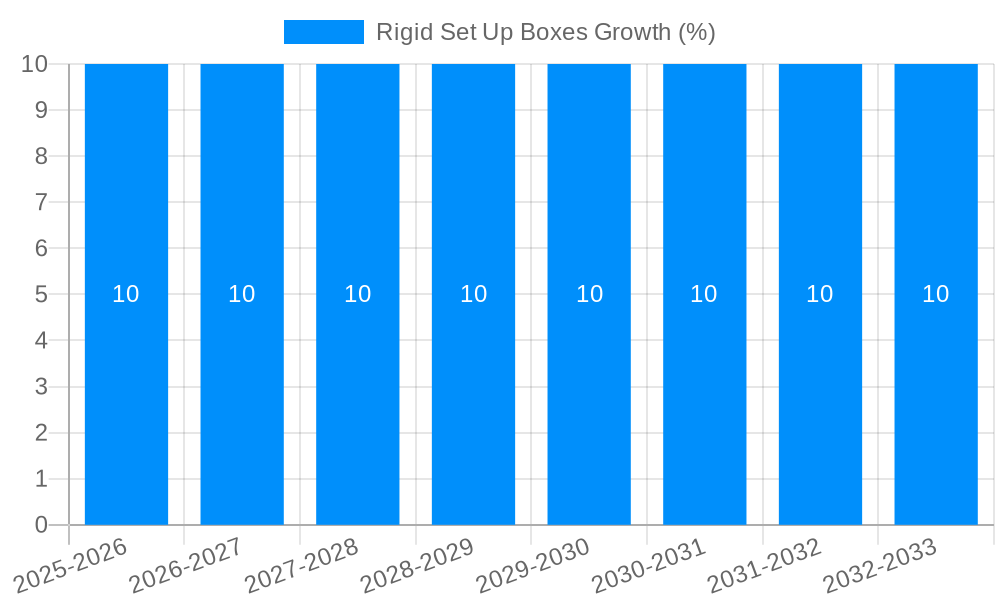

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rigid Set Up Boxes?

The projected CAGR is approximately 4.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rigid Set Up Boxes

Rigid Set Up BoxesRigid Set Up Boxes by Type (Cardboard, Kraft Paper, Corrugated Paper, Others, World Rigid Set Up Boxes Production ), by Application (Food and Beverage, Healthcare, Cosmetic and Personal Care, Electrical and Electronic, Consumer Goods, Others, World Rigid Set Up Boxes Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Rigid Set Up Boxes market is poised for significant expansion, projected to reach an impressive market size of $228.97 billion. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.8%, indicating sustained demand and increasing adoption of these premium packaging solutions. The market's dynamism is fueled by several key drivers, including the escalating demand for sophisticated and durable packaging across various industries, particularly in the luxury goods, electronics, and premium food and beverage sectors. Consumers' increasing preference for unboxing experiences, where the presentation of a product is as crucial as the product itself, further propels the adoption of rigid set up boxes. These boxes offer superior protection, enhanced brand perception, and a premium feel, making them an indispensable choice for brands looking to differentiate themselves in a competitive marketplace. The market's growth is also influenced by the rising e-commerce sector, which necessitates sturdy and aesthetically pleasing packaging to withstand transit while maintaining brand integrity and appeal upon arrival.

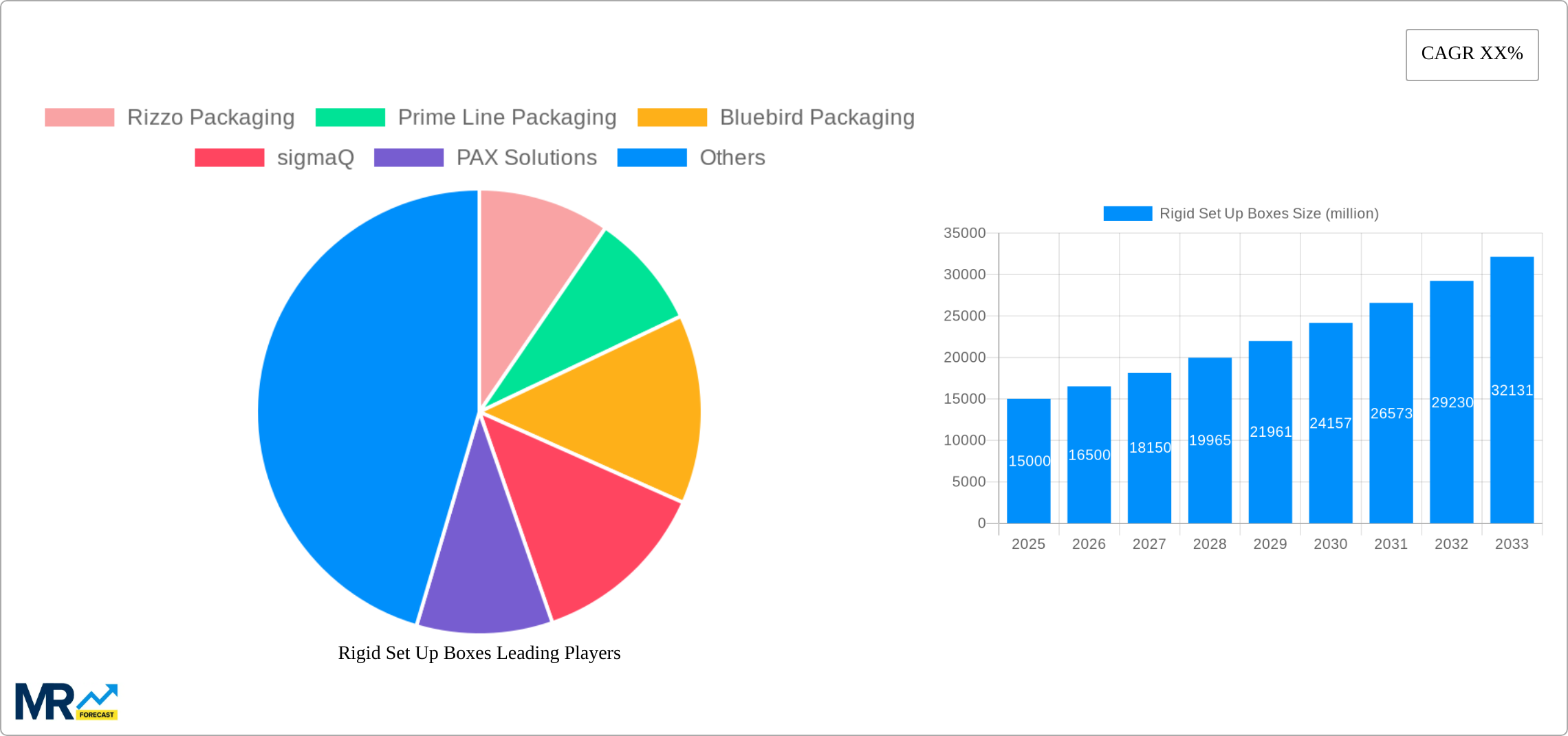

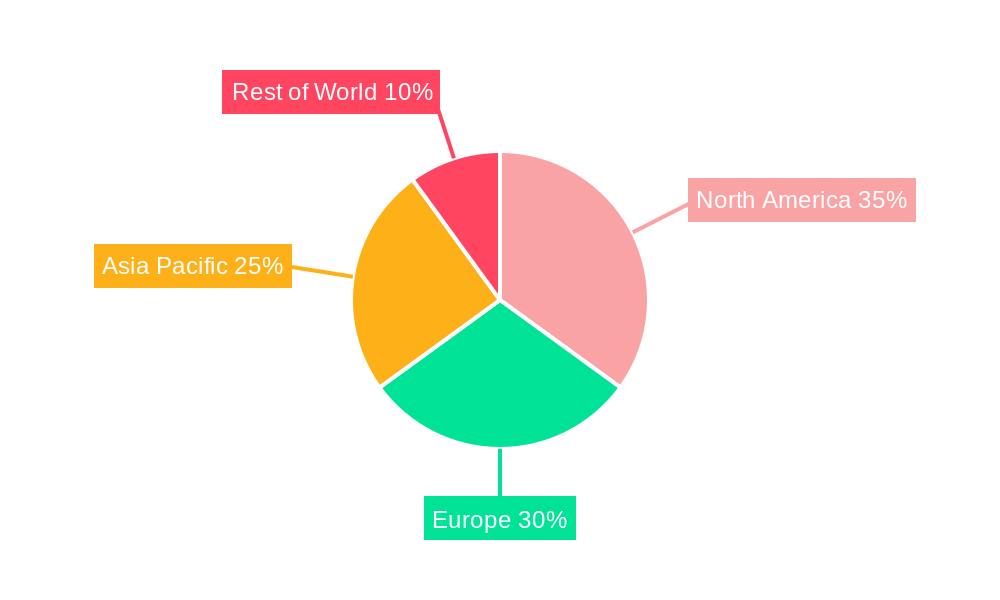

The market segmentation reveals a diverse landscape, with Cardboard and Corrugated Paper holding substantial shares due to their versatility and cost-effectiveness. However, the "Others" category, likely encompassing materials like molded pulp and specialized composites, is expected to witness significant growth as manufacturers innovate with sustainable and premium materials. In terms of applications, the Food and Beverage and Cosmetic and Personal Care segments are the largest contributors, reflecting the strong consumer reliance on these sectors for premium and giftable products. The Healthcare and Electrical and Electronic segments are also emerging as significant growth areas, driven by the need for secure and high-quality packaging for sensitive and high-value items. Geographically, Asia Pacific is anticipated to be a dominant region, propelled by rapid industrialization, a burgeoning middle class, and increasing consumer spending. North America and Europe remain mature yet stable markets, characterized by a strong emphasis on luxury branding and sustainable packaging initiatives. Companies like Smurfit Kappa, Sonoco, and WestRock are key players, actively investing in innovation and capacity expansion to cater to the evolving market demands and capitalize on the growth opportunities.

Here is a report description on Rigid Set Up Boxes, incorporating your specified elements and structure:

The global rigid set up boxes market is experiencing a dynamic evolution, driven by a confluence of consumer preferences, technological advancements, and an increasing emphasis on premium and sustainable packaging solutions. During the study period of 2019-2033, with a base and estimated year of 2025, the market is projected to witness significant growth, reaching multibillion-dollar valuations. Historically, from 2019 to 2024, the market laid a strong foundation, characterized by a steady uptake in applications demanding high-value presentation and product protection. The estimated year of 2025 marks a pivotal point, with robust expansion anticipated throughout the forecast period of 2025-2033. A key trend observed is the escalating demand for rigid boxes in the Cosmetic and Personal Care segment. Consumers increasingly associate these boxes with luxury, quality, and a superior unboxing experience, making them indispensable for high-end beauty products. This trend is further amplified by e-commerce, where the protective nature and aesthetic appeal of rigid boxes enhance brand perception during transit and at the point of delivery.

Furthermore, the Electrical and Electronic segment is a significant contributor to market growth. The need for robust protection for delicate and high-value electronic goods, coupled with the desire for premium packaging that reflects the innovation and quality of the products within, is fueling the adoption of rigid set up boxes. Companies are investing in custom-designed rigid boxes to differentiate their offerings and provide an unparalleled customer experience. The Food and Beverage sector is also showing a discernible upward trajectory, particularly for premium food items, confectionery, and gourmet beverages. Rigid boxes in this application offer superior preservation capabilities and a sophisticated presentation, elevating the perceived value of the packaged goods. The Consumer Goods segment, encompassing a broad spectrum of products, is also embracing rigid set up boxes for their durability and visual appeal, especially for gift sets and promotional packaging. The overarching trend is a shift from basic functional packaging to experiential packaging, where the box itself becomes an integral part of the brand story and customer engagement. This necessitates innovation in materials, design, and printing techniques to meet the evolving demands of these diverse applications. The market is responding with an increased focus on bespoke solutions, sustainable materials, and smart packaging features that enhance both functionality and aesthetic appeal, consolidating the position of rigid set up boxes as a premium packaging choice.

The global rigid set up boxes market is experiencing robust expansion, propelled by a powerful combination of evolving consumer expectations and strategic industry initiatives. The increasing consumer desire for premium and luxurious packaging, especially in the Cosmetic and Personal Care and Electrical and Electronic sectors, is a primary driver. Consumers now view packaging as an extension of the product itself, equating higher quality packaging with superior product value and brand prestige. This has led to a greater demand for rigid boxes that offer an exceptional unboxing experience, fostering brand loyalty and enhancing perceived product quality.

Furthermore, the burgeoning e-commerce landscape has significantly influenced the market. The need for durable and protective packaging that can withstand the rigors of shipping while maintaining its aesthetic appeal during transit is paramount. Rigid set up boxes excel in this regard, offering superior product protection and ensuring that items arrive at the customer's doorstep in pristine condition, thereby minimizing returns and enhancing customer satisfaction. The growing emphasis on sustainability is also playing a crucial role. As consumers and regulatory bodies push for environmentally responsible practices, manufacturers are increasingly opting for rigid boxes made from recycled materials and those that are easily recyclable. This trend is driving innovation in material science and manufacturing processes, making rigid set up boxes a more appealing choice for environmentally conscious brands. The expansion of premium product categories, including gourmet foods, fine wines, and high-end electronics, further fuels the demand for packaging that reflects the exclusivity and quality of these items. These sectors rely on rigid set up boxes to create an impression of sophistication and value, contributing significantly to the market's upward trajectory.

Despite the optimistic growth trajectory, the rigid set up boxes market is not without its challenges. One of the most significant restraints is the higher cost of production compared to more flexible packaging alternatives. The intricate manufacturing processes and specialized materials required for rigid boxes can lead to increased unit costs, which may deter price-sensitive brands or those operating in lower-margin product categories. This cost factor can limit market penetration in price-sensitive segments or regions where budget constraints are a primary concern for businesses.

Another notable challenge revolves around logistics and storage. Rigid boxes, by their very nature, are bulky and take up more space than foldable cartons. This can lead to higher transportation costs and increased warehousing expenses for both manufacturers and end-users. Efficient space utilization during shipping and storage becomes a critical consideration, potentially impacting the overall supply chain efficiency and cost-effectiveness. Furthermore, the sustainability discourse presents a dual-edged sword. While there is a growing demand for sustainable packaging, the production of certain rigid boxes can still have a substantial environmental footprint if not managed properly. Sourcing raw materials, energy consumption during manufacturing, and end-of-life disposal all present areas that require continuous improvement. Brands are under increasing pressure to demonstrate genuine eco-friendliness, and any perceived shortcomings in this area can lead to reputational damage. Lastly, competition from alternative premium packaging solutions, such as custom-molded plastic containers or advanced flexible pouches with premium finishes, can also pose a challenge. These alternatives may offer certain advantages in terms of cost, weight, or specific functional properties, requiring rigid box manufacturers to constantly innovate and emphasize their unique value proposition.

The global rigid set up boxes market is poised for significant growth, with certain regions and application segments set to spearhead this expansion. The Asia Pacific region is projected to emerge as a dominant force, driven by its rapidly growing economies, expanding middle class, and a burgeoning e-commerce sector. Countries like China, India, and Southeast Asian nations are witnessing an increased demand for premium consumer goods, including cosmetics, electronics, and gourmet food items, all of which heavily utilize rigid set up boxes. The increasing disposable income and evolving consumer lifestyles in these regions are fueling the desire for products that offer a superior unboxing experience and perceived luxury, directly benefiting the rigid set up box market. Furthermore, the presence of a robust manufacturing base and favorable government policies supporting industrial growth in Asia Pacific contribute to its leading position.

The Cosmetic and Personal Care segment is anticipated to be a key driver of market dominance. The inherent demand for aesthetically pleasing and protective packaging in this sector, coupled with the trend towards luxury and high-value beauty products, makes rigid set up boxes an indispensable choice. Brands in this segment consistently invest in premium packaging to differentiate their offerings and attract discerning consumers. The unboxing experience is often a critical part of the marketing strategy for cosmetic products, and rigid boxes provide the ideal canvas for creating memorable and impactful presentations.

Beyond Asia Pacific, North America and Europe are expected to maintain their strong market positions. These regions have a mature market for premium consumer goods and a well-established e-commerce infrastructure. The high consumer awareness regarding brand perception and product quality in these developed economies ensures a sustained demand for rigid set up boxes. The focus on sustainability in these regions also pushes for innovative and eco-friendly rigid packaging solutions.

Within the types of materials, Cardboard is likely to continue its reign as a dominant segment. Its versatility, cost-effectiveness, and increasing availability in recycled and recyclable forms make it a preferred choice for a wide range of applications. However, Kraft Paper is gaining traction due to its eco-friendly appeal and natural aesthetic, particularly for brands aiming for a more organic or artisanal image. The World Rigid Set Up Boxes Production as a whole is influenced by these regional and segmental dynamics, with innovation in material technology and design constantly shaping the market landscape. The synergy between growing economies, rising consumer aspirations, and the inherent advantages of rigid set up boxes in presenting and protecting high-value products will collectively define the dominant regions and segments in the coming years.

The rigid set up boxes industry is experiencing significant growth, catalyzed by several key factors. The persistent demand for premium and luxury product presentation, especially in the cosmetic, personal care, and electronics sectors, is a primary growth engine. The evolving e-commerce landscape, necessitating robust and visually appealing packaging for enhanced customer experience and reduced transit damage, further fuels this demand. Moreover, the increasing consumer awareness and regulatory push for sustainable packaging solutions are driving innovation in the use of recycled and recyclable materials for rigid boxes, making them a more attractive option for environmentally conscious brands.

This comprehensive report delves deep into the global rigid set up boxes market, spanning the study period of 2019-2033 with detailed analysis for the base year of 2025. It offers a granular understanding of market dynamics, driven by evolving consumer preferences for premium packaging, the rapid growth of e-commerce, and an increasing imperative for sustainable solutions. The report meticulously dissects the market by type, including Cardboard, Kraft Paper, Corrugated Paper, and Others, and by application segments such as Food and Beverage, Healthcare, Cosmetic and Personal Care, Electrical and Electronic, Consumer Goods, and Others. It provides valuable insights into the World Rigid Set Up Boxes Production, identifying key growth catalysts, challenges, and industry developments. Furthermore, the report features an in-depth examination of leading players and regional market dominance, equipping stakeholders with the essential information to navigate this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.8%.

Key companies in the market include Rizzo Packaging, Prime Line Packaging, Bluebird Packaging, sigmaQ, PAX Solutions, Luv2Pak, Deluxe Boxes, Smurfit Kappa, Sonoco, WestRock, All Packaging Company, Amcor, Bell Incorporated, Delta Packaging, International Paper, Mayr Melnhof Karton, Georgia-Pacific, PackMojo Limited, Emenac Packaging, Cross Country Box Company, Vallée Packaging, Re-Newbox, Emans Packaging, Madovar Packaging LLC.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Rigid Set Up Boxes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rigid Set Up Boxes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.