1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-static PET Protective Film?

The projected CAGR is approximately 11.48%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti-static PET Protective Film

Anti-static PET Protective FilmAnti-static PET Protective Film by Type (Anti-static PET Protective Film (With Glue), Anti-static PET Protective Film (Without Glue), World Anti-static PET Protective Film Production ), by Application (Electronic, Print, Package, Automobile, Industry, World Anti-static PET Protective Film Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

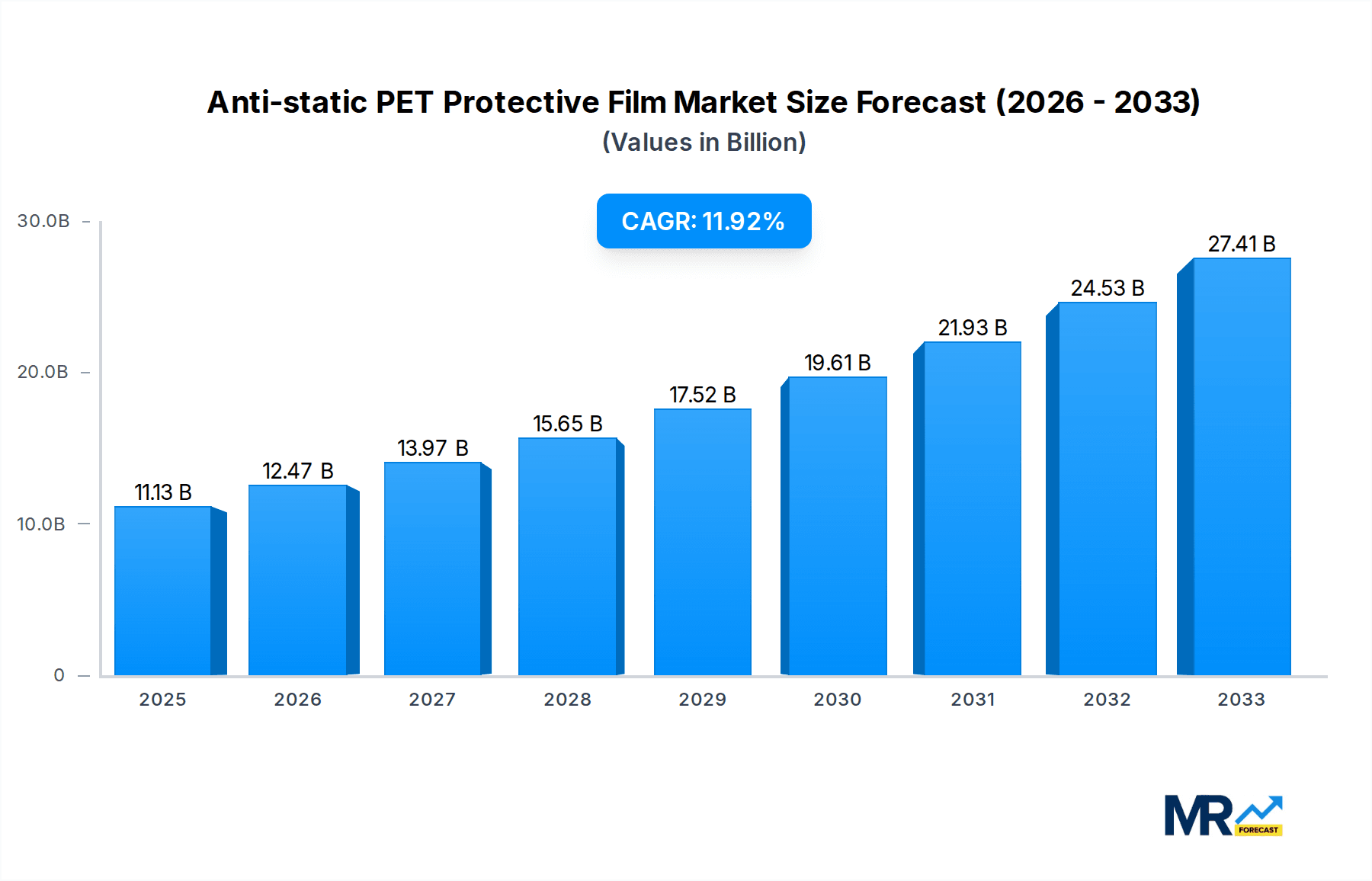

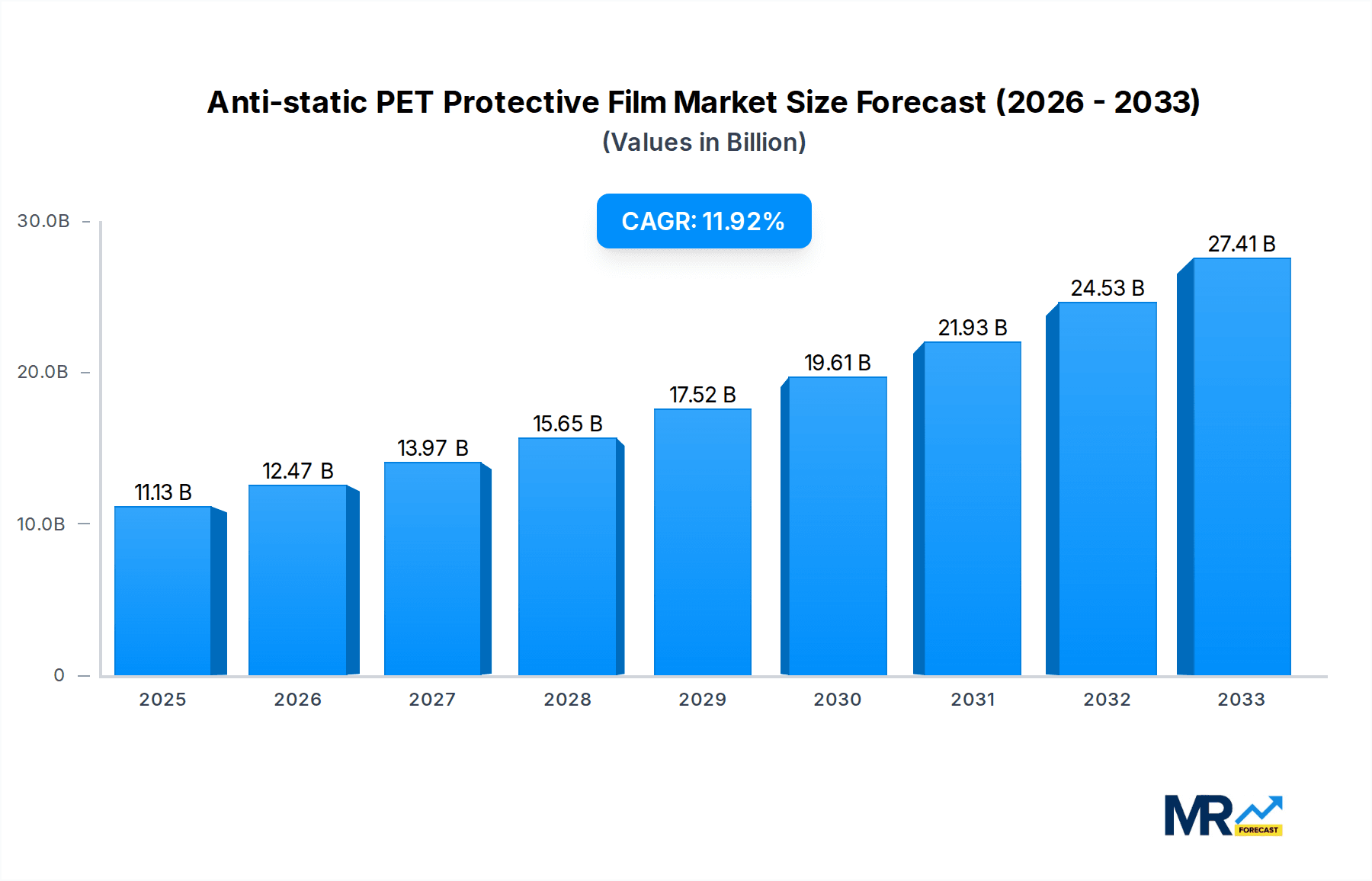

The global Anti-static PET Protective Film market is poised for substantial expansion, projecting a market size of $11.13 billion in the base year 2025, with an impressive Compound Annual Growth Rate (CAGR) of 11.48% anticipated to continue through 2033. This robust growth is primarily driven by the escalating demand from the electronics sector, where the protection of sensitive components from electrostatic discharge (ESD) is paramount. As electronic devices become more sophisticated and miniaturized, the need for advanced anti-static solutions intensifies. The automotive industry also presents a significant growth avenue, with the increasing integration of electronic systems in vehicles necessitating high-performance protective films. Furthermore, the burgeoning print and packaging industries, seeking to preserve the integrity of their products and materials, contribute to the market's upward trajectory.

The market segmentation reveals key areas of focus. In terms of type, both anti-static PET protective films with and without glue cater to diverse application needs, with the "with glue" variant likely to see higher demand due to its adhesive properties for secure application. World Anti-static PET Protective Film production, a crucial indicator, underscores the global manufacturing capacity and geographical distribution of this essential material. Key players like Aerchs, Toray Industries, SKC, and Mitsubishi Polyester Film are at the forefront, driving innovation and capturing significant market share. Emerging players in regions like China and Southeast Asia are also contributing to increased production and competitive pricing. However, the market may face restraints such as fluctuating raw material costs and the development of alternative protective technologies, though the inherent advantages of PET films in terms of clarity, durability, and anti-static properties are expected to mitigate these challenges and sustain the strong growth momentum.

The global Anti-static PET Protective Film market is poised for significant expansion, driven by escalating demand for sophisticated protective solutions across a myriad of industries. Our comprehensive report, spanning the Study Period of 2019-2033 with a Base Year of 2025, forecasts robust growth, anticipating the market to reach multi-billion dollar valuations by 2033. The Estimated Year of 2025 marks a critical juncture, with the market already exhibiting strong momentum. During the Historical Period of 2019-2024, foundational growth was established, setting the stage for accelerated expansion in the Forecast Period of 2025-2033. A key insight is the increasing integration of advanced anti-static properties into PET films, moving beyond basic surface treatments to embed more durable and effective electrostatic discharge (ESD) protection. This trend is particularly evident in the Electronic segment, where the miniaturization of components and the proliferation of sensitive semiconductor devices necessitate premium protection against electrostatic damage. The market is witnessing a bifurcation in product types: Anti-static PET Protective Film (With Glue) offers enhanced adhesion for demanding applications, particularly in precision assembly and protective packaging, while Anti-static PET Protective Film (Without Glue) caters to situations where residue-free removal is paramount, such as in screen protection for high-end electronics and specialized industrial applications. The continuous innovation in polymer science and adhesive technology is enabling manufacturers to tailor films with specific characteristics, including varying levels of static dissipation, optical clarity, and mechanical strength. This nuanced approach to product development is a dominant trend, allowing the market to address highly specific application needs. Furthermore, the growing awareness of the financial implications of ESD damage within manufacturing processes is compelling businesses to invest more proactively in protective measures, thereby fueling market demand. The report will delve deep into the nuanced dynamics of these trends, offering granular insights into regional variations and segment-specific growth trajectories.

The market's trajectory is further shaped by macro-economic factors and technological advancements. The increasing reliance on electronic devices in everyday life, from smartphones and laptops to complex industrial machinery, directly translates to a heightened need for reliable anti-static protection. The Automobile sector, with its increasing integration of advanced electronics and touchscreens, is also emerging as a significant consumer of these specialized films. Similarly, the Print industry utilizes anti-static films to prevent dust attraction and ensure high-quality printing on sensitive substrates. The Package segment, particularly for high-value or sensitive electronic components, is increasingly incorporating these films to guarantee product integrity during transit and storage. Overall, the increasing sophistication of manufacturing processes and the inherent fragility of modern materials are creating a fertile ground for the widespread adoption of anti-static PET protective films. The projected market value, reaching billions of dollars, underscores the critical role these films play in safeguarding investments and ensuring product reliability across the global industrial landscape.

The World Anti-static PET Protective Film Production is not merely about sheer volume but also about the evolution of production techniques. Manufacturers are investing in advanced coating and extrusion technologies to create films with superior and long-lasting anti-static properties. This includes the development of intrinsically anti-static PET resins and sophisticated surface treatments that are resistant to abrasion and environmental factors. The emphasis is shifting towards sustainable production methods, with a growing interest in recyclable and eco-friendly materials, which will influence future market dynamics. The competitive landscape is characterized by a blend of established global players and emerging regional manufacturers, each vying for market share through innovation, cost-effectiveness, and strategic partnerships. The report will meticulously analyze the competitive intensity and strategic moves of these key stakeholders, providing a holistic view of the market's operational ecosystem.

The global Anti-static PET Protective Film market is experiencing a significant upswing, propelled by a confluence of powerful driving forces. Foremost among these is the relentless advancement and proliferation of electronic devices. As components become smaller, more sensitive, and increasingly complex, the risk of electrostatic discharge (ESD) damage escalates. This heightened vulnerability mandates robust protective solutions, positioning anti-static PET films as indispensable. The Electronic segment, a cornerstone of this market, is a prime beneficiary, with applications ranging from the protection of sensitive semiconductor wafers during manufacturing to safeguarding finished consumer electronics during handling and transport. Furthermore, the increasing sophistication of touchscreens and high-resolution displays in consumer electronics, the Automobile sector, and industrial equipment necessitates films that not only provide ESD protection but also maintain excellent optical clarity and scratch resistance. This dual functionality is a key growth driver.

The growing awareness of the economic impact of ESD-related failures is another significant propellant. Manufacturers across various industries are increasingly recognizing that the cost of ESD damage—including component replacement, production downtime, and product returns—far outweighs the investment in preventative measures like anti-static films. This proactive approach to risk mitigation is fueling demand. The Package segment, particularly for high-value and sensitive goods, is actively adopting anti-static films to ensure product integrity throughout the supply chain. Moreover, the evolution of manufacturing processes, especially in industries like Automobile and advanced electronics, demands cleaner and more controlled environments. Anti-static films contribute to this by preventing the attraction of airborne dust and particles, which can be detrimental to precision assembly and product quality. This dual benefit of ESD protection and particle repulsion solidifies their importance.

The expansion of industries requiring precision and cleanliness, such as the Print sector for sensitive substrates and various Industry applications where static can cause production defects, further contributes to the market's propulsion. The continuous drive for higher yields and reduced waste in manufacturing operations directly benefits from the reliable protection offered by these films. As a result, the demand for specialized films that offer tailored anti-static properties, combined with other desirable characteristics like durability and ease of application, is set to witness sustained growth over the Forecast Period of 2025-2033.

Despite the robust growth trajectory, the Anti-static PET Protective Film market faces several challenges and restraints that could temper its expansion. One significant hurdle is the cost sensitivity in certain market segments. While the long-term benefits of ESD protection are recognized, some smaller manufacturers or businesses in price-sensitive sectors might hesitate to adopt premium anti-static films due to their perceived higher initial cost compared to conventional protective films. This can lead to a trade-off between cost and product reliability. The development and application of effective, long-lasting anti-static properties also present a technical challenge. Ensuring that the anti-static functionality remains effective throughout the film's lifespan, especially under varying environmental conditions such as humidity and temperature fluctuations, requires continuous innovation in material science and manufacturing processes. Poorly implemented or short-lived anti-static properties can lead to product failure and damage brand reputation, thereby creating a barrier to adoption.

Another restraint is the availability of alternative protective solutions. While anti-static PET films offer a unique combination of properties, other materials or specialized treatments, such as conductive plastics or surface-treated packaging materials, might be considered for specific applications. The competitive landscape of protective materials requires anti-static PET film manufacturers to constantly differentiate their offerings and demonstrate superior performance. Furthermore, stringent regulatory requirements and industry standards related to material safety, environmental impact, and performance validation can add to the complexity and cost of product development and market entry. Companies need to invest in research and development to meet these evolving standards.

The complexity of the global supply chain and potential disruptions can also impact market growth. Fluctuations in the availability and price of raw materials, such as PET resin and anti-static additives, can affect production costs and lead times, thereby posing a challenge to consistent supply. Additionally, technical challenges in film application and removal, particularly for specialized applications requiring residue-free surfaces, can be a concern. The need for precise application techniques and compatibility with various substrates might limit adoption in certain areas without adequate user training or specialized equipment. Finally, the pace of technological obsolescence in the electronics sector means that protective film requirements can evolve rapidly, necessitating continuous investment in R&D to stay ahead of changing needs and maintain market relevance.

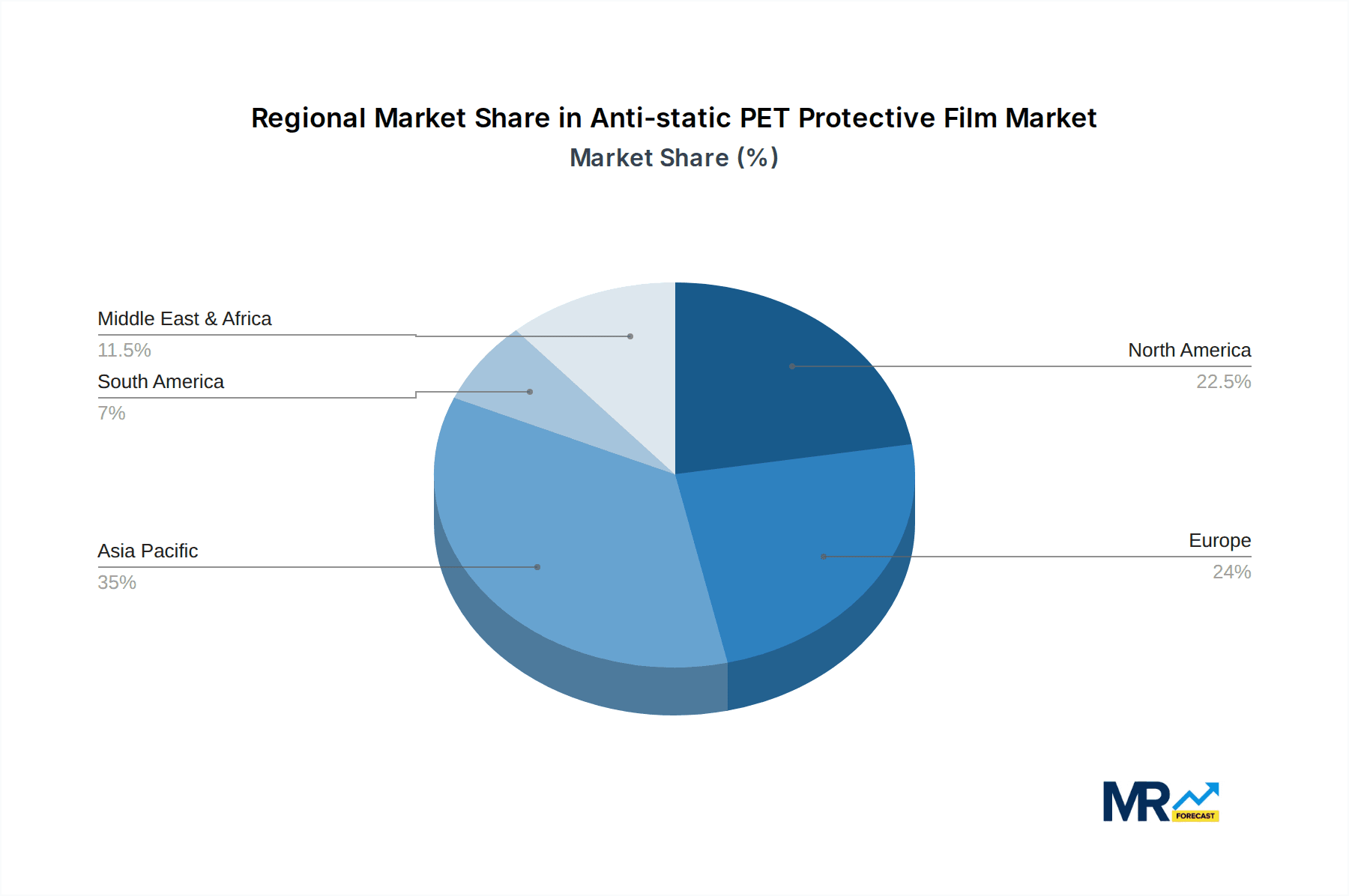

Several regions and segments are poised to dominate the global Anti-static PET Protective Film market, driven by a combination of industrial infrastructure, technological adoption, and end-user demand. The Electronic segment, encompassing the manufacturing of semiconductors, printed circuit boards (PCBs), consumer electronics, and integrated circuits, is unequivocally the most dominant force. The inherent sensitivity of electronic components to electrostatic discharge makes anti-static protection not just a recommendation but an absolute necessity. The ongoing miniaturization of electronic devices, the increasing complexity of integrated circuits, and the relentless demand for higher performance necessitate stringent ESD control measures throughout the entire production and handling lifecycle. Countries and regions with a strong presence in electronics manufacturing, such as East Asia (particularly China, South Korea, and Taiwan), North America (primarily the United States), and parts of Europe, are therefore central to the dominance of this segment.

Within the Electronic segment, the specific application of Anti-static PET Protective Film (With Glue) is expected to witness substantial growth. These films offer superior adhesion, providing a more secure and reliable protective layer for sensitive components and surfaces during assembly, testing, and packaging. Their ability to conform to complex shapes and prevent slippage makes them ideal for protecting high-value semiconductor wafers, precision optics, and delicate display screens. The increasing trend of integrating touch interfaces in various devices, including smartphones, tablets, automotive displays, and industrial control panels, further amplifies the demand for these high-performance protective films. The demand is not just for ESD protection but also for scratch resistance, optical clarity, and ease of application and removal without leaving residue, all of which are offered by advanced formulations of glued anti-static PET films.

Geographically, East Asia is predicted to emerge as the dominant region. This dominance is underpinned by its unparalleled position as the global hub for electronics manufacturing. Countries like China, South Korea, and Taiwan are home to a vast ecosystem of semiconductor foundries, electronics assembly plants, and component manufacturers. The sheer volume of production, coupled with stringent quality control measures driven by global demand for electronic goods, makes this region the largest consumer and producer of anti-static PET protective films. The rapid pace of technological innovation in these countries, leading to the continuous introduction of new and more sensitive electronic devices, further fuels the demand for advanced protective solutions. The presence of major electronics giants like Samsung, LG, TSMC, and Foxconn within this region ensures a consistent and substantial demand for anti-static PET films throughout the Study Period (2019-2033).

Beyond East Asia, North America and Europe are also significant markets. The United States, with its strong focus on high-end electronics manufacturing, aerospace, and defense industries, presents a substantial market for specialized anti-static films. Similarly, European countries with advanced manufacturing capabilities, particularly in the automotive and industrial electronics sectors, are key contributors. The Automobile segment, with its increasing reliance on sophisticated electronics, sensors, and infotainment systems, is another crucial area of market dominance. The integration of advanced driver-assistance systems (ADAS), electric vehicle (EV) technology, and complex in-car connectivity solutions necessitates the protection of numerous electronic components from ESD, thereby driving demand for anti-static PET films. The Industry segment, encompassing a broad spectrum of manufacturing and processing applications where static electricity can cause defects, inefficiencies, or safety hazards, also represents a considerable and growing market. This includes areas like cleanroom operations, precision machinery, and specialized equipment manufacturing. The combination of the dominant Electronic segment, the growing importance of the Automobile and Industry segments, and the manufacturing prowess of regions like East Asia will collectively dictate the future landscape of the Anti-static PET Protective Film market.

The Anti-static PET Protective Film industry is experiencing robust growth, fueled by several key catalysts. Foremost is the ever-increasing miniaturization and sensitivity of electronic components, which amplifies the risk of damage from electrostatic discharge (ESD). This directly drives demand for advanced protective films in the Electronic sector. Secondly, the growing awareness of the significant economic costs associated with ESD failures, including component replacement and production downtime, is compelling manufacturers across various industries to invest proactively in ESD control solutions. The expansion of the Automobile sector's reliance on sophisticated electronics and touch interfaces, along with the Package industry's need to protect high-value goods, further accelerates market growth. Lastly, continuous innovation in material science is leading to the development of more effective, durable, and application-specific anti-static PET films, enhancing their appeal and utility.

This comprehensive report offers an in-depth analysis of the global Anti-static PET Protective Film market, meticulously examining its trajectory from the Historical Period of 2019-2024 through the Base Year of 2025 and projecting its growth into the Forecast Period of 2025-2033. The study delves into the intricate market dynamics, identifying key drivers such as the escalating demand from the Electronic, Automobile, and Package segments, propelled by the continuous innovation in device technology and the critical need for ESD protection. It also addresses the challenges and restraints impacting market expansion, including cost sensitivities and the complexity of achieving persistent anti-static properties. Furthermore, the report provides a detailed regional analysis, pinpointing East Asia as a dominant market due to its robust electronics manufacturing base. A thorough examination of leading players and significant market developments ensures a holistic understanding of the competitive landscape and future trends. The report's value lies in its granular insights, providing actionable intelligence for stakeholders navigating this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.48% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.48%.

Key companies in the market include Aerchs, Blueridge Films, Toray Industries, Unitika, SKC, Mitsubishi Polyester Film, Achilles, Syfan, Laufenberg, Firsta Group, L&V Company, Kyndia Bucker, Uni Film, Nanya Plastics, Shenzhen HiMore Technology, Shanghai CN Industries, Shenzhen KHJ Group, Shenzhen Cheermo Innovative Adhesive Materials, Shenzhen Xinst Technology, Wuxi Sanli Protective Film, Dongguan Evershare.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Anti-static PET Protective Film," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti-static PET Protective Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.