1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Type I Glass Tube?

The projected CAGR is approximately 8.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pharmaceutical Type I Glass Tube

Pharmaceutical Type I Glass TubePharmaceutical Type I Glass Tube by Type (Colorless Glass Tube, Brown Glass Tube, World Pharmaceutical Type I Glass Tube Production ), by Application (Pharmaceutical Preparations, Diagnostic Reagents, Research and Laboratory Applications, Others, World Pharmaceutical Type I Glass Tube Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

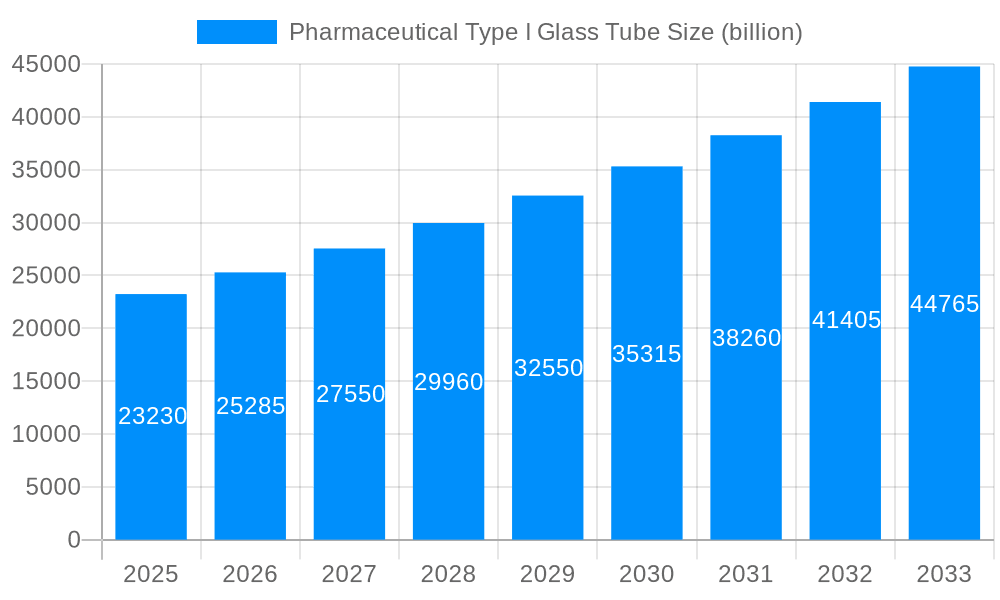

The global Pharmaceutical Type I Glass Tube market is poised for significant expansion, projected to reach a substantial valuation with a Compound Annual Growth Rate (CAGR) of 8.8% from 2025 through 2033. This robust growth trajectory is fueled by an increasing demand for high-purity and chemically inert packaging solutions essential for the stable storage and delivery of sensitive pharmaceutical products, including advanced biologics and sterile injectables. The market's expansion is further propelled by stringent regulatory requirements emphasizing product integrity and patient safety, which necessitates the use of Type I borosilicate glass, known for its superior resistance to chemical attack and thermal shock. Key drivers include the burgeoning biopharmaceutical sector, the continuous development of new drug formulations, and the growing global healthcare expenditure. The rise in diagnostic reagent usage, especially in areas like in-vitro diagnostics and personalized medicine, also contributes significantly to the demand for these specialized glass tubes.

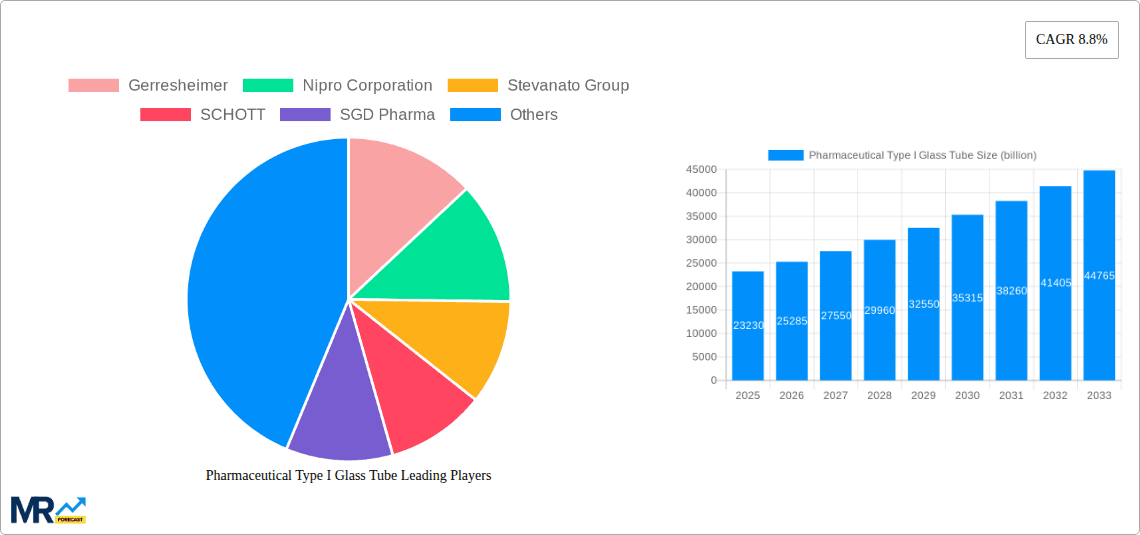

The Pharmaceutical Type I Glass Tube market is segmented by Type into Colorless Glass Tube and Brown Glass Tube, with "World Pharmaceutical Type I Glass Tube Production" being a significant overarching category. Applications span Pharmaceutical Preparations, Diagnostic Reagents, Research and Laboratory Applications, and Others, with pharmaceutical preparations representing the largest share due to the sheer volume of drug production. Restraints, such as the potential for high manufacturing costs and the availability of alternative packaging materials, are being mitigated by technological advancements in glass production and the inherent advantages of Type I glass for critical applications. Key players like Gerresheimer, Nipro Corporation, and Stevanato Group are actively investing in innovation and expanding their production capacities to cater to the escalating global demand, particularly in the Asia Pacific region, which is emerging as a major manufacturing and consumption hub.

This comprehensive report delves into the dynamic global market for Pharmaceutical Type I Glass Tubes, offering an in-depth analysis from the historical period of 2019-2024 to a forward-looking forecast extending to 2033. With 2025 designated as both the base and estimated year, the report meticulously examines market trends, driving forces, and challenges that are shaping this critical segment of the pharmaceutical packaging industry. The analysis will leverage an extensive dataset, with values presented in billions of units, to provide a robust understanding of market size and growth trajectories.

The global market for Pharmaceutical Type I Glass Tubes is on a trajectory of substantial growth, driven by an escalating demand for safe, inert, and reliable containment solutions for a wide array of pharmaceutical products. Throughout the historical period of 2019-2024, the market demonstrated consistent expansion, a trend that is projected to accelerate, reaching significant valuations in the billions of units by 2033. This upward momentum is underpinned by the inherent superiority of Type I borosilicate glass, which offers exceptional resistance to chemical attack, thermal shock, and mechanical stress. This makes it the material of choice for highly sensitive drugs, injectables, and parenteral formulations where product integrity and patient safety are paramount.

Key market insights reveal a pronounced shift towards advanced manufacturing processes and enhanced quality control measures by leading players. Companies are investing heavily in R&D to develop innovative glass formulations that offer improved barrier properties and even greater chemical inertness, catering to the evolving needs of complex biologics and novel therapeutic agents. The increasing prevalence of chronic diseases and an aging global population are directly correlating with a higher demand for pharmaceutical preparations, thereby bolstering the need for reliable primary packaging like Type I glass tubes. Furthermore, the burgeoning biopharmaceutical sector, with its emphasis on precision and purity, is a significant contributor to this growth.

The forecast period from 2025-2033 anticipates a sustained and robust CAGR, fueled by ongoing technological advancements and expanding healthcare infrastructure worldwide. The market's growth is not merely quantitative; qualitative enhancements in production efficiency and sustainability are also becoming increasingly important. Manufacturers are exploring eco-friendly production methods and recyclable materials to align with global environmental regulations and consumer preferences. The increasing focus on personalized medicine and the development of smaller, more potent drug formulations also necessitate highly specialized and precisely manufactured glass tubing. This intricate interplay of factors positions the Pharmaceutical Type I Glass Tube market as a vital and expanding component of the global pharmaceutical supply chain, with market revenues projected to reach hundreds of billions of units by the report's conclusion. The base year of 2025 serves as a critical benchmark for understanding the current market landscape before the projected acceleration in growth.

The global Pharmaceutical Type I Glass Tube market is experiencing significant propulsion from several key driving forces, each contributing to its sustained growth and increasing importance. Foremost among these is the unyielding demand for high-purity and chemically inert packaging for a vast spectrum of pharmaceutical products. Type I glass, with its superior chemical resistance and minimal leaching properties, is indispensable for preserving the stability and efficacy of sensitive drugs, biologics, and injectable formulations. The escalating global healthcare expenditure, coupled with an aging population and the rising incidence of chronic diseases, directly translates into a higher volume of pharmaceutical production, thus amplifying the need for reliable primary packaging solutions.

Furthermore, advancements in the biopharmaceutical sector, particularly the development of complex biologics and vaccines, are a significant catalyst. These sophisticated drugs often require packaging that can maintain their integrity and prevent degradation over extended shelf lives, a requirement that Type I glass tubes are uniquely positioned to meet. Stringent regulatory frameworks and quality standards imposed by health authorities worldwide also play a crucial role, mandating the use of inert and safe packaging materials to ensure patient safety and product efficacy. This regulatory push inherently favors Type I glass over less stable alternatives, driving market demand.

The continuous innovation in drug delivery systems, including the development of specialized syringes and vials, further fuels the demand for precision-engineered Type I glass tubes. Manufacturers are investing in advanced production technologies to meet the exacting specifications for these applications. The growing emphasis on research and development in the pharmaceutical industry, leading to the discovery of new drugs and treatments, indirectly contributes to the market’s expansion as these new products require appropriate containment. In essence, the convergence of rising healthcare needs, technological advancements in pharmaceuticals, and rigorous quality standards creates a robust ecosystem that propels the Pharmaceutical Type I Glass Tube market forward, ensuring its continued relevance and growth in the billions of units annually.

Despite its robust growth trajectory, the Pharmaceutical Type I Glass Tube market is not without its share of challenges and restraints that warrant careful consideration. One of the primary hurdles is the inherent fragility of glass, which, while offering superior inertness, can be susceptible to breakage during manufacturing, transit, and handling. This necessitates sophisticated packaging and logistics, adding to the overall cost of the supply chain. The production of Type I glass itself is an energy-intensive process, contributing to higher manufacturing costs compared to some alternative materials like plastics. This cost factor can be a restraint, especially for pharmaceutical companies operating with tighter budgets or for markets where cost-effectiveness is a paramount consideration.

Moreover, the stringent regulatory landscape, while a driver in many respects, also presents challenges. Manufacturers must adhere to exacting quality control standards and undergo rigorous testing and validation processes, which can be time-consuming and expensive. Any deviation from these standards can lead to significant delays or rejections. The emergence of alternative packaging materials, particularly advanced plastics and polymers, offers a potential competitive threat. While these materials may not always match the inertness of Type I glass, their lighter weight, shatter-resistance, and often lower cost can make them attractive for certain applications, especially those with less stringent containment requirements.

Geopolitical factors and supply chain disruptions, as evidenced in recent global events, can also pose significant challenges. Fluctuations in raw material prices, energy costs, and international trade policies can impact production volumes and pricing. Furthermore, the growing global emphasis on sustainability, while an opportunity for innovation, also presents a challenge for the glass industry to develop more energy-efficient and recyclable manufacturing processes that can compete with the perceived environmental benefits of some plastic alternatives. Overcoming these challenges will be crucial for sustained market expansion and for ensuring the continued dominance of Type I glass in critical pharmaceutical applications, even as it navigates these complexities in the billions of units marketplace.

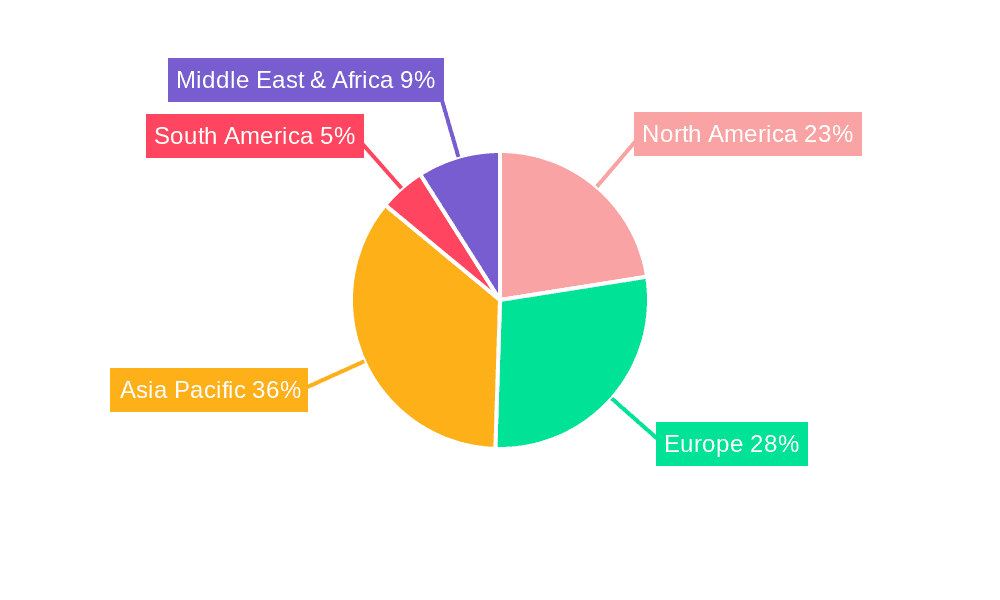

The global Pharmaceutical Type I Glass Tube market is characterized by distinct regional dynamics and segment dominance, with a keen eye on the Asia Pacific region and the Pharmaceutical Preparations application segment poised to be key contenders in shaping the market's future.

Asia Pacific Region Dominance:

Pharmaceutical Preparations Segment Dominance:

In conclusion, the synergistic interplay of a robust manufacturing and consumption base in the Asia Pacific region, coupled with the evergreen and expanding demand from the Pharmaceutical Preparations segment, positions these as the pivotal forces driving the global Pharmaceutical Type I Glass Tube market towards unprecedented growth, measured in billions of units, in the coming years.

The Pharmaceutical Type I Glass Tube industry is propelled by several key growth catalysts. The escalating global demand for safe and effective pharmaceuticals, particularly injectables and biologics, is a primary driver. Advancements in drug development, leading to the creation of more sensitive and potent therapeutic agents, necessitate the use of highly inert packaging like Type I glass. Furthermore, stringent regulatory requirements from health authorities worldwide mandate the use of materials that ensure product integrity and patient safety, favoring Type I glass. The increasing healthcare expenditure and access to advanced medical treatments in emerging economies also contribute significantly to market expansion.

This comprehensive report provides an unparalleled deep dive into the global Pharmaceutical Type I Glass Tube market, meticulously analyzing every facet from historical performance to future projections. It offers a granular breakdown of market dynamics, including detailed insights into trends, the driving forces propelling growth, and the challenges that may impede expansion. The report leverages extensive data, presenting values in the billions of units, to offer a precise understanding of market size and value across the study period of 2019-2033, with a focus on the estimated year of 2025. It delves into the specific contributions of key regions and segments, identifying dominant players and their strategic initiatives. Furthermore, the report highlights significant developments and technological advancements shaping the industry. This exhaustive coverage ensures stakeholders gain a holistic perspective and actionable intelligence for strategic decision-making within this vital market segment.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.8%.

Key companies in the market include Gerresheimer, Nipro Corporation, Stevanato Group, SCHOTT, SGD Pharma, Bormioli Pharma, Shandong Pharmaceutical Glass Co., Ltd., West Pharmaceutical Services, Inc., Corning Incorporated, Zhuzhou Kibing Group Co., Ltd., Henan Ancai HI-TECH Co., Ltd., Hangzhou Tianshan Medical Glass Co., Ltd., Nantong Xinde Medical Packing Material Co., Ltd., Gerresheimer Shuangfeng Pharmaceutical Glass (Danyang) Co., Ltd., Dezhou Jinghua Pharmaceutical Glass Co., Ltd., Fujian Longwei Medical Glass Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD 23.23 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Pharmaceutical Type I Glass Tube," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmaceutical Type I Glass Tube, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.