1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Chemical Packaging?

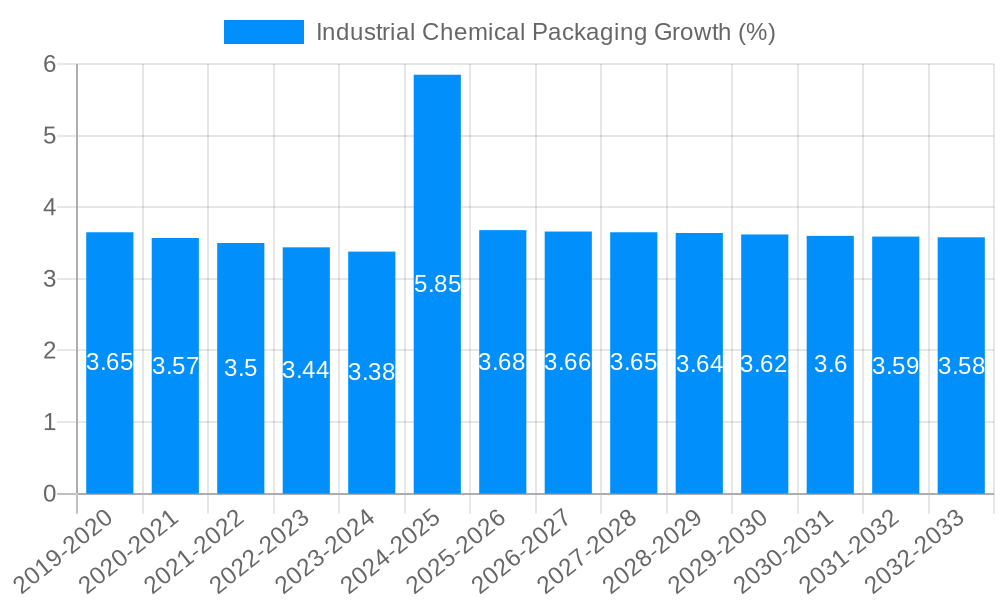

The projected CAGR is approximately 3.61%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Industrial Chemical Packaging

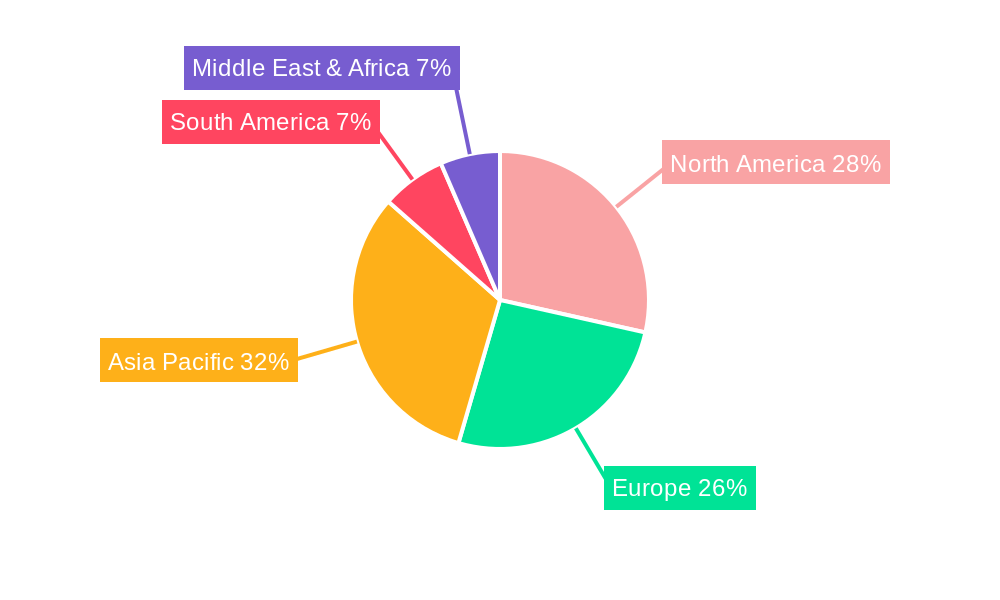

Industrial Chemical PackagingIndustrial Chemical Packaging by Type (/> Hazardous Chemical Packaging, Non-hazardous Chemical Packaging), by Application (/> Pharmaceutical Industry, Water Treatment Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

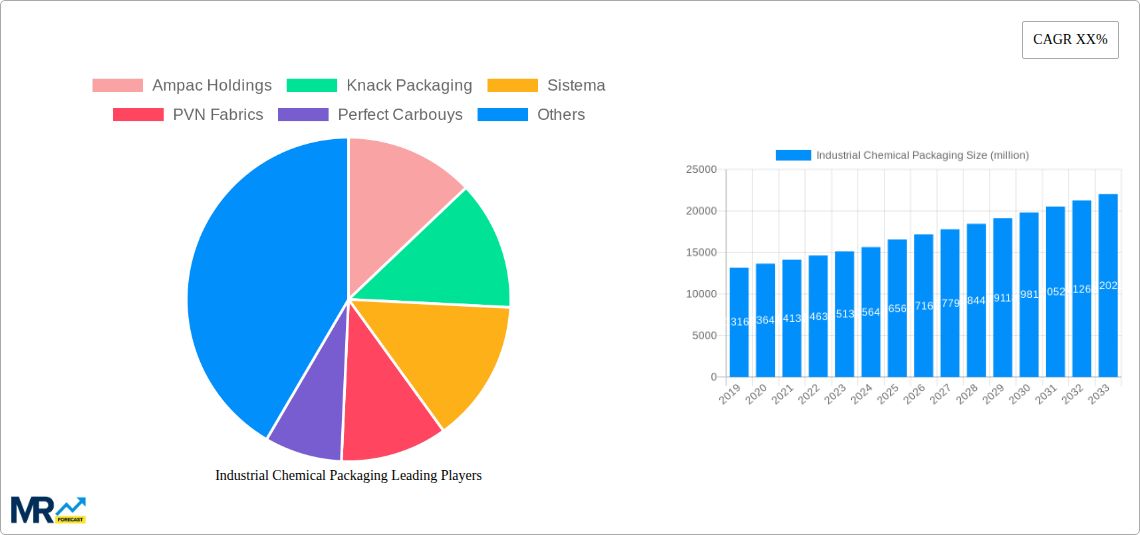

The global Industrial Chemical Packaging market is projected to reach a substantial 16.56 billion USD by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 3.61% from 2019 to 2033. This consistent growth is primarily fueled by the escalating demand for chemicals across various end-use industries, including the pharmaceutical and water treatment sectors. The pharmaceutical industry, in particular, is a significant contributor due to stringent regulations surrounding the safe and secure packaging of sensitive and often hazardous drug components. Similarly, the growing global focus on water purification and wastewater management is driving increased demand for chemicals used in these processes, necessitating robust and reliable packaging solutions. The "Others" segment, encompassing a broad range of industrial chemicals, also plays a crucial role, reflecting the diverse applications of chemicals in manufacturing, agriculture, and more.

Key drivers shaping this market include evolving safety regulations, a growing emphasis on sustainable packaging solutions, and advancements in material science leading to more durable and cost-effective packaging options. The trend towards lightweight yet strong materials, such as advanced plastics and composite drums, is gaining traction. However, the market faces restraints such as fluctuating raw material prices, particularly for petrochemical derivatives used in plastic packaging, and the complex logistical challenges associated with transporting hazardous chemicals globally. Companies like Berry Global, Sonoco Products, and Sealed Air are at the forefront, innovating with sustainable materials and smart packaging technologies to address these challenges and capitalize on the market's growth trajectory. The market's segmentation into Hazardous and Non-hazardous Chemical Packaging further highlights the specialized needs and regulatory considerations within the industry.

This report offers an in-depth analysis of the global Industrial Chemical Packaging market, providing strategic insights and forecasts to guide stakeholders in this dynamic sector. Spanning a study period from 2019 to 2033, with a Base Year of 2025 and a Forecast Period of 2025-2033, the report meticulously examines the historical landscape (2019-2024) and projects future trajectories. The market is projected to reach an impressive $XX billion in 2025, with significant growth anticipated over the next decade.

The industrial chemical packaging market is undergoing a significant transformation, driven by a confluence of factors including stringent regulatory mandates, evolving consumer preferences, and the relentless pursuit of sustainability. XXX The market is witnessing a pronounced shift towards advanced packaging solutions that prioritize safety, containment integrity, and environmental responsibility. A key trend is the increasing adoption of smart packaging technologies, integrating features like RFID tags and temperature sensors to enhance traceability, monitor product integrity during transit, and prevent counterfeiting. This is particularly critical for the Hazardous Chemical Packaging segment, where the risk of spillage or contamination carries severe implications. Furthermore, the demand for lighter yet more robust packaging materials is escalating. Innovations in polymer science and composite materials are enabling the development of containers that offer superior chemical resistance and durability while reducing overall material usage and transportation costs. The circular economy principles are also deeply influencing the market, with a growing emphasis on recyclable, reusable, and biodegradable packaging options. Manufacturers are actively investing in research and development to create packaging that minimizes environmental footprint without compromising on performance. The Pharmaceutical Industry and Water Treatment Industry are leading this charge, demanding packaging that meets exceptionally high standards for purity, sterility, and containment. The increasing globalization of the chemical industry also necessitates packaging that can withstand diverse transportation conditions and comply with international shipping regulations. As a result, the market is experiencing a surge in demand for UN-certified packaging for hazardous materials and specialized solutions for sensitive chemicals. The proliferation of e-commerce for industrial chemicals, while still nascent, is also beginning to shape packaging requirements, demanding solutions that are optimized for single-unit shipping and consumer-level handling.

The industrial chemical packaging market is experiencing robust growth, fueled by a complex interplay of economic, regulatory, and technological drivers. The escalating global demand for chemicals across various end-use industries, from agriculture and manufacturing to pharmaceuticals and personal care, forms the foundational impetus. As industrial output rises and economies expand, so too does the volume of chemicals that require safe and efficient packaging for storage, transportation, and distribution. Stringent safety regulations and compliance requirements, particularly for the handling and transport of hazardous chemicals, are a significant propellant. Governing bodies worldwide are enforcing stricter guidelines to minimize risks associated with chemical spills, environmental contamination, and occupational hazards. This necessitates the adoption of advanced, compliant packaging solutions that offer superior containment and protection, thereby driving demand for high-performance containers. The increasing focus on sustainability and environmental responsibility is another powerful driver. Growing consumer and corporate awareness regarding the environmental impact of packaging waste is compelling manufacturers to invest in eco-friendly alternatives. This includes a surge in demand for recyclable, reusable, and biodegradable packaging materials, as well as a move towards optimized packaging designs that minimize material consumption. Technological advancements in material science and manufacturing processes are also playing a crucial role. Innovations in polymer technology, for instance, are leading to the development of lighter, stronger, and more chemically resistant packaging materials. Automated filling and sealing technologies are improving efficiency and safety in packaging operations.

Despite the promising growth trajectory, the industrial chemical packaging market faces several significant challenges and restraints that can impede its full potential. The primary concern revolves around the cost of advanced and sustainable packaging solutions. The research, development, and implementation of innovative materials and technologies often come with a higher price tag, making them less accessible for smaller enterprises or for certain low-margin chemical products. This cost factor can deter widespread adoption, particularly in price-sensitive markets. Another major restraint is the complexity of regulatory landscapes. The chemical industry is subject to a patchwork of national and international regulations concerning packaging, labeling, and transportation. Navigating these diverse and often evolving regulatory frameworks can be time-consuming and resource-intensive for packaging manufacturers and chemical producers alike. Ensuring compliance across different regions requires constant vigilance and adaptation. The inherent risks associated with handling and transporting chemicals, especially hazardous ones, also present a continuous challenge. Despite advancements in packaging technology, the potential for leaks, spills, or material degradation remains a concern, necessitating rigorous quality control and testing protocols. This adds to the overall cost and complexity of operations. Furthermore, the availability and fluctuating prices of raw materials, such as polymers and metals, can impact the profitability and supply chain stability for packaging manufacturers. Geopolitical events and global economic uncertainties can further exacerbate these supply chain vulnerabilities. Finally, the limited infrastructure for recycling and waste management in certain regions can hinder the widespread adoption of sustainable packaging solutions, creating a paradox where environmentally conscious packaging choices face practical implementation hurdles.

The global industrial chemical packaging market is poised for substantial growth across various regions and segments. However, certain key regions and segments are expected to exhibit a more pronounced dominance.

Dominant Regions:

Dominant Segments:

The industrial chemical packaging market is propelled by several key growth catalysts. The escalating global demand for chemicals across diverse end-use industries, coupled with increasingly stringent regulatory requirements for safety and environmental protection, are primary drivers. The growing emphasis on sustainability is fostering innovation in recyclable, reusable, and biodegradable packaging materials. Technological advancements in material science and manufacturing processes are leading to the development of more efficient, durable, and cost-effective packaging solutions. Furthermore, the expanding pharmaceutical and water treatment sectors, with their inherent need for specialized and high-integrity packaging, significantly contribute to market expansion.

This comprehensive report provides an exhaustive analysis of the Industrial Chemical Packaging market. It delves into critical market insights, strategic trends, and detailed forecasts for the period spanning 2019-2033, with a focus on the Base Year of 2025 and the Forecast Period of 2025-2033. The report examines market dynamics, including driving forces and challenges, and identifies key regions and dominant segments within the market. Furthermore, it highlights crucial growth catalysts and profiles leading industry players. The report also details significant developments and offers a holistic perspective on the market's future trajectory, equipping stakeholders with the necessary information for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.61% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.61%.

Key companies in the market include Ampac Holdings, Knack Packaging, Sistema, PVN Fabrics, Perfect Carbouys, Time Technoplast, Hoover Ferguson Group, Bway Holding, Berlin Packaging, DS Smith, International Paper, Berry Global, Schutz Container Systems, Sonoco Products, Sealed Air, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Industrial Chemical Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Industrial Chemical Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.