1. What is the projected Compound Annual Growth Rate (CAGR) of the Liquid Bulk Container Liners?

The projected CAGR is approximately 6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Liquid Bulk Container Liners

Liquid Bulk Container LinersLiquid Bulk Container Liners by Type (Single Layer, Multi Layers), by Application (Food and Drinks, Chemical Industry, Petroleum, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

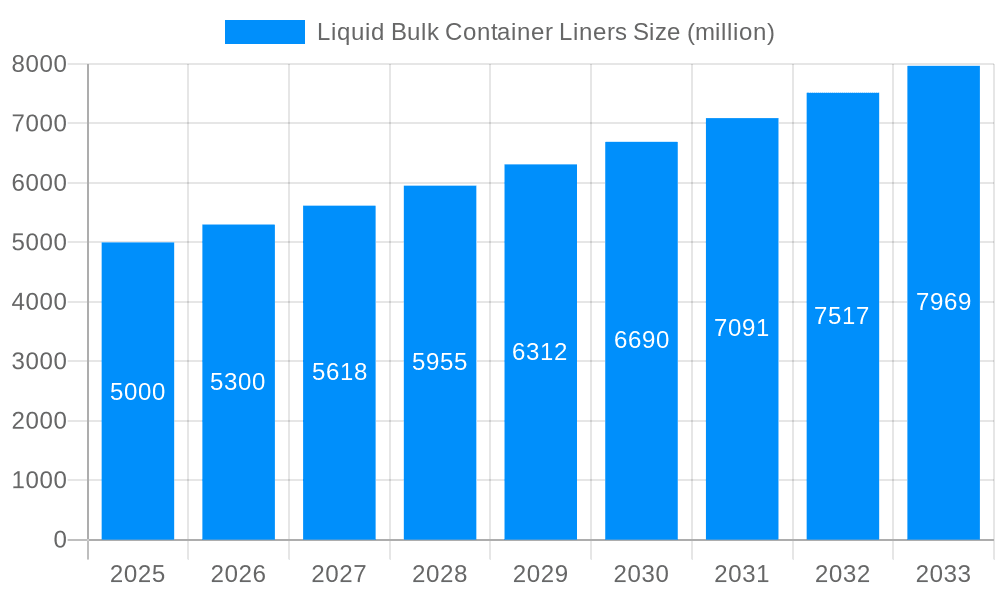

The global market for Liquid Bulk Container Liners is poised for substantial growth, projected to reach an estimated $5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6% from 2019 to 2033. This expansion is primarily driven by the increasing demand for efficient, safe, and cost-effective solutions for transporting liquids across various industries. The Food and Drinks sector stands out as a significant contributor, leveraging these liners to maintain product integrity and prevent contamination during transit. Similarly, the Chemical Industry and Petroleum sectors are increasingly adopting liquid bulk container liners for their ability to handle hazardous materials safely and minimize leakage risks. Innovations in material science and manufacturing processes are leading to the development of more durable, flexible, and sustainable liner options, further fueling market adoption. The trend towards larger volume transportation, coupled with stricter regulations concerning the safe handling of liquid goods, is creating a favorable environment for market expansion.

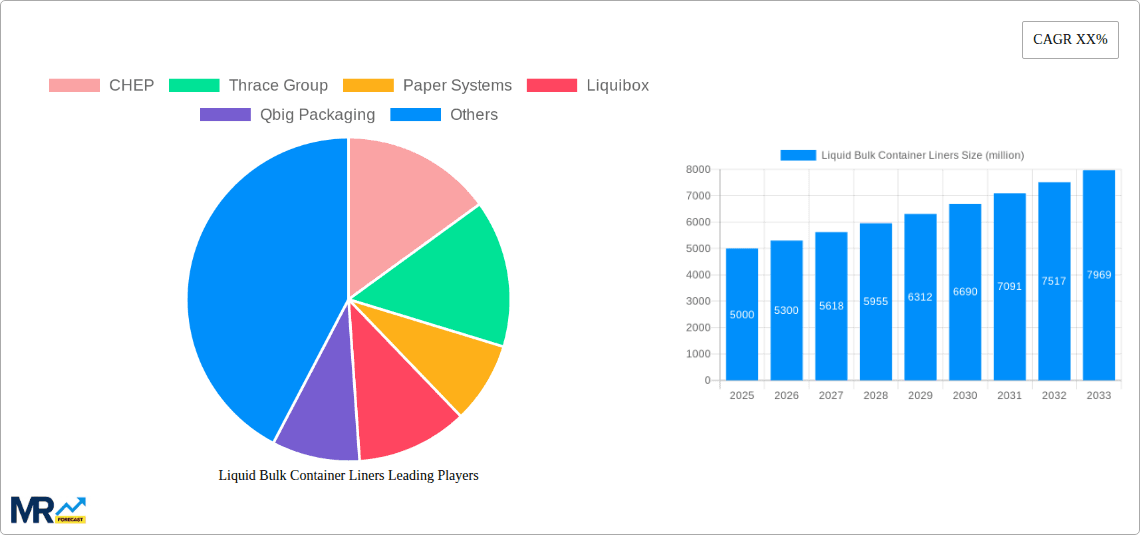

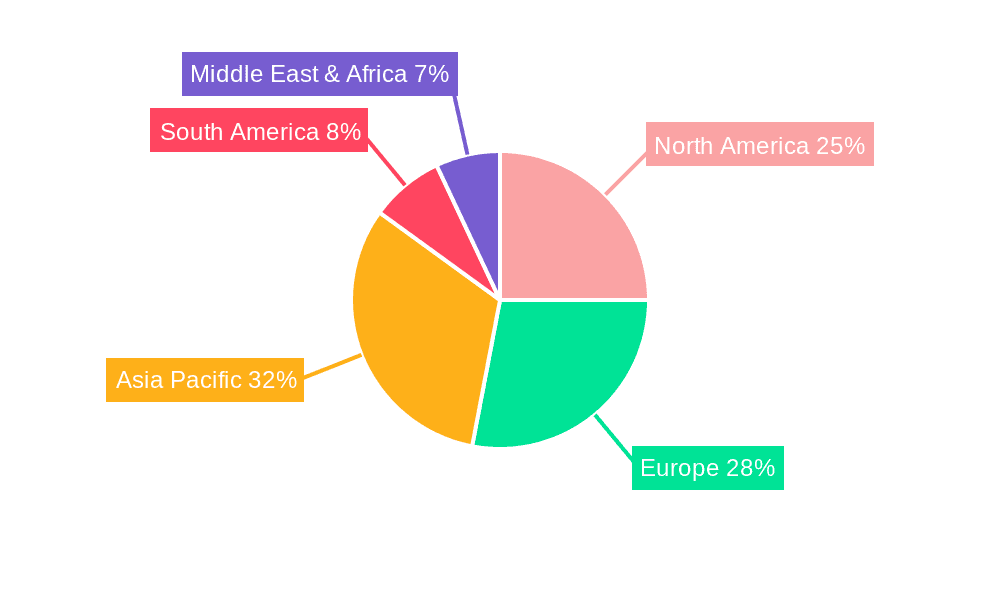

The market landscape is characterized by a competitive environment with key players like CHEP, Thrace Group, and Smurfit Kappa investing in advanced technologies and expanding their product portfolios to cater to diverse application needs. The emergence of multi-layer liners, offering enhanced barrier properties and resistance to chemicals and temperature fluctuations, is a notable trend. While the market is largely driven by these positive factors, potential restraints include the initial capital investment for some advanced liner systems and the need for specialized handling equipment in certain applications. However, the long-term benefits in terms of reduced product loss, lower cleaning costs for containers, and improved environmental compliance are expected to outweigh these considerations. The Asia Pacific region, particularly China and India, is anticipated to witness the fastest growth due to rapid industrialization and increasing trade volumes, making it a critical focus area for market participants.

This comprehensive report delves into the dynamic global market for Liquid Bulk Container Liners, offering an in-depth analysis and five-year forecast for the period of 2025-2033, with a historical review from 2019-2024. The market, estimated to reach $7.5 billion in the Base Year of 2025, is poised for significant expansion, driven by evolving industrial demands and increasing global trade. Our research meticulously examines key industry trends, identifies the principal growth drivers and restraints, and provides granular insights into regional dominance and segment-specific performance. The report is meticulously structured to offer actionable intelligence for stakeholders, including manufacturers, suppliers, end-users, and investors, enabling them to navigate this increasingly vital sector. We will present a nuanced understanding of the market landscape, projecting its trajectory through 2033.

The global Liquid Bulk Container Liners market is experiencing a transformative shift, characterized by a burgeoning demand for efficient, safe, and cost-effective solutions for the transportation and storage of liquid commodities. In the Base Year of 2025, the market is projected to be valued at a robust $7.5 billion, with projections indicating continued robust growth throughout the Forecast Period of 2025-2033. This expansion is underpinned by several interconnected trends. Firstly, the increasing globalization of supply chains for a diverse range of liquid products, from foodstuffs and beverages to industrial chemicals and petroleum derivatives, necessitates reliable containment solutions. Liquid bulk container liners offer a superior alternative to traditional drum or tote packaging, particularly for high-volume shipments, due to their ability to maximize cargo space within standard shipping containers, thereby reducing overall logistics costs. The Historical Period of 2019-2024 witnessed the initial acceleration of this trend, with a growing awareness among industries regarding the environmental and economic benefits of liner usage.

Furthermore, a significant trend is the increasing emphasis on product integrity and contamination prevention. Liquid bulk container liners, often constructed from food-grade or chemically inert materials, provide a hermetic barrier that protects the contents from external elements and prevents cross-contamination during transit. This is particularly crucial for the Food and Drinks and Chemical Industry segments, where product purity and safety are paramount. The development of advanced liner technologies, including multi-layer constructions offering enhanced barrier properties and puncture resistance, is also shaping the market. These innovations cater to the specific requirements of sensitive liquids, such as those prone to oxidation or degradation. The "Other" segment, encompassing a wide array of niche applications, is also contributing to market diversification, with custom-engineered liners addressing unique industry challenges. The Study Period of 2019-2033 encompasses the entire evolution of these trends, from their nascent stages to their mature integration into global logistics strategies, with the Estimated Year of 2025 serving as a pivotal point for current market valuation and immediate future outlook.

The ascent of the Liquid Bulk Container Liners market is primarily propelled by an confluence of economic, environmental, and operational imperatives. The paramount driver is the relentless pursuit of cost optimization within global logistics. By leveraging the inherent design of shipping containers, liquid bulk liners allow for the efficient maximization of cargo volume, significantly reducing the per-unit cost of transporting liquids compared to traditional packaging methods like drums or intermediate bulk containers (IBCs). This economic advantage is particularly attractive for high-volume commodity movements across industries such as Petroleum and Chemical Industry. The Study Period of 2019-2033 has witnessed a heightened awareness of these cost efficiencies.

Complementing this economic imperative is the growing global focus on sustainability and environmental responsibility. Liquid bulk liners offer a demonstrably greener alternative by minimizing packaging waste. Unlike single-use drums or totes, a single liner replaces multiple smaller containers, reducing landfill burden and the carbon footprint associated with manufacturing and disposing of such packaging. This environmental benefit resonates strongly with industries and consumers alike, pushing for more eco-conscious supply chain practices. The Base Year of 2025, valued at an estimated $7.5 billion, is a testament to this growing adoption. Moreover, the inherent safety features of liquid bulk liners are a critical driving force. They provide a secure and leak-proof containment solution, thereby minimizing the risk of product spillage, environmental contamination, and potential hazards during transit. This enhanced safety profile is crucial for the transportation of hazardous chemicals and sensitive food products, driving adoption across diverse segments.

Despite the robust growth trajectory, the Liquid Bulk Container Liners market is not without its formidable challenges and restraints. A primary concern revolves around the initial investment and infrastructure requirements for adopting bulk liquid transportation systems. While liners themselves are cost-effective in the long run, the transition often necessitates investment in specialized filling and discharge equipment, which can be a significant barrier for smaller enterprises or those in less developed regions. This upfront cost can impede the widespread adoption, particularly in the Historical Period of 2019-2024 and the initial years of the Forecast Period.

Furthermore, the perceived risk associated with single-point-of-failure in bulk liquid packaging remains a significant hurdle for certain highly sensitive or extremely hazardous liquid applications. While advancements in liner technology have significantly improved reliability, concerns about potential leaks or ruptures during transit, especially in demanding logistical environments, can deter some potential users. The stringent regulatory landscape surrounding the transportation of certain chemicals and food products also presents a challenge. Ensuring compliance with varying international and regional regulations regarding container integrity, material certifications, and product compatibility requires constant vigilance and can add complexity to the adoption process. The Base Year of 2025, with an estimated market value of $7.5 billion, is still navigating these complexities. The availability and cost of specialized raw materials used in high-performance liners can also fluctuate, impacting production costs and final product pricing, thereby acting as a restraint on market expansion.

The global Liquid Bulk Container Liners market is characterized by regional variations in demand and a clear segmentation based on product type and application. Among the key regions, Asia Pacific is poised to emerge as a dominant force, driven by its rapidly expanding manufacturing base, burgeoning export markets, and increasing adoption of efficient logistics solutions. Countries like China and India, with their extensive industrial capacities in the Chemical Industry and Food and Drinks sectors, are significant consumers of liquid bulk container liners. The growing emphasis on streamlining supply chains and reducing transportation costs in this region, coupled with increasing investments in infrastructure, further bolsters demand. The region's large population and rising disposable incomes also contribute to a substantial demand for packaged food and beverages, indirectly driving the need for reliable liquid transport solutions. The Study Period of 2019-2033 will witness this ascendancy.

Within this dynamic regional landscape, the Chemical Industry segment is projected to be a consistent leader in dominating the market. The inherent need for safe, secure, and contamination-free transportation of a vast array of industrial chemicals, including solvents, acids, bases, and specialty chemicals, makes liquid bulk container liners an indispensable solution. These liners offer superior protection against leaks and spills, which are critical concerns in chemical handling due to potential environmental and safety hazards. The ability of liners to handle diverse chemical compatibilities, from corrosive substances to sensitive reagents, further solidifies their position in this sector. The market value of $7.5 billion in the Base Year of 2025 is significantly influenced by this segment.

Another segment exhibiting strong dominance, particularly within the Food and Drinks application, is the Multi Layers type of liquid bulk container liners. The increasing demand for extended shelf-life products, the need to preserve flavor and nutritional integrity, and the stringent hygiene requirements in the food and beverage industry necessitate advanced barrier properties. Multi-layer liners, often incorporating specialized films like polyethylene, EVOH, or nylon, provide exceptional protection against oxygen, moisture, and other contaminants that can degrade food products. This is particularly crucial for bulk transportation of edible oils, dairy products, juices, and other sensitive consumables. The Food and Drinks application, leveraging the benefits of Multi Layers liners, will continue to be a substantial revenue generator throughout the Forecast Period of 2025-2033. The seamless integration of these liner types within the broader logistics framework of these dominant segments, supported by ongoing technological advancements, will ensure their continued market leadership.

The Liquid Bulk Container Liners industry is experiencing robust growth fueled by several key catalysts. The increasing global demand for bulk liquid transportation, driven by international trade and industrial expansion, is a primary growth engine. Furthermore, a growing awareness and emphasis on sustainable packaging solutions are steering industries towards more eco-friendly options like liners, which minimize waste and carbon footprint. The continuous innovation in material science, leading to the development of more resilient, chemically resistant, and food-grade liners, also opens up new application possibilities and enhances product performance, thereby accelerating market penetration.

This report provides a holistic view of the Liquid Bulk Container Liners market, spanning from 2019 to 2033. It offers an exhaustive analysis of market dynamics, identifying key trends, growth drivers, and potential challenges. The report meticulously examines each segment, including liner types like Single Layer and Multi Layers, and applications such as Food and Drinks, Chemical Industry, and Petroleum. With a Base Year of 2025, the report presents detailed market valuations and forecasts for the period 2025-2033, building upon historical data from 2019-2024. Stakeholders will gain comprehensive insights into the market's present state and future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6%.

Key companies in the market include CHEP, Thrace Group, Paper Systems, Liquibox, Qbig Packaging, Arena Products, CDF Corporation, Peak Packaging, Smurfit Kappa, ILC Dover, Bulk Liquid Solutions, Qingdao LAF Packaging, Evropac, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Liquid Bulk Container Liners," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Liquid Bulk Container Liners, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.