1. What is the projected Compound Annual Growth Rate (CAGR) of the Antistatic Plastic Reels?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Antistatic Plastic Reels

Antistatic Plastic ReelsAntistatic Plastic Reels by Type (4 inch, 7 inch, 13 inch, 15 inch, 22 inch, Other), by Application (Carrier Tape, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

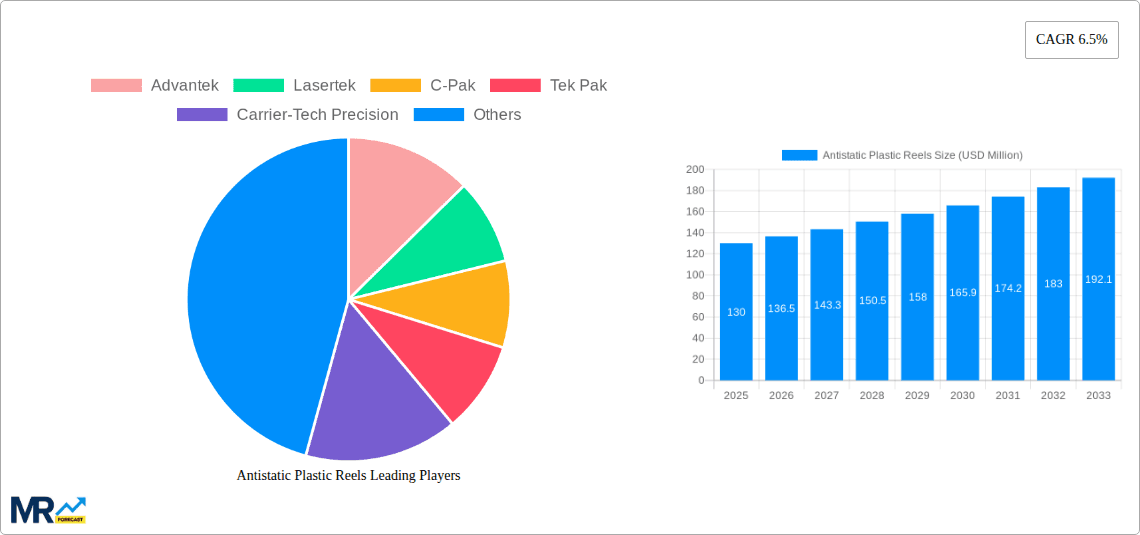

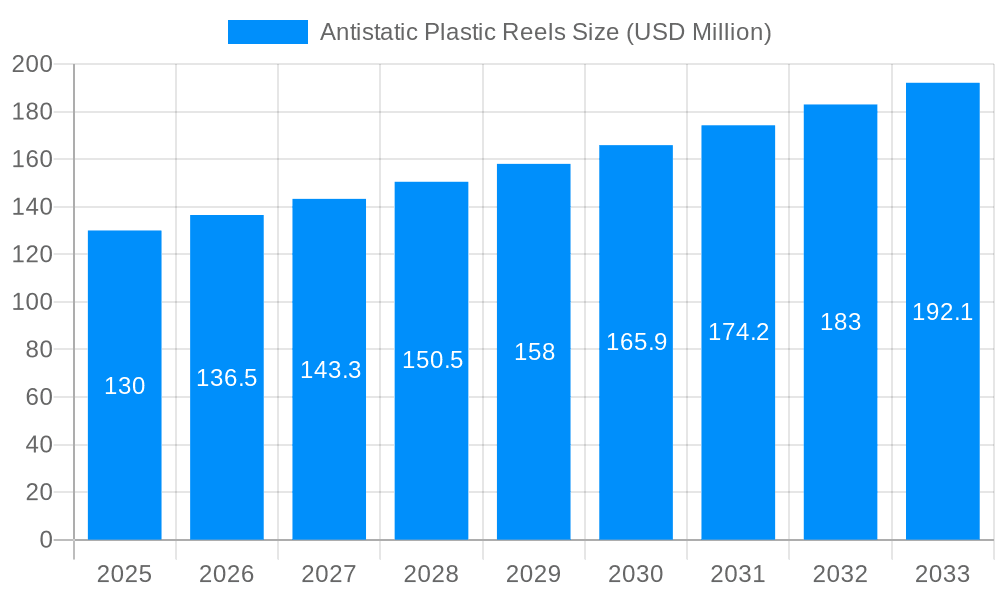

The global Antistatic Plastic Reels market is poised for steady growth, driven by the increasing demand for sensitive electronic components and the imperative to protect them from electrostatic discharge (ESD). The market, valued at approximately USD 130 million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033. This growth is primarily fueled by the burgeoning electronics manufacturing sector, particularly in regions like Asia Pacific, where the production of smartphones, semiconductors, and other advanced devices continues to escalate. The need for reliable and efficient packaging solutions that prevent damage to delicate circuitry is paramount, making antistatic reels an indispensable component in the supply chain. Key applications such as carrier tapes, integral to automated component placement, will continue to be a major demand driver, alongside other specialized uses within the broader electronics and industrial sectors.

The market's trajectory is further shaped by ongoing technological advancements and evolving industry standards for ESD protection. While the demand for antistatic plastic reels is robust, certain restraints such as fluctuating raw material costs and the emergence of alternative protective materials could influence market dynamics. However, the inherent benefits of plastic reels, including their durability, cost-effectiveness, and reusability, are expected to outweigh these challenges. Key players like Advantek, Lasertek, and Futaba Corporation are actively investing in product innovation and expanding their manufacturing capacities to meet the growing global demand. The market is segmented by reel types, with 7-inch and 13-inch variants likely to dominate due to their widespread adoption in automated assembly lines, while applications will predominantly revolve around carrier tapes and other essential electronic component handling.

Here is a unique report description for Antistatic Plastic Reels, incorporating your specific instructions and data:

The antistatic plastic reels market is poised for robust growth, projected to reach USD 3.5 billion by 2033, showcasing a Compound Annual Growth Rate (CAGR) of approximately 6.2% from a base year of 2025. This expansion is fundamentally driven by the escalating demand for high-precision electronic components across a burgeoning array of industries, including automotive, consumer electronics, and telecommunications. The increasing miniaturization and sensitivity of these components necessitate advanced packaging solutions that can effectively mitigate electrostatic discharge (ESD) risks. The study period, spanning from 2019 to 2033, highlights a consistent upward trajectory, with the historical period (2019-2024) laying the groundwork for the substantial projected market value by 2025. The forecast period (2025-2033) anticipates continued innovation and market penetration, fueled by technological advancements and evolving industry standards. Key market insights reveal a growing preference for sustainable and recyclable antistatic reel materials, aligning with global environmental initiatives. Furthermore, the expansion of smart manufacturing and the Internet of Things (IoT) is creating new application frontiers for antistatic plastic reels, requiring specialized solutions for the safe handling and transportation of sensitive electronic devices. The market dynamics are also being influenced by the increasing complexity of supply chains, demanding reliable and consistent ESD protection throughout the entire logistics network. As the digital transformation continues to permeate various sectors, the need for safeguarding delicate electronic parts from static electricity will only intensify, solidifying the antistatic plastic reels market’s significance. The global adoption of advanced semiconductor manufacturing processes, which are inherently susceptible to ESD damage, further underscores the critical role of these reels in ensuring product integrity and reliability. The market is also witnessing a gradual shift towards customized reel solutions tailored to specific component sizes and handling requirements, thereby enhancing operational efficiency for manufacturers.

Several key factors are driving the significant growth witnessed in the antistatic plastic reels market. Foremost among these is the relentless advancement in semiconductor technology and the increasing complexity of electronic components. As devices become smaller and more intricate, their susceptibility to electrostatic discharge (ESD) damage escalates dramatically. This has made antistatic plastic reels indispensable for manufacturers seeking to protect their sensitive products during storage, handling, and transportation. The proliferation of the Internet of Things (IoT) and the burgeoning automotive electronics sector are also major contributors. With billions of interconnected devices and increasingly sophisticated in-car electronics, the demand for reliable ESD protection solutions has surged. The growing emphasis on quality control and product reliability across all electronic manufacturing sectors further necessitates the use of antistatic packaging. Stringent industry regulations and standards related to ESD control, particularly in sensitive industries like aerospace and medical devices, compel manufacturers to adopt high-performance antistatic reel solutions, thus propelling market expansion. The sustained investment in research and development by key players, leading to the introduction of innovative materials and enhanced ESD protective properties, also plays a pivotal role in driving market adoption and segment expansion. The global economic recovery and the subsequent increase in manufacturing output, particularly in the electronics sector, are also contributing to the heightened demand for these essential packaging components.

Despite the promising growth trajectory, the antistatic plastic reels market is not without its challenges and restraints. One of the primary hurdles is the fluctuating raw material costs. The production of antistatic plastics relies on specific chemical additives and polymers, whose prices can be subject to global market volatility. This unpredictability in input costs can impact the profitability of manufacturers and potentially lead to price increases for end-users, which could dampen demand in price-sensitive segments. Furthermore, stringent regulatory requirements and the need for certifications can pose a significant barrier for smaller or new market entrants. Obtaining and maintaining compliance with various international ESD standards and environmental regulations requires substantial investment in testing, quality control, and documentation, which can be prohibitive for some. Another significant restraint is the competition from alternative packaging solutions. While antistatic plastic reels are a dominant force, other ESD protection methods, such as conductive packaging or specialized static-shielding bags, can offer comparable protection in certain applications. The development and adoption of these alternatives could potentially limit the market share growth of antistatic plastic reels. Moreover, technological obsolescence is a constant threat. As electronic components evolve rapidly, there is an ongoing need for antistatic reel manufacturers to innovate and adapt their product offerings to meet new ESD protection demands, requiring continuous investment in R&D. The global supply chain disruptions, which have become more prevalent in recent years, can also impact the availability and timely delivery of antistatic plastic reels, potentially affecting production schedules for end-users. Finally, consumer and industry perception regarding the environmental impact of plastic packaging, even antistatic varieties, can create headwinds.

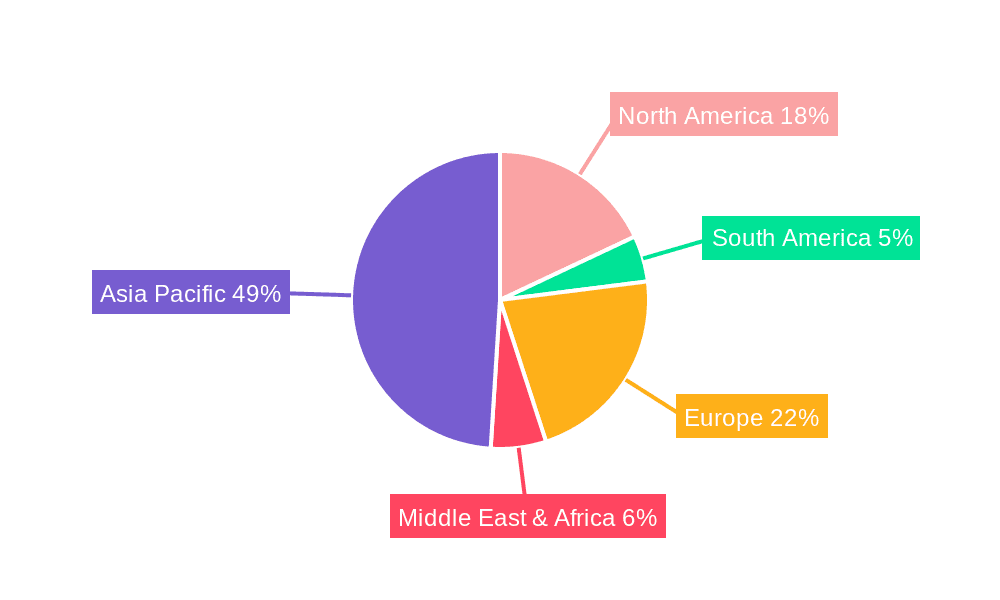

The Asia-Pacific region is overwhelmingly poised to dominate the antistatic plastic reels market, with a projected market share exceeding USD 1.5 billion by 2033. This dominance is underpinned by several critical factors, including the region's status as the global manufacturing hub for electronics, an immense and growing domestic demand for consumer electronics, and the presence of leading semiconductor fabrication plants. Countries like China, South Korea, Taiwan, and Japan are at the forefront of electronics production and innovation, necessitating a vast and consistent supply of antistatic plastic reels for their extensive manufacturing operations. The rapid industrialization and urbanization in emerging economies within the Asia-Pacific further fuel the demand for electronic devices, consequently driving the need for protective packaging solutions like antistatic reels.

Within this dominant region, the 7-inch and 15-inch antistatic plastic reels are anticipated to lead the market significantly. The 7-inch reels are crucial for the packaging of a wide array of small-to-medium sized electronic components, including surface-mount devices (SMDs), microchips, and discrete components that are ubiquitous in smartphones, wearable devices, and other consumer electronics. The sheer volume of these components manufactured globally makes the 7-inch segment a powerhouse in terms of unit sales.

The 15-inch reels, on the other hand, cater to the packaging of larger and more complex electronic components, such as connectors, larger ICs, and power semiconductors. These are increasingly critical in the burgeoning automotive electronics sector and in industrial automation equipment. As vehicles become more electrified and autonomous, and as factories embrace Industry 4.0, the demand for these larger reels for their sophisticated electronic systems is set to skyrocket. The application segment of Carrier Tape is directly intertwined with the dominance of these reel sizes. Carrier tapes, which are custom-designed to hold electronic components securely within the reels, are essential for automated pick-and-place machines used in high-volume electronics manufacturing. The evolution of carrier tape designs, offering enhanced protection and component retention, further solidifies the demand for accompanying antistatic plastic reels. Companies like Advantek, Lasertek, and Guann Ming Industrial, with strong manufacturing bases in Asia, are strategically positioned to capitalize on this regional and segmental dominance, leveraging their production capabilities and established distribution networks to serve the massive demand. The consistent growth in the production of printed circuit boards (PCBs) and the increasing adoption of advanced packaging technologies in the Asia-Pacific also contribute to the strong performance of these specific reel sizes and the carrier tape application.

The antistatic plastic reels industry is experiencing robust growth fueled by several key catalysts. The relentless demand for smaller and more sensitive electronic components across diverse industries, from consumer electronics to automotive and medical devices, necessitates superior ESD protection. The accelerating adoption of IoT devices and the expansion of 5G infrastructure create a surge in the production of sophisticated electronic modules that require reliable packaging. Furthermore, growing awareness and stringent regulations concerning ESD damage prevention are pushing manufacturers towards adopting advanced antistatic solutions. The trend towards automation in manufacturing and logistics further emphasizes the need for standardized and reliable packaging like antistatic reels for efficient handling and transportation.

This comprehensive report provides an in-depth analysis of the global antistatic plastic reels market, offering invaluable insights for stakeholders. It meticulously covers market dynamics, including the significant growth drivers and potential challenges that shape the industry's landscape. The report delves into the intricate trends and forecasts, projecting the market to reach USD 3.5 billion by 2033, with a detailed breakdown of market segmentation by type, application, and end-user industry. It highlights key regions and countries poised for substantial market share, with a particular focus on the Asia-Pacific region's dominance. Furthermore, the report provides a thorough overview of the competitive landscape, profiling leading players and their strategic initiatives. It also examines significant industry developments and technological advancements, offering a forward-looking perspective on the evolution of antistatic plastic reels.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Advantek, Lasertek, C-Pak, Tek Pak, Carrier-Tech Precision, Accu Tech Plastics, ROTHE, K-TECH, Guann Ming Industrial, Reel Service, SuperMount Pack, TCTEC, Dongguan Baizhou New Material, SWS-Packaging GmbH, Futaba Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Antistatic Plastic Reels," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Antistatic Plastic Reels, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.