1. What is the projected Compound Annual Growth Rate (CAGR) of the Chipboard Packaging?

The projected CAGR is approximately 8.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chipboard Packaging

Chipboard PackagingChipboard Packaging by Type (Flower Column, Closed, Combined, World Chipboard Packaging Production ), by Application (Electronic, Medical, Food, Cosmetic, World Chipboard Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

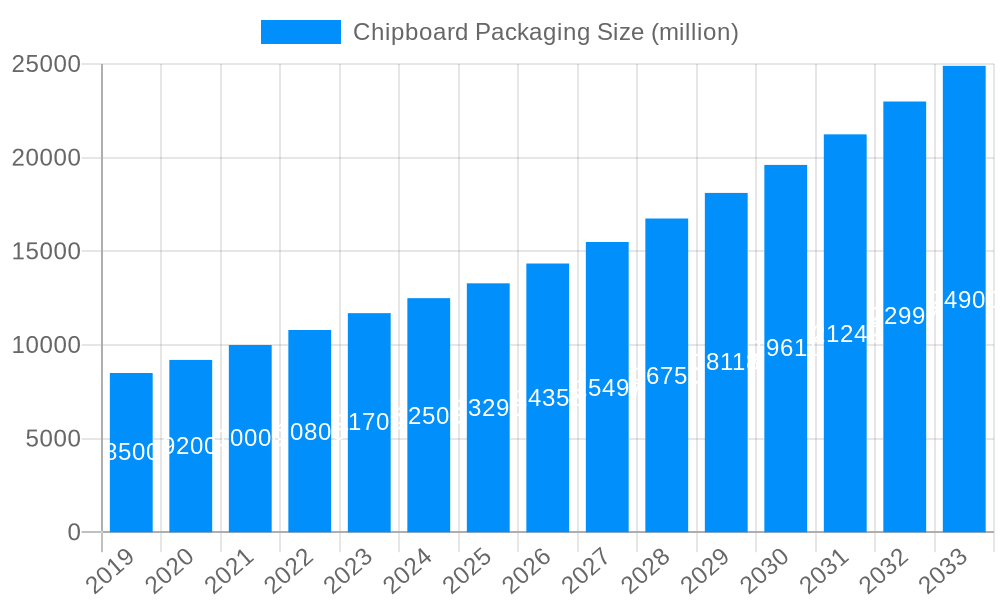

The global chipboard packaging market is poised for significant expansion, projected to reach an estimated USD 13.29 billion by 2025. This robust growth is underpinned by a Compound Annual Growth Rate (CAGR) of 8.8% from 2019 to 2033, indicating a sustained upward trajectory driven by several compelling factors. The increasing demand for sustainable and eco-friendly packaging solutions is a primary catalyst, as chipboard, being recyclable and biodegradable, aligns perfectly with growing environmental consciousness. Furthermore, the expanding e-commerce sector continues to fuel the need for sturdy and cost-effective packaging for a wide array of products, from electronics and cosmetics to food and pharmaceuticals. The versatility of chipboard in forming various packaging types, including flower columns, closed boxes, and combined formats, caters to diverse industry requirements, further solidifying its market position.

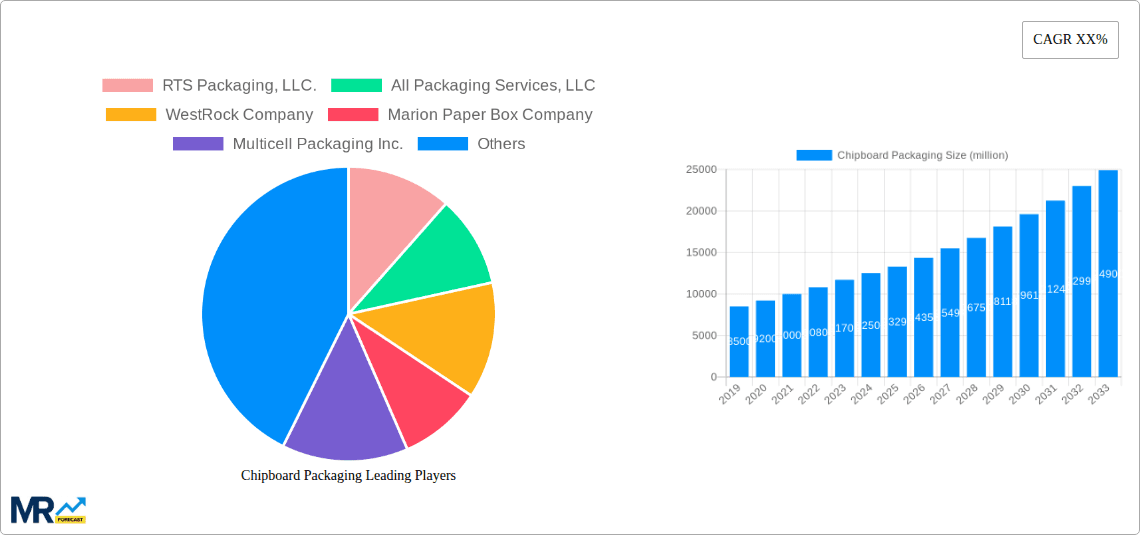

The market's dynamism is further amplified by emerging trends such as the adoption of innovative printing technologies for enhanced branding and customization, and the development of specialized chipboard grades for enhanced strength and moisture resistance. While these drivers propel growth, the market also navigates certain restraints. Fluctuations in raw material prices, particularly pulp and paper, can impact manufacturing costs and influence pricing strategies. Moreover, intense competition from alternative packaging materials like plastics and corrugated cardboard necessitates continuous innovation and cost optimization by chipboard packaging manufacturers. Key players like RTS Packaging, LLC., WestRock Company, and DS Smith are actively investing in research and development to address these challenges and capitalize on the burgeoning opportunities in segments such as electronic, medical, food, and cosmetic packaging across major regions like North America, Europe, and Asia Pacific.

This report offers an in-depth analysis of the global chipboard packaging market, providing crucial insights for stakeholders navigating this dynamic sector. Covering the historical period from 2019 to 2024, with a base year of 2025 and extending through a forecast period of 2025-2033, this study leverages extensive data and expert analysis to paint a clear picture of market trajectories. The report delves into the intricate nuances of chipboard packaging, encompassing production volumes, segment-wise performance, application-specific demands, and emerging industry developments. With a projected market size reaching billions of dollars in the coming years, understanding the underlying trends and influencing factors is paramount for strategic decision-making.

The global chipboard packaging market is experiencing a significant evolutionary phase, driven by a confluence of sustainability mandates, evolving consumer preferences, and technological advancements. XXX, a key insight into market dynamics, highlights the increasing demand for eco-friendly and recyclable packaging solutions, which directly benefits chipboard. As environmental consciousness permeates across industries and consumer bases, chipboard, derived from recycled paper fibers, is emerging as a preferred alternative to plastics and other less sustainable materials. This shift is not merely an ethical consideration but also an economic one, with regulatory pressures and corporate social responsibility initiatives pushing businesses towards greener packaging options. The market is witnessing a rise in innovative chipboard designs and constructions that enhance both their protective capabilities and aesthetic appeal. For instance, advancements in printing technologies and finishing techniques are allowing for high-quality graphics and branding on chipboard, making it suitable for premium product packaging. The increasing adoption of e-commerce has also spurred demand for robust and protective secondary packaging, where chipboard excels. Furthermore, the cost-effectiveness of chipboard, compared to many other packaging materials, remains a significant draw for businesses, especially in competitive markets. This affordability, coupled with its versatility, allows for its application across a wide spectrum of industries, from everyday consumer goods to specialized industrial products. The study period of 2019-2033, with a 2025 base year and forecast period of 2025-2033, indicates a sustained growth trajectory, with an estimated market value in the billions of dollars. This growth is underpinned by continuous innovation in material science and manufacturing processes, leading to improved strength, moisture resistance, and printability of chipboard. The trend towards customization and personalization in packaging further amplifies the role of chipboard, as it can be easily molded and printed to meet specific brand requirements. The integration of smart technologies, such as QR codes and NFC tags printed on chipboard, is also gaining traction, enabling enhanced product traceability and consumer engagement. The market is also seeing a rise in specialized chipboard grades designed for specific applications, such as food-grade packaging with enhanced barrier properties or high-strength chipboard for industrial shipping. The overall outlook for chipboard packaging is one of robust and sustained growth, propelled by its inherent environmental advantages, economic viability, and increasing adaptability to modern packaging demands.

The chipboard packaging market is being propelled by a powerful synergy of factors that are reshaping its landscape. Foremost among these is the escalating global emphasis on sustainability and environmental responsibility. Governments worldwide are implementing stricter regulations concerning single-use plastics and promoting the use of recyclable and biodegradable materials. Chipboard, being a product of recycled paper pulp, inherently aligns with these mandates, making it an attractive choice for businesses seeking to reduce their environmental footprint and comply with regulatory frameworks. This has led to a significant surge in demand from industries aiming to demonstrate their commitment to eco-friendly practices. Furthermore, the burgeoning e-commerce sector acts as a substantial growth catalyst. The convenience and widespread adoption of online shopping have amplified the need for durable, protective, and cost-effective packaging for the shipment of goods. Chipboard's inherent strength, crush resistance, and relatively low weight make it an ideal material for secondary packaging, safeguarding products during transit and ensuring they reach consumers in pristine condition. The economic viability of chipboard packaging also plays a crucial role in its widespread adoption. Compared to many alternative packaging materials, chipboard offers a more cost-effective solution without compromising on quality or functionality. This affordability is particularly appealing to small and medium-sized enterprises (SMEs) and businesses operating in price-sensitive markets, enabling them to optimize their packaging expenditures. Consumer preference for sustainable and aesthetically pleasing packaging is also a significant driver. As consumers become more environmentally conscious, they are increasingly opting for products packaged in materials that reflect these values. Chipboard, with its natural aesthetic and recyclability, resonates well with this demographic.

Despite its promising growth, the chipboard packaging market is not without its challenges and restraints. One of the primary concerns revolves around the material's inherent susceptibility to moisture and humidity. In environments with high moisture levels or during prolonged exposure to damp conditions, chipboard can lose its structural integrity, leading to potential product damage. This limitation necessitates the use of protective coatings or barrier layers, which can increase the overall cost of packaging and, in some cases, complicate the recycling process, thereby potentially impacting its eco-friendly appeal. The availability and consistent quality of recycled paper pulp, the primary raw material for chipboard, can also pose a challenge. Fluctuations in the supply chain of recovered paper, influenced by collection rates, contamination levels, and global demand for recycled materials, can lead to price volatility and potential shortages, impacting production costs and lead times for chipboard manufacturers. Furthermore, while chipboard is generally considered a sustainable material, its environmental impact is not entirely negligible. The pulping process, even with recycled materials, consumes energy and water, and the use of inks and adhesives in printing and assembly can introduce chemicals that require careful management to ensure environmental compliance. The presence of certain inks or laminates can also hinder the recyclability of chipboard, leading to its classification as contaminated waste in some recycling facilities. In highly competitive markets, especially for premium or luxury goods, chipboard may sometimes be perceived as less sophisticated or durable than alternative materials like rigid paperboard or plastics. This perception can limit its application in specific high-end segments where aesthetics and perceived value are paramount. The logistical complexities of transporting bulky chipboard materials and the associated carbon footprint also contribute to the overall environmental considerations and operational costs for manufacturers and end-users.

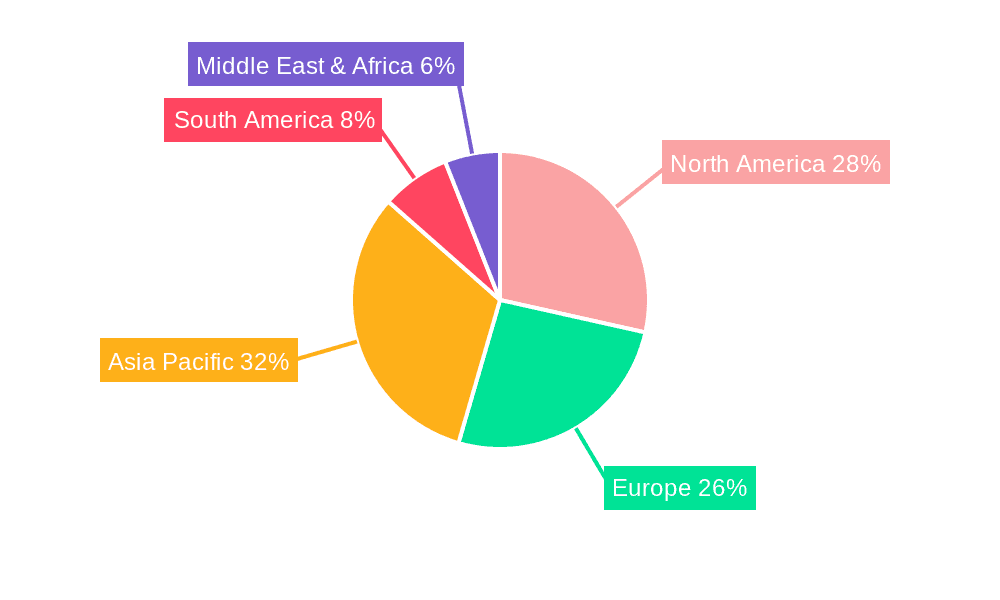

The global chipboard packaging market is poised for significant growth, with certain regions and segments expected to lead this expansion.

Dominating Segments:

Application: Electronic: The Electronic application segment is projected to be a significant dominator in the chipboard packaging market. This dominance is fueled by several key factors:

Type: Closed: The Closed type of chipboard packaging is also expected to play a pivotal role in market dominance. This category encompasses boxes and containers that are fully enclosed, offering complete protection and containment for the packaged items.

Key Region to Dominate the Market:

The confluence of these factors in North America, coupled with the growth in the Electronic application segment and the demand for Closed type packaging, positions the region as a key driver of the global chipboard packaging market. The estimated market size for chipboard packaging in this region, and globally, is expected to be in the billions of dollars throughout the study period, with particularly strong performance anticipated in the 2025-2033 forecast period.

The chipboard packaging industry is fueled by several key growth catalysts. The undeniable surge in global e-commerce is a primary driver, creating a perpetual demand for robust and cost-effective shipping solutions. Furthermore, an intensified focus on sustainability and environmental regulations worldwide is compelling businesses to opt for recyclable and biodegradable materials like chipboard. The affordability and versatility of chipboard also make it an attractive option across diverse industries, particularly for small and medium-sized enterprises. Continuous innovation in printing technologies and finishing techniques allows for enhanced aesthetic appeal, further broadening its application in consumer-facing products.

This comprehensive report provides a meticulous examination of the global chipboard packaging market, projecting a market value in the billions of dollars. It offers an exhaustive analysis of historical data from 2019-2024 and forecasts future trends from 2025-2033, with 2025 serving as the base and estimated year. The report delves deep into market dynamics, exploring drivers such as the burgeoning e-commerce sector and stringent environmental regulations that favor sustainable materials like chipboard. It also addresses the challenges, including susceptibility to moisture and raw material price volatility. Furthermore, the study identifies key regions and segments poised for dominance, with a particular focus on the Electronic application and Closed type packaging. Leading players and significant industry developments are also thoroughly covered, offering stakeholders a holistic understanding of the market's present landscape and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.8%.

Key companies in the market include RTS Packaging, LLC., All Packaging Services, LLC, WestRock Company, Marion Paper Box Company, Multicell Packaging Inc., PakFactory, REID PACKAGING, Canpaco Inc., Imperial Printing & Paper Box Mfg. Co., DS Smith, Ameripak Company, Riverside Paper Co. Inc., Romiley Board Mill, Carton Service, P.J Packaging Inc., Peek Packaging, Mankato Packaging, Mayr-Melnhof Karton AG, Graphic Packaging International, LLC.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Chipboard Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chipboard Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.