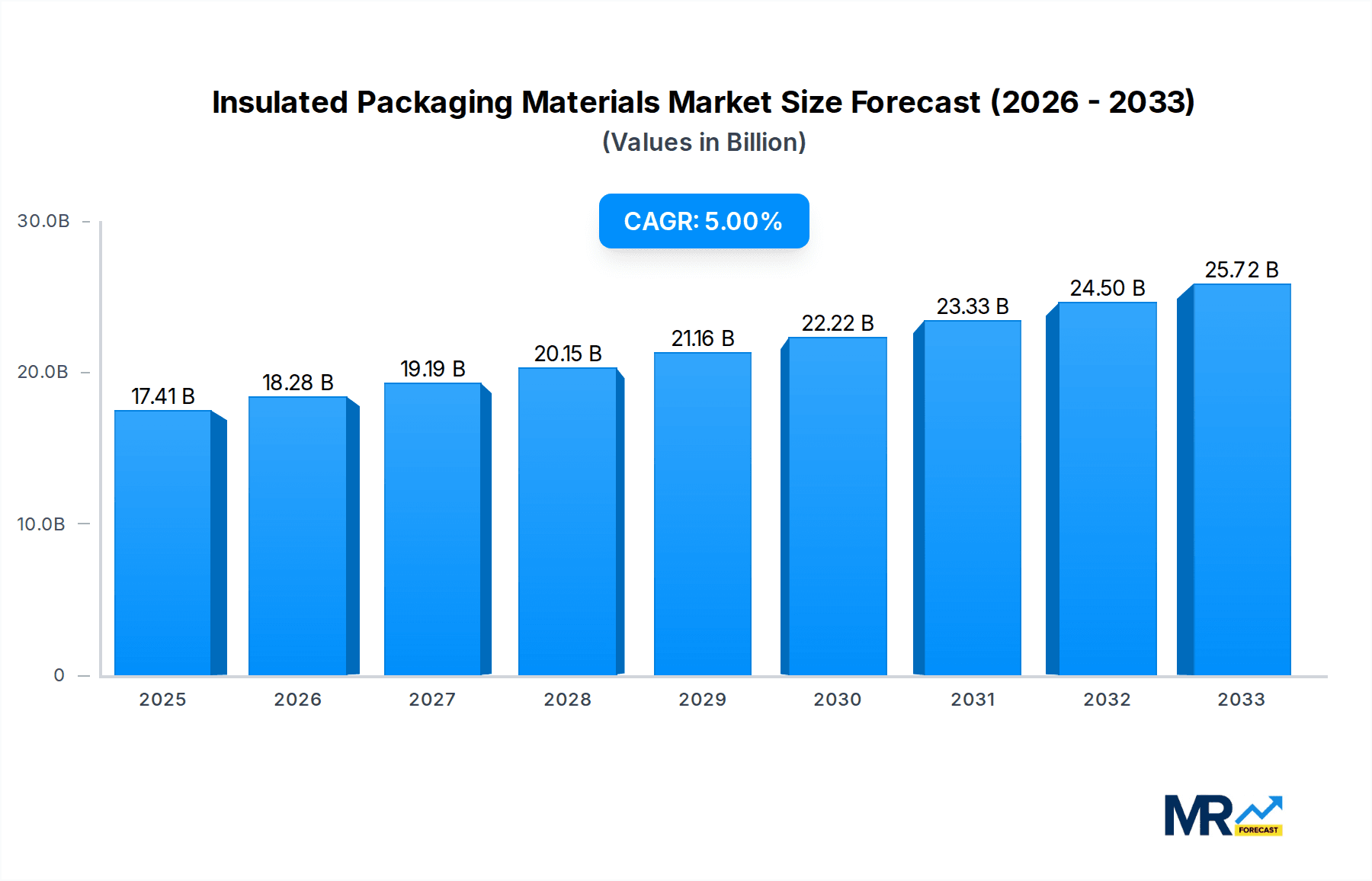

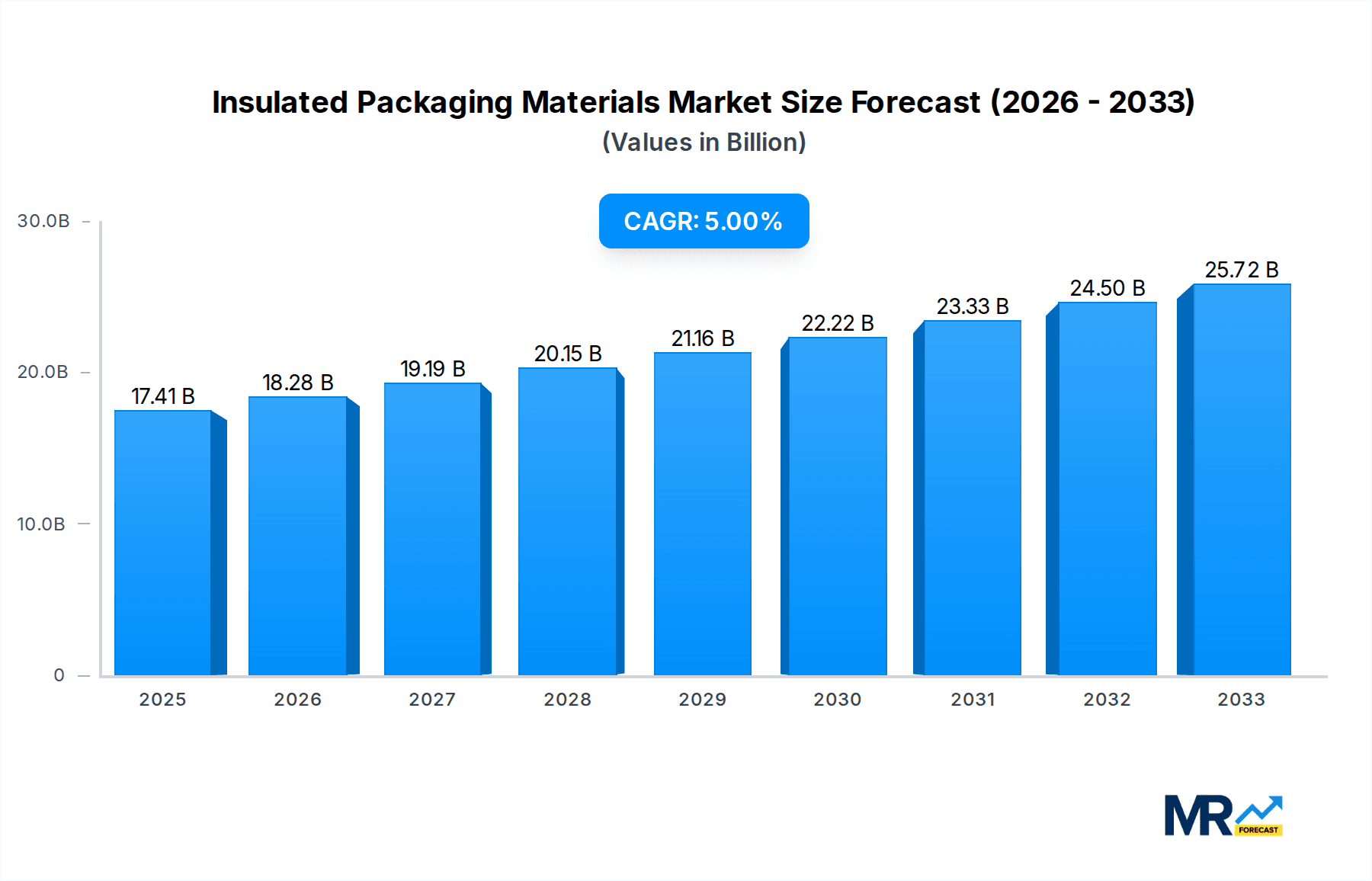

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insulated Packaging Materials?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Insulated Packaging Materials

Insulated Packaging MaterialsInsulated Packaging Materials by Type (Plastic, Wood, Corrugated Cardboard, Others), by Application (Pharmaceutical, Food and Beverages, Cosmetic, Industrial, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global insulated packaging materials market is poised for robust growth, projected to reach an estimated USD 17.41 billion in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 5% throughout the forecast period of 2025-2033. This significant expansion is largely driven by the increasing demand for temperature-sensitive product protection across various industries, most notably pharmaceuticals, food & beverages, and cosmetics. The burgeoning e-commerce sector, coupled with the rising global trade of perishable goods, necessitates reliable and effective insulated packaging solutions to maintain product integrity during transit. Advancements in material science are also contributing to market dynamism, with the development of more sustainable and high-performance insulation materials gaining traction. These innovations address growing environmental concerns and offer enhanced thermal efficiency, further stimulating market adoption.

The market segmentation reveals a diversified landscape, with "Plastic" and "Corrugated Cardboard" types dominating in terms of application breadth and adoption rates. In pharmaceuticals, the stringent requirements for maintaining vaccine and drug efficacy at specific temperatures are a primary growth catalyst. Similarly, the food and beverage industry's reliance on chilled and frozen product delivery, especially with the surge in online grocery sales, is a significant market driver. While traditional materials continue to hold sway, there is a discernible shift towards eco-friendly alternatives, including molded pulp and advanced bio-based insulations, reflecting a broader industry trend towards sustainability. However, the market faces certain restraints, including the fluctuating costs of raw materials and the logistical challenges associated with implementing specialized cold chain solutions, particularly in developing economies. Despite these challenges, strategic investments in research and development, coupled with expanding global supply chains, are expected to propel the insulated packaging materials market to new heights.

Here's a comprehensive report description on Insulated Packaging Materials, incorporating your specified elements:

The global insulated packaging materials market is poised for remarkable expansion, projected to surge from an estimated $12.5 billion in the base year of 2025 to an impressive $25.2 billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by evolving consumer preferences, stringent regulatory landscapes, and the increasing demand for maintaining product integrity throughout the supply chain. During the historical period of 2019-2024, the market witnessed a steady upward trend, driven by the burgeoning e-commerce sector and the growing awareness surrounding the importance of temperature-sensitive product protection. The study period, encompassing 2019-2033, highlights a sustained and robust CAGR, underscoring the enduring relevance and adaptability of these materials. Key market insights reveal a discernible shift towards sustainable and eco-friendly solutions. While traditional materials like expanded polystyrene (EPS) continue to hold a significant market share due to their cost-effectiveness and insulating properties, there's a growing impetus to develop and adopt alternatives. The pharmaceutical and food & beverage sectors are at the forefront of this innovation, demanding packaging that can reliably maintain precise temperature ranges, thereby minimizing spoilage and ensuring product efficacy. The rise of specialized applications, such as the transportation of vaccines and perishable gourmet foods, further accentuates the need for advanced insulation technologies. Furthermore, the increasing complexity of global supply chains necessitates packaging that offers superior thermal performance and durability, contributing to the overall market expansion. The "Others" segment for both type and application categories is also expected to see substantial growth, indicative of emerging applications and novel material developments not yet categorized. The market's dynamic nature is further shaped by technological advancements in material science and manufacturing processes, enabling the creation of lighter, more efficient, and environmentally responsible insulated packaging solutions. The estimated year of 2025 serves as a critical benchmark, reflecting the current market dynamics and setting the stage for the anticipated growth.

The insulated packaging materials market is experiencing a powerful uplift driven by a confluence of critical factors that underscore its indispensable role in modern commerce. Foremost among these is the exponential growth of the e-commerce industry, particularly in sectors dealing with perishable goods. Online sales of groceries, pharmaceuticals, and specialty food items have surged, creating an unprecedented demand for packaging that can maintain specific temperature conditions during transit from warehouse to doorstep. This necessitates reliable thermal insulation to prevent spoilage, maintain efficacy, and ensure customer satisfaction. Concurrently, the global emphasis on food safety and pharmaceutical integrity plays a pivotal role. Regulations are becoming increasingly stringent regarding the handling and transportation of temperature-sensitive products, compelling manufacturers and distributors to invest in high-performance insulated packaging. The need to prevent product degradation, maintain the cold chain, and comply with these regulations is a significant market driver. Moreover, increasing consumer awareness and demand for sustainable packaging solutions are indirectly fueling innovation in the insulated packaging sector. While traditionally, some materials used have faced environmental scrutiny, there is a strong push towards biodegradable, recyclable, and reusable insulated packaging options. This evolving consumer preference is forcing manufacturers to develop greener alternatives, thereby expanding the market for innovative and eco-conscious insulated packaging.

Despite the robust growth trajectory, the insulated packaging materials market is not without its hurdles. A primary challenge lies in the cost associated with advanced, high-performance insulation. While materials like vacuum insulated panels (VIPs) offer superior thermal efficiency, their production costs can be significantly higher compared to conventional options. This premium pricing can deter adoption in cost-sensitive markets or for less critical applications, thereby acting as a restraint on overall market penetration. Furthermore, the environmental impact of certain traditional insulation materials, particularly expanded polystyrene (EPS) and its derivatives, continues to be a significant concern. While these materials offer excellent insulation and are cost-effective, their non-biodegradability and challenges in recycling have led to increased regulatory pressure and consumer backlash. This necessitates substantial investment in research and development for sustainable alternatives, which can be a costly and time-consuming process, potentially slowing down the transition for some manufacturers. Supply chain disruptions, as witnessed in recent years, can also pose a challenge. The availability of raw materials and the logistics of producing and distributing specialized insulated packaging can be impacted by global events, leading to increased lead times and price volatility. Finally, the need for specialized handling and disposal procedures for certain advanced insulation materials can also create barriers to widespread adoption, requiring education and infrastructure development.

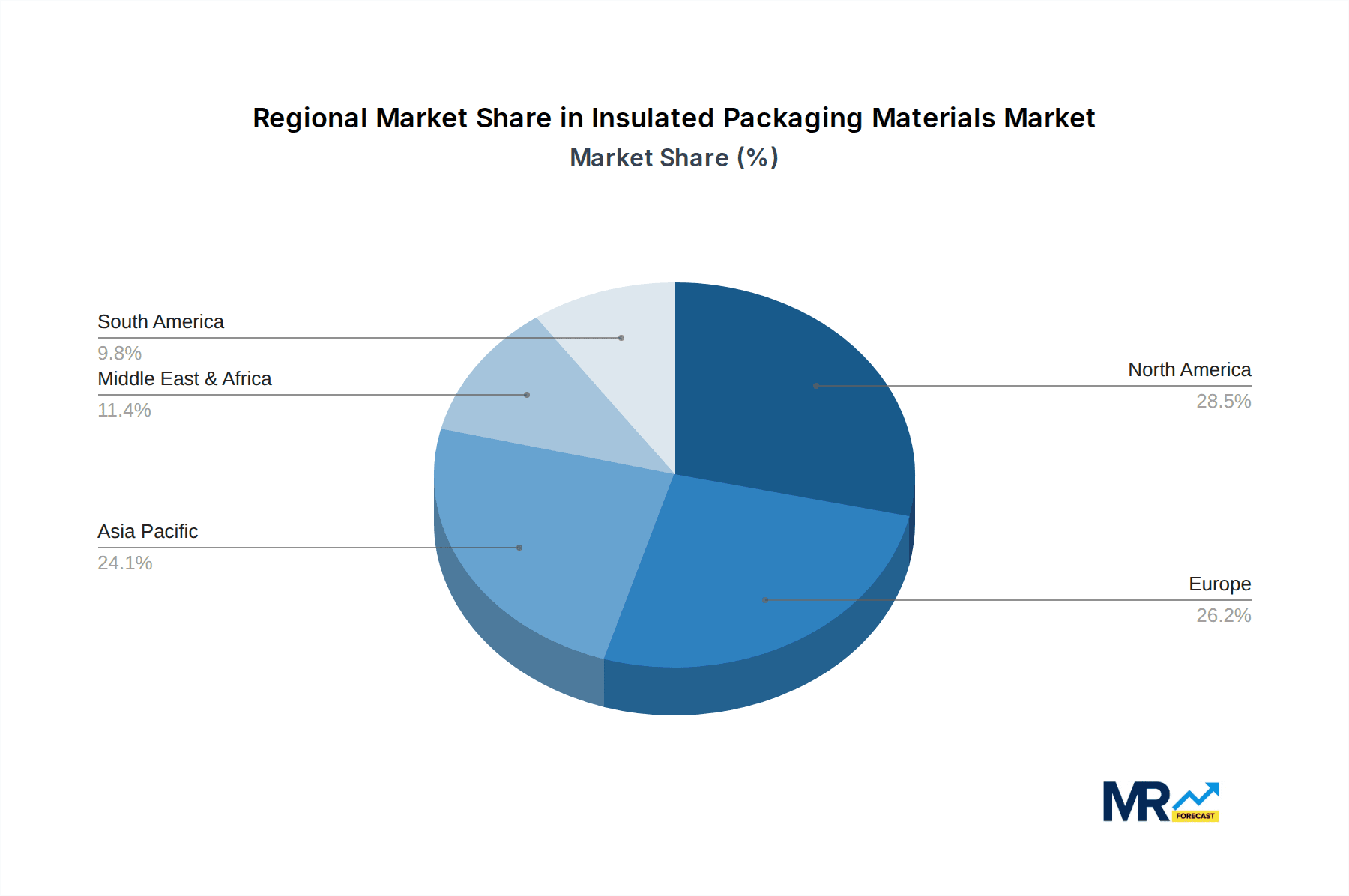

The insulated packaging materials market is characterized by a dynamic interplay between regional demands and segment-specific adoption. Within the Type segment, Plastic insulated packaging is anticipated to dominate the market. This dominance is largely attributed to the versatility, cost-effectiveness, and high performance of various plastic-based insulation materials, including expanded polystyrene (EPS), extruded polystyrene (XPS), and polyurethane (PU) foams. These materials offer excellent thermal resistance, moisture barrier properties, and durability, making them ideal for a wide range of applications. The ability of plastics to be molded into various shapes and sizes also caters to diverse packaging needs, further solidifying their market leadership.

In terms of Application, the Food and Beverages segment is projected to be the leading force driving market growth. The ever-increasing global demand for fresh, frozen, and temperature-controlled food products, coupled with the burgeoning e-commerce sector for groceries and meal kits, necessitates robust insulated packaging solutions. This segment's dominance is further amplified by stringent food safety regulations and the growing consumer preference for high-quality, fresh produce delivered directly to their homes. The need to maintain the cold chain for a wide array of products, from dairy and meat to fruits and vegetables, ensures a consistent and substantial demand for insulated packaging.

Geographically, North America is expected to emerge as a dominant region in the insulated packaging materials market. This leadership is driven by several key factors. Firstly, the region boasts a highly developed e-commerce infrastructure and a significant online grocery market, which directly translates to a substantial demand for insulated packaging for food and beverage delivery. Secondly, the presence of a robust pharmaceutical industry, with stringent regulations for drug and vaccine transportation, further bolsters the demand for high-performance insulated packaging solutions. The United States, in particular, is a major consumer of insulated packaging due to its large population, diverse climate zones requiring temperature control for various goods, and a high disposable income that supports the purchase of premium, temperature-sensitive products. The region's commitment to technological innovation also drives the development and adoption of advanced insulated packaging materials. Furthermore, increasing consumer awareness regarding food safety and the preference for ethically sourced and temperature-controlled products contribute to the growth of this segment in North America. The region's proactive approach to adopting sustainable packaging solutions, while a challenge, is also spurring innovation within the plastic and other segment types, which are often designed to be more eco-friendly. The estimated year of 2025 serves as a pivotal point where these trends are solidified, setting the stage for continued dominance throughout the forecast period.

The insulated packaging materials industry is experiencing significant growth acceleration fueled by several key catalysts. The relentless expansion of e-commerce, particularly for groceries and pharmaceuticals, creates an ever-present need for reliable temperature-controlled logistics. Furthermore, increasing global awareness and stringent regulations surrounding food safety and pharmaceutical integrity mandate the use of effective insulated packaging to maintain product quality and prevent spoilage. The growing consumer demand for sustainable and eco-friendly packaging solutions is also acting as a powerful catalyst, driving innovation in biodegradable and recyclable insulated materials.

This comprehensive report offers an in-depth analysis of the global insulated packaging materials market, spanning the historical period of 2019-2024, the base and estimated year of 2025, and a detailed forecast period from 2025-2033. The report delves into the intricate trends shaping the market, highlighting key insights that demonstrate a projected market value of $12.5 billion in 2025 escalating to an impressive $25.2 billion by 2033. It meticulously examines the driving forces, including the e-commerce boom and stringent regulatory landscapes, alongside the challenges and restraints such as cost and environmental concerns associated with traditional materials. The analysis also pinpoints dominant regions and segments, such as the Plastic type and Food & Beverages application, and identifies critical growth catalysts propelling the industry forward. With detailed company profiles of leading players and a review of significant industry developments, this report provides an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving insulated packaging materials landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Sealed Air, FEURER Group GmbH, Sancell, The Wool Packaging Company Limited, CoolPac, Cascades Inc., ICEE Containers Pty Ltd, TemperPack, Icertech, Insulated Products Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD 17.41 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Insulated Packaging Materials," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Insulated Packaging Materials, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.