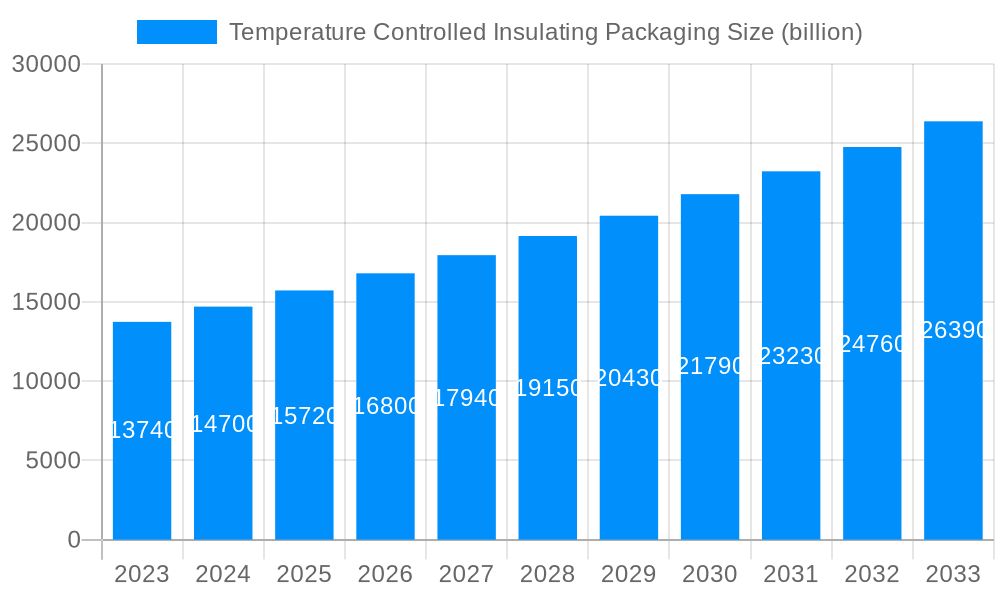

1. What is the projected Compound Annual Growth Rate (CAGR) of the Temperature Controlled Insulating Packaging?

The projected CAGR is approximately 6.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Temperature Controlled Insulating Packaging

Temperature Controlled Insulating PackagingTemperature Controlled Insulating Packaging by Application (Food, Pharmaceutical, Others, World Temperature Controlled Insulating Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Temperature Controlled Insulating Packaging market is poised for significant expansion, projected to reach approximately $17.44 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.8% expected to continue through 2033. This growth is primarily fueled by the escalating demand for reliable and efficient temperature-sensitive logistics across the pharmaceutical and food industries. The pharmaceutical sector, in particular, is a major driver, with increasing global healthcare spending and the growing market for biologics, vaccines, and specialized medications that require strict temperature control during transit. Advancements in material science leading to more effective and sustainable insulating materials, coupled with the continuous development of innovative packaging solutions, further bolster market expansion. The inherent need to maintain product integrity, prevent spoilage, and comply with stringent regulatory requirements for temperature-sensitive goods across these critical sectors underpins this sustained growth trajectory.

The market's dynamism is further shaped by evolving consumer expectations for fresh and frozen food delivery, as well as the expanding e-commerce landscape for perishable goods. Emerging economies, with their burgeoning middle classes and increasing disposable incomes, present considerable untapped potential, driving greater investment in cold chain infrastructure and specialized packaging. While the market benefits from these tailwinds, certain restraints, such as the initial high cost of advanced insulating materials and the logistical complexities associated with international temperature-controlled shipping, need to be addressed. However, the ongoing commitment to research and development, focusing on cost-effective and environmentally friendly solutions, alongside the integration of smart technologies for real-time temperature monitoring, is expected to mitigate these challenges and propel the Temperature Controlled Insulating Packaging market towards continued, strong performance.

This report delves into the dynamic world of temperature-controlled insulating packaging, a critical component in safeguarding sensitive goods across various industries. With a projected global market value of over $15 billion by 2033, the industry is poised for significant expansion, driven by evolving consumer demands, stricter regulatory landscapes, and advancements in material science. Our analysis spans the historical period of 2019-2024, with a detailed base year estimation for 2025 and an extensive forecast period extending to 2033. We aim to provide stakeholders with actionable insights into market trends, key growth drivers, potential challenges, and the competitive landscape.

The global temperature-controlled insulating packaging market, valued at an estimated $10 billion in the base year 2025, is characterized by a pervasive trend towards sustainability and enhanced thermal performance. Manufacturers are increasingly investing in research and development to create packaging solutions that not only maintain precise temperature ranges for extended durations but also minimize their environmental footprint. This includes a notable shift from traditional expanded polystyrene (EPS) to more eco-friendly alternatives like molded fiber, plant-based foams, and vacuum insulated panels (VIPs). The demand for reusable and recyclable packaging is also on the rise, fueled by corporate sustainability initiatives and increasing consumer awareness. Furthermore, the integration of smart technologies, such as IoT sensors for real-time temperature monitoring and data logging, is becoming a significant differentiator. These intelligent solutions offer enhanced traceability and assurance of product integrity throughout the cold chain. The pharmaceutical sector, in particular, is a major proponent of these technological advancements, driven by the stringent requirements for vaccine and biopharmaceutical transport. The e-commerce boom, especially in the food and beverage sector, has also created a substantial demand for smaller, more cost-effective, and highly efficient insulated packaging solutions designed for last-mile delivery. This intricate interplay of sustainability, performance, and technological innovation is shaping the future of temperature-controlled insulating packaging, pushing the market towards solutions that offer superior protection while aligning with global environmental goals. The market is witnessing a surge in demand for specialized packaging designed for specific temperature ranges, from frozen (-80°C and below) to refrigerated (2°C to 8°C) and ambient (15°C to 25°C), catering to the diverse needs of highly sensitive products like pharmaceuticals, biologics, and perishable foods. The increasing globalization of supply chains, coupled with the growing complexity of cold chain logistics, further accentuates the need for robust and reliable insulated packaging solutions. As the market matures, we anticipate a greater focus on customized packaging designs that address unique product requirements and logistical challenges, moving away from one-size-fits-all approaches. The economic impact of product spoilage due to temperature excursions is substantial, estimated to be in the billions annually, underscoring the critical role of effective temperature-controlled packaging in mitigating these losses. The regulatory landscape, particularly concerning pharmaceutical shipments, continues to evolve, demanding higher standards for packaging integrity and validation, thus spurring innovation and investment in advanced materials and design.

Several powerful forces are collectively propelling the significant growth anticipated in the temperature-controlled insulating packaging market, projected to reach over $15 billion by 2033. The burgeoning global pharmaceutical industry, with its increasing reliance on the safe and secure transport of temperature-sensitive biologics, vaccines, and specialized drugs, stands as a primary driver. The complexity of these supply chains, often spanning continents, necessitates packaging that can maintain critical temperature ranges for extended periods, thus minimizing the risk of product degradation and ensuring patient safety. The rapid expansion of the e-commerce sector, particularly for perishable goods like fresh food, gourmet meal kits, and premium beverages, is another monumental force. Consumers now expect the same level of freshness and quality for delivered items as they would find in a physical store, creating an insatiable demand for efficient and cost-effective insulated packaging solutions that can withstand the rigrates of last-mile delivery. The increasing awareness and adoption of sustainable practices across industries also play a crucial role. Regulatory pressures and a growing consumer preference for environmentally friendly products are pushing manufacturers to develop biodegradable, recyclable, and reusable insulated packaging alternatives. This shift is not only driven by ethical considerations but also by the potential for cost savings through reduced waste disposal fees and enhanced brand image. Furthermore, advancements in material science are continuously yielding innovative insulation materials with superior thermal resistance and lighter weight, enabling longer hold times and reduced shipping costs.

Despite the robust growth trajectory, the temperature-controlled insulating packaging market faces certain challenges and restraints that could temper its expansion, with an estimated market value of over $10 billion in 2025. One of the most significant hurdles is the high cost of advanced insulation materials and technologies. While solutions like vacuum insulated panels (VIPs) offer exceptional thermal performance, their manufacturing complexity and material sourcing can lead to higher upfront costs compared to conventional materials like EPS. This can be a deterrent for smaller businesses or those operating in price-sensitive segments. Stringent regulatory compliance presents another layer of complexity. The pharmaceutical industry, in particular, demands rigorous validation and qualification of packaging solutions to ensure they meet specific temperature profiles and product integrity standards. Achieving and maintaining these compliances can be time-consuming and resource-intensive. Logistical complexities and infrastructure limitations in certain regions can also pose a challenge. Ensuring the availability of consistent and reliable cold chain infrastructure, from refrigerated transport to temperature-controlled warehousing, is paramount for the effective use of insulated packaging. Any gaps in this chain can render even the most sophisticated packaging ineffective. Furthermore, the disposal and end-of-life management of certain insulation materials can be problematic, particularly for non-recyclable or composite materials. While the industry is moving towards more sustainable options, the legacy of traditional materials and the infrastructure for their proper disposal continue to be a concern. Finally, fluctuations in raw material prices can impact manufacturing costs and, consequently, the final price of insulated packaging, creating uncertainty for both manufacturers and end-users.

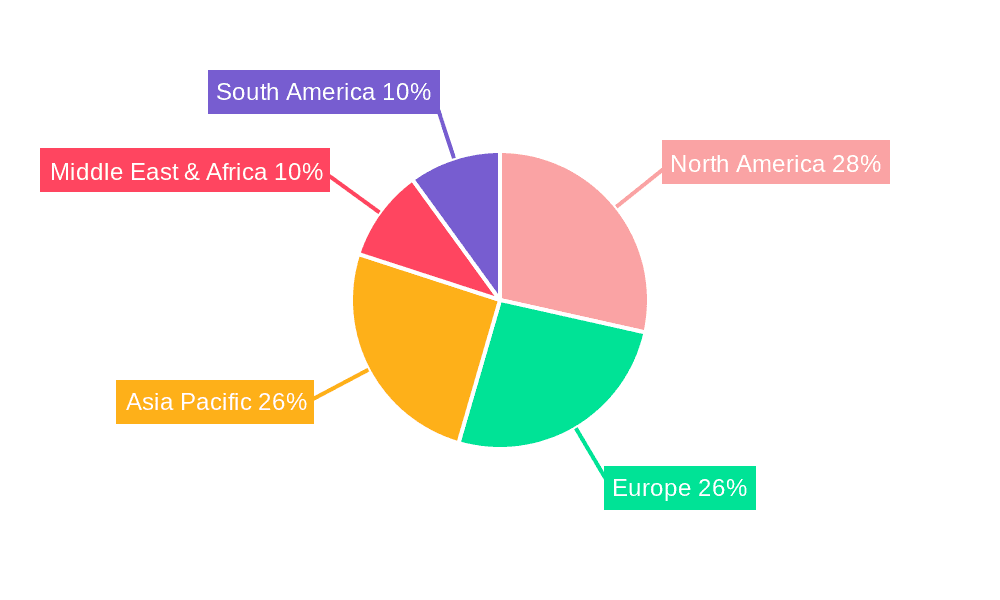

The global temperature-controlled insulating packaging market, estimated to be over $10 billion in 2025, is poised for significant growth, with the Pharmaceutical segment and the North America region projected to exhibit dominant market share and influence throughout the forecast period (2025-2033). The pharmaceutical industry's unwavering demand for secure and precise temperature control for its high-value, temperature-sensitive products such as vaccines, biologics, and specialized therapeutics, is the primary catalyst for this segment's dominance. The increasing prevalence of chronic diseases, advancements in biotechnology, and the global rollout of vaccination campaigns necessitate a robust and reliable cold chain infrastructure. Packaging solutions are critical for ensuring the efficacy and safety of these life-saving medications, driving substantial investment in advanced insulated packaging technologies. Stringent regulatory requirements from bodies like the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) mandate rigorous validation and qualification processes for pharmaceutical packaging, further boosting the demand for high-performance, compliant solutions. Companies like CSafe, Peli BioThermal, and World Courier are at the forefront of providing specialized solutions tailored to the unique needs of pharmaceutical logistics.

North America is expected to emerge as a dominant region due to a confluence of factors. The presence of a well-established pharmaceutical and biotechnology industry, coupled with a highly developed and sophisticated cold chain logistics network, provides a strong foundation for the market. The region's advanced infrastructure, including extensive refrigerated transportation fleets and state-of-the-art cold storage facilities, supports the efficient deployment of temperature-controlled packaging. Furthermore, the burgeoning e-commerce market in North America, particularly for online grocery and meal delivery services, is creating significant demand for insulated packaging in the food sector. Government initiatives promoting sustainable packaging solutions and increasing consumer awareness regarding food safety and quality further bolster market growth in this region. Key players like Sonoco, Sealed Air, and Veritiv have a strong presence and extensive distribution networks in North America, catering to the diverse needs of both the pharmaceutical and food industries. The increasing adoption of advanced insulation technologies and a focus on supply chain efficiency within the region are expected to maintain its leading position. The market is also witnessing a growing demand for customized packaging solutions that address specific regional climatic conditions and logistical challenges, further cementing North America's role as a trendsetter and major consumer of temperature-controlled insulating packaging.

World Temperature Controlled Insulating Packaging Production

The production of temperature-controlled insulating packaging is undergoing a significant transformation, driven by the need for enhanced sustainability and improved thermal performance. While traditional materials like expanded polystyrene (EPS) remain prevalent due to their cost-effectiveness and widespread availability, there's a marked shift towards greener alternatives. The manufacturing processes are evolving to incorporate advanced insulation materials such as vacuum insulated panels (VIPs), molded pulp, and various plant-based foams derived from materials like sugarcane, corn starch, and mycelium. These innovations aim to reduce the environmental impact associated with production and disposal. The scale of production globally is substantial, with the market expected to exceed $15 billion by 2033. Key production hubs are emerging in regions with strong manufacturing capabilities and growing demand, particularly in North America and Europe, alongside significant contributions from Asia-Pacific. Companies are investing in research and development to optimize their production lines for these new materials, focusing on scalability and cost efficiency. The integration of automation and smart manufacturing technologies is also becoming more prominent, enhancing precision and reducing waste in the production cycle. The global production capacity is being shaped by the increasing demand from the pharmaceutical and food sectors, necessitating a diverse range of packaging solutions, from small parcel solutions for last-mile delivery to large-scale containers for international freight.

Several key growth catalysts are fueling the expansion of the temperature-controlled insulating packaging industry. The escalating demand from the pharmaceutical sector for the safe transport of vaccines, biologics, and temperature-sensitive drugs is a primary driver. Concurrently, the booming e-commerce, especially for perishable food and meal kits, necessitates reliable insulated packaging for last-mile delivery. Growing consumer and regulatory pressure for sustainable packaging solutions is spurring innovation in eco-friendly materials, while advancements in insulation technology are leading to lighter, more efficient, and cost-effective options.

This report provides an in-depth analysis of the global temperature-controlled insulating packaging market, offering a comprehensive overview from 2019 to 2033, with a detailed base year estimation for 2025. It meticulously examines market trends, growth drivers, and potential challenges, while highlighting the dominance of the pharmaceutical segment and North America. The report also identifies key players and significant industry developments, offering a 360-degree perspective for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.8%.

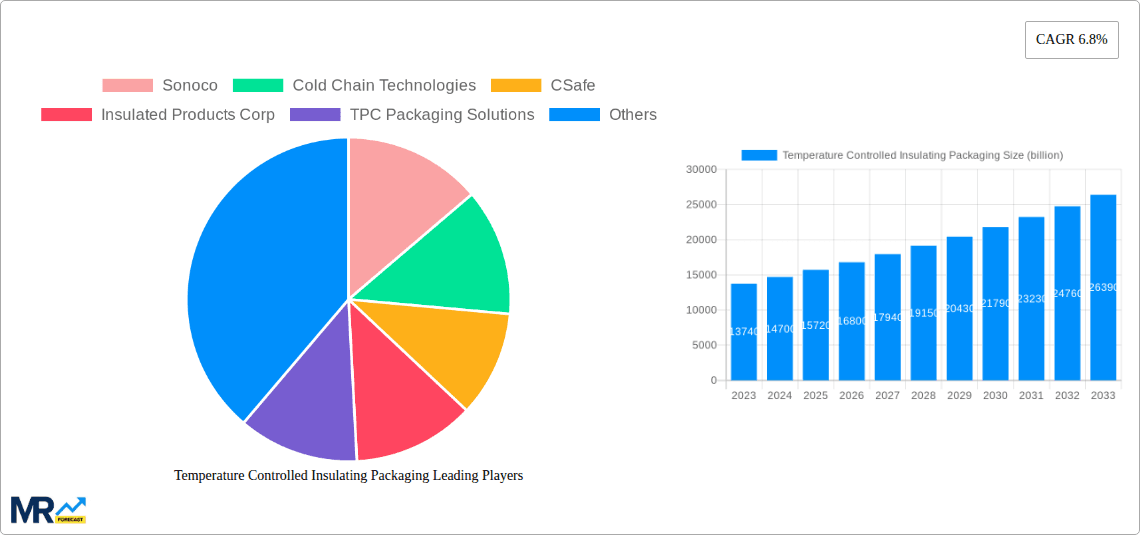

Key companies in the market include Sonoco, Cold Chain Technologies, CSafe, Insulated Products Corp, TPC Packaging Solutions, Peli BioThermal, Sofrigam, Inmark, Veritiv, Ranpak, Envirotainer, Cryopak, Orora Group, Nordic Cold Chain Solutions, Sealed Air, Thermologistics Group, Softbox Systems, World Courier, DS Smith, Woolcool, .

The market segments include Application.

The market size is estimated to be USD 17.44 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Temperature Controlled Insulating Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Temperature Controlled Insulating Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.