1. What is the projected Compound Annual Growth Rate (CAGR) of the Mono-Material Barrier Packaging?

The projected CAGR is approximately 15.63%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mono-Material Barrier Packaging

Mono-Material Barrier PackagingMono-Material Barrier Packaging by Type (PE Packaging, PVC Packaging, PP Packaging, Others, World Mono-Material Barrier Packaging Production ), by Application (Food and Beverage, Medicine, Consumer Goods, Others, World Mono-Material Barrier Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

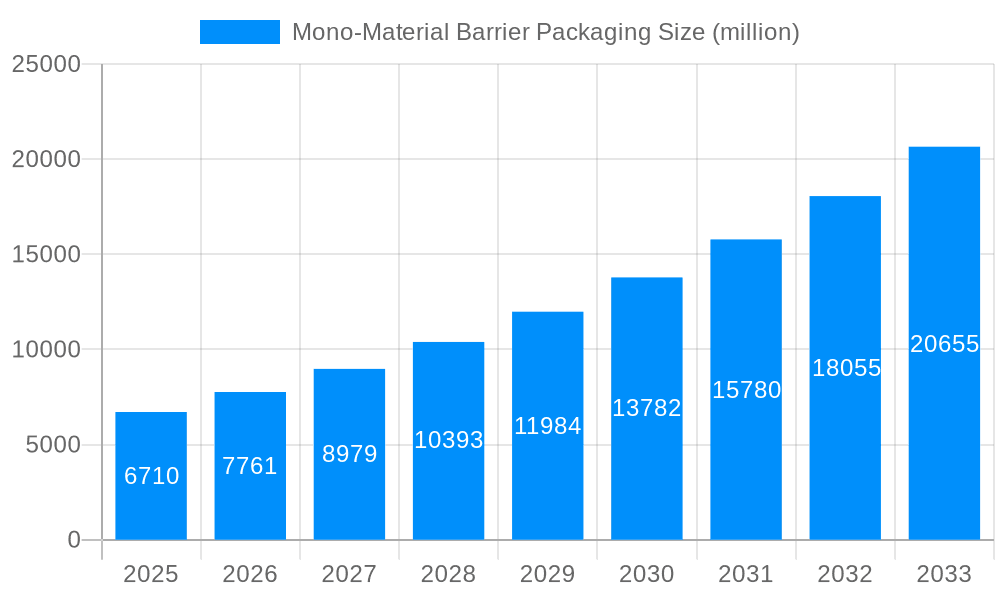

The global mono-material barrier packaging market is poised for substantial expansion, projected to reach an impressive USD 6.71 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 15.63%. This remarkable growth is fueled by an increasing demand for sustainable and recyclable packaging solutions across various industries. Manufacturers are actively shifting away from multi-material laminates, which pose significant recycling challenges, towards mono-material alternatives. These innovative materials, often based on polyethylene (PE) and polypropylene (PP), offer comparable barrier properties to traditional packaging, effectively protecting sensitive products like food, beverages, and pharmaceuticals from oxygen, moisture, and light. This transition is further accelerated by stringent environmental regulations and growing consumer awareness regarding the environmental impact of packaging waste. The market's trajectory is also shaped by advancements in material science and processing technologies, enabling the creation of high-performance mono-material films and containers that meet the diverse needs of the market.

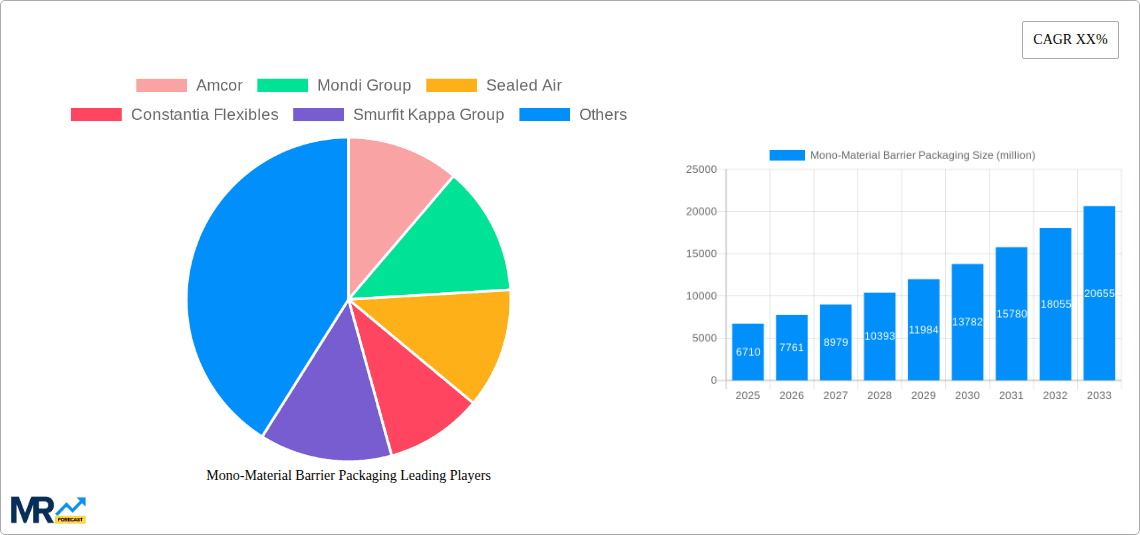

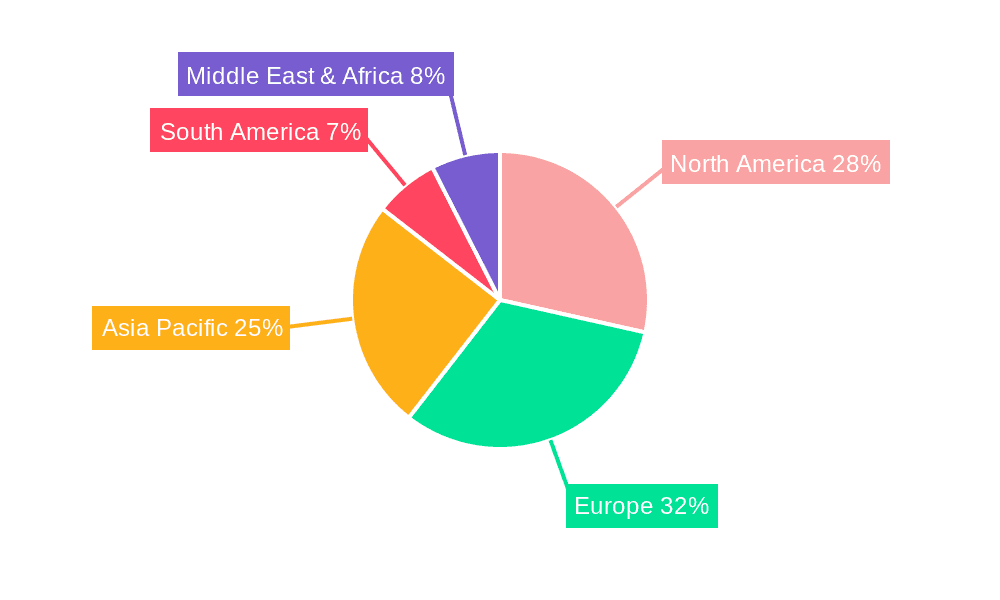

The market is segmented into key types, with PE Packaging and PP Packaging expected to dominate owing to their versatility and recyclability. The application segment is primarily led by the Food and Beverage industry, which accounts for the largest share due to the critical need for extended shelf life and product protection. Medicine and Consumer Goods also represent significant application areas, reflecting the growing adoption of mono-material barrier packaging for pharmaceuticals and everyday items. Key players such as Amcor, Mondi Group, Sealed Air, and Smurfit Kappa Group are at the forefront of innovation, investing heavily in research and development to enhance the barrier properties and cost-effectiveness of mono-material solutions. Regional dynamics indicate strong growth across North America and Europe, driven by supportive government policies and established recycling infrastructure. Asia Pacific, particularly China and India, is also emerging as a significant growth engine due to rapid industrialization and rising disposable incomes, further solidifying the bright future of the mono-material barrier packaging market.

Here is a unique report description for Mono-Material Barrier Packaging, incorporating the specified elements:

The global mono-material barrier packaging market is poised for substantial growth, driven by a confluence of environmental mandates, evolving consumer preferences, and technological advancements. This report delves into the intricate dynamics shaping this vital sector, projecting a market value expected to reach an impressive USD 75.5 billion by 2033. The study period, spanning from 2019 to 2033, with a base and estimated year of 2025, captures the transformative journey of this industry. Historically, from 2019 to 2024, the market has witnessed a steady ascent, characterized by increasing awareness of the limitations of multi-material packaging in terms of recyclability and the growing demand for sustainable alternatives. The forecast period (2025-2033) is anticipated to accelerate this trend, with a compound annual growth rate (CAGR) that underscores the market’s robust expansion.

A significant trend is the widespread adoption of mono-material structures, particularly those based on Polyethylene (PE) and Polypropylene (PP). These materials, long valued for their versatility and cost-effectiveness, are now being engineered with advanced barrier properties, making them suitable for a broader range of applications that historically relied on less recyclable multi-layer films. This shift is not merely about replacing existing materials but about innovative design and material science enabling high-performance barrier solutions from a single polymer type. The push for circular economy principles is a primary catalyst, encouraging brand owners and packaging converters to prioritize materials that can be easily collected, sorted, and reprocessed. This is leading to a decline in the market share of less recyclable options like PVC Packaging, while PE and PP Packaging are expected to witness significant market expansion.

Furthermore, the report highlights the increasing integration of advanced barrier technologies within mono-material films. This includes the development of specialized coatings and additives that enhance properties such as oxygen, moisture, and aroma barrier without compromising the recyclability of the base polymer. The Food and Beverage segment continues to be the dominant application, benefiting from the enhanced shelf-life and product protection offered by these advanced mono-material solutions. However, significant growth is also anticipated in the Medicine and Consumer Goods sectors, as regulatory pressures and consumer demand for sustainable packaging gain traction. The market's trajectory is indicative of a paradigm shift, moving towards a more streamlined and environmentally conscious approach to packaging design and material selection. The estimated market size for 2025 is projected to be around USD 53.1 billion, setting a strong foundation for the subsequent growth trajectory.

The surge in mono-material barrier packaging is propelled by a potent combination of global sustainability initiatives, stringent regulatory frameworks, and a burgeoning consumer consciousness. Governments worldwide are increasingly implementing policies aimed at reducing plastic waste and promoting a circular economy, often by imposing restrictions or levies on hard-to-recycle packaging formats. This regulatory pressure acts as a significant impetus for manufacturers and brand owners to transition towards mono-material solutions that are demonstrably recyclable. Concurrently, consumers are becoming more discerning, actively seeking products with eco-friendly packaging and demonstrating a preference for brands that align with their environmental values. This consumer-led demand creates a powerful market pull, incentivizing companies to invest in and adopt sustainable packaging technologies.

Moreover, technological advancements in polymer science and processing techniques are playing a crucial role. Innovations in extrusion, co-extrusion, and coating technologies have enabled the creation of mono-material films with enhanced barrier properties, rivaling or even surpassing those of traditional multi-layer structures. This means that delicate products requiring protection from oxygen, moisture, or light can now be packaged in recyclable mono-material formats without compromising product integrity or shelf life. The economic benefits, stemming from streamlined production processes and potential reductions in material usage over time, also contribute to the driving force behind this shift. As the infrastructure for collecting and recycling mono-material streams improves, the overall cost-effectiveness and environmental advantage become increasingly pronounced, further fueling market adoption.

Despite its promising trajectory, the mono-material barrier packaging market faces several significant challenges and restraints. A primary hurdle is the current infrastructure for collection, sorting, and recycling. While mono-material PE and PP are theoretically recyclable, the widespread implementation of effective sorting and recycling streams specifically designed for these advanced barrier films is still in its nascent stages in many regions. Inconsistent sorting technologies and the presence of contamination can hinder the successful reprocessing of these materials, leading to lower-quality recycled content or, in some cases, landfilling. The capital investment required to upgrade existing recycling facilities to handle the complexities of some advanced mono-material barrier packaging can also be substantial, slowing down the pace of widespread adoption.

Furthermore, achieving the same level of barrier performance as some highly engineered multi-material laminates can still be a challenge for certain demanding applications using only mono-material solutions. This is particularly true for products with extremely sensitive contents or those requiring very long shelf lives under harsh conditions. The cost of developing and implementing new mono-material barrier technologies can also be higher in the initial phases compared to established multi-material options, which might deter some smaller manufacturers. Consumer education and awareness also play a role; while demand for sustainable packaging is growing, a lack of clear communication about the recyclability of specific mono-material packaging can lead to confusion and improper disposal, ultimately undermining the intended environmental benefits.

The global mono-material barrier packaging market is characterized by a dynamic interplay between regional adoption rates and the dominance of specific material types and applications.

Dominant Regions/Countries:

Dominant Segments:

The interplay of these regions and segments creates a complex yet predictable market landscape. The continued focus on improving recycling infrastructure in emerging economies, coupled with ongoing innovation in material science for PE and PP, will shape the dominance patterns in the coming years, solidifying the trend towards a more sustainable and circular packaging future.

The growth of the mono-material barrier packaging industry is primarily fueled by escalating environmental regulations and a proactive shift towards a circular economy. Brand owners are increasingly pressured by governments and consumers to adopt packaging that can be easily recycled, leading to significant investments in mono-material alternatives. Technological advancements in polymer science are enabling the creation of mono-material films with enhanced barrier properties, matching or exceeding those of traditional multi-layer structures, thus expanding their application scope. Furthermore, the growing consumer demand for sustainable products and the resulting preference for brands demonstrating environmental responsibility act as a powerful market pull, incentivizing innovation and adoption.

This comprehensive report provides an in-depth analysis of the global mono-material barrier packaging market, projecting its value to reach USD 75.5 billion by 2033. Covering the historical period from 2019 to 2024 and extending to a forecast period of 2025-2033, with 2025 as the base and estimated year, the study delves into the key trends, driving forces, and challenges shaping this dynamic sector. It meticulously examines the market by type (PE, PVC, PP, Others) and application (Food and Beverage, Medicine, Consumer Goods, Others), offering detailed insights into regional dominance, particularly in North America, Europe, and Asia Pacific. The report highlights the critical role of PE Packaging and the Food and Beverage segment in market growth, alongside the rising importance of PP Packaging.

Furthermore, the report identifies key growth catalysts, including regulatory pressures, technological advancements, and evolving consumer demand for sustainability. It provides a comprehensive list of leading players and a timeline of significant developments within the sector, offering a forward-looking perspective on innovation and investment. This report is an indispensable resource for stakeholders seeking to understand the market dynamics, identify growth opportunities, and navigate the evolving landscape of sustainable packaging solutions. It aims to equip businesses with the strategic intelligence needed to capitalize on the burgeoning demand for eco-friendly and high-performance mono-material barrier packaging.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.63% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.63%.

Key companies in the market include Amcor, Mondi Group, Sealed Air, Constantia Flexibles, Smurfit Kappa Group, Berry Global, Tetra Pak, Huhtamaki, Coveris, Novolex, DNP Group, AptarGroup, DS Smith, Mitsui Chemicals, Stora Enso, Polysack, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Mono-Material Barrier Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mono-Material Barrier Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.