1. What is the projected Compound Annual Growth Rate (CAGR) of the Single-Use Assemblies?

The projected CAGR is approximately 23.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Single-Use Assemblies

Single-Use AssembliesSingle-Use Assemblies by Type (Bag Components, Bottle Components), by Application (Medical Packaging, Food Packaging, Biological Equipment Packaging, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

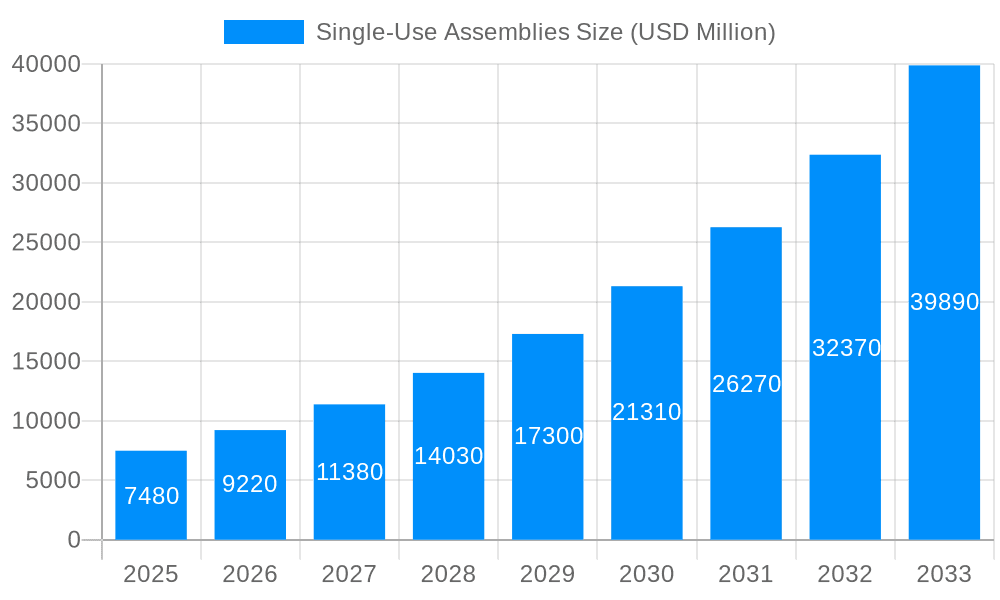

The global Single-Use Assemblies market is experiencing remarkable expansion, projected to reach a substantial USD 7.48 billion in the base year of 2025. This impressive growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 23.3% anticipated throughout the forecast period of 2025-2033. This rapid escalation signifies a significant shift in the biopharmaceutical and healthcare industries, driven by an increasing adoption of disposable technologies. The primary catalyst for this surge is the inherent flexibility and reduced risk of cross-contamination offered by single-use systems, particularly vital in sterile manufacturing environments for biologics, pharmaceuticals, and advanced medical devices. Furthermore, the growing emphasis on expedited drug development and production cycles, coupled with stringent regulatory demands for product purity and patient safety, are propelling the demand for these sterile, pre-assembled solutions. The inherent cost-effectiveness in terms of reduced cleaning validation, capital expenditure, and faster batch turnaround times also contributes significantly to its widespread acceptance across various applications.

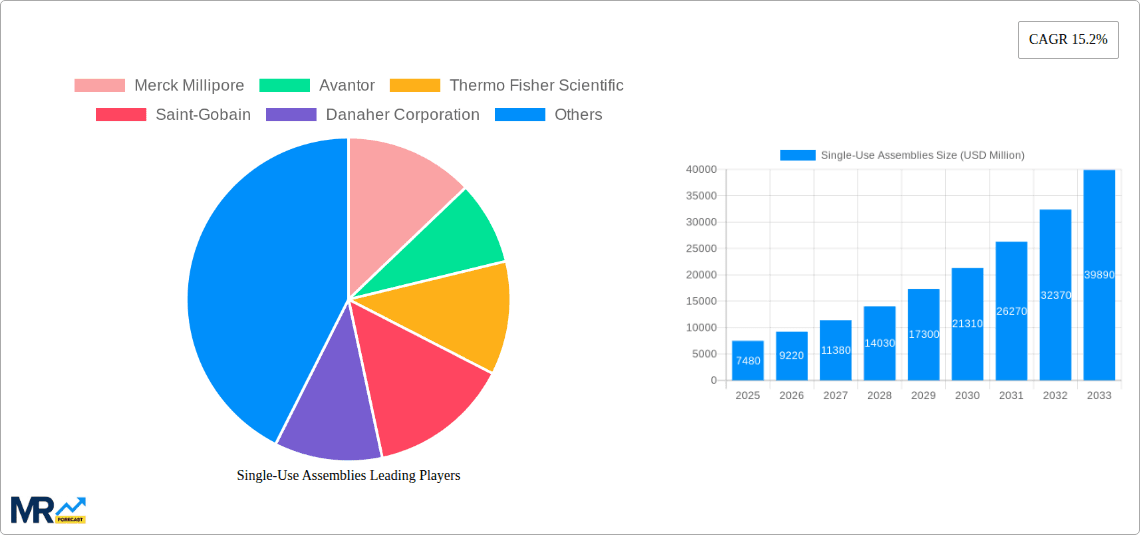

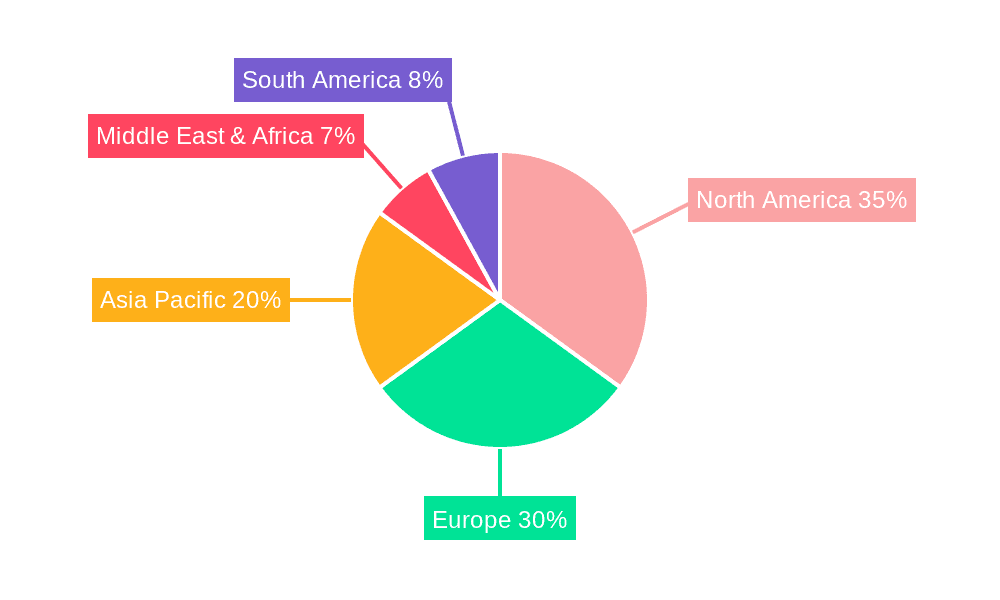

The market's dynamism is further shaped by key trends and evolving segments. The Bag Components and Bottle Components segments are poised for substantial growth, reflecting the increasing complexity and scale of biopharmaceutical manufacturing. In terms of applications, Medical Packaging, Food Packaging, and Biological Equipment Packaging are emerging as dominant forces, driven by the need for sterile and contamination-free solutions. While the market exhibits strong upward momentum, certain restraints, such as the potential for leachables and extractables in certain materials and the disposal challenges associated with plastic waste, are areas of ongoing research and development. However, continuous innovation in material science and sustainable disposal methods are actively mitigating these concerns. Leading companies like Merck Millipore, Avantor, Thermo Fisher Scientific, and Sartorius Stedim Biotech are at the forefront of this market, investing heavily in research and development to offer advanced, integrated single-use solutions that cater to the evolving needs of the bioprocessing and healthcare sectors. Geographically, North America and Europe are anticipated to maintain significant market shares due to established biopharmaceutical hubs and stringent quality standards, while the Asia Pacific region is expected to witness the fastest growth due to increasing healthcare investments and a burgeoning biopharmaceutical industry.

Here's a unique report description for Single-Use Assemblies, incorporating your specified elements:

The global Single-Use Assemblies market is poised for unprecedented expansion, projecting a valuation that will surge past the $35 billion mark by 2033, a remarkable leap from its estimated $16 billion in 2025. This trajectory, meticulously analyzed from the historical period of 2019-2024, highlights a market that has consistently outpaced expectations. The base year of 2025 serves as a critical inflection point, with the forecast period of 2025-2033 expecting an aggressive compound annual growth rate (CAGR). This sustained growth is fundamentally driven by the escalating demand for biopharmaceuticals and a growing emphasis on disposable technologies within the pharmaceutical and biotechnology sectors. The inherent advantages of single-use assemblies – namely, reduced cross-contamination risks, faster product changeovers, enhanced flexibility, and a lower initial capital expenditure compared to traditional stainless steel systems – are becoming increasingly indispensable for drug manufacturers.

The market's evolution is characterized by a relentless push towards innovation, with manufacturers continuously developing novel materials, advanced designs, and integrated solutions to meet the intricate needs of bioprocessing. This includes the development of more robust and versatile bag components, sophisticated bottle assemblies for various laboratory and storage applications, and specialized packaging solutions for sensitive biological materials. The shift towards single-use technology is not merely a trend; it represents a paradigm shift in how biopharmaceutical production is conceived and executed, enabling more agile and cost-effective development and manufacturing processes. The market's dynamism is further fueled by increased investments in research and development, alongside strategic collaborations and acquisitions aimed at consolidating market share and expanding product portfolios. The sheer volume of new biologic drugs entering the pipeline, coupled with the increasing complexity of their manufacturing processes, further solidifies the indispensable role of single-use assemblies in the modern biopharmaceutical landscape. The projected market size underscores the profound impact of these technologies on global healthcare and scientific advancement.

The surge in the single-use assemblies market is primarily propelled by the exponential growth within the biopharmaceutical industry. The rising prevalence of chronic diseases and an aging global population are driving a substantial increase in the demand for biologics, vaccines, and advanced therapies. This heightened demand directly translates into a greater need for flexible, scalable, and contamination-free manufacturing solutions, a niche perfectly filled by single-use assemblies. Furthermore, stringent regulatory requirements aimed at ensuring product safety and efficacy are increasingly favoring disposable systems due to their inherent ability to minimize the risk of cross-contamination. The initial high capital investment and extensive cleaning validation protocols associated with traditional stainless-steel bioreactors and downstream processing equipment are significant deterrents for many companies, particularly smaller biotech firms and those in the early stages of drug development. Single-use assemblies offer a compelling alternative, significantly reducing upfront costs and accelerating time-to-market, thereby empowering innovation and bringing life-saving therapies to patients faster. The focus on rapid scale-up and decentralized manufacturing models, especially amplified by global health events, also underscores the agility and accessibility that single-use solutions provide.

Despite its robust growth, the single-use assemblies market faces several significant challenges and restraints that could temper its expansion. One of the primary concerns revolves around the environmental impact associated with the disposal of large volumes of plastic components. While efforts are underway to develop more sustainable materials and improve recycling infrastructure, the current waste generation poses a considerable environmental challenge, attracting scrutiny from regulatory bodies and increasing pressure from environmentally conscious stakeholders. Furthermore, the leachables and extractables (L&E) from polymeric materials used in single-use assemblies can potentially contaminate the final drug product, leading to safety concerns and requiring rigorous testing and validation. This necessitates ongoing research and development into advanced materials with minimal L&E profiles. Supply chain disruptions, as evidenced by recent global events, can also pose a significant risk, impacting the availability and cost of raw materials and finished single-use components. The complex regulatory landscape, with varying standards and approval processes across different regions, can also create hurdles for market entry and global scalability. Finally, while the initial capital cost is lower, the ongoing operational cost of frequently replacing single-use components can, in the long run, become a consideration for large-scale, continuous manufacturing processes, leading some established players to maintain hybrid systems.

The North American region, particularly the United States, is expected to continue its dominance in the global single-use assemblies market through the forecast period of 2025-2033. This leadership is underpinned by several key factors, including the presence of a highly developed and robust biopharmaceutical industry, a significant concentration of research and development activities, and favorable government initiatives supporting biotechnology and pharmaceutical innovation. The region is home to a large number of leading biopharmaceutical companies, many of whom have readily adopted single-use technologies to accelerate drug development and manufacturing. Furthermore, substantial investments in biosimilar development and the growing pipeline of novel biologics, including advanced cell and gene therapies, are creating an insatiable demand for the flexibility and scalability offered by single-use solutions.

Within this dynamic market, the Bag Components segment is projected to be a significant contributor and likely to dominate the market. This dominance is attributed to their widespread application across various bioprocessing stages, from cell culture and media preparation to buffer storage and final product formulation. Bag components are integral to the operation of single-use bioreactors, mixers, and transfer systems, which are becoming increasingly prevalent in pharmaceutical and biotechnology manufacturing. Their inherent flexibility, ease of use, and ability to minimize contamination risks make them highly attractive for a wide range of applications, including the production of monoclonal antibodies, vaccines, and other complex biologics. The continuous innovation in bag material science, ensuring enhanced barrier properties, chemical resistance, and reduced leachables, further solidifies their market position.

Beyond bag components, Biological Equipment Packaging also stands out as a crucial and growing segment. This application is vital for ensuring the sterile and secure transport and storage of sensitive biological materials, including cell lines, reagents, and finished biopharmaceutical products. As the production of biologics becomes more globalized and the need for robust cold chain management intensifies, specialized and reliable packaging solutions are paramount. Single-use assemblies designed for biological equipment packaging offer superior protection against contamination, temperature fluctuations, and physical damage, thereby safeguarding the integrity and efficacy of valuable biological assets. This segment is further propelled by the increasing complexity and value of the biological products being manufactured and distributed worldwide, demanding cutting-edge packaging technologies.

Other notable segments driving market growth include Medical Packaging and Food Packaging. In the medical sector, single-use assemblies are increasingly employed for sterile packaging of medical devices, diagnostic kits, and components for implants, where preventing contamination is of utmost importance. The food industry is also seeing a growing adoption for packaging of specialized food ingredients, sensitive food products, and in applications requiring high levels of sterility and shelf-life extension. The overarching trend across all these segments is the increasing emphasis on hygiene, safety, and efficiency, which single-use assemblies are uniquely positioned to address, thus contributing to the overall expansion and market share dominance within their respective applications.

The growth catalysts for the single-use assemblies industry are multi-faceted, primarily driven by the accelerating pace of biopharmaceutical innovation and the increasing complexity of drug manufacturing. The burgeoning pipeline of biologics, including personalized medicines and cell and gene therapies, necessitates flexible and scalable manufacturing solutions, which single-use assemblies provide. Furthermore, heightened regulatory scrutiny and the global push for enhanced product safety and reduced cross-contamination risks are compelling manufacturers to adopt disposable technologies. Economic factors, such as lower upfront capital investment and faster time-to-market, also act as significant catalysts, particularly for emerging biotechs and research institutions.

This comprehensive report provides an in-depth analysis of the global single-use assemblies market, meticulously covering the historical period from 2019 to 2024 and projecting growth through 2033, with a specific focus on the base and estimated year of 2025. The study delves into the intricate market dynamics, dissecting key trends, and identifying the pivotal driving forces that are reshaping the industry landscape. It critically examines the challenges and restraints that could potentially impede market expansion, offering a balanced perspective on future growth trajectories. Furthermore, the report highlights the dominant regions and segments, with particular attention paid to the substantial contributions of Bag Components and Biological Equipment Packaging. It also identifies crucial growth catalysts and profiles the leading players in the market. The report aims to equip stakeholders with actionable insights, enabling informed strategic decision-making within this rapidly evolving and critical sector of the life sciences industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 23.3%.

Key companies in the market include Merck Millipore, Avantor, Thermo Fisher Scientific, Saint-Gobain, Danaher Corporation, GE Healthcare, Sartorius Stedim Biotech, Parker Hannifin Corporation, Corning Incorporated, Repligen Corporation, Lonza, Entegris, PBS Biotech, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Single-Use Assemblies," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Single-Use Assemblies, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.