1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical IBC Container?

The projected CAGR is approximately 5.32%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pharmaceutical IBC Container

Pharmaceutical IBC ContainerPharmaceutical IBC Container by Type (Powders, Bulk Solid, World Pharmaceutical IBC Container Production ), by Application (Pharmaceutical, Food, Chemical Industries, Others, World Pharmaceutical IBC Container Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

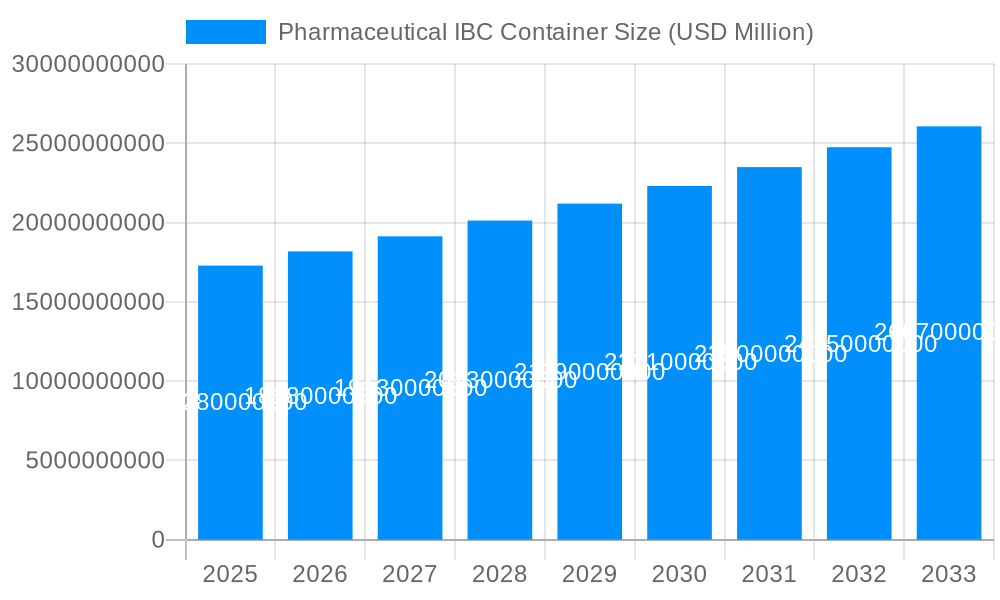

The global Pharmaceutical Intermediate Bulk Container (IBC) market is poised for significant growth, driven by the increasing demand for efficient and safe material handling solutions within the pharmaceutical, food, and chemical industries. Valued at approximately $17.28 billion, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.32% from 2025 through 2033. This robust growth trajectory is fueled by several key factors, including the escalating production of pharmaceuticals globally, the growing emphasis on stringent quality control and containment measures, and the adoption of advanced material handling technologies. Pharmaceutical companies are increasingly investing in IBCs for their superior durability, reusability, and ability to maintain product integrity during storage and transit, thereby reducing contamination risks and operational costs. The "Powders" and "Bulk Solid" segments are expected to dominate the market due to their widespread use in pharmaceutical manufacturing processes.

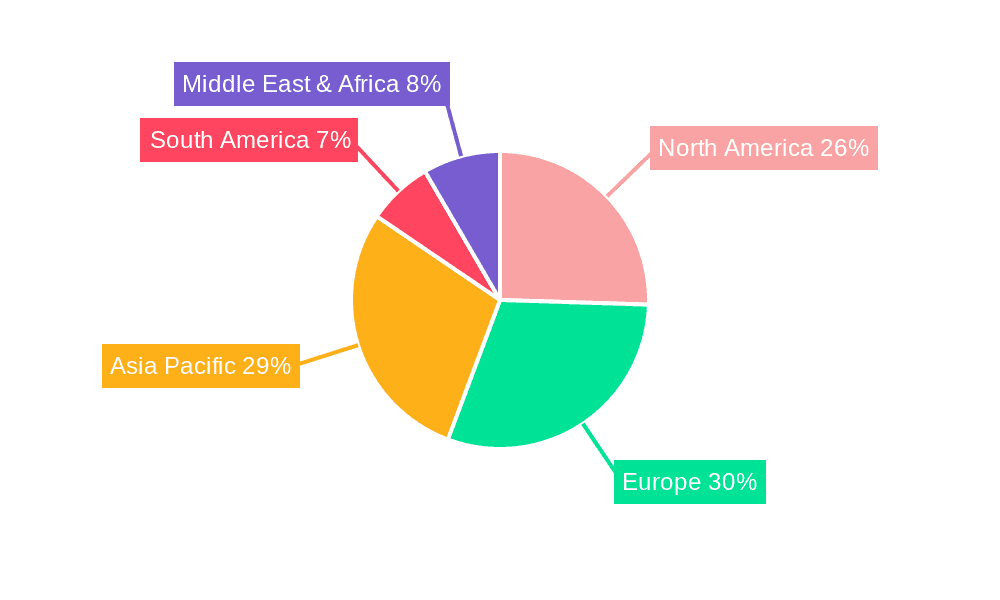

The market dynamics are further shaped by evolving regulatory landscapes that prioritize product safety and traceability. Regions like North America and Europe are leading the adoption of advanced IBC solutions, supported by established pharmaceutical manufacturing hubs and stringent regulatory frameworks. Asia Pacific, particularly China and India, presents a substantial growth opportunity, driven by a rapidly expanding pharmaceutical industry and increasing investments in modern infrastructure. While the market demonstrates strong positive momentum, potential restraints include the initial capital investment required for high-quality IBCs and the availability of alternative, albeit less efficient, material handling methods. However, the long-term cost savings and enhanced operational efficiency offered by Pharmaceutical IBCs are expected to outweigh these initial considerations, solidifying their importance in the supply chain. Leading companies such as THIELMANN, Uhlmann Pac-Systeme, and GEA are continuously innovating, offering specialized IBC solutions that cater to the unique needs of the pharmaceutical sector, further propelling market expansion.

Here's a unique report description for Pharmaceutical IBC Containers, incorporating your specified elements:

The global pharmaceutical Intermediate Bulk Container (IBC) market is poised for substantial expansion, projected to reach a valuation exceeding $3.5 billion by 2025, with robust growth anticipated through 2033. This growth trajectory is fueled by the increasing sophistication of pharmaceutical manufacturing processes, a heightened emphasis on supply chain integrity, and stringent regulatory requirements. The historical period from 2019 to 2024 has laid a strong foundation, characterized by rising demand for sterile and contamination-free handling solutions. The base year of 2025 marks a pivotal point, with significant investments expected in advanced IBC designs and materials. The forecast period, 2025-2033, will witness a CAGR of approximately 6.2%, underscoring the sustained demand for these critical containment units. Key market insights reveal a growing preference for stainless steel IBCs due to their durability, chemical inertness, and ease of cleaning, making them ideal for sensitive pharmaceutical ingredients. Furthermore, the market is seeing an increasing integration of smart technologies, such as RFID tags and sensor systems, to enhance traceability and real-time monitoring of contents, further bolstering pharmaceutical supply chain security. The demand for IBCs specifically designed for powders and bulk solids, crucial for API (Active Pharmaceutical Ingredient) handling, is particularly strong. The broader applications within the chemical and food industries also contribute significantly to the overall market volume, though the pharmaceutical sector remains the dominant driver due to its high value and stringent requirements. Emerging economies, with their rapidly expanding pharmaceutical manufacturing capabilities, are also emerging as significant consumption hubs, presenting new avenues for market penetration. The evolving landscape of drug development, including the rise of biologics and personalized medicine, necessitates specialized IBC solutions that can maintain precise temperature control and sterility, further pushing innovation in this sector. The economic influence of these factors, when aggregated, points towards a market that is not only growing in volume but also in the sophistication and value of the solutions it offers.

Several powerful forces are propelling the pharmaceutical IBC container market forward, ensuring its continued expansion and innovation. Foremost among these is the relentless drive for enhanced product quality and safety within the pharmaceutical industry. As regulatory bodies worldwide impose increasingly stringent standards on manufacturing, handling, and transportation of pharmaceutical ingredients and finished products, the demand for secure, hygienic, and contamination-free containment solutions like IBCs intensifies. These containers are instrumental in preventing cross-contamination, ensuring product integrity, and facilitating efficient material flow throughout the complex pharmaceutical supply chain. Secondly, the burgeoning global pharmaceutical market, driven by an aging population, rising healthcare expenditure, and the continuous development of new therapies, directly translates into a higher volume of raw materials and intermediate products that require robust containment. This escalating demand for pharmaceuticals creates a proportional need for the infrastructure to support their production and distribution, with IBCs playing a central role. The increasing focus on supply chain efficiency and cost optimization also plays a significant role. IBCs offer a reusable and cost-effective solution for bulk material handling compared to smaller packaging, reducing waste and logistical complexities. Their design facilitates easier filling, emptying, and transportation, contributing to streamlined operations and reduced operational costs for pharmaceutical manufacturers. The growing emphasis on sustainability and environmental responsibility further bolsters the adoption of reusable IBCs, aligning with industry-wide initiatives to minimize waste and reduce the carbon footprint of manufacturing processes.

Despite the promising growth outlook, the pharmaceutical IBC container market faces certain challenges and restraints that could temper its expansion. A primary concern is the high initial capital investment required for purchasing and maintaining high-quality, pharmaceutical-grade IBCs, particularly those made from specialized materials like stainless steel and equipped with advanced features. This can be a significant barrier for smaller manufacturers or those operating in regions with limited access to capital. Furthermore, stringent and evolving regulatory compliance adds another layer of complexity. Manufacturers must ensure their IBCs meet a wide array of international and regional standards for hygiene, material compatibility, and traceability. Any deviation can lead to product recalls or market access issues, necessitating continuous investment in quality control and certification. The risk of contamination and the need for rigorous cleaning and sterilization protocols represent an ongoing challenge. Improper handling or inadequate cleaning can compromise product integrity, leading to severe consequences for patient safety and brand reputation. This necessitates significant investment in cleaning infrastructure and training, adding to the overall operational cost. The interoperability and standardization of IBCs across different manufacturers and supply chain partners can also be an issue, leading to logistical inefficiencies if systems are not compatible. Finally, the availability of alternative containment solutions, such as drums, bags, and specialized tanks, although often less suited for the specific demands of pharmaceutical handling, can present a competitive challenge, especially for less sensitive applications or in price-sensitive markets.

The North America region is projected to be a dominant force in the global Pharmaceutical IBC Container market, with its significant market share expected to continue through the forecast period. This dominance is underpinned by several key factors that are highly relevant to the specified segments.

Segment: Powders & Bulk Solids: North America is a leading hub for pharmaceutical research, development, and manufacturing, particularly for Active Pharmaceutical Ingredients (APIs) and complex drug formulations, which are predominantly handled as powders and bulk solids. The region's robust pharmaceutical industry, characterized by a high concentration of major pharmaceutical companies and contract manufacturing organizations (CMOs), drives substantial demand for IBCs designed to safely and hygienically store and transport these materials. The stringent regulatory environment, overseen by agencies like the FDA, mandates the highest standards for containment and product integrity, making advanced IBC solutions a necessity. This demand translates into significant market penetration for high-quality stainless steel IBCs and specialized designs that prevent powder agglomeration and ensure dust containment.

Application: Pharmaceutical Industries: The sheer scale and sophistication of the pharmaceutical industry in North America, encompassing both innovative drug development and large-scale generics manufacturing, makes it a primary consumer of pharmaceutical IBCs. The region’s advanced healthcare infrastructure and continuous introduction of new therapies fuel the need for reliable and sterile containment solutions throughout the drug lifecycle. The emphasis on Good Manufacturing Practices (GMP) and supply chain security further elevates the importance of IBCs in ensuring product quality and patient safety. This segment alone accounts for a substantial portion of the overall market, with a particular focus on IBCs that offer features like leak-proof seals, inert materials, and easy-to-clean designs.

World Pharmaceutical IBC Container Production: North America is not only a significant consumer but also a major producer of pharmaceutical IBCs. Several leading global manufacturers have a strong presence in the region, investing in advanced manufacturing capabilities and innovative product development. This local production capacity, coupled with a focus on technological advancements, allows for quicker response times to market demands and a competitive edge in offering customized solutions. The region's commitment to R&D in material science and engineering contributes to the development of more durable, lightweight, and intelligent IBCs, further solidifying its leadership in production and market influence. The synergy between high demand and robust local production capacity ensures that North America will continue to be a pivotal region for the pharmaceutical IBC container market.

The pharmaceutical IBC container industry is experiencing significant growth catalysts. The increasing demand for sterile and contamination-free handling of APIs and sensitive pharmaceutical ingredients is a primary driver. Stringent regulatory compliances globally are pushing manufacturers towards safer and more traceable containment solutions. Furthermore, the expanding global pharmaceutical market, fueled by an aging population and rising healthcare expenditure, directly translates to a higher volume of raw materials requiring efficient and secure handling. The adoption of reusable IBCs also aligns with growing sustainability initiatives, offering cost-effectiveness and waste reduction benefits for pharmaceutical companies.

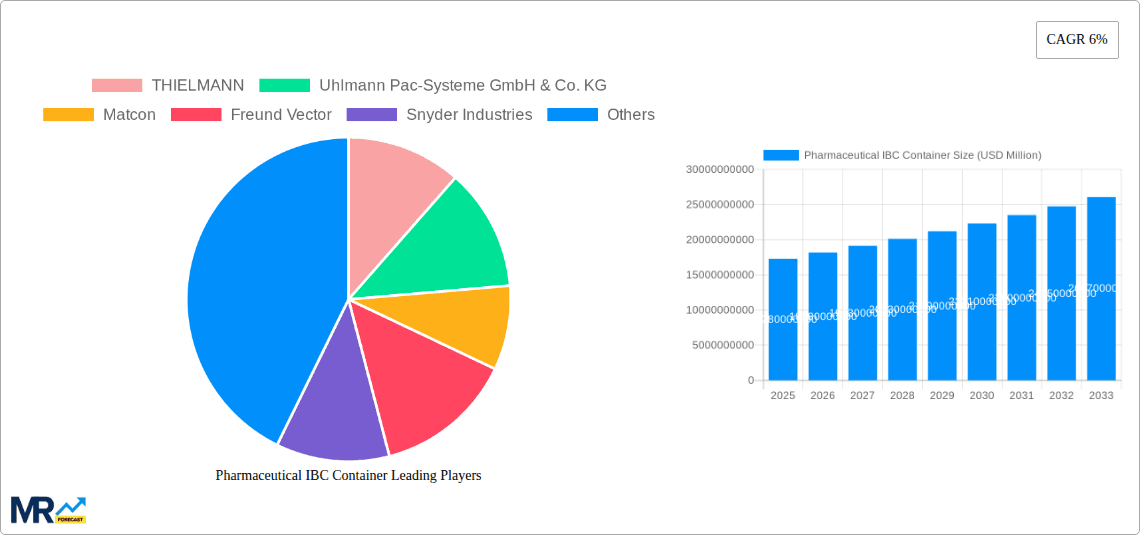

This comprehensive report delves deep into the global Pharmaceutical IBC Container market, meticulously analyzing trends, drivers, challenges, and opportunities. Spanning the historical period of 2019-2024, with a base and estimated year of 2025, the report provides an in-depth forecast from 2025-2033. It examines the market segmentation by Type (Powders, Bulk Solid) and Application (Pharmaceutical, Food, Chemical Industries, Others), and analyzes World Pharmaceutical IBC Container Production and Industry Developments. The report also identifies the key regions poised for dominance, such as North America, and details the growth catalysts and restraints impacting the industry. With an exhaustive list of leading players, including THIELMANN, Uhlmann Pac-Systeme GmbH & Co. KG, Matcon, and others, and a timeline of significant developments, this report offers invaluable insights for stakeholders seeking to navigate and capitalize on the evolving pharmaceutical IBC container landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.32% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.32%.

Key companies in the market include THIELMANN, Uhlmann Pac-Systeme GmbH & Co. KG, Matcon, Freund Vector, Snyder Industries, Tien Tuan Pharmaceutical Machinery Co. Ltd, Cremer, Hoover Ferguson Group, SERVOLiFT LLC, Palamatic Process, Finncont, Hanningfield, Brookeson Material Handling Ltd., Titan IBC, SCHÄFER Container Systems, GEA.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Pharmaceutical IBC Container," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmaceutical IBC Container, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.