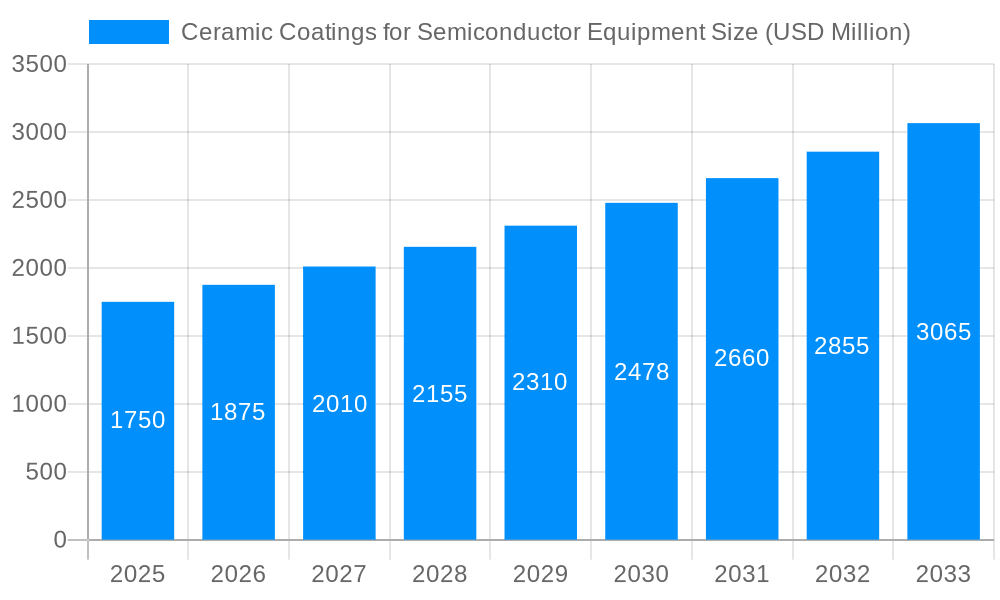

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ceramic Coatings for Semiconductor Equipment?

The projected CAGR is approximately 7.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ceramic Coatings for Semiconductor Equipment

Ceramic Coatings for Semiconductor EquipmentCeramic Coatings for Semiconductor Equipment by Application (Etching, Thin Film, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global market for Ceramic Coatings for Semiconductor Equipment is poised for significant expansion, projected to reach approximately $2330 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.4% from a base year of 2025. This growth is primarily fueled by the escalating demand for advanced semiconductor devices across a multitude of industries, including consumer electronics, automotive, and telecommunications. The relentless pursuit of smaller, faster, and more powerful chips necessitates sophisticated manufacturing processes, where ceramic coatings play a crucial role in enhancing equipment performance, durability, and resistance to harsh chemical environments encountered during etching and thin film deposition. As semiconductor fabrication processes become more intricate, the need for highly specialized and reliable coating solutions will only intensify, driving innovation and market penetration for ceramic coating providers.

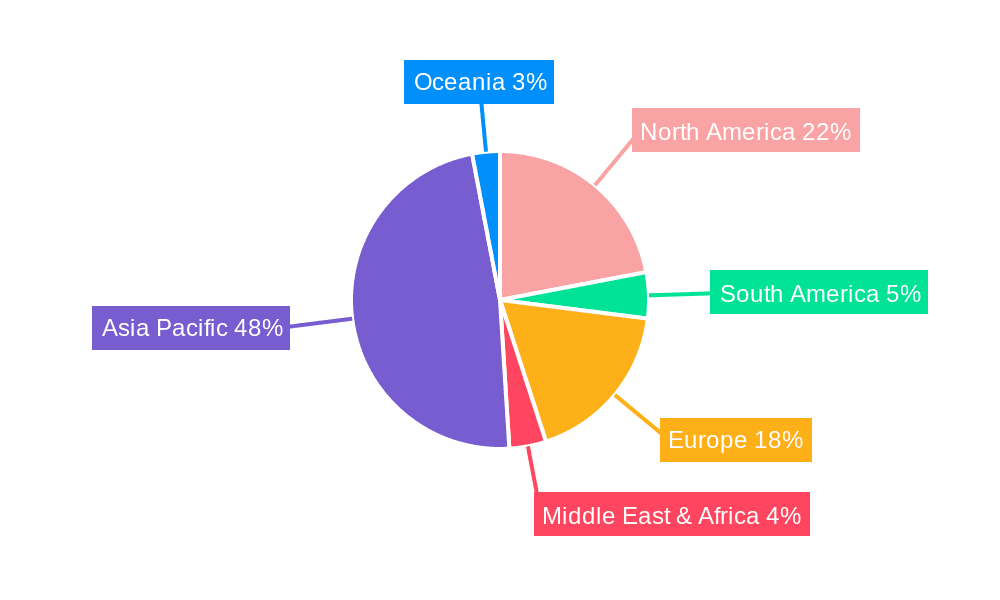

Key drivers underpinning this market growth include the increasing complexity of semiconductor fabrication technologies, such as the transition to smaller process nodes and advanced packaging techniques. These advancements place greater demands on equipment components, requiring enhanced material properties like superior wear resistance, chemical inertness, and thermal stability, all of which ceramic coatings effectively deliver. Furthermore, the expanding global semiconductor manufacturing infrastructure, particularly in the Asia Pacific region, will continue to be a major consumption hub. While the market enjoys strong growth prospects, potential restraints such as the high cost of specialized ceramic materials and complex application processes, alongside the availability of alternative coating solutions, will require continuous innovation and cost-optimization strategies from market participants. The market is segmented by application, with Etching and Thin Film representing the dominant segments due to their critical role in semiconductor manufacturing.

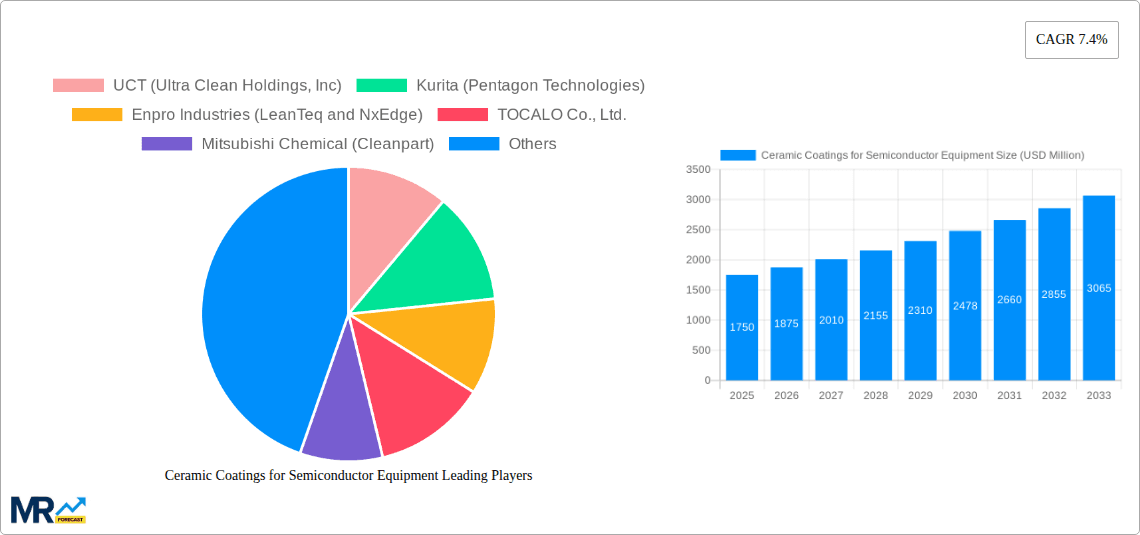

This report offers an in-depth analysis of the global ceramic coatings for semiconductor equipment market, providing critical insights and forecasts for the period of 2019-2033. With a base year of 2025, the study leverages historical data from 2019-2024 to project future market dynamics. The report will delve into the nuanced trends, driving forces, and challenges that shape this vital segment of the semiconductor manufacturing ecosystem. Key applications such as etching and thin film deposition, alongside emerging "Others" categories, will be meticulously examined. Furthermore, significant industry developments and the strategies of leading market players, including but not limited to UCT (Ultra Clean Holdings, Inc), Kurita (Pentagon Technologies), Enpro Industries (LeanTeq and NxEdge), TOCALO Co., Ltd., and Mitsubishi Chemical (Cleanpart), will be thoroughly investigated. The report aims to equip stakeholders with the strategic intelligence needed to navigate this evolving landscape, identifying growth catalysts and dominant regional or segment opportunities. The market size, projected to be in the hundreds of millions of dollars, is expected to witness substantial growth driven by technological advancements and the relentless pursuit of efficiency and purity in semiconductor fabrication.

The global market for ceramic coatings in semiconductor equipment is characterized by a dynamic and evolving landscape, poised for significant expansion driven by the insatiable demand for advanced semiconductor devices and the relentless pursuit of manufacturing excellence. XXX, the key market insight driving this trend is the escalating requirement for enhanced wafer purity and contamination control throughout the semiconductor fabrication process. As feature sizes shrink and manufacturing complexity increases, even minute particulate contamination can lead to significant yield loss, making advanced protective coatings an indispensable component of next-generation equipment. Furthermore, the drive towards higher throughput and extended equipment lifespan necessitates coatings that offer superior resistance to harsh process chemistries, high temperatures, and plasma etching environments. This has spurred innovation in materials science, leading to the development of novel ceramic compositions with improved wear resistance, chemical inertness, and thermal stability. The market is witnessing a growing adoption of advanced ceramic materials such as Aluminum Oxide (Al2O3), Yttrium Oxide (Y2O3), and Silicon Nitride (Si3N4), which offer unparalleled performance characteristics for critical components in etch chambers, deposition tools, and wafer handling systems. The increasing complexity of wafer processing, coupled with the introduction of new materials and chemistries in advanced nodes, directly translates into a higher demand for specialized ceramic coatings that can withstand these challenging conditions without introducing impurities. The economic implications of enhanced yield and reduced downtime are substantial, making the investment in high-performance ceramic coatings a strategic imperative for semiconductor manufacturers. The projected market size, estimated to be in the hundreds of millions of dollars, underscores the significant economic value and growth potential of this specialized coatings sector within the broader semiconductor industry.

The market for ceramic coatings in semiconductor equipment is propelled by a confluence of powerful drivers, primarily stemming from the ever-increasing demands of the semiconductor industry itself. The relentless miniaturization of semiconductor devices, leading to smaller feature sizes and more complex architectures, necessitates an equally sophisticated approach to equipment integrity and contamination control. Ceramic coatings play a pivotal role in this by providing ultra-pure, chemically inert, and highly durable surfaces that prevent metallic ion contamination and particle generation within critical process chambers. As manufacturers push the boundaries of lithography, etching, and deposition, the exposure of equipment components to aggressive plasma environments and high-temperature processes intensifies. Ceramic coatings offer superior resistance to this chemical and thermal erosion, extending the lifespan of components and ensuring consistent process performance, thereby directly impacting wafer yield and manufacturing efficiency. Furthermore, the growing emphasis on cost reduction and operational efficiency within the semiconductor manufacturing sector makes ceramic coatings an attractive solution. By reducing equipment downtime for maintenance and replacement, and by improving wafer yield through better contamination control, these coatings contribute significantly to the overall economic viability of advanced semiconductor production. The market is also influenced by the continuous innovation in coating technologies, with ongoing research and development focused on creating even more specialized and high-performance ceramic formulations tailored to specific process requirements, further fueling market expansion.

Despite the robust growth trajectory, the ceramic coatings for semiconductor equipment market encounters several significant challenges and restraints. A primary concern revolves around the intricate and often high-cost nature of advanced ceramic coating application processes. Achieving the required uniformity, adhesion, and defect-free surfaces for critical semiconductor equipment components demands specialized equipment, highly skilled labor, and stringent quality control measures, which can translate into substantial initial investment and ongoing operational expenses. Moreover, the compatibility of ceramic coatings with a wide array of process chemistries and equipment designs can be a complex technical hurdle. While ceramic materials offer excellent chemical inertness, specific process environments might still pose compatibility issues, requiring tailored solutions and extensive testing. The development and validation of new ceramic coating formulations for emerging semiconductor manufacturing processes can also be a time-consuming and resource-intensive endeavor. The semiconductor industry operates under exceptionally demanding specifications, and the qualification of new materials and coatings can take years, acting as a bottleneck for rapid adoption. Furthermore, the global supply chain for specialized ceramic materials and the expertise required for their application can be concentrated, leading to potential vulnerabilities and price fluctuations. The need for consistent and reliable supply of high-quality coatings is paramount for semiconductor manufacturers, and any disruptions can have severe consequences on production schedules. Lastly, the stringent regulatory landscape and evolving environmental standards in some regions might impose additional compliance requirements on coating manufacturers, adding to the operational complexity and cost.

The Thin Film application segment is poised to be a dominant force in the ceramic coatings for semiconductor equipment market, with Asia Pacific, particularly Taiwan and South Korea, emerging as key regions set to lead the charge. The Thin Film segment, encompassing applications like Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD), Atomic Layer Deposition (ALD), and sputtering, is the bedrock of modern semiconductor manufacturing, responsible for creating the intricate layers of conductive, insulating, and semiconducting materials on wafers. These processes inherently involve highly aggressive chemistries, elevated temperatures, and plasma environments, all of which necessitate robust and ultra-pure equipment components. Ceramic coatings are indispensable in this segment for several critical reasons:

The dominance of Asia Pacific in this market is largely attributed to its central role in global semiconductor manufacturing. Countries like Taiwan, home to the world's largest contract chip manufacturer, TSMC, and South Korea, with major players like Samsung Electronics and SK Hynix, are at the forefront of semiconductor innovation and production. These regions house a vast ecosystem of wafer fabrication plants that continuously demand high-performance equipment and consumables, including advanced ceramic coatings. The presence of leading equipment manufacturers and R&D centers in these countries further fuels the adoption of cutting-edge coating technologies. The sheer volume of wafer manufacturing activities in these countries directly translates into a substantial market for ceramic coatings applied to the myriad of equipment used in etching and thin film deposition. The market size in these dominant regions is estimated to be in the hundreds of millions of dollars, reflecting their critical importance.

Other key players in the market include companies like UCT (Ultra Clean Holdings, Inc), Kurita (Pentagon Technologies), Enpro Industries (LeanTeq and NxEdge), TOCALO Co., Ltd., Mitsubishi Chemical (Cleanpart), KoMiCo, Cinos, and WONIK QnC, who are actively supplying specialized ceramic coating solutions and services to these leading semiconductor manufacturing hubs. The focus on advanced nodes, such as those below 7nm, where contamination control and process precision are paramount, further solidifies the importance of the Thin Film segment and the regions leading its development.

The growth of the ceramic coatings for semiconductor equipment industry is significantly fueled by the increasing complexity of semiconductor devices and the relentless drive for higher wafer yields. As wafer feature sizes shrink and device architectures become more intricate, the need for pristine equipment surfaces capable of preventing particulate contamination and resisting aggressive process chemistries escalates. This, in turn, drives the demand for advanced ceramic coatings that offer superior purity, chemical inertness, and wear resistance. Furthermore, the expanding global demand for semiconductors across various sectors, including consumer electronics, automotive, and artificial intelligence, necessitates increased manufacturing capacity and efficiency, indirectly boosting the market for components that enhance equipment uptime and process stability, such as ceramic coatings.

This report provides a holistic view of the ceramic coatings for semiconductor equipment market, offering a granular analysis of its various facets. It delves deep into the historical performance, current trends, and future projections from 2019 to 2033, with a specific focus on the base year of 2025. The report meticulously examines the key market drivers, including the ever-increasing complexity of semiconductor manufacturing and the demand for higher wafer yields, which directly translate into a greater need for robust and pure equipment components. Furthermore, it addresses the significant challenges and restraints that shape market dynamics, such as the high cost and technical intricacies of coating application. The report identifies dominant regions and segments, highlighting the pivotal role of Thin Film applications and the leading positions of Asia Pacific countries like Taiwan and South Korea. Leading market players are profiled, alongside a detailed timeline of significant industry developments. This comprehensive coverage ensures that stakeholders gain a profound understanding of the market's potential and the strategic considerations for success in this vital sector of the semiconductor industry, where the market size is projected to reach hundreds of millions of dollars.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.4%.

Key companies in the market include UCT (Ultra Clean Holdings, Inc), Kurita (Pentagon Technologies), Enpro Industries (LeanTeq and NxEdge), TOCALO Co., Ltd., Mitsubishi Chemical (Cleanpart), KoMiCo, Cinos, Hansol IONES, WONIK QnC, Dftech, TOPWINTECH, FEMVIX, SEWON HARDFACING CO.,LTD, Frontken Corporation Berhad, KERTZ HIGH TECH, Hung Jie Technology Corporation, Oerlikon Balzers, Beneq, APS Materials, Inc., SilcoTek, Alumiplate, ASSET Solutions, Inc., Persys Group, Entegris, Inficon, Value Engineering Co., Ltd, HTCSolar, Jiangsu Kaiweitesi Semiconductor Technology Co., Ltd., HCUT Co., Ltd, Ferrotec (Anhui) Technology Development Co., Ltd, Shanghai Companion, Chongqing Genori Technology Co., Ltd, GRAND HITEK.

The market segments include Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Ceramic Coatings for Semiconductor Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ceramic Coatings for Semiconductor Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.