1. What is the projected Compound Annual Growth Rate (CAGR) of the Lip Gloss Packaging Tube?

The projected CAGR is approximately 11.53%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Lip Gloss Packaging Tube

Lip Gloss Packaging TubeLip Gloss Packaging Tube by Application (Makeup Shop, Personal, Others, World Lip Gloss Packaging Tube Production ), by Type (Polypropylene, High-Density Polyethylene, Metal, World Lip Gloss Packaging Tube Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

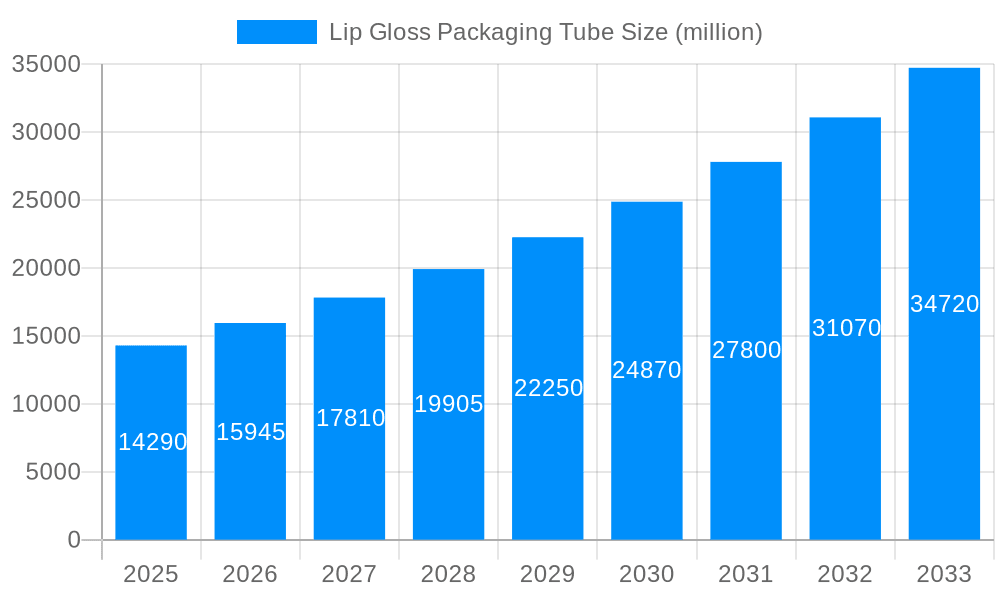

The global lip gloss packaging tube market is poised for significant expansion, projected to reach USD 14.29 billion by 2025. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 11.53% throughout the forecast period. A primary driver for this surge is the ever-increasing demand for cosmetic products, particularly lip gloss, driven by evolving fashion trends, social media influence, and a growing consumer emphasis on personal grooming and appearance. The market's expansion is also supported by continuous innovation in packaging designs, materials, and functionalities, aiming to enhance product appeal, user experience, and sustainability. Manufacturers are increasingly focusing on offering premium and eco-friendly packaging solutions to cater to a discerning consumer base and stricter environmental regulations.

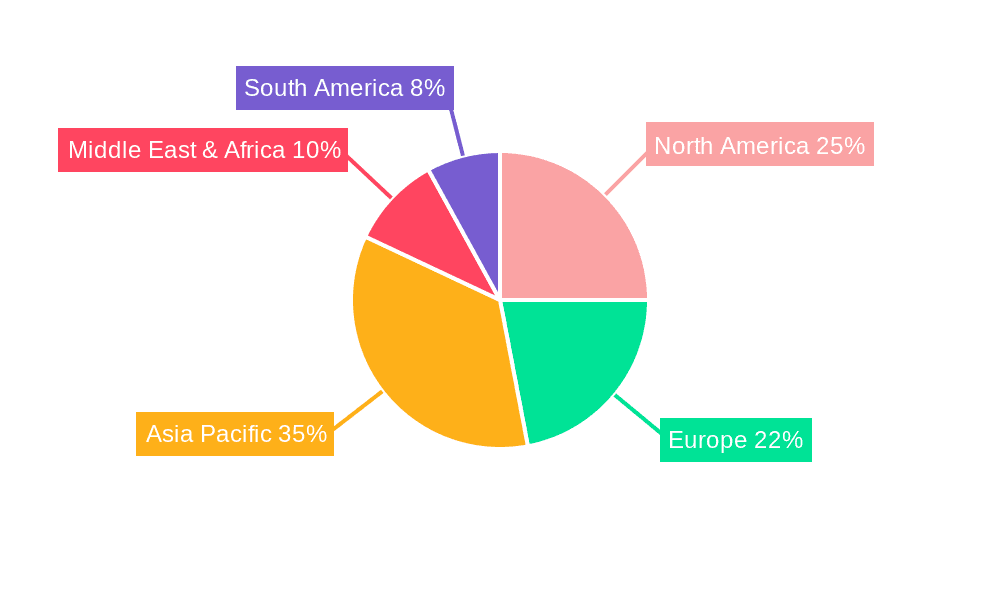

The market's dynamic landscape is characterized by a competitive environment with numerous key players actively involved in research and development, strategic partnerships, and mergers and acquisitions to expand their market reach and product portfolios. The "World Lip Gloss Packaging Tube Production" segment is particularly dynamic, with a strong focus on enhancing aesthetic appeal and convenience. Key material segments like Polypropylene and High-Density Polyethylene are expected to dominate due to their cost-effectiveness and versatility, while Metal and other advanced materials will cater to the premium segment. Geographically, the Asia Pacific region, led by China, is anticipated to be a major contributor to market growth, owing to its large consumer base and burgeoning cosmetics industry. North America and Europe will remain significant markets, driven by a mature consumer base and a strong inclination towards premium and innovative beauty products.

This report delves into the dynamic global market for lip gloss packaging tubes, providing an in-depth analysis of its trends, drivers, challenges, and future outlook. Spanning the historical period of 2019-2024, the base year of 2025, and projecting through the forecast period of 2025-2033, this study offers a detailed examination of market dynamics. With an estimated market size in the billions of units, the report leverages extensive data to identify key opportunities and potential roadblocks. The research meticulously covers various segments including applications (Makeup Shop, Personal, Others), tube types (Polypropylene, High-Density Polyethylene, Metal), and crucially, the overall World Lip Gloss Packaging Tube Production. The report also highlights industry developments and profiles leading manufacturers, making it an indispensable resource for stakeholders seeking to navigate this evolving industry.

The lip gloss packaging tube market is experiencing a significant evolutionary phase, driven by a confluence of consumer preferences, technological advancements, and evolving cosmetic industry standards. A key trend observed is the increasing demand for sustainable packaging solutions. Consumers are becoming more environmentally conscious, actively seeking products with reduced ecological footprints. This translates into a growing preference for recyclable, biodegradable, or made-from-recycled materials for lip gloss tubes. Manufacturers are responding by exploring innovative materials like post-consumer recycled (PCR) plastics and bio-based alternatives, aiming to minimize plastic waste and appeal to an eco-aware demographic. Furthermore, the aesthetic appeal of packaging remains paramount. There's a notable shift towards minimalist and sophisticated designs, with brands emphasizing premium finishes, unique textures, and elegant color palettes to elevate the perceived value of their lip gloss products. This trend aligns with the broader luxury beauty market's focus on sophisticated presentation.

The advent of smart packaging is another emerging trend, although still in its nascent stages for lip gloss tubes. While not yet mainstream, early explorations involve incorporating features like QR codes for product authentication or ingredient transparency, and potentially even interactive elements to enhance consumer engagement. Personalization is also gaining traction. Brands are exploring options for customized packaging, allowing consumers to add personal touches or select unique color combinations for their lip gloss tubes, fostering a deeper connection with the product. From a functional perspective, convenience and portability continue to be driving factors. The demand for sleek, easy-to-use tubes that fit seamlessly into makeup bags and on-the-go lifestyles persists. This includes features like precise applicators, leak-proof designs, and compact forms. The World Lip Gloss Packaging Tube Production is thus being shaped by these multifaceted demands, pushing innovation in material science, design, and manufacturing processes. The market is expected to see a continued rise in the adoption of these trends throughout the study period, with sustainability and premium aesthetics at the forefront of consumer preference, influencing the overall production volumes and manufacturing strategies. The interplay between these trends will dictate the future landscape of lip gloss packaging, impacting material choices, design philosophies, and the overall market valuation which is estimated to be in the billions of units.

The growth of the lip gloss packaging tube market is being significantly propelled by several key factors, primarily rooted in the booming global cosmetics industry and shifting consumer behaviors. The ever-expanding beauty and personal care sector, particularly the makeup segment, is the foundational driver. As new makeup trends emerge and the desire for self-expression through cosmetics intensifies, the demand for lip gloss, a staple product, consequently rises. This sustained consumer interest translates directly into a greater need for its packaging. Furthermore, the increasing disposable income in developing economies is empowering a larger segment of the population to engage with the beauty market, further fueling demand for products like lip gloss and, by extension, their packaging.

The rise of e-commerce and social media influencers has also played a crucial role. Online platforms have democratized access to beauty products, allowing brands to reach a wider audience and consumers to discover new products more easily. Visually appealing lip gloss packaging is essential for capturing attention in the competitive online space, acting as a silent salesperson. Influencers, in turn, showcase products and their packaging, creating trends and driving purchase decisions, with unique and aesthetically pleasing tubes often becoming a talking point. Moreover, the continuous innovation in lip gloss formulations, ranging from long-wear to hydrating and plumping effects, necessitates packaging that can effectively house and dispense these diverse products while maintaining their integrity. This drives the need for specialized tube designs and materials, contributing to market expansion. The World Lip Gloss Packaging Tube Production is thus intrinsically linked to these consumer-centric and industry-driven advancements, creating a robust demand that supports substantial market growth, projected to reach billions of units in production.

Despite the robust growth trajectory, the lip gloss packaging tube market is not without its hurdles and restraints. A primary challenge stems from the increasing regulatory scrutiny and environmental concerns surrounding plastic packaging. As global efforts to combat plastic pollution intensify, manufacturers face mounting pressure to adopt more sustainable materials and processes. This can involve higher costs associated with developing and sourcing eco-friendly alternatives, as well as the need for significant investment in new manufacturing technologies. The transition away from conventional plastics may also encounter resistance due to performance limitations or cost-effectiveness issues of newer materials, potentially impacting the final price of lip gloss products.

Furthermore, the intense competition within the packaging industry, including the lip gloss tube sector, can lead to price wars and a squeeze on profit margins for manufacturers. The sheer number of suppliers vying for contracts with cosmetic brands creates a buyer's market, forcing companies to constantly innovate and optimize their production to remain competitive. Supply chain disruptions, as witnessed in recent years due to global events, can also pose a significant challenge. Fluctuations in raw material prices, transportation costs, and geopolitical instability can impact the availability and cost of essential components for tube manufacturing, leading to production delays and increased expenses. Moreover, the ever-evolving aesthetic demands of consumers and brands can be both a driver and a restraint. Keeping pace with rapidly changing design trends requires constant adaptation and investment in new molds and tooling, which can be costly and time-consuming. The need for high-quality, visually appealing, and functional packaging, while desirable, also adds to the complexity and expense of production. The World Lip Gloss Packaging Tube Production must navigate these complexities to ensure continued growth and profitability.

The global lip gloss packaging tube market is characterized by distinct regional strengths and dominant segments, with significant contributions from Asia Pacific, particularly China, and a strong showing from North America and Europe. Asia Pacific, spearheaded by China, is projected to lead the market in terms of both production volume and value. This dominance is attributed to several factors, including the presence of a vast and sophisticated manufacturing infrastructure for cosmetic packaging. China has long been a global hub for the production of beauty product components, boasting a skilled workforce, established supply chains, and competitive manufacturing costs. The region also benefits from a rapidly growing domestic cosmetics market, driven by increasing disposable incomes and a young, trend-conscious population that actively consumes lip gloss. The World Lip Gloss Packaging Tube Production is heavily influenced by the manufacturing prowess of this region.

Within the segmentation of tube types, Polypropylene (PP) is anticipated to hold a substantial market share and exert considerable influence on market dynamics. Polypropylene offers a compelling balance of properties, including excellent chemical resistance, good rigidity, and a relatively low cost of production, making it a favored material for a wide array of cosmetic packaging. Its versatility allows for various aesthetic finishes, including matte, gloss, and frosted effects, which are crucial for brands aiming to differentiate their products in a crowded market. PP tubes are also amenable to various printing and decorating techniques, enabling brands to implement intricate designs and logos that enhance visual appeal. Furthermore, advancements in PP formulations are leading to the development of more sustainable options, such as recycled PP (RPP), which aligns with the growing consumer demand for eco-friendly packaging. This makes PP a material that can adapt to evolving market demands for both performance and sustainability.

The application segment of Makeup Shop also plays a pivotal role in dominating market demand. The sheer volume of lip gloss sold through dedicated makeup retailers, both brick-and-mortar stores and e-commerce platforms specializing in beauty products, creates a consistent and significant demand for packaging. These retail environments are where consumers actively seek out and purchase cosmetic items, making the packaging a critical element in product presentation and shelf appeal. Brands leverage the packaging within these settings to communicate their brand identity, highlight product benefits, and attract impulse purchases. The competitive nature of the makeup retail landscape necessitates that lip gloss packaging be not only functional but also visually striking and aligned with the latest aesthetic trends.

In summary, the dominance of Asia Pacific, especially China, in manufacturing capacity, coupled with the widespread preference for Polypropylene due to its cost-effectiveness and versatility, and the consistent demand generated by the Makeup Shop application segment, collectively position these as key drivers shaping the global lip gloss packaging tube market. The interplay between these regional, material, and application segments dictates the overall flow and growth of the World Lip Gloss Packaging Tube Production.

The lip gloss packaging tube industry is experiencing robust growth fueled by several key catalysts. The burgeoning global cosmetics market, particularly the strong demand for lip products, directly translates into increased need for effective and appealing packaging. Furthermore, the rising influence of social media and e-commerce platforms has amplified the importance of visually attractive packaging, turning tubes into miniature billboards that attract consumer attention and drive purchase decisions. Innovations in material science, leading to more sustainable and cost-effective packaging options like recycled plastics and bio-based alternatives, are also acting as significant growth enablers, aligning with consumer preferences for eco-conscious products.

This comprehensive report offers an unparalleled look into the global lip gloss packaging tube market, presenting data and insights valued in the billions of units. The study meticulously examines the market from 2019 to 2033, with a detailed base year analysis for 2025 and a forward-looking forecast period. It dissects the industry by application, including the significant Makeup Shop segment, and by material type, with a particular focus on Polypropylene, highlighting their respective market shares and growth potential. The report also provides a detailed overview of World Lip Gloss Packaging Tube Production, identifying key trends, driving forces, and the challenges that stakeholders must navigate. Leading players are identified, and significant industry developments are chronicled, making this report an essential tool for strategic decision-making and investment planning in this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.53% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.53%.

Key companies in the market include VisonPack, Albea Group, Graham Packaging, HCP Packaging, ABC Packaging, Aptargroup, Libo Cosmetics, KING SAN YOU, Shantou Yifan Cosmetic Packaging, East Hill Industries, Berlin Packaging, The Packaging Company, Raepak Ltd, Taizhou Kechuang Plastic, Jiangyin Meishun Packing, Shangyu Wanrong(WR)Plastic, Shantou City of Guangdong Province Fine Arts Plastic, Zhan Yu Enterprise, Zhejiang Axilone Shunhua Aluminium & Plastic, Zhejiang Sanrong Plastic & Rubber, Shaoxing Hongyu Aluminium Plastic, Shantou Feiyi Cosmetic Packaging, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Lip Gloss Packaging Tube," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lip Gloss Packaging Tube, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.