1. What is the projected Compound Annual Growth Rate (CAGR) of the Stainless Steel Commercial Beer Kegs?

The projected CAGR is approximately 9.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Stainless Steel Commercial Beer Kegs

Stainless Steel Commercial Beer KegsStainless Steel Commercial Beer Kegs by Type (≤ 20L, 21~50L, > 50L, World Stainless Steel Commercial Beer Kegs Production ), by Application (Mass Production Beer), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

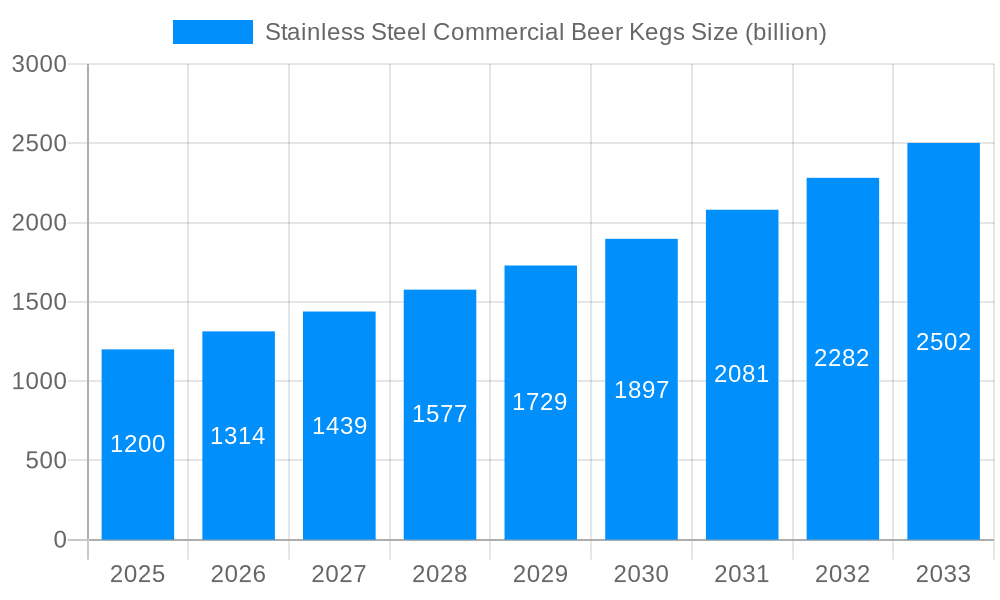

The global market for Stainless Steel Commercial Beer Kegs is projected to experience robust growth, reaching an estimated market size of $1.2 billion in 2025 and expanding at a compound annual growth rate (CAGR) of 9.5% through 2033. This significant expansion is primarily driven by the increasing global consumption of craft and commercial beer, leading to a greater demand for reliable and durable beverage containers. The trend towards mass production of beer, coupled with the growing popularity of draft beer systems in both on-premise and off-premise establishments, further fuels market expansion. Furthermore, the inherent advantages of stainless steel kegs, such as their longevity, resistance to corrosion, ease of cleaning, and ability to maintain beverage quality, make them the preferred choice for brewers worldwide, reinforcing market dominance.

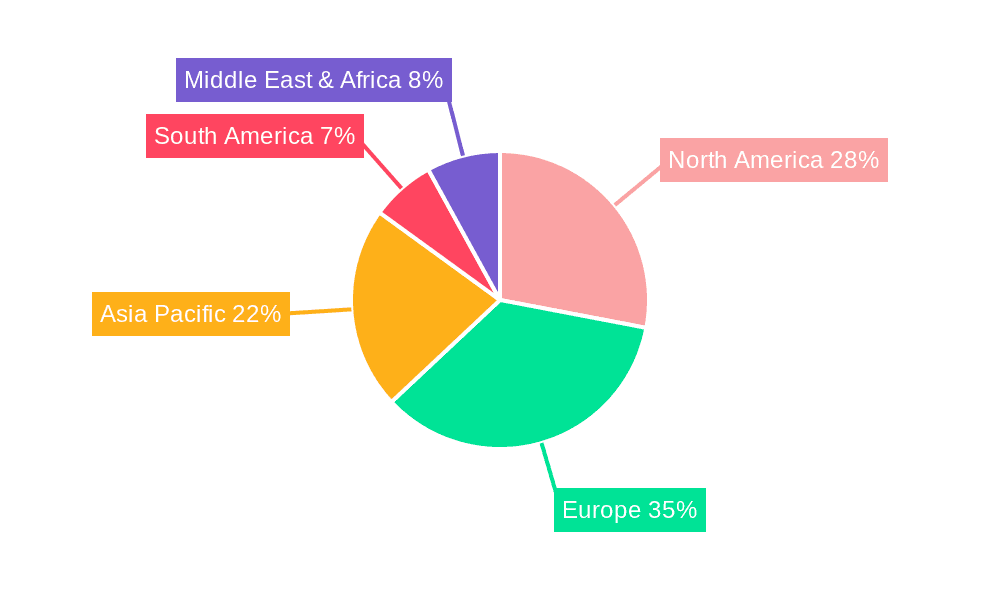

The market segmentation by type highlights a strong demand for kegs across various capacities, with the ≤ 20L segment catering to smaller craft breweries and specialty offerings, while the 21~50L and > 50L segments are essential for larger commercial operations and mass production. Geographically, Asia Pacific is emerging as a key growth region, owing to the rapid expansion of its brewing industry and increasing consumer preference for draft beer. North America and Europe, established markets with a mature beer culture, will continue to represent substantial market share, driven by consistent demand and innovation. However, potential restraints such as the high initial investment cost for kegs and the increasing adoption of alternative packaging solutions like cans could pose challenges. Despite these, the overall outlook for stainless steel commercial beer kegs remains highly positive, supported by a growing global beverage industry and the enduring appeal of draft beer.

The global market for stainless steel commercial beer kegs is poised for substantial growth, driven by evolving consumer preferences and significant industry developments. Throughout the Study Period of 2019-2033, with a Base Year of 2025 and an Estimated Year also in 2025, the market has witnessed and will continue to observe a dynamic interplay of factors shaping its trajectory. Historical data from 2019-2024 indicates a steady demand, fueled by the burgeoning craft beer industry and the increasing reliance on reusable and sustainable packaging solutions. The Base Year 2025 sets the stage for a projected compound annual growth rate (CAGR) that is expected to reach upwards of $2.5 billion by the end of the Forecast Period in 2033. This expansion is underpinned by a fundamental shift in how beverages, particularly beer, are distributed and consumed. The convenience and durability of stainless steel kegs, compared to traditional glass bottles or single-use alternatives, have made them indispensable for breweries and distributors. Furthermore, innovations in keg technology, such as improved valve systems and enhanced cleaning protocols, are contributing to increased efficiency and reduced operational costs, thereby bolstering market confidence. The rise of on-tap delivery services and the growing popularity of draft beer in both commercial establishments and home settings are also key contributors to this upward trend. As sustainability becomes a paramount concern for consumers and businesses alike, the long lifespan and recyclability of stainless steel kegs align perfectly with environmental mandates and corporate social responsibility initiatives. The market's valuation, projected to surpass $3 billion by 2033, reflects not just an increase in unit sales but also a growing appreciation for the inherent value and long-term economic benefits offered by these robust containers. The increasing penetration of stainless steel kegs in emerging markets, alongside continued dominance in established ones, paints a picture of a resilient and expanding global market. The Base Year 2025 is a crucial inflection point, where existing trends solidify and new opportunities for market expansion begin to materialize, setting a positive tone for the subsequent years of the Forecast Period. The overall market sentiment is one of sustained expansion, driven by a confluence of technological advancements, economic efficiencies, and a growing commitment to sustainable practices within the beverage industry. The projected market size indicates a significant economic contribution, with billions of dollars invested and generated annually by the stainless steel commercial beer kegs sector.

The stainless steel commercial beer kegs market is experiencing a robust upward trajectory, propelled by a confluence of powerful driving forces that are reshaping the beverage packaging landscape. Foremost among these is the unwavering surge in the global craft beer movement. As breweries, both large and small, continue to innovate and expand their offerings, the demand for reliable, high-quality packaging solutions like stainless steel kegs escalates. These kegs are not merely containers; they are essential components in maintaining the integrity and freshness of premium brews, ensuring that the intended flavor profile reaches the consumer unimpaired. Secondly, the inherent sustainability and reusability of stainless steel kegs are increasingly becoming a critical factor for businesses aiming to reduce their environmental footprint. In an era where corporate social responsibility and eco-friendly practices are paramount, the long lifespan and recyclability of these kegs present a compelling advantage over disposable packaging. This aligns perfectly with global initiatives focused on waste reduction and resource conservation. Furthermore, the economic efficiencies offered by stainless steel kegs cannot be overstated. While the initial investment might be higher than some alternatives, their durability, resistance to corrosion, and ease of cleaning translate into significant cost savings over their extensive operational life. This reduced total cost of ownership makes them an attractive long-term investment for breweries and beverage distributors alike. The increasing focus on hygiene and product safety within the food and beverage industry also plays a pivotal role. Stainless steel's non-porous surface and resistance to bacterial growth make it an ideal material for maintaining stringent sanitation standards, crucial for preserving the quality and safety of beer. Finally, the growing trend towards draft beer consumption, whether in restaurants, bars, or even for home use, directly fuels the demand for commercial beer kegs. The convenience and superior drinking experience associated with draft beer necessitate a robust and efficient kegging infrastructure. These combined forces are creating a dynamic and expanding market, with projections indicating a significant increase in market value, potentially reaching $2.8 billion by the end of the Forecast Period in 2033.

Despite the overwhelmingly positive outlook for the stainless steel commercial beer kegs market, several challenges and restraints could potentially temper its growth trajectory. One of the most significant hurdles is the high initial capital investment required for acquiring stainless steel kegs. While their long-term economic benefits are undeniable, the upfront cost can be a deterrent for smaller breweries or those in emerging markets with limited access to capital. This barrier to entry can slow down the adoption rate in certain regions. Another considerable challenge revolves around the logistics and management of keg fleets. The efficient tracking, collection, cleaning, and redistribution of kegs across vast geographical areas require sophisticated supply chain management systems. Inefficiencies in these processes can lead to increased operational costs, potential keg loss, and delays, impacting profitability and customer satisfaction. Furthermore, the availability and cost of raw materials, particularly stainless steel, can be a volatile factor. Fluctuations in global commodity prices can directly influence the manufacturing cost of kegs, potentially leading to price increases that could dampen demand. Geopolitical events, trade disputes, or disruptions in mining and processing can exacerbate these price volatilities. The competition from alternative packaging solutions, such as aluminum cans and PET bottles, although often less sustainable and durable, remains a persistent restraint. These alternatives may offer lower upfront costs and different logistical advantages for specific applications, posing a competitive threat in certain market segments. For instance, for limited-edition or single-serving applications, cans might still be preferred. Lastly, regulatory hurdles and evolving environmental standards could also pose challenges. While stainless steel kegs are generally considered environmentally friendly, manufacturers and users must constantly adapt to new regulations concerning material sourcing, manufacturing processes, and waste disposal. Ensuring compliance with these evolving standards can add complexity and cost. The Base Year of 2025 highlights the importance of addressing these restraints proactively to ensure sustained growth beyond this point, aiming to mitigate potential market headwinds and capitalize on emerging opportunities.

The global stainless steel commercial beer kegs market is characterized by a multi-faceted dominance across specific regions and segments, driven by distinct economic, industrial, and consumer trends. Within the Study Period of 2019-2033, with a Base Year of 2025, several key areas are projected to lead the market's expansion and consumption.

North America (United States and Canada): This region is a powerhouse for stainless steel commercial beer kegs due to the mature and continuously expanding craft beer industry. The sheer volume of craft breweries, coupled with a strong consumer preference for draft beer and a well-established distribution network, makes North America a consistently dominant market. The Application: Mass Production Beer segment here is significant, alongside a growing niche for specialty and limited-release brews requiring premium packaging. The overall market valuation within North America is expected to contribute substantially, potentially accounting for over $1 billion in revenue by 2033. The emphasis on quality, innovation, and a commitment to sustainability further solidifies its leading position.

Europe (Germany, United Kingdom, and Belgium): Europe boasts a long-standing tradition of beer production and consumption, with countries like Germany, the UK, and Belgium being major players. The established brewing infrastructure, coupled with increasing consumer demand for diverse beer styles, fuels the need for robust kegging solutions. The focus on quality and heritage in European brewing aligns well with the reliability of stainless steel kegs. The World Stainless Steel Commercial Beer Kegs Production within Europe is also significant, as many leading manufacturers are based in this region, serving both domestic and international markets. The market value here is projected to approach $900 million by 2033.

Asia-Pacific (China and Japan): While historically a smaller market, the Asia-Pacific region is demonstrating rapid growth in stainless steel commercial beer kegs. The burgeoning middle class, increasing urbanization, and the growing popularity of Western beverages, including craft beer, are driving demand. China, in particular, is witnessing significant investment in its domestic brewing industry, leading to a surge in the need for efficient and modern packaging solutions. The Application: Mass Production Beer segment is expected to see considerable expansion here. Japan's established beverage industry and its appreciation for quality also contribute to its market share, though at a more mature pace. The region's overall market value is projected to cross $600 million by 2033, signifying its increasing importance.

Type: > 50L: This segment, encompassing kegs larger than 50 liters, is expected to dominate the market, particularly for large-scale commercial breweries and beverage distributors. These larger kegs are ideal for high-volume operations, enabling efficient dispensing and reducing the frequency of refills. The Application: Mass Production Beer is the primary driver for this segment, where bulk handling and consistent supply are crucial. The economic efficiency of larger kegs for mass production contributes to their market dominance. The market share for this segment is projected to exceed 60% of the total market value by 2033.

World Stainless Steel Commercial Beer Kegs Production: This refers to the overall output and manufacturing capacity of stainless steel kegs globally. The regions with significant manufacturing bases, such as Europe and North America, will continue to be key players in production. However, emerging production hubs in Asia-Pacific are also gaining traction, driven by cost advantages and growing local demand. The efficiency and scale of World Stainless Steel Commercial Beer Kegs Production directly influence market supply and pricing. Innovations in manufacturing processes and automation will be critical for maintaining competitiveness in this segment.

Application: Mass Production Beer: This segment is the backbone of the stainless steel commercial beer kegs market. The consistent demand from large breweries producing mainstream beer brands for widespread distribution ensures a steady and substantial market for kegs. As global beer consumption continues to rise, driven by population growth and increasing disposable incomes, the need for reliable kegging solutions for mass production will only intensify. This segment is intrinsically linked to the Type: > 50L segment, as larger kegs are typically preferred for mass production.

The interplay between these dominant regions and segments creates a dynamic and robust market landscape. The Base Year of 2025 serves as a crucial point for evaluating the established dominance and the emerging growth trajectories, setting the stage for continued market leadership in the subsequent years of the Forecast Period (2025-2033).

The stainless steel commercial beer kegs industry is poised for significant expansion, fueled by several powerful growth catalysts. The persistent and escalating demand from the global craft beer revolution is a primary driver, with microbreweries and taprooms increasingly relying on durable and high-quality kegs to preserve the integrity of their specialized brews. Furthermore, the growing emphasis on sustainability and corporate social responsibility among consumers and businesses alike is a potent catalyst, as stainless steel kegs offer a reusable and environmentally friendly alternative to disposable packaging. The inherent economic benefits, including long lifespan and reduced waste, further enhance their appeal. Technological advancements in keg manufacturing, such as improved welding techniques and innovative valve designs, are also contributing to more efficient and cost-effective production, thereby stimulating market growth. The expansion of draft beer culture into new geographical markets and evolving consumer preferences for on-tap experiences are also significant growth catalysts, ensuring a sustained demand for commercial beer kegs.

This comprehensive report provides an in-depth analysis of the global stainless steel commercial beer kegs market, encompassing a detailed exploration of its dynamics from 2019 to 2033. The study meticulously examines key trends, including the growing preference for sustainable packaging and the increasing adoption of smart keg technology. It delves into the driving forces behind market expansion, such as the robust growth of the craft beer industry and the economic efficiencies offered by durable kegs. The report also addresses the significant challenges and restraints, including high initial investment costs and complex logistics. Furthermore, it identifies and analyzes the dominant regions and segments, with a particular focus on North America and Europe, and the market leadership of kegs exceeding 50L for mass production beer. The report highlights crucial growth catalysts, such as evolving consumer preferences and technological advancements, while also profiling the leading companies that are shaping the industry landscape. Significant developments, from smart keg integration to sustainable manufacturing, are tracked with precise year-based insights, offering a holistic view of the market's evolution and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.5%.

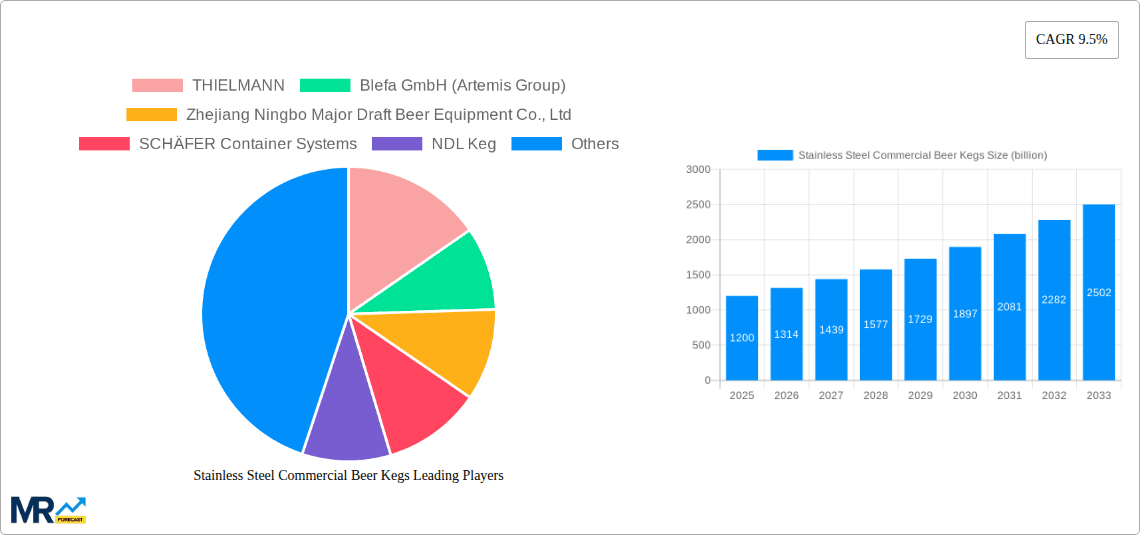

Key companies in the market include THIELMANN, Blefa GmbH (Artemis Group), Zhejiang Ningbo Major Draft Beer Equipment Co., Ltd, SCHÄFER Container Systems, NDL Keg, Ningbo BestFriends Beverage Containers, American Keg Company, INOXCVA (Inox), WorldKeg, Cubic Container Systems, Shinhan Industrial Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD 1.2 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Stainless Steel Commercial Beer Kegs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Stainless Steel Commercial Beer Kegs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.