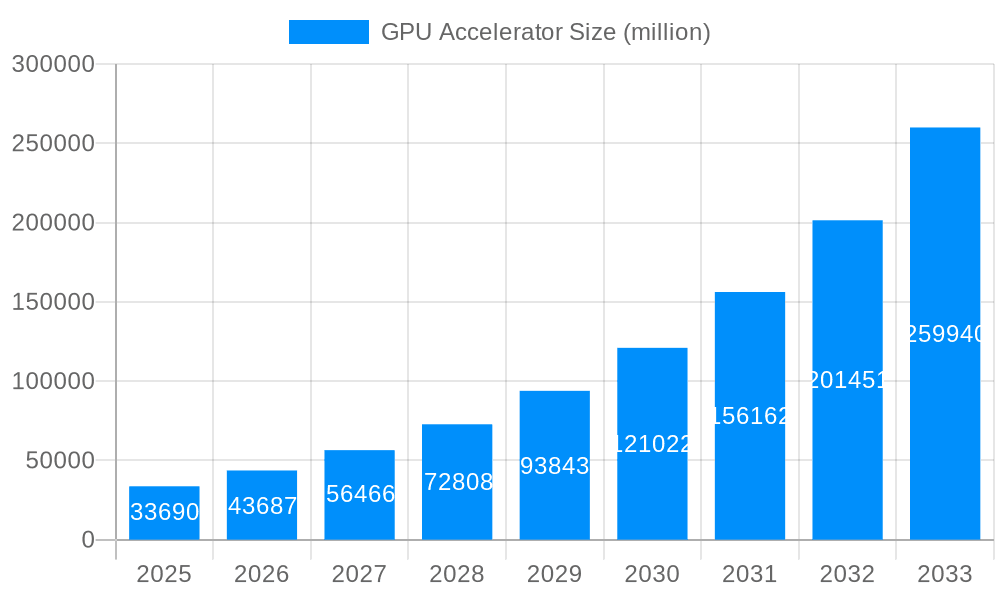

1. What is the projected Compound Annual Growth Rate (CAGR) of the GPU Accelerator?

The projected CAGR is approximately 30.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

GPU Accelerator

GPU AcceleratorGPU Accelerator by Application (Game Development, Image Processing, Financial Calculations, Machine Learning, Computational Storage, Others, World GPU Accelerator Production ), by Type (Independent GPU, Integrated GPU, World GPU Accelerator Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global GPU accelerator market is poised for exceptional growth, projected to reach a substantial \$33.69 billion in market size. This impressive expansion is driven by a remarkable Compound Annual Growth Rate (CAGR) of 30.7%, indicating a period of rapid adoption and innovation. The burgeoning demand for high-performance computing power across diverse sectors, including game development, image processing, financial calculations, and particularly the booming field of machine learning and artificial intelligence, is fueling this upward trajectory. The increasing complexity of AI models, the need for faster data analysis, and the constant pursuit of enhanced visual realism in gaming are all significant contributors to this demand. Furthermore, the ongoing evolution of computational storage solutions and the broader World GPU Accelerator Production landscape are creating new avenues for market expansion and technological advancement, ensuring the continued relevance and growth of GPU accelerators.

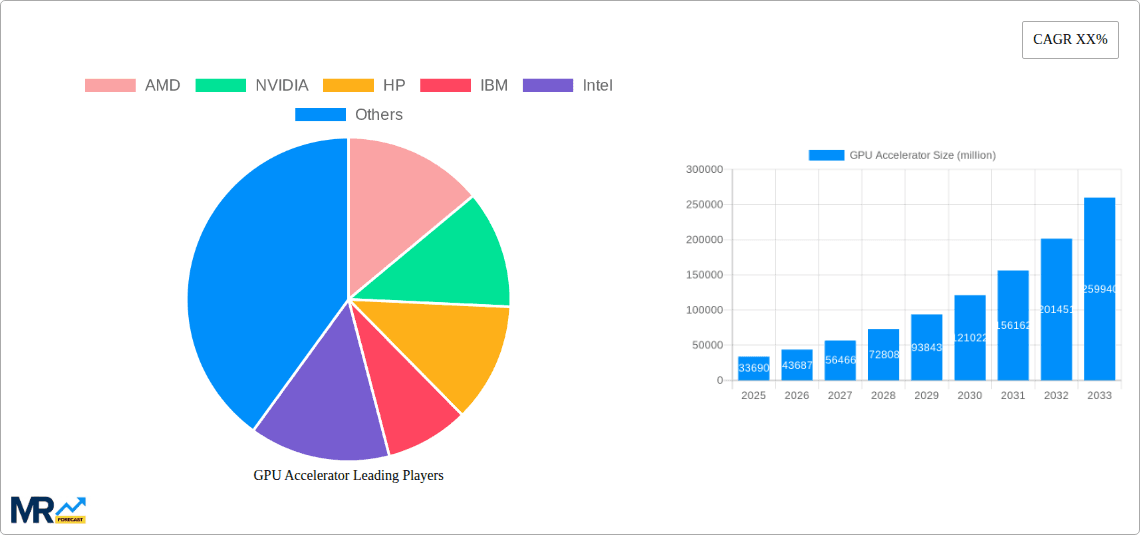

This dynamic market is characterized by several key trends and drivers that underscore its robust growth potential. The widespread integration of GPU accelerators into various applications, from enterprise-level data centers to consumer devices, highlights their increasing indispensability. The development of more powerful and energy-efficient GPU architectures by leading companies like NVIDIA and AMD is a critical driver, enabling new possibilities and pushing the boundaries of what's achievable. While the market benefits from strong demand, certain restraints such as the high initial cost of advanced GPU hardware and the ongoing global supply chain challenges could present short-term headwinds. However, the relentless pace of technological innovation, coupled with strategic investments in research and development by major industry players, is expected to mitigate these challenges. The market segments of Game Development and Machine Learning are anticipated to lead the growth, with Image Processing and Financial Calculations also contributing significantly. The continuous advancements in both Independent and Integrated GPU technologies further diversify the market, catering to a wider range of performance needs and price points.

Here's a unique report description for a GPU Accelerator market analysis, incorporating your specified elements and format:

The global GPU accelerator market is poised for exponential growth, projected to surge past \$100 billion by 2033. XXX, the market is experiencing an unprecedented acceleration, driven by the insatiable demand for advanced computational power across a myriad of industries. During the Historical Period (2019-2024), the market witnessed a steady climb, fueled by the nascent stages of AI adoption and the increasing complexity of visual content. The Base Year of 2025 stands as a critical inflection point, with the market already valued at an estimated \$50 billion, setting the stage for a dramatic expansion throughout the Forecast Period (2025-2033). This growth is not merely incremental; it represents a fundamental shift in how computing is approached, with GPUs evolving from specialized graphics processors to versatile computational engines. The increasing integration of GPUs into server infrastructure, coupled with breakthroughs in chip architecture and manufacturing processes, are key enablers. Furthermore, the proliferation of cloud computing services, which heavily leverage GPU acceleration for their diverse workloads, continues to be a significant tailwind. The interplay between hardware innovation and software optimization is creating a synergistic effect, unlocking new applications and pushing the boundaries of what's computationally feasible. Emerging economies are also beginning to contribute more significantly to this market, as their digital transformation initiatives gain momentum and require enhanced processing capabilities. The demand for more powerful and energy-efficient GPUs is a constant driver, prompting companies to invest heavily in research and development to stay ahead of the curve. This dynamic landscape suggests a future where GPU acceleration becomes an indispensable component of almost every advanced technological undertaking, from scientific simulations to hyper-realistic gaming experiences. The ongoing evolution of AI algorithms, requiring massive parallel processing, is perhaps the single most influential factor propelling this market trajectory.

The surge in GPU accelerator demand is fundamentally driven by the exponential growth of data and the increasing complexity of computational tasks. The Machine Learning and Artificial Intelligence revolution stands as the preeminent force, requiring immense parallel processing power to train sophisticated models and execute complex inference tasks. Beyond AI, the ever-increasing demand for hyper-realistic graphics in Game Development necessitates powerful GPUs capable of rendering intricate visual environments. Image Processing, from professional photography to advanced medical imaging, also relies heavily on GPU acceleration for faster and more detailed analysis. Furthermore, the burgeoning field of Computational Storage, aiming to offload processing from traditional CPUs to storage devices, is increasingly incorporating GPU-like accelerators for specialized data operations. Financial Calculations, particularly in areas like high-frequency trading and risk modeling, benefit immensely from the parallel processing capabilities of GPUs for rapid data analysis and simulation. The pervasive digitalization of industries, leading to vast data generation, inherently creates a need for more efficient processing solutions, with GPU accelerators at the forefront. The continuous innovation in GPU architecture, leading to enhanced performance and power efficiency, further fuels adoption across all segments.

Despite the robust growth trajectory, the GPU accelerator market faces several significant challenges. A primary restraint is the high cost of development and manufacturing for advanced GPUs, particularly for cutting-edge architectures and processes. This can create a barrier to entry for smaller players and limit widespread adoption in cost-sensitive markets. Supply chain disruptions, as witnessed in recent years, can also significantly impact production volumes and lead to price volatility, hindering market expansion. The energy consumption of high-performance GPUs remains a concern, especially in large-scale data centers, necessitating ongoing innovation in power efficiency. Furthermore, software ecosystem fragmentation and the need for specialized programming expertise can pose challenges for developers looking to leverage GPU acceleration effectively. The rapid pace of technological obsolescence also necessitates continuous investment in upgrades, adding to the total cost of ownership. Regulatory landscapes and geopolitical factors can also introduce uncertainties and potential trade barriers, impacting global market access. The complexity of integrating GPUs into existing IT infrastructure can also be a deterrent for some organizations.

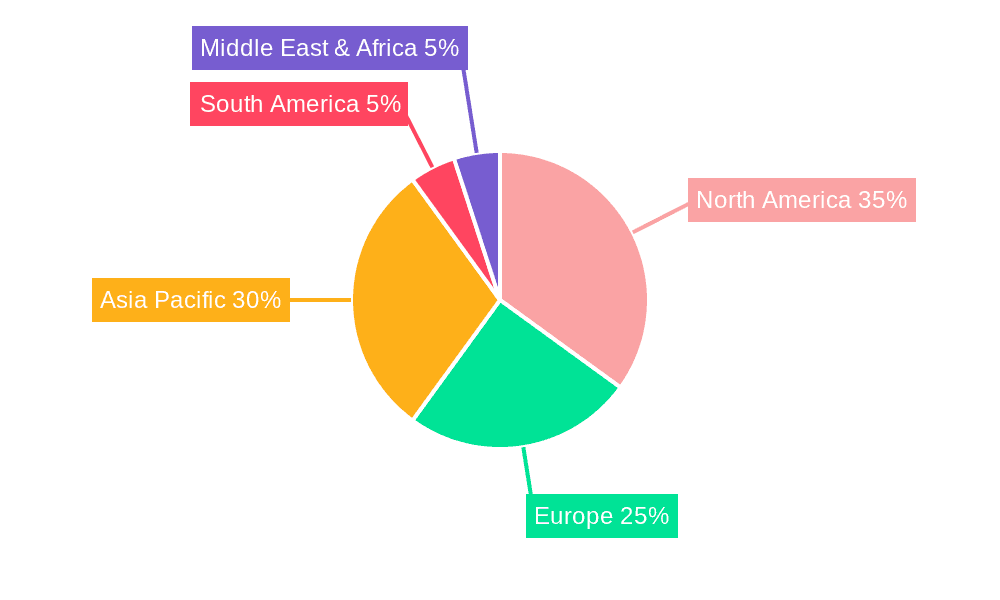

The GPU Accelerator market is characterized by a dynamic interplay between dominant regions and burgeoning segments, with North America and Asia Pacific emerging as key geographical powerhouses.

North America, particularly the United States, is a pivotal region due to its leading position in:

Asia Pacific, led by China, is another critical region exhibiting remarkable growth, driven by:

Dominant Segments Driving Market Value:

While various applications benefit from GPU acceleration, the following segments are poised to dominate the market in terms of value and growth:

The GPU accelerator industry is being propelled by several key catalysts. The insatiable demand for artificial intelligence and machine learning applications, requiring immense parallel processing for training and inference, is paramount. The ongoing advancements in graphics technology for immersive gaming and virtual/augmented reality experiences are also significant drivers. Furthermore, the increasing need for high-performance computing in scientific research, drug discovery, and climate modeling, alongside the growing adoption of cloud-based GPU services, are creating substantial market opportunities. The drive towards more energy-efficient and powerful hardware by companies like AMD, NVIDIA, and Intel also fuels innovation and adoption.

This report offers a comprehensive examination of the global GPU accelerator market, spanning the Historical Period (2019-2024) and extending through the Forecast Period (2025-2033), with the Base Year at 2025. It delves into the intricate trends and future projections, painting a clear picture of the market's trajectory. The analysis meticulously dissects the driving forces, including the indispensable role of AI and Machine Learning, and the persistent demand from Game Development. Furthermore, it critically assesses the challenges and restraints, such as high development costs and supply chain vulnerabilities, providing a balanced perspective. The report highlights key regions and segments poised for market dominance, offering valuable insights into geographical and application-specific growth opportunities. It identifies significant leading players and their contributions, along with crucial industry developments and their timing. This in-depth coverage aims to equip stakeholders with the knowledge needed to navigate and capitalize on this rapidly evolving technological landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 30.7%.

Key companies in the market include AMD, NVIDIA, HP, IBM, Intel, Jingjia Micro, Biren Technology, Moore Threads, Innosilicon, Iluvatar CoreX.

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "GPU Accelerator," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the GPU Accelerator, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.