1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Aluminum Foil Packaging?

The projected CAGR is approximately 4.39%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pharmaceutical Aluminum Foil Packaging

Pharmaceutical Aluminum Foil PackagingPharmaceutical Aluminum Foil Packaging by Type (Strip Foil Packaging, Blister Packaging, Cold form packaging, World Pharmaceutical Aluminum Foil Packaging Production ), by Application (Large Pharmaceutical Companies, Small and Medium Pharmaceutical Factory, World Pharmaceutical Aluminum Foil Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

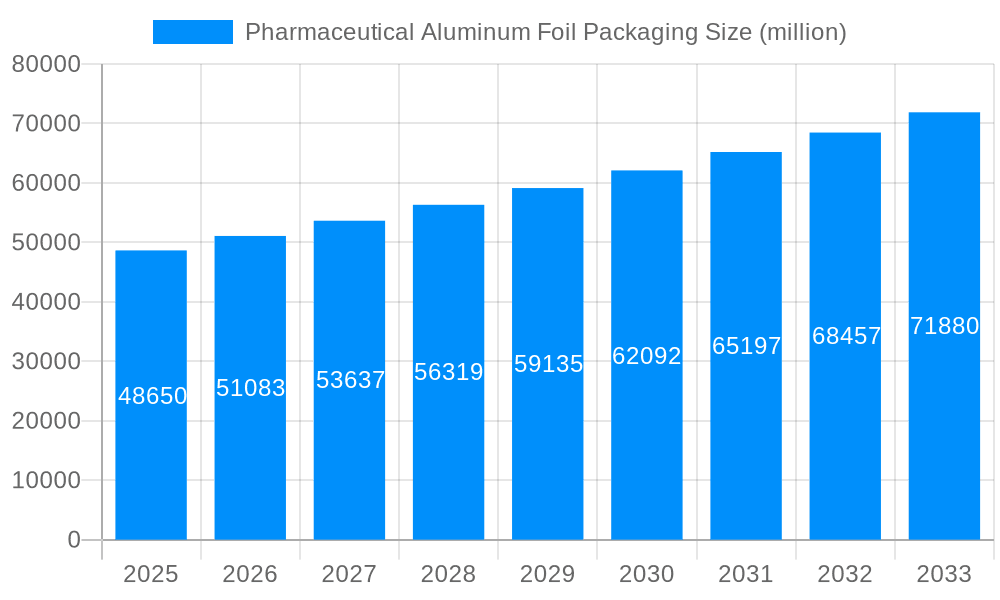

The global pharmaceutical aluminum foil packaging market is projected to reach an estimated $15.49 billion by 2025, driven by a CAGR of 4.39% through 2033. This growth highlights aluminum foil's essential role in preserving pharmaceutical product integrity, stability, and efficacy. Key demand factors include escalating global healthcare expenditure, rising chronic disease prevalence, and an increased focus on patient safety, all necessitating high-quality, reliable packaging. Aluminum foil's superior barrier properties against moisture, light, and oxygen make it ideal for diverse formats like strip foil, blister packs, and cold form packaging. Stringent pharmaceutical regulations mandating advanced packaging to prevent contamination and ensure product shelf-life further bolster market expansion.

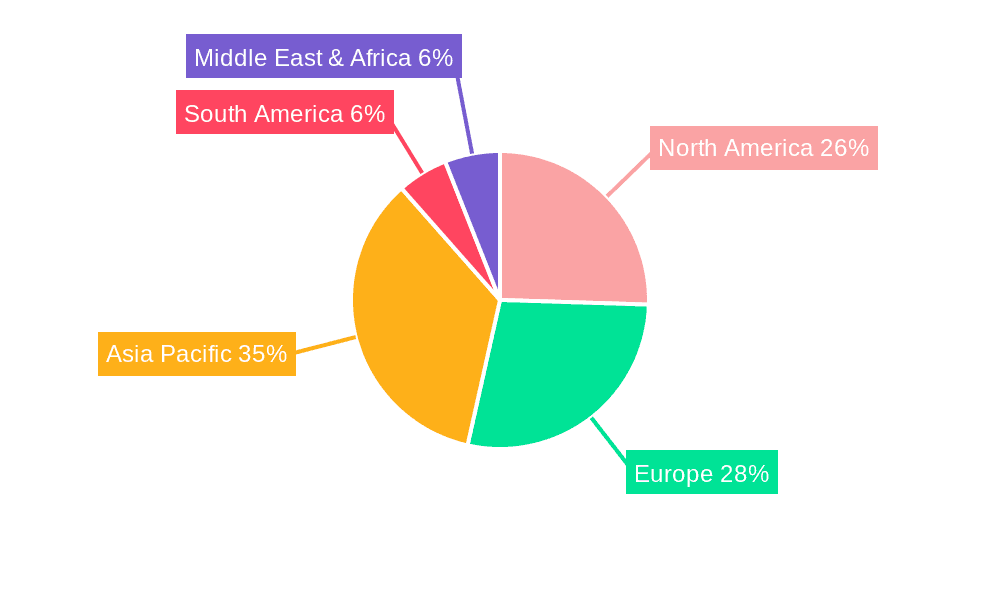

Technological advancements in foil manufacturing, yielding thinner, stronger, and more sustainable options, alongside expanding pharmaceutical production in emerging economies, are significant growth catalysts. The rise of personalized medicine and complex biologics also presents opportunities for specialized aluminum foil packaging solutions. While raw material price volatility and the demand for eco-friendly alternatives pose challenges, manufacturers are innovating. The superior protective qualities and cost-effectiveness of aluminum foil are expected to maintain its market leadership. Market segmentation indicates strong demand from both large pharmaceutical corporations and small to medium-sized manufacturers, signifying broad industry adoption. Geographically, the Asia Pacific region, led by China and India, is emerging as a key production and consumption hub, complementing established North American and European markets.

This report offers a comprehensive analysis of the dynamic global pharmaceutical aluminum foil packaging market, crucial for ensuring the safety, efficacy, and shelf-life of medicinal products. Covering the study period from 2019 to 2033, with 2025 as the base year and forecast period from 2025 to 2033, the analysis provides in-depth insights into market trends, drivers, challenges, and the competitive landscape. The historical period (2019-2024) provides foundational context for future projections. Market sizes will be quantified to offer a clear perspective on production volumes and consumption patterns across segments and applications.

The pharmaceutical aluminum foil packaging market is witnessing a steady and robust expansion, driven by an escalating global demand for healthcare products and an increasing emphasis on stringent quality and safety standards within the pharmaceutical industry. The World Pharmaceutical Aluminum Foil Packaging Production has seen consistent growth, with estimates suggesting significant volumes in the million units range. A key trend is the continuous innovation in foil properties, focusing on enhanced barrier capabilities against moisture, light, and oxygen. This is crucial for preserving the integrity of sensitive drugs, particularly biologics and advanced formulations. The market is also observing a discernible shift towards more sophisticated packaging solutions that offer improved user convenience and tamper-evidence features. This includes advancements in specialized coatings and lamination techniques to meet the unique requirements of diverse drug formulations, from tablets and capsules to injectables.

Furthermore, the growing prevalence of chronic diseases globally and the subsequent rise in the production of essential medications are directly fueling the demand for reliable and cost-effective packaging. The Application: Large Pharmaceutical Companies continues to be the dominant consumer segment, owing to their high production volumes and stringent regulatory compliance needs. However, the report also identifies a growing contribution from Small and Medium Pharmaceutical Factories, who are increasingly investing in advanced packaging to enhance their product's market appeal and compliance. The adoption of Blister Packaging remains a cornerstone of the market, offering individual dose protection and ease of dispensing. Simultaneously, Cold Form Packaging, known for its superior barrier properties and suitability for highly sensitive drugs, is experiencing accelerated adoption, particularly for high-value pharmaceuticals. This upward trajectory in World Pharmaceutical Aluminum Foil Packaging Production is expected to continue, with specific growth rates to be detailed within the report, highlighting the market's resilience and adaptability to evolving pharmaceutical needs. The focus on sustainability is also indirectly influencing trends, with manufacturers exploring lighter-gauge foils and more recyclable components, though the paramount importance of product protection remains the primary driver. The intricate interplay between regulatory demands, technological advancements, and market needs is shaping a dynamic and promising future for pharmaceutical aluminum foil packaging.

The global pharmaceutical aluminum foil packaging market is propelled by a confluence of powerful forces, primarily rooted in the ever-increasing demand for safe and effective medicines worldwide. The growing global population and the rising incidence of chronic diseases are directly translating into higher production volumes for pharmaceutical companies, thereby escalating the need for robust packaging solutions. The stringent regulatory landscape governing pharmaceutical products plays a pivotal role, mandating the use of packaging materials that ensure product integrity, prevent contamination, and extend shelf life. Aluminum foil, with its unparalleled barrier properties against moisture, light, and oxygen, perfectly aligns with these regulatory demands. Furthermore, technological advancements in manufacturing processes have led to the development of thinner, yet stronger, aluminum foils, improving cost-effectiveness and reducing material usage.

The increasing emphasis on patient safety and adherence is another significant driver. Packaging that protects against counterfeiting and ensures tamper-evidence builds consumer trust and facilitates medication adherence. Innovations in blister packaging and cold form packaging offer individual dose protection, enhancing patient convenience and compliance, particularly for complex treatment regimens. The growth of the biologics and biosimilars market, which often requires highly specialized and protective packaging, is also a major impetus for the demand for advanced aluminum foil solutions. As pharmaceutical companies expand their global reach, the need for packaging that can withstand diverse climatic conditions and distribution challenges further solidifies the position of aluminum foil. The increasing investment in research and development by pharmaceutical manufacturers to bring novel drugs to market also translates into a sustained demand for innovative and reliable packaging.

Despite its robust growth trajectory, the pharmaceutical aluminum foil packaging market faces several challenges and restraints that could impede its full potential. One of the primary concerns is the escalating cost of raw materials, particularly aluminum. Fluctuations in global aluminum prices, influenced by geopolitical factors, energy costs, and supply-demand dynamics, can directly impact the profitability of packaging manufacturers and, consequently, the cost for pharmaceutical companies. Environmental concerns and increasing regulatory pressure regarding the recyclability and sustainability of packaging materials present another significant challenge. While aluminum is highly recyclable, the overall complexity of multi-layered pharmaceutical packaging, often incorporating plastics and adhesives, can hinder efficient recycling processes and lead to a perception of environmental inefficiency.

The highly regulated nature of the pharmaceutical industry, while a driver, can also be a restraint. The rigorous and lengthy approval processes for new packaging materials and designs can slow down the adoption of innovative solutions, requiring significant investment in time and resources from manufacturers. Furthermore, the market is characterized by intense competition, leading to price pressures and a need for continuous optimization of production processes to maintain margins. The threat of alternative packaging materials, such as advanced polymers and high-barrier plastics, although not yet matching aluminum's complete barrier properties for all applications, represents a potential long-term challenge. Supply chain disruptions, which have become more prevalent in recent years, can also impact the availability and timely delivery of aluminum foil, affecting production schedules for pharmaceutical companies. Lastly, the technical complexities associated with ensuring the consistent quality and integrity of aluminum foil packaging, especially for highly sensitive drugs, demand continuous investment in quality control and advanced manufacturing technologies.

The global pharmaceutical aluminum foil packaging market is characterized by significant regional variations and segment dominance, driven by factors such as pharmaceutical manufacturing capabilities, regulatory environments, healthcare expenditure, and population demographics.

Key Regions and Countries:

Asia Pacific: This region is poised to be a dominant force in the pharmaceutical aluminum foil packaging market.

North America (United States & Canada): This region will continue to be a significant market due to its advanced pharmaceutical industry and high healthcare spending.

Europe: A mature market with a strong emphasis on quality, innovation, and sustainability.

Dominant Segments:

Type: Blister Packaging: This remains the most dominant segment within pharmaceutical aluminum foil packaging.

Application: Large Pharmaceutical Companies: These entities are the primary consumers of pharmaceutical aluminum foil packaging.

The interplay of these regions and segments paints a picture of a market driven by high-volume production in Asia Pacific, high-value innovation in North America and Europe, and the pervasive dominance of blister packaging for widespread pharmaceutical applications, particularly by large pharmaceutical enterprises.

The pharmaceutical aluminum foil packaging industry's growth is significantly catalyzed by the accelerating global demand for healthcare and pharmaceuticals, driven by an aging population and the increasing prevalence of chronic diseases. Advances in drug formulation, particularly the development of sensitive biologics and advanced therapies, necessitate superior barrier properties offered by aluminum foil. Stringent regulatory requirements worldwide mandating product integrity and patient safety further solidify the role of aluminum foil packaging. Moreover, continuous technological innovations in foil manufacturing and lamination are enhancing barrier performance, reducing material usage, and improving cost-effectiveness, making it an attractive option for pharmaceutical companies aiming for both quality and efficiency. The expanding pharmaceutical manufacturing base in emerging economies also presents a substantial growth avenue.

This comprehensive report offers an in-depth analysis of the global pharmaceutical aluminum foil packaging market, providing critical insights for stakeholders. It meticulously examines market dynamics across the Study Period: 2019-2033, with a detailed focus on the Base Year: 2025 and Forecast Period: 2025-2033, building upon the Historical Period: 2019-2024. The report quantifies the World Pharmaceutical Aluminum Foil Packaging Production in million units, offering a precise understanding of market volumes. It explores key market trends, including the growing demand for enhanced barrier properties, innovations in blister and cold form packaging, and the impact of regulatory compliance. The report identifies the primary driving forces, such as increasing pharmaceutical production and global healthcare needs, as well as the challenges and restraints, including raw material costs and sustainability concerns. Furthermore, it highlights dominant regions and segments, such as the Asia Pacific region and the blister packaging segment, providing a detailed regional and segment-wise analysis of market share and growth potential. The report also identifies key growth catalysts and presents a comprehensive list of leading market players.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.39% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.39%.

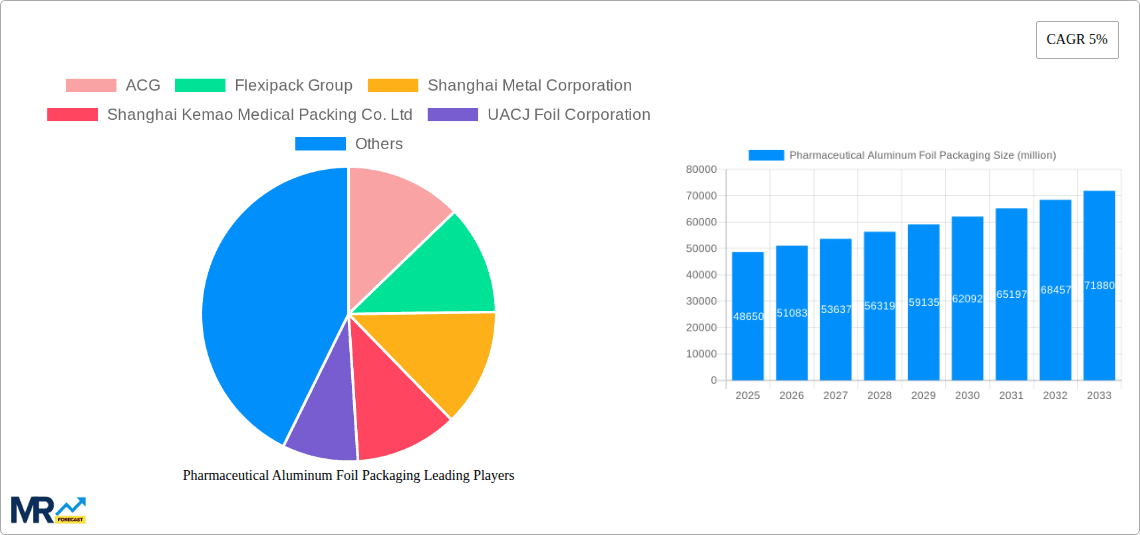

Key companies in the market include ACG, Flexipack Group, Shanghai Metal Corporation, Shanghai Kemao Medical Packing Co. Ltd, UACJ Foil Corporation, Karl, HTMM Group, Zibo Horzion Foil, Flexifoil Packaging Pvt. Ltd., NGPL, HAOMEI Aluminum Foil, Inc., All Foils, Inc., Inicious Solutions Pvt. Ltd., HWPFP, Symetal, FUKUDA METAL FOIL & POWDER CO., LTD., Changzhou Huajian Pharm Pack Material Stock Co.,Ltd, Shriram Veritech Solutions Pvt. Ltd., Cartonal Italia, MILK Packaging Factory, Amcor, Constantia Flexibles, .

The market segments include Type, Application.

The market size is estimated to be USD 15.49 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Pharmaceutical Aluminum Foil Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmaceutical Aluminum Foil Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.