1. What is the projected Compound Annual Growth Rate (CAGR) of the Pe Stretch Film Packaging?

The projected CAGR is approximately 3.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pe Stretch Film Packaging

Pe Stretch Film PackagingPe Stretch Film Packaging by Type (Cast Machine Stretch Film, Blown Machine Stretch Film, Others, World Pe Stretch Film Packaging Production ), by Application (Food Industry, Medical Industry, Retail Industry, Others, World Pe Stretch Film Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

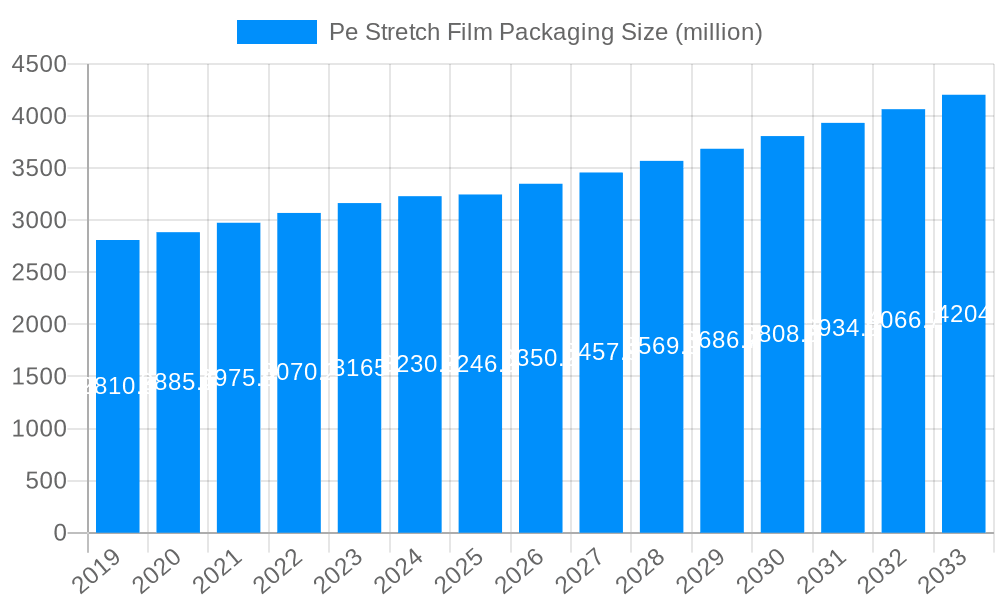

The global PE stretch film packaging market is poised for steady growth, projected to reach approximately $3,246.9 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 3.1% through 2033. This expansion is primarily fueled by the increasing demand for efficient and cost-effective packaging solutions across a spectrum of industries, most notably food and medical sectors. The inherent properties of PE stretch film, such as its high tensile strength, puncture resistance, and ability to secure irregularly shaped items, make it an indispensable material for product protection during transit and storage. Key drivers include the burgeoning e-commerce landscape, necessitating robust secondary packaging, and the growing emphasis on hygiene and containment in food and pharmaceutical applications. Furthermore, advancements in film technology, leading to thinner yet stronger materials and improved stretchability, are contributing to market dynamism and encouraging wider adoption.

The market is segmented by type into Cast Machine Stretch Film, Blown Machine Stretch Film, and Others, with Cast Machine Stretch Film likely holding a dominant share due to its superior clarity, cling, and tear resistance properties, ideal for consumer-facing packaging. Application-wise, the Food Industry is expected to remain the largest segment, driven by the need for extended shelf life and protection against contamination, followed closely by the Medical Industry, where sterile and secure packaging is paramount. Retail and other miscellaneous applications also contribute significantly to demand. Despite the positive outlook, the market faces certain restraints, including fluctuating raw material prices (polyethylene) and increasing environmental concerns regarding plastic waste, prompting a growing interest in recyclable and biodegradable alternatives. However, ongoing innovation in developing sustainable PE stretch film options and efficient recycling programs is expected to mitigate these challenges, ensuring continued market resilience.

This report delves into the dynamic global PE Stretch Film Packaging market, offering a comprehensive analysis from 2019 to 2033. With a focus on the base year 2025 and an extensive forecast period of 2025-2033, the study meticulously examines historical trends (2019-2024) and projects future trajectories. We anticipate the global PE Stretch Film Packaging production to reach approximately 35 million units by the end of 2025, with significant expansion projected in the coming years. The report provides an in-depth understanding of market nuances, including product types, applications, driving forces, challenges, regional dominance, and strategic developments, empowering stakeholders with actionable insights.

The global PE Stretch Film Packaging market is witnessing a significant evolutionary phase, driven by an ever-increasing demand for efficient, cost-effective, and secure product protection across a multitude of industries. As of the base year 2025, we project the global production to stand at an impressive 35 million units, a testament to its widespread adoption and critical role in supply chains. A prominent trend is the escalating adoption of advanced manufacturing techniques, particularly in the realm of Cast Machine Stretch Film, which continues to hold a dominant share due to its superior clarity, puncture resistance, and stretchability. This segment alone is estimated to account for over 20 million units of the total global production in 2025. The Retail Industry remains a colossal consumer, representing approximately 15 million units of demand in 2025, driven by the continuous need for pallet stabilization, goods protection during transit, and enhanced shelf appeal. However, the Food Industry is exhibiting robust growth, projected to contribute 10 million units in 2025, fueled by the growing demand for extended shelf life, tamper-evident packaging, and hygienic transportation of perishable goods. The increasing focus on sustainability is also shaping trends, leading to a rise in the development and adoption of thinner, yet stronger, stretch films that reduce material consumption without compromising performance. Furthermore, the "Others" category, encompassing applications in logistics, construction, and industrial manufacturing, is also showing steady upward momentum, collectively contributing around 5 million units in 2025, highlighting the versatility of PE stretch films. The study meticulously analyzes these evolving patterns, providing granular insights into their projected growth and impact on market dynamics.

The PE Stretch Film Packaging market's robust growth is intricately linked to a confluence of powerful driving forces that are reshaping global supply chains and consumer expectations. A primary catalyst is the ever-expanding global trade and e-commerce landscape. As goods are increasingly manufactured and distributed across vast geographical distances, the necessity for reliable and secure packaging solutions to prevent damage, pilferage, and spoilage during transit becomes paramount. PE stretch film, with its inherent ability to form a tight, cohesive load, effectively addresses these needs, making it an indispensable component of modern logistics. Moreover, the increasing emphasis on supply chain efficiency and cost optimization further fuels demand. Businesses are constantly seeking ways to streamline operations and reduce material costs without sacrificing product integrity. PE stretch film offers a cost-effective alternative to more rigid packaging solutions, while its ability to secure multiple items together on a pallet can significantly reduce handling time and labor costs. The growing awareness and adoption of automation in warehousing and logistics also play a crucial role. Automated stretch wrapping machines are becoming more prevalent, enhancing wrapping speed and consistency, which in turn drives the demand for high-quality, machine-grade stretch films. The demand for enhanced product protection and preservation, particularly in sectors like the food and medical industries, is another significant driver. The ability of PE stretch films to create a barrier against environmental factors, maintain product freshness, and ensure hygiene further solidifies their position.

Despite its robust growth, the PE Stretch Film Packaging market is not without its set of challenges and restraints that could potentially moderate its expansion. A significant concern revolves around the growing environmental scrutiny and regulatory pressure concerning plastic waste. While PE stretch film offers significant advantages in product protection, its end-of-life disposal remains a critical issue. Increasing consumer and governmental demands for sustainable packaging solutions are pushing manufacturers to explore and implement more eco-friendly alternatives or enhance recycling infrastructure. This could lead to a gradual shift away from virgin PE films if viable and cost-effective circular economy solutions are not adequately developed and adopted. Furthermore, fluctuations in raw material prices, particularly polyethylene, can impact the overall profitability and pricing strategies of PE stretch film manufacturers. Volatility in crude oil prices, the primary feedstock for polyethylene production, can lead to unpredictable cost escalations, affecting market competitiveness and potentially deterring some end-users. The inherent limitations in puncture and tear resistance of some thinner gauge stretch films, especially in highly demanding industrial applications, can also act as a restraint. While advancements are continuously being made, certain extreme environments or sharp-edged products might necessitate alternative or supplementary packaging solutions, thereby limiting the addressable market for pure PE stretch film. Lastly, competition from alternative packaging materials and technologies poses another challenge. Innovations in biodegradable films, reusable packaging systems, and other advanced wrapping technologies could present viable substitutes in specific applications, requiring PE stretch film manufacturers to continually innovate and differentiate their offerings.

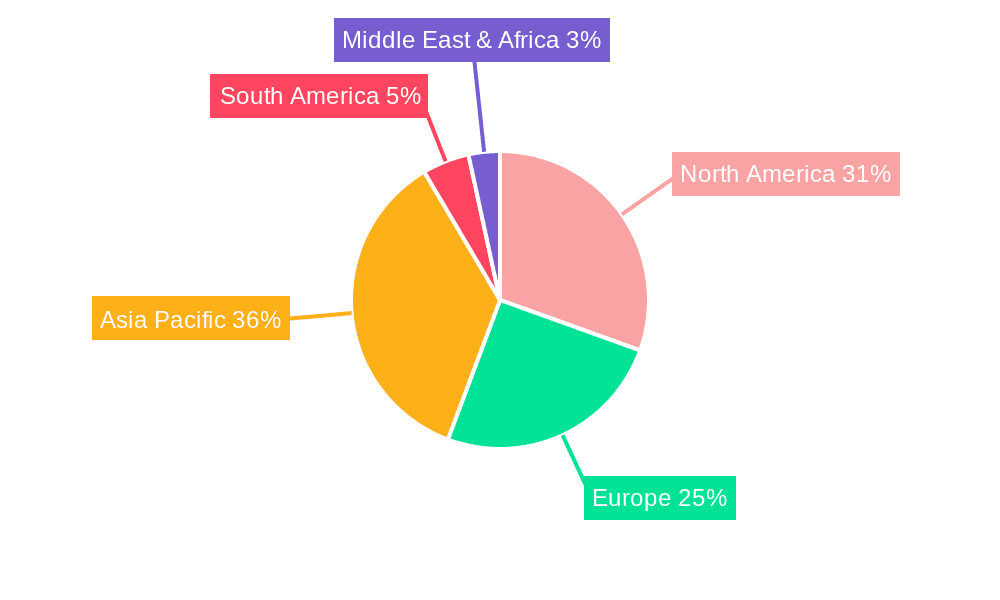

The global PE Stretch Film Packaging market is characterized by significant regional variations and segment-specific dominance. In terms of geographical influence, North America, particularly the United States, is poised to remain a dominant force in the PE Stretch Film Packaging market throughout the study period (2019-2033). The region's mature industrial base, extensive logistics network, and significant presence of large-scale manufacturers in sectors like food and beverage, retail, and general manufacturing contribute to its substantial demand. With an estimated production of 12 million units in 2025, North America's market size is driven by its advanced e-commerce penetration and a well-established supply chain infrastructure that relies heavily on efficient pallet stabilization. The Retail Industry within North America, projected to account for approximately 5 million units of demand in 2025, is a primary consumer, driven by the need to protect a vast array of consumer goods during transit from distribution centers to retail shelves and ultimately to end consumers.

However, the Asia-Pacific region, led by countries such as China and India, is exhibiting the fastest growth trajectory and is expected to significantly increase its market share in the coming years. By 2025, Asia-Pacific is projected to contribute an estimated 8 million units to the global production, with a Compound Annual Growth Rate (CAGR) significantly higher than other regions. This rapid expansion is fueled by the region's burgeoning manufacturing sector, increasing disposable incomes, a growing middle class, and the substantial growth of e-commerce. The Food Industry in Asia-Pacific, projected to demand around 4 million units in 2025, is a key driver, with increasing demand for packaged and processed foods.

Focusing on segments, Cast Machine Stretch Film is unequivocally the dominant type, estimated to account for over 20 million units of global production in 2025. Its superior properties, including high clarity, excellent puncture resistance, and consistent cling, make it the preferred choice for a wide range of applications, especially in high-volume industrial and retail settings where performance and visual appeal are crucial. The ability to produce thinner, high-performance films through the cast process also contributes to its dominance, aligning with sustainability trends.

Within applications, the Retail Industry (approximately 15 million units in 2025) and the Food Industry (approximately 10 million units in 2025) are the most significant contributors to global PE Stretch Film Packaging production. The sheer volume of goods handled by these sectors necessitates robust and reliable packaging. The Food Industry's demand is further amplified by stringent hygiene requirements and the need to extend product shelf life, making stretch film an integral part of its packaging ecosystem. While the Medical Industry's demand is smaller in absolute terms (estimated at 2 million units in 2025), its growth is driven by specialized requirements for sterility and tamper-evidence, presenting niche opportunities for advanced stretch film solutions.

The PE Stretch Film Packaging industry is propelled by several key growth catalysts that underpin its sustained expansion. The relentless surge in global e-commerce is a paramount driver, demanding secure and efficient packaging for millions of parcels delivered daily. Furthermore, the ongoing industrialization and expansion of manufacturing sectors worldwide, particularly in emerging economies, necessitate increased use of stretch film for palletizing and protecting goods during transit. The growing preference for convenience and extended shelf life in the food and beverage sector also fuels demand for hygienic and tamper-evident packaging solutions, where PE stretch film plays a crucial role.

This comprehensive report offers a 360-degree view of the PE Stretch Film Packaging market, meticulously analyzing trends, drivers, and challenges. It provides invaluable insights into regional dominance, with a particular focus on North America and the rapidly expanding Asia-Pacific region. Furthermore, the report delves into key segment analyses, highlighting the stronghold of Cast Machine Stretch Film and the significant contributions of the Retail and Food Industries to global production, estimated at approximately 15 million units and 10 million units respectively in 2025. Stakeholders will gain a deep understanding of market dynamics, growth catalysts, and the competitive landscape, empowering informed strategic decision-making for the forecast period of 2025-2033.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.1%.

Key companies in the market include Berry Global, Inc., Inteplast Group, AEP Industries (Berry Global), Paragon Films, Inc., Manuli Stretch, Uline, Sigma Plastics Group, Western Plastics, Raven Engineered Films, Malpack Ltd. (Coveris Company), Sigma Stretch Film, FlexSol Packaging Corp., .

The market segments include Type, Application.

The market size is estimated to be USD 3246.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pe Stretch Film Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pe Stretch Film Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.