1. What is the projected Compound Annual Growth Rate (CAGR) of the Sustainable Pharmaceutical Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sustainable Pharmaceutical Packaging

Sustainable Pharmaceutical PackagingSustainable Pharmaceutical Packaging by Type (Plastic, Metal, Glass, Paperboard), by Application (Pharmaceutical, Hospital, Clinic Center, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

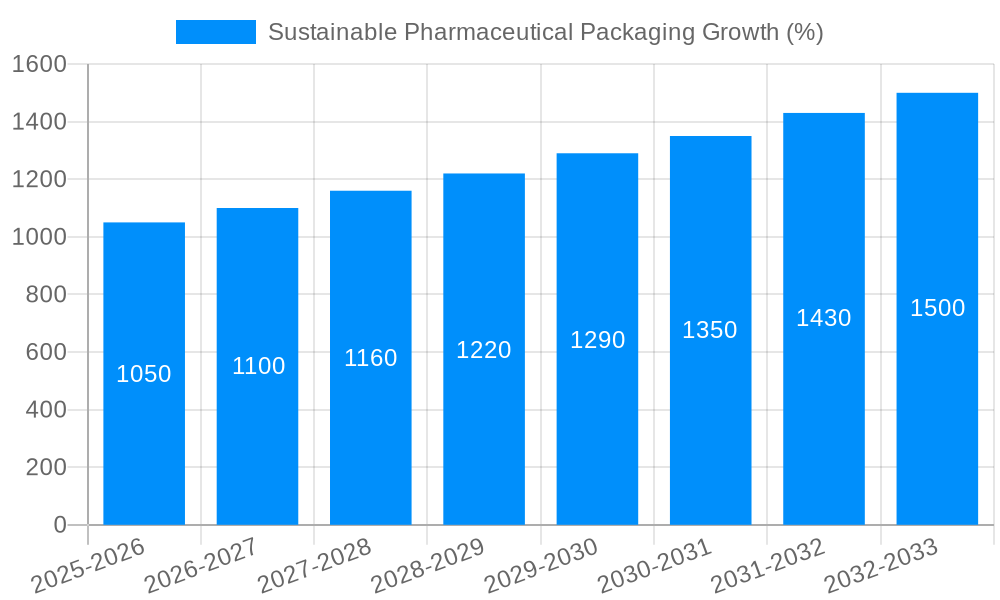

The global Sustainable Pharmaceutical Packaging market is experiencing robust growth, projected to reach a significant market size of approximately $30,000 million by 2025. This expansion is fueled by a compound annual growth rate (CAGR) of roughly 8.5% over the forecast period of 2025-2033. The increasing awareness among pharmaceutical companies and regulatory bodies regarding the environmental impact of traditional packaging materials is a primary driver. This shift towards sustainability is not merely an ethical imperative but also a strategic business move, as consumers and healthcare providers increasingly favor eco-friendly options. Innovations in materials science, leading to the development of biodegradable, compostable, and recyclable alternatives, are further propelling market adoption. Furthermore, stringent government regulations aimed at reducing plastic waste and promoting circular economy principles are creating a favorable landscape for sustainable packaging solutions in the pharmaceutical industry. The demand is particularly high for packaging that ensures product integrity and safety while minimizing its environmental footprint.

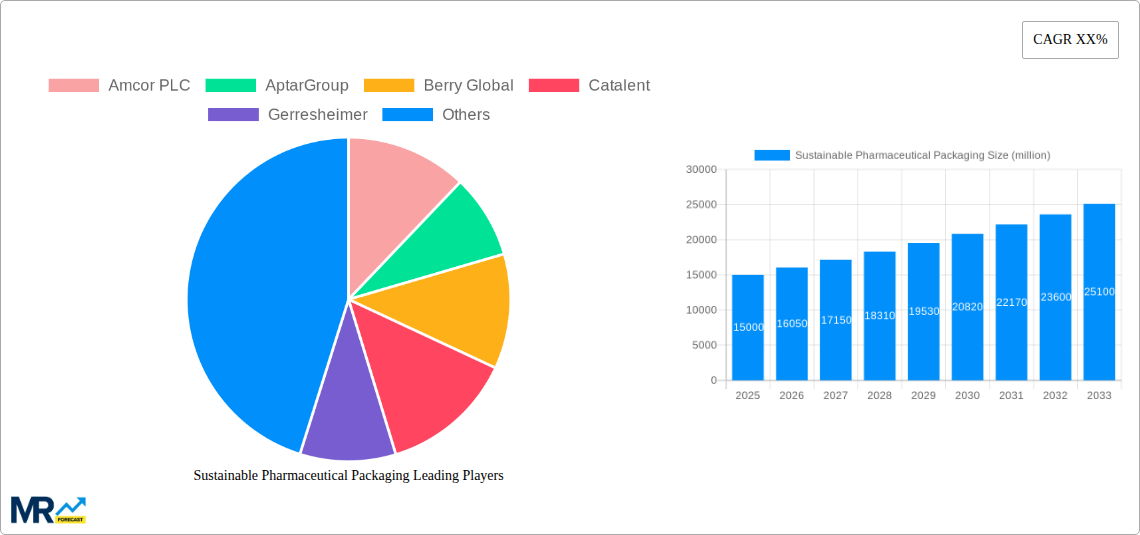

The market segmentation reveals a dynamic interplay of material preferences and application needs. While plastic currently holds a substantial share due to its versatility and cost-effectiveness, its sustainable variants are gaining traction. Metal and glass packaging are also significant, particularly for sensitive pharmaceuticals requiring enhanced protection. Paperboard is emerging as a strong contender, especially for secondary packaging, with advancements in barrier coatings enhancing its suitability for direct product contact. In terms of application, the pharmaceutical sector itself represents the largest consumer, followed closely by hospitals and clinic centers, all seeking to align their operations with sustainability goals. The trend towards advanced drug delivery systems and biologics further necessitates specialized sustainable packaging solutions. Key players like Amcor PLC, AptarGroup, and Berry Global are at the forefront of this transformation, investing heavily in research and development to offer innovative and compliant sustainable packaging. Challenges such as the initial cost of implementation and the need for robust supply chain integration are being addressed through technological advancements and collaborative efforts.

This report provides an in-depth analysis of the global Sustainable Pharmaceutical Packaging market, offering a comprehensive understanding of its current landscape and future trajectory. Spanning the historical period of 2019-2024 and projecting forward to 2033, with a base and estimated year of 2025, the report delves into critical market dynamics, growth drivers, and prevailing challenges. We project a significant expansion of the market, with volumes anticipated to reach XXX million units by the end of the forecast period. The study meticulously examines the evolving industry, detailing key trends, strategic initiatives by leading players, and the impact of technological advancements. Through rigorous data analysis and expert insights, this report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within the sustainable pharmaceutical packaging sector.

The global pharmaceutical packaging market is undergoing a profound transformation, driven by an escalating demand for eco-friendly and sustainable solutions. This paradigm shift is not merely a response to regulatory pressures but a proactive embrace of environmental responsibility by pharmaceutical manufacturers, packaging providers, and increasingly, informed consumers. The historical period of 2019-2024 has witnessed a discernible acceleration in the adoption of sustainable materials and practices, with the base year of 2025 serving as a critical juncture for established trends. Consumers, highly conscious of their ecological footprint, are actively seeking products with minimal environmental impact, influencing brand choices and driving innovation. Pharmaceutical companies, in turn, are recognizing that sustainable packaging is no longer a niche offering but a core component of their corporate social responsibility and a significant differentiator in a competitive marketplace. This evolution is evident in the increasing investment in research and development for biodegradable, compostable, and recyclable packaging alternatives. Furthermore, the advent of novel manufacturing processes that minimize waste and energy consumption is playing a crucial role. The forecast period of 2025-2033 is expected to see these trends solidify, with a greater emphasis on circular economy principles, where packaging materials are designed for reuse or effective recycling, thereby reducing reliance on virgin resources. The integration of smart packaging technologies that enhance product integrity and trackability while maintaining sustainability credentials will also be a defining characteristic of this era. The sheer volume of pharmaceutical products manufactured globally, estimated in the hundreds of millions of units annually, underscores the immense potential and critical importance of these sustainable initiatives. The focus extends beyond the primary packaging to include secondary and tertiary packaging, encompassing everything from blister packs and vials to shipping containers and labels. The market's trajectory is a testament to the industry's commitment to balancing patient safety and efficacy with environmental stewardship, setting a precedent for other consumer goods sectors. The integration of advanced materials science and innovative design thinking will continue to shape this landscape, leading to solutions that are not only environmentally sound but also cost-effective and efficient for the pharmaceutical supply chain.

The rapid ascent of sustainable pharmaceutical packaging is not a serendipitous event but a confluence of powerful forces shaping the industry. Foremost among these is the increasingly stringent regulatory landscape. Governments worldwide are enacting legislation that mandates the use of eco-friendly packaging, promotes recycling initiatives, and sets targets for waste reduction. These regulations create a clear imperative for pharmaceutical companies to adapt their packaging strategies, investing in compliant and sustainable alternatives. Public awareness and consumer demand are equally potent drivers. Patients and healthcare providers are more informed than ever about the environmental impact of consumer goods, including pharmaceuticals. This heightened awareness translates into a preference for brands that demonstrate a commitment to sustainability, influencing purchasing decisions and brand loyalty. Consequently, pharmaceutical companies are recognizing that embracing sustainable packaging is crucial for maintaining a positive brand image and meeting stakeholder expectations. Furthermore, advancements in material science and packaging technology are unlocking new possibilities for sustainable solutions. Innovations in biodegradable polymers, recyclable barrier films, and eco-friendly inks are providing manufacturers with a wider array of viable and effective packaging options. The economic benefits, though sometimes perceived as an initial hurdle, are also becoming increasingly apparent. Reduced material costs through lightweighting, lower waste disposal fees, and enhanced brand reputation can contribute to long-term profitability. The collective impact of these forces creates a powerful momentum, pushing the sustainable pharmaceutical packaging market towards significant growth and innovation throughout the study period of 2019-2033, with the base year of 2025 marking a crucial inflection point in adoption rates. The sheer volume of pharmaceutical products being produced globally, likely in the XXX million units range annually, amplifies the impact of these drivers, making the transition to sustainability not just a choice but a necessity.

Despite the compelling advantages and growing momentum, the widespread adoption of sustainable pharmaceutical packaging faces several significant challenges and restraints. The primary concern revolves around maintaining the stringent safety and efficacy standards required for pharmaceutical products. Sustainable materials must offer equivalent or superior barrier properties to protect medications from moisture, light, oxygen, and contamination, ensuring product integrity throughout its shelf life. This often requires extensive research, development, and rigorous testing, which can be time-consuming and costly. Another major hurdle is the cost of transitioning to sustainable packaging. While the long-term benefits are evident, the initial investment in new materials, manufacturing processes, and equipment can be substantial, particularly for smaller pharmaceutical companies or those operating on tight margins. The availability and scalability of certain sustainable materials can also be a limiting factor. While innovations are emerging rapidly, the global supply chains for some bio-based or highly specialized recyclable materials may not yet be robust enough to meet the immense demand from the pharmaceutical industry, which deals with hundreds of millions of units of packaging each year. Furthermore, consumer perception and education play a crucial role. While consumers generally favor sustainability, there can be confusion or skepticism regarding the actual environmental benefits of certain "green" claims, or concerns about the performance of new packaging formats. The infrastructure for collection and recycling of these new materials also needs to be well-established and accessible across various regions to ensure effective end-of-life management. Finally, the complex regulatory requirements within the pharmaceutical sector can create inertia. Any change in packaging material or design necessitates thorough validation and regulatory approval, which can be a lengthy and bureaucratic process, slowing down the adoption of innovative sustainable solutions.

The global Sustainable Pharmaceutical Packaging market is poised for significant growth, with certain regions and segments expected to lead this expansion. The Plastic segment, in particular, is anticipated to maintain its dominance, albeit with a significant shift towards more sustainable forms of plastic. This includes the increasing use of recycled content, bio-based plastics derived from renewable resources, and the development of advanced polymers that are more readily recyclable. The sheer versatility, cost-effectiveness, and established manufacturing infrastructure for plastics make it a difficult segment to dislodge entirely. However, the emphasis will be on innovation within this segment to meet sustainability goals, with the projected XXX million units of plastic packaging used in the pharmaceutical sector evolving towards eco-friendlier options.

The Application segment of Pharmaceutical itself will, by definition, be the largest driver of demand. Within this, the packaging for solid dosage forms (tablets and capsules) will continue to represent a substantial portion, with blister packs and bottles being key areas for sustainable innovation. However, the growth in biologics and specialized therapies is also driving demand for sophisticated, yet sustainable, primary packaging solutions that can ensure product stability and integrity.

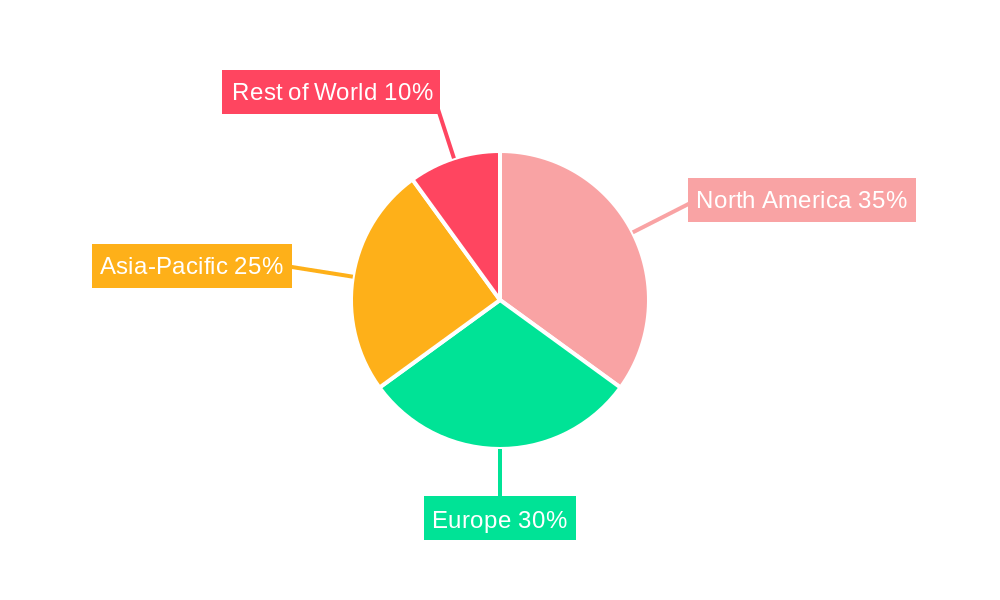

In terms of Key Regions, North America and Europe are expected to be at the forefront of the sustainable pharmaceutical packaging market. Both regions boast strong regulatory frameworks that encourage environmental responsibility, coupled with a highly informed and environmentally conscious consumer base. Governments in these regions are actively implementing policies to reduce plastic waste and promote the circular economy, pushing pharmaceutical companies to invest heavily in sustainable packaging solutions. The presence of major pharmaceutical manufacturers and advanced packaging technology providers in these regions further fuels innovation and adoption. For instance, in North America, the increasing focus on Extended Producer Responsibility (EPR) schemes and the growing preference for recyclable materials are significant drivers. In Europe, the European Green Deal and the Circular Economy Action Plan are directly influencing packaging choices, with a strong emphasis on achieving higher recycling rates and reducing single-use packaging. The market volume here, encompassing a significant portion of the global XXX million units, will reflect these proactive measures.

While North America and Europe are expected to lead, the Asia-Pacific region, particularly countries like China and India, presents a substantial growth opportunity. As these economies continue to develop and their pharmaceutical industries expand to meet the needs of their large populations (contributing significantly to the overall XXX million units of packaging), there is a growing awareness and adoption of sustainable practices. Government initiatives to curb pollution and promote green manufacturing are gaining traction, creating a fertile ground for sustainable packaging solutions. Early adoption in these regions, driven by both regulatory push and growing consumer demand, will be crucial for their market share. The sheer scale of the pharmaceutical production in this region means that even incremental shifts towards sustainability will have a significant global impact. The integration of advanced materials and recycling technologies, coupled with a growing emphasis on environmental stewardship, positions these regions as key players in the future of sustainable pharmaceutical packaging.

Several key catalysts are igniting growth in the sustainable pharmaceutical packaging industry. Stringent government regulations mandating eco-friendly packaging and waste reduction are a primary driver. Growing consumer awareness and preference for environmentally responsible brands are pushing pharmaceutical companies to adopt greener solutions. Furthermore, continuous advancements in material science, leading to the development of innovative biodegradable, compostable, and easily recyclable packaging materials, are making sustainable options more viable and cost-effective. Investment in research and development by leading players is further accelerating this trend, making sustainable packaging an integral part of the pharmaceutical supply chain.

This report offers a comprehensive exploration of the global Sustainable Pharmaceutical Packaging market, covering the historical period from 2019 to 2024 and projecting growth up to 2033, with 2025 serving as both the base and estimated year. It delves into critical market insights, driving forces, and inherent challenges. Key regions and dominant segments within the market are meticulously analyzed. Leading players and significant industry developments are highlighted, providing stakeholders with an indispensable resource for understanding and navigating this dynamic sector. The report's detailed analysis of market trends, encompassing material innovations, regulatory impacts, and consumer preferences, will equip businesses with the knowledge to make informed strategic decisions and capitalize on the burgeoning opportunities within sustainable pharmaceutical packaging, contributing to an estimated market volume of XXX million units by the end of the forecast period.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amcor PLC, AptarGroup, Berry Global, Catalent, Gerresheimer, Schott AG, UPM Specialty Papers, WestRock.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Sustainable Pharmaceutical Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sustainable Pharmaceutical Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.