1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Counterfeiting Aluminium Closures?

The projected CAGR is approximately 13.87%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti Counterfeiting Aluminium Closures

Anti Counterfeiting Aluminium ClosuresAnti Counterfeiting Aluminium Closures by Application (Beer, Wine, Spirits, Non-Alcoholic Beverages, Healthcare Products, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

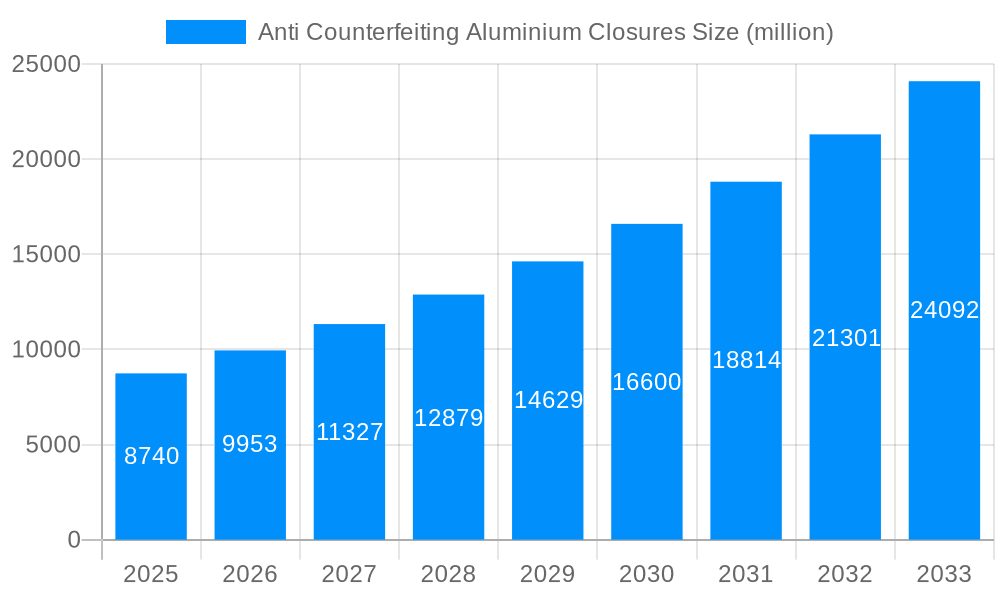

The global market for Anti-Counterfeiting Aluminium Closures is poised for substantial growth, projected to reach approximately $8.74 billion by 2025. This robust expansion is driven by an impressive Compound Annual Growth Rate (CAGR) of 13.87% throughout the forecast period of 2025-2033. The increasing prevalence of product counterfeiting across various industries, particularly in beverages and healthcare, is a primary catalyst. Consumers and brand owners alike are demanding more sophisticated packaging solutions to ensure product authenticity and safeguard brand reputation. Aluminium closures offer a premium feel, excellent barrier properties, and a readily tamper-evident design, making them an ideal choice for combating illicit trade. The heightened awareness of health and safety regulations further propels the adoption of secure and verifiable packaging, directly benefiting the anti-counterfeiting closures segment.

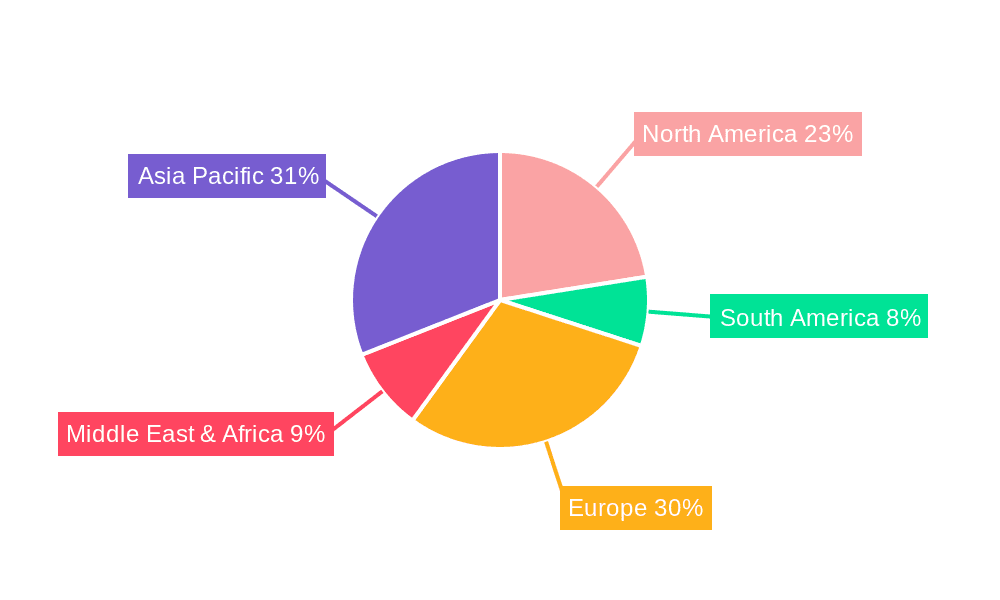

The market's growth trajectory is further supported by technological advancements in closure manufacturing, incorporating features like holograms, unique identification codes, and advanced sealing mechanisms. These innovations enhance the traceability and verification of products, making it significantly harder for counterfeiters to replicate. Key application segments such as Beer, Wine, Spirits, and Healthcare Products are expected to witness significant demand, driven by the need to protect high-value goods and consumer well-being. Geographically, Asia Pacific, led by China and India, is anticipated to emerge as a major growth engine due to its large consumer base and rapidly expanding manufacturing sector, coupled with increasing regulatory focus on product safety. However, challenges such as the fluctuating raw material prices of aluminium and the upfront investment in advanced anti-counterfeiting technologies may present some restraints, though the overwhelming demand for authentic products is expected to outweigh these concerns.

This comprehensive report delves into the dynamic global market for anti-counterfeiting aluminum closures, offering an in-depth analysis from the historical period of 2019-2024 through to a projected forecast up to 2033, with a base and estimated year of 2025. The study meticulously examines market trends, driving forces, challenges, regional dominance, key growth catalysts, and leading industry players, providing invaluable insights for stakeholders. The report quantifies market potential in billions of units, highlighting the substantial and growing demand for secure and authentic packaging solutions.

The global anti-counterfeiting aluminum closures market is experiencing robust growth, driven by an escalating imperative to safeguard brands and consumers from the pervasive threat of product counterfeiting. Over the historical period of 2019-2024, the market has witnessed a steady upward trajectory, with an estimated X billion units in 2025. This growth is intrinsically linked to the increasing sophistication of counterfeiters and the resultant financial and reputational damage incurred by businesses across various sectors. The fundamental value proposition of these closures lies in their ability to provide a tangible and verifiable barrier against illicit replication. As the market progresses towards 2033, projections indicate a sustained expansion, potentially reaching Y billion units. This expansion is fueled by technological advancements in tamper-evident features, intricate designs, and integrated authentication mechanisms. Furthermore, the rising disposable incomes and burgeoning consumer awareness regarding product authenticity, particularly in emerging economies, are amplifying the demand for premium and secure packaging. The increasing globalization of supply chains, while offering efficiency, also presents vulnerabilities that anti-counterfeiting closures are strategically designed to mitigate. The industry is seeing a significant shift towards integrated solutions that combine physical security with digital verification, such as QR codes and NFC tags, providing an enhanced layer of traceability and authentication. The adoption of advanced printing techniques, holographic elements, and micro-embossing further strengthens the anti-counterfeiting capabilities, making unauthorized replication exceedingly difficult and costly for counterfeiters. The environmental considerations surrounding aluminum as a recyclable material also contribute to its favorable positioning in the packaging landscape, aligning with broader sustainability goals and further bolstering its market appeal. The market is also witnessing increased investment in research and development, focusing on innovative materials and functionalities that offer superior protection and user experience.

The surge in demand for anti-counterfeiting aluminum closures is propelled by a confluence of powerful market forces. Foremost among these is the escalating global economic impact of counterfeiting, which translates into significant revenue losses for legitimate businesses and poses severe health and safety risks to consumers. The estimated financial drain from counterfeit goods runs into hundreds of billions of dollars annually, making robust protective measures a non-negotiable priority for brand owners. This imperative is further amplified by increasingly stringent regulatory frameworks in various countries that mandate enhanced product security and traceability, especially in sensitive sectors like pharmaceuticals and food and beverage. Moreover, the growing global interconnectedness and the rise of e-commerce platforms, while facilitating market access, also create new avenues for counterfeiters to operate. Consequently, brands are actively seeking reliable and scalable solutions to protect their market share and maintain consumer trust. The inherent properties of aluminum closures – their durability, malleability, and recyclability – make them an ideal substrate for integrating advanced anti-counterfeiting technologies. This includes sophisticated tamper-evident seals, holographic foils, micro-printing, and serialization capabilities, all of which contribute to making product replication a daunting task for illicit operators. The increasing consumer consciousness and demand for authentic products, coupled with the brand reputation risks associated with supplying counterfeit items, are also significant drivers. Companies are recognizing that investing in effective anti-counterfeiting measures is not merely a cost but a critical investment in brand integrity and long-term business sustainability.

Despite the robust growth trajectory, the anti-counterfeiting aluminum closures market is not without its challenges and restraints. A primary hurdle is the ever-evolving nature of counterfeiting techniques. As new anti-counterfeiting technologies are implemented, counterfeiters adapt and develop more sophisticated methods to bypass them, creating an ongoing arms race that requires continuous innovation and investment. This necessitates substantial research and development expenditure for closure manufacturers, which can impact profit margins, especially for smaller players. Another significant challenge is the cost factor. While the long-term benefits of preventing counterfeiting are substantial, the initial investment in advanced anti-counterfeiting features can be higher compared to conventional closures. This can be a deterrent for price-sensitive industries or smaller businesses with limited budgets, potentially leading to a segment of the market remaining vulnerable. Furthermore, the complexity of implementation and integration of certain advanced security features can pose challenges for manufacturers in adapting their existing production lines and for brand owners in their supply chain management. Ensuring seamless integration with filling and capping machinery, as well as maintaining consistency in application across large production volumes, requires meticulous planning and execution. The global economic uncertainties and fluctuations in raw material prices, particularly for aluminum, can also affect the overall cost competitiveness of these closures and influence purchasing decisions. Finally, lack of universal standardization in anti-counterfeiting technologies across different regions and industries can create complexities in supply chain management and enforcement, potentially diluting the effectiveness of some security measures.

The global anti-counterfeiting aluminum closures market exhibits distinct regional and segment dominance, driven by a combination of regulatory landscapes, industry presence, and consumer demographics.

Dominant Region/Country:

Dominant Segment (Application):

The anti-counterfeiting aluminum closures industry is experiencing significant growth fueled by several key catalysts. The escalating financial losses and reputational damage inflicted by product counterfeiting globally are a primary driver, compelling brands across all sectors to invest in robust protective measures. Furthermore, increasingly stringent government regulations and international trade agreements that mandate enhanced product authenticity and traceability are creating a favorable market environment. The rapid expansion of e-commerce, while offering new market opportunities, also presents vulnerabilities to counterfeiting, thus necessitating advanced closure solutions for secure online sales. Technological advancements in tamper-evident features, holography, serialization, and track-and-trace capabilities are making aluminum closures more sophisticated and effective, further stimulating demand. Finally, a growing consumer awareness and demand for genuine products, coupled with the inherent recyclability and premium appeal of aluminum, contribute to the sustained growth of this vital market segment.

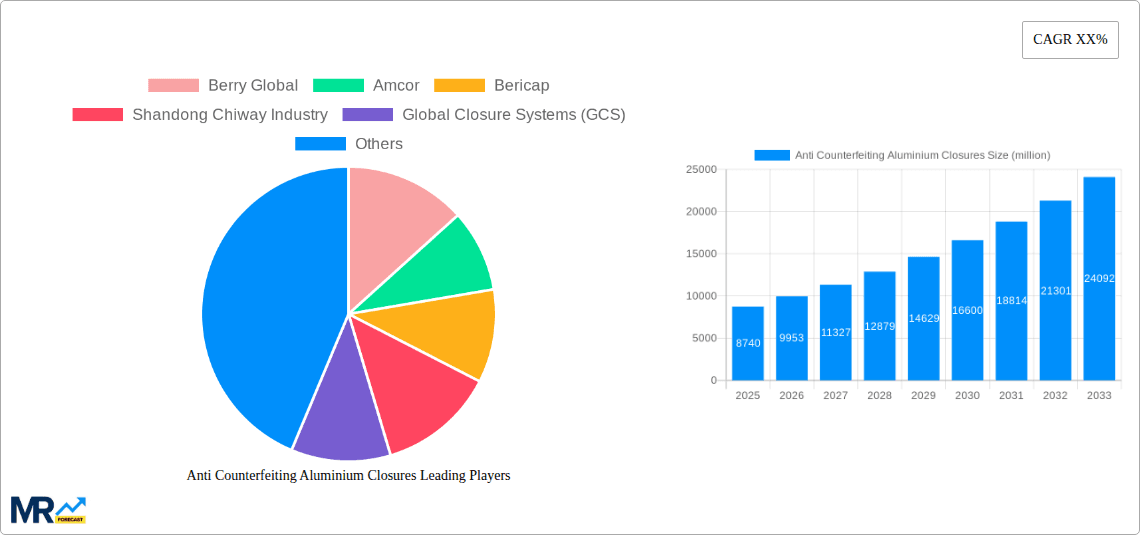

The global anti-counterfeiting aluminum closures market is characterized by the presence of several prominent and innovative players. These companies are at the forefront of developing and implementing advanced security features to combat product counterfeiting.

The anti-counterfeiting aluminum closures sector has witnessed several pivotal developments that have significantly enhanced its capabilities and market reach. These advancements reflect the industry's continuous effort to stay ahead of evolving counterfeiting threats.

This report offers a truly comprehensive overview of the anti-counterfeiting aluminum closures market, delving into every facet that influences its trajectory. Beyond the core market analysis, it provides an in-depth examination of technological advancements, including the integration of holographic features, tamper-evident mechanisms, and digital authentication technologies like QR codes and NFC. The report also scrutinizes the impact of evolving regulatory landscapes across key global markets and their influence on product security mandates. Furthermore, it presents detailed competitive intelligence on leading manufacturers, analyzing their product portfolios, strategic initiatives, and market positioning. The study also includes an extensive breakdown of market segmentation by application and region, offering granular insights into demand drivers and growth opportunities within specific sectors and geographies. By quantifying market potential in billions of units and projecting future trends up to 2033, this report equips stakeholders with the critical data and strategic foresight necessary to navigate this complex and rapidly evolving industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.87% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 13.87%.

Key companies in the market include Berry Global, Amcor, Bericap, Shandong Chiway Industry, Global Closure Systems (GCS), GualaClosures Group, Taiwan HonChuan Group, Anhui Baishijia Packaging, .

The market segments include Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Anti Counterfeiting Aluminium Closures," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti Counterfeiting Aluminium Closures, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.