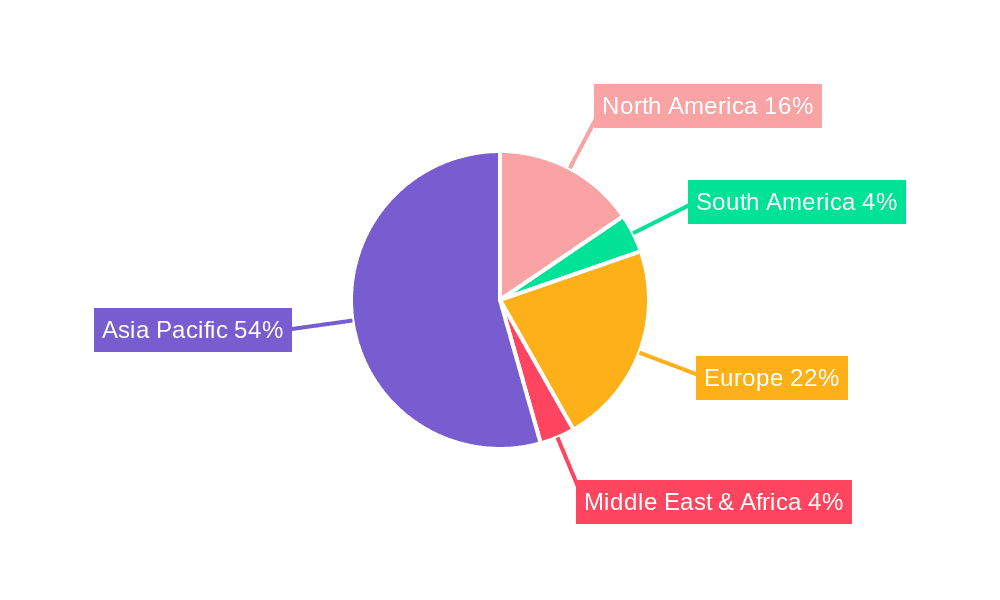

The Asia-Pacific region, particularly East Asia, is poised to be the dominant force in the global CIM System for Flat Panel Display market, driven by its established manufacturing prowess and significant investments in advanced display technologies. Countries like South Korea, Taiwan, and China are home to the world's leading flat panel display manufacturers, who are at the forefront of adopting and developing cutting-edge CIM solutions. This dominance is further cemented by the region's proactive approach to embracing Industry 4.0 principles and its substantial investments in research and development for next-generation display technologies.

Within the Application segment, the OLED application is projected to experience the most significant growth and market dominance. The rapid expansion of OLED technology across various devices, from smartphones and smartwatches to televisions and automotive displays, is creating an immense demand for highly sophisticated and integrated CIM systems. OLED manufacturing processes are inherently more complex than traditional LCDs, requiring precise control over material deposition, encapsulation, and patterning. This complexity necessitates advanced CIM functionalities, including real-time process monitoring, sophisticated yield management, and predictive quality control, to ensure high production yields and consistent performance.

The Manufacture Execution System (MES) segment is also anticipated to be a key driver of market growth. MES solutions are critical for managing the entire production process, from raw material tracking to finished product inspection. In the context of flat panel display manufacturing, MES systems are essential for:

Moreover, the Equipment Automation Program (EAP) segment will continue to play a crucial role, enabling the seamless communication and control of manufacturing equipment. As automation becomes increasingly prevalent in flat panel display factories, robust EAP solutions are vital for orchestrating complex machine interactions, reducing human error, and maximizing equipment uptime.

The growth of the CIM System for Flat Panel Display industry is significantly catalyzed by the relentless innovation in display technologies, such as the expansion of foldable and rollable displays, which demand highly adaptable and precise manufacturing processes. The increasing adoption of automation and AI in manufacturing floors directly fuels the need for sophisticated CIM systems to orchestrate these advanced operations. Furthermore, the growing imperative for supply chain resilience and real-time visibility across global operations is pushing manufacturers to invest in integrated CIM solutions that offer end-to-end control and transparency.

This report provides an in-depth analysis of the CIM System for Flat Panel Display market, offering a comprehensive understanding of its current landscape and future trajectory. It delves into the intricate details of market trends, meticulously examining factors shaping the industry's evolution, with a projected market valuation of $42.5 billion by the end of the Forecast Period (2025-2033). The report meticulously identifies and elaborates on the key driving forces, such as the escalating demand for advanced display technologies, and potential challenges and restraints, including the substantial initial investment and integration complexities. Furthermore, it highlights the dominant regions and segments, emphasizing the pivotal role of Asia-Pacific and the burgeoning OLED application. The study also illuminates crucial growth catalysts and provides an exhaustive list of leading players, alongside significant historical and projected developments, offering readers a complete panorama of this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.3%.

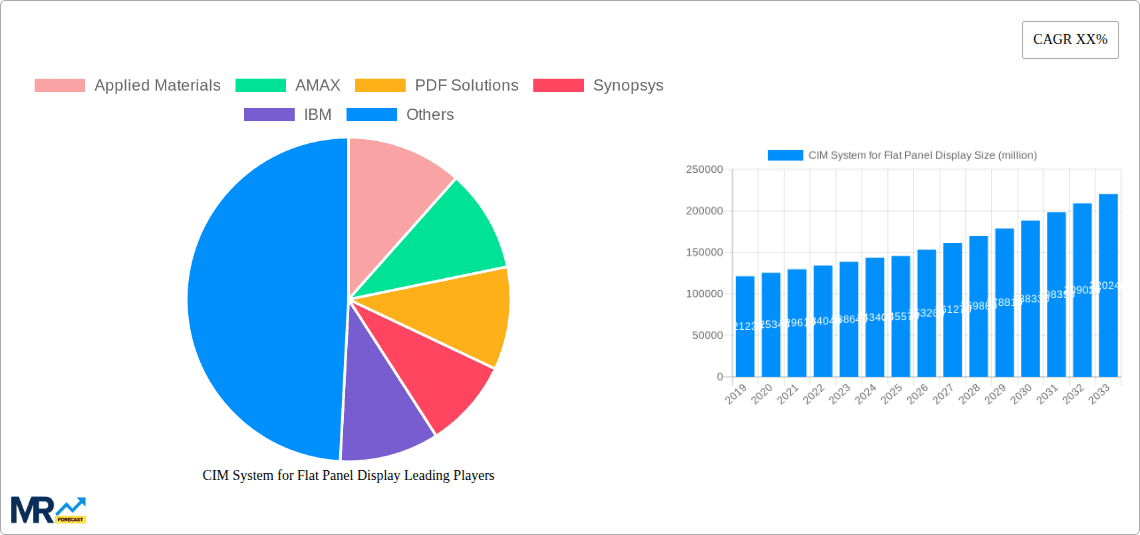

Key companies in the market include Applied Materials, AMAX, PDF Solutions, Synopsys, IBM, Critical Manufacturing (ASMPT), Daifuku, Murata Machinery, AIM Systems, Miracom Inc, SEMES Co. Ltd., SFA Semicon, Mirle, Castec, Digihua Intelligent, Jiangsu Taizhi Technology, Wuxi Xinxiang, Glorysoft, Semi Tech, IKAS, PinWei, Torchwell, ZC-TEK, Huajing, VTTECH, Huaxin, LinkWise Tech, Meetfuture, Wonder Automation, Sineva, FA Software.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "CIM System for Flat Panel Display," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the CIM System for Flat Panel Display, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.