1. What is the projected Compound Annual Growth Rate (CAGR) of the Third-Generation Semiconductor Devices & Modules?

The projected CAGR is approximately 6.25%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Third-Generation Semiconductor Devices & Modules

Third-Generation Semiconductor Devices & ModulesThird-Generation Semiconductor Devices & Modules by Type (SiC MOSFET Modules, SiC MOSFET Discrete, SiC Diode, GaN RF Device, GaN Power Device, World Third-Generation Semiconductor Devices & Modules Production ), by Application (Automotive & EV/HEV, EV Charging, UPS, Data Center & Server, PV, Energy Storage, Wind Power, Telecom Infrastructure, Defense & Aerospace, Rail Transport, Consumer, Others, World Third-Generation Semiconductor Devices & Modules Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

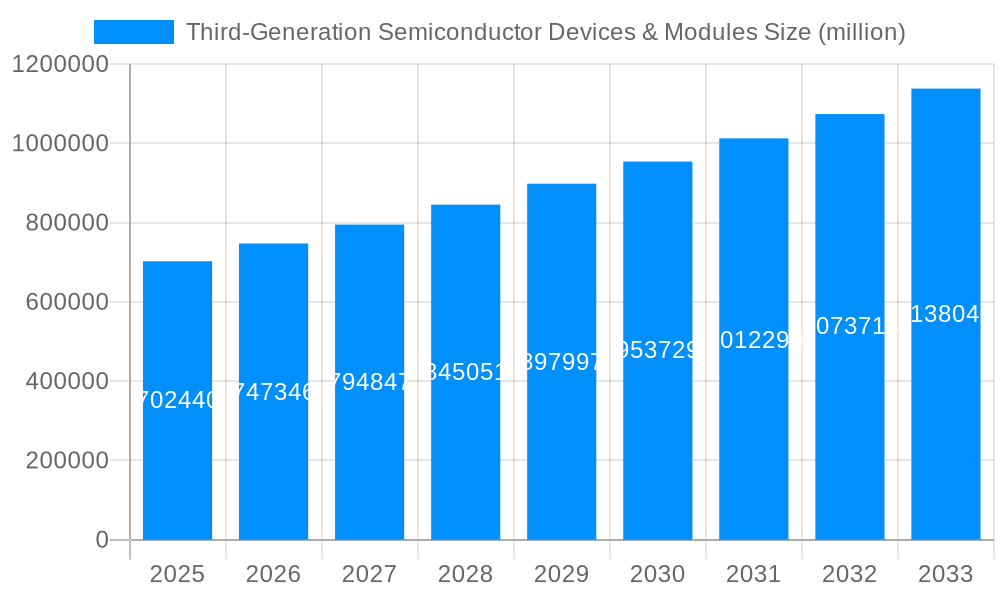

The global market for Third-Generation Semiconductor Devices & Modules is poised for substantial growth, projected to reach an impressive $702.44 billion by 2025. This rapid expansion is fueled by a compound annual growth rate (CAGR) of 6.25% during the forecast period of 2025-2033. Driving this surge are the unique properties of wide-bandgap materials like Silicon Carbide (SiC) and Gallium Nitride (GaN), offering superior efficiency, higher power density, and enhanced thermal performance compared to traditional silicon-based semiconductors. These advancements are critical in enabling next-generation technologies across a multitude of sectors.

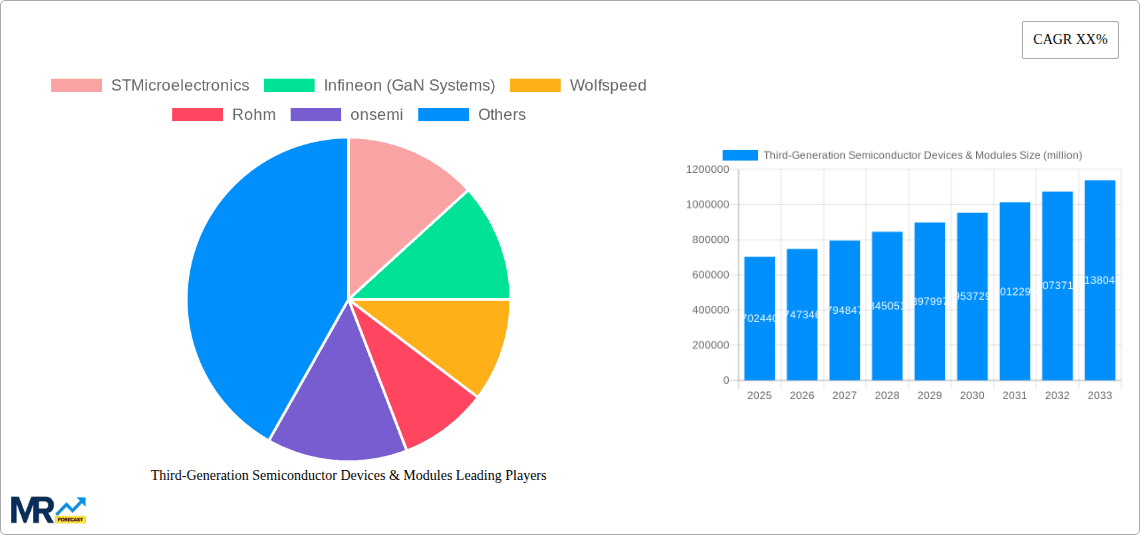

The automotive industry, particularly electric and hybrid electric vehicles (EV/HEV), represents a significant growth engine, with the escalating demand for electric vehicle charging infrastructure and onboard power systems directly benefiting the SiC and GaN markets. Furthermore, the increasing adoption of these advanced semiconductors in data centers and servers, photovoltaic (PV) systems, energy storage solutions, and wind power generation underscores their pivotal role in the global transition towards more sustainable and efficient energy ecosystems. While the market demonstrates robust growth, potential supply chain constraints and the high initial investment cost for manufacturing advanced semiconductor fabrication facilities could present challenges. However, continuous innovation and strategic investments from key players like STMicroelectronics, Infineon, and Wolfspeed are expected to overcome these hurdles, solidifying the dominance of third-generation semiconductors in future electronics.

The global market for third-generation semiconductor devices and modules is poised for explosive growth, driven by an insatiable demand for enhanced energy efficiency, higher power density, and superior performance across a multitude of applications. These next-generation materials, primarily Silicon Carbide (SiC) and Gallium Nitride (GaN), are fundamentally reshaping the landscape of power electronics and radio-frequency (RF) applications. Our comprehensive analysis forecasts the World Third-Generation Semiconductor Devices & Modules Production to reach a staggering value exceeding $50 billion by 2025, with projections indicating continued exponential expansion throughout the Forecast Period of 2025-2033. This surge is underpinned by significant advancements in manufacturing techniques, material purity, and device integration, making these semiconductors increasingly viable and cost-effective alternatives to traditional silicon-based solutions. The Study Period of 2019-2033, encompassing historical trends from 2019-2024 and robust estimations for the future, highlights a transformative journey for this sector. Key market insights reveal a pronounced shift towards higher voltage and higher frequency applications where the inherent advantages of SiC and GaN are most pronounced. The Base Year of 2025 serves as a critical inflection point, marking the widespread adoption and commercial maturity of these technologies. We've observed an escalating interest in SiC MOSFET Modules and GaN Power Devices as the primary growth engines, catering to the evolving needs of the automotive, renewable energy, and data center industries. The increasing integration of these devices into complex modules is a key trend, offering enhanced reliability and simplified system design for end-users. Furthermore, the market is witnessing a bifurcation in growth strategies, with some players focusing on discrete components for specialized applications and others on integrated module solutions for mass deployment. The competitive landscape is intensifying, with established players and emerging innovators vying for market share. Strategic collaborations, mergers, and acquisitions are becoming commonplace as companies seek to secure raw material supply chains, expand their technological expertise, and broaden their product portfolios to address the diverse needs of the global market. The ongoing research and development efforts are continuously pushing the boundaries of performance, reliability, and cost-effectiveness, further accelerating the adoption of these revolutionary semiconductor technologies.

The ascendancy of third-generation semiconductor devices and modules is not a mere technological evolution but a response to pressing global demands for sustainability and performance. Foremost among these drivers is the burgeoning electric vehicle (EV) and hybrid electric vehicle (HEV) market. The inherent efficiency of SiC and GaN devices in power conversion applications directly translates to extended EV range and faster charging times, making them indispensable for the automotive industry's electrification ambitions. Beyond transportation, the global push for renewable energy sources, including solar (PV) and wind power, necessitates highly efficient power conversion systems to integrate these intermittent sources into the grid. Third-generation semiconductors excel in these applications, minimizing energy loss during conversion and storage. The insatiable growth of data centers and the increasing demand for high-speed telecommunications infrastructure are also major propellers. These sectors require robust and efficient power solutions to handle massive data loads and ensure reliable operations, areas where SiC and GaN demonstrate superior performance. Moreover, governmental regulations and incentives worldwide are actively promoting energy efficiency and carbon emission reduction, creating a favorable market environment for technologies that deliver on these fronts. This confluence of technological advancement, market demand, and supportive policies creates a powerful momentum, ensuring the sustained and rapid growth of the third-generation semiconductor market.

Despite the immense promise, the widespread adoption of third-generation semiconductor devices and modules faces several significant hurdles. A primary challenge remains the cost of production. While decreasing, the manufacturing of high-quality SiC and GaN wafers and devices is still more expensive than that of traditional silicon, impacting the overall cost-effectiveness, especially for price-sensitive applications. The complexity of manufacturing processes, including epitaxy and wafer fabrication, requires specialized equipment and expertise, limiting the number of capable manufacturers and contributing to higher production costs. Another significant restraint is the limited availability of raw materials and the concentration of production in specific geographical regions, leading to potential supply chain disruptions and price volatility. Furthermore, thermal management can be a challenge for high-power GaN devices, requiring sophisticated cooling solutions to maintain optimal performance and reliability. Reliability and long-term durability in harsh operating environments are still areas of ongoing research and validation, and any perceived lack of maturity can deter adoption in critical applications. Finally, the lack of standardized testing and qualification procedures across the industry can create uncertainty for system designers and integrators, slowing down the design and implementation cycles. Overcoming these challenges will be crucial for unlocking the full potential of third-generation semiconductors.

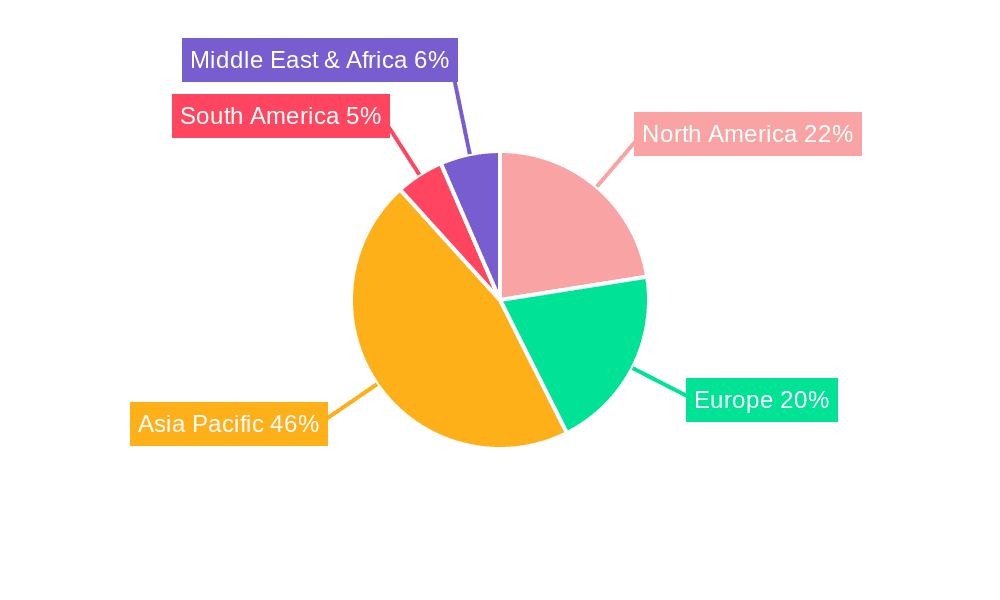

The global third-generation semiconductor devices and modules market is characterized by dynamic regional growth and the dominance of specific segments, particularly in high-demand application areas.

Dominant Segments:

Dominant Regions/Countries:

The interplay between these dominant segments and regions creates a powerful synergy. For instance, the demand for SiC MOSFET Modules in the Automotive & EV/HEV segment is heavily concentrated in Asia-Pacific and Europe, creating a substantial market for manufacturers. Similarly, the growth of GaN Power Devices in consumer electronics and telecom is driven by advancements and mass production capabilities primarily found in Asia-Pacific. The significant investments in World Third-Generation Semiconductor Devices & Modules Production infrastructure, particularly in China, are further solidifying Asia-Pacific's leading position. The trend of regionalization of supply chains, driven by geopolitical considerations and a desire for localized manufacturing, might lead to some redistribution of production capacity in the long term, but currently, Asia-Pacific's dominance in manufacturing and demand is undeniable. The estimated market value for World Third-Generation Semiconductor Devices & Modules Production is projected to see substantial contributions from these key regions, with Asia-Pacific expected to hold the largest share, followed by North America and Europe. The continuous innovation and expansion of the application base will ensure that these segments and regions remain critical to the market's overall trajectory.

The accelerating adoption of third-generation semiconductors is propelled by several key growth catalysts. The unyielding global demand for energy efficiency across all sectors, from transportation to data centers, is paramount. Furthermore, the rapid expansion of the electric vehicle (EV) market and the associated charging infrastructure directly fuels the demand for high-performance SiC and GaN power electronics. Supportive government policies and incentives aimed at promoting renewable energy adoption and reducing carbon emissions create a favorable market landscape. Advancements in manufacturing technologies are steadily driving down costs and improving device performance, making these materials more accessible. Finally, continuous innovation in application areas like advanced power supplies, 5G infrastructure, and defense systems unlocks new avenues for growth.

This report offers an exhaustive analysis of the global third-generation semiconductor devices and modules market, providing critical insights into its evolution from 2019-2033. It delves deep into the market dynamics, segmentation, and regional landscapes, offering a granular view of trends and opportunities. The report meticulously analyzes driving forces such as the electrifying automotive sector and the growing demand for renewable energy, alongside challenges like production costs and supply chain complexities. With a focus on World Third-Generation Semiconductor Devices & Modules Production, it forecasts significant market expansion, reaching over $50 billion by 2025 and continuing its upward trajectory through 2033. Key players and their strategic developments are highlighted, providing a comprehensive understanding of the competitive environment. The report also meticulously examines specific segments like SiC MOSFET Modules and GaN Power Devices, and their dominant application areas, including Automotive & EV/HEV and EV Charging, offering actionable intelligence for stakeholders navigating this transformative industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.25%.

Key companies in the market include STMicroelectronics, Infineon (GaN Systems), Wolfspeed, Rohm, onsemi, BYD Semiconductor, Microchip (Microsemi), Mitsubishi Electric (Vincotech), Semikron Danfoss, Fuji Electric, Navitas (GeneSiC), Toshiba, Qorvo (UnitedSiC), Sumitomo Electric Device Innovations (SEDI), NXP Semiconductors, Efficient Power Conversion Corporation (EPC), GE Aerospace, Bosch, Littelfuse (IXYS), IQE, Soitec (EpiGaN), Transphorm Inc., NTT Advanced Technology (NTT-AT), DOWA Electronics Materials, San'an Optoelectronics, CETC 55, WeEn Semiconductors, BASiC Semiconductor, Innoscience, Episil-Precision Inc, SemiQ, Diodes Incorporated, SanRex, Alpha & Omega Semiconductor, Bosch, MACOM, Power Integrations, Inc., RFHIC Corporation, NexGen Power Systems, Altum RF, Renesas Electronics, Fujitsu.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Third-Generation Semiconductor Devices & Modules," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Third-Generation Semiconductor Devices & Modules, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.