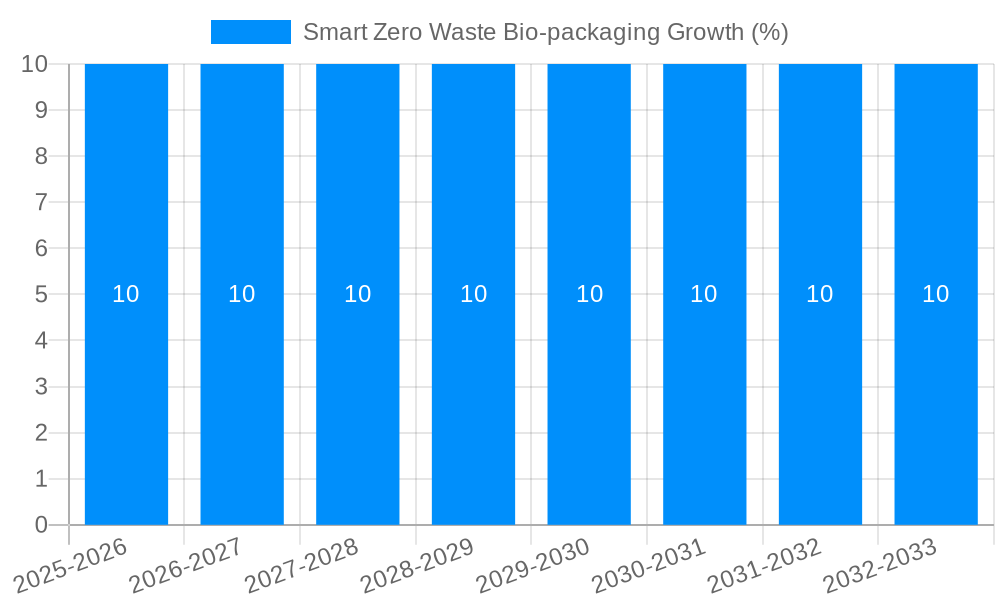

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Zero Waste Bio-packaging?

The projected CAGR is approximately 10%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Smart Zero Waste Bio-packaging

Smart Zero Waste Bio-packagingSmart Zero Waste Bio-packaging by Type (Bamboo, Seaweed, Sugarcane, Others, World Smart Zero Waste Bio-packaging Production ), by Application (Food and Beverage Packaging, Healthcare Packaging, Personal Care Packaging, Industrial Packaging, Others, World Smart Zero Waste Bio-packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

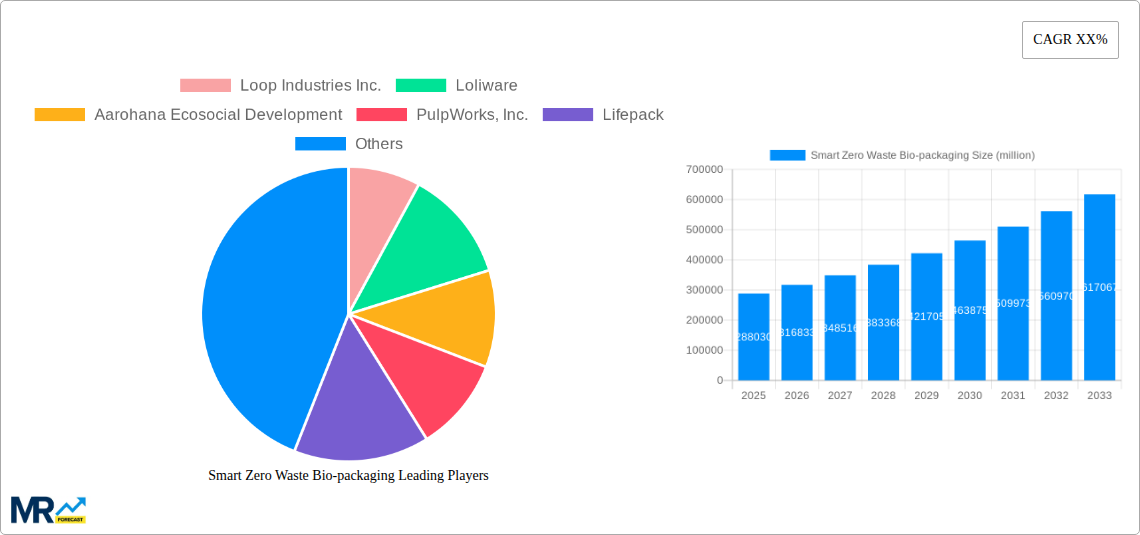

The global Smart Zero Waste Bio-packaging market is poised for substantial expansion, projected to reach approximately USD 288.03 billion by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 10% from 2019-2033, indicating a sustained and significant upswing. A primary driver for this market's ascent is the escalating global demand for sustainable and eco-friendly packaging solutions, fueled by increasing environmental awareness among consumers and stringent government regulations aimed at reducing plastic waste. The inherent properties of bio-packaging, such as biodegradability and compostability, directly address these concerns, positioning it as a compelling alternative to conventional packaging materials. Furthermore, continuous innovation in material science and production technologies is leading to the development of more cost-effective and performance-enhanced bio-packaging options, thereby broadening their applicability across various sectors.

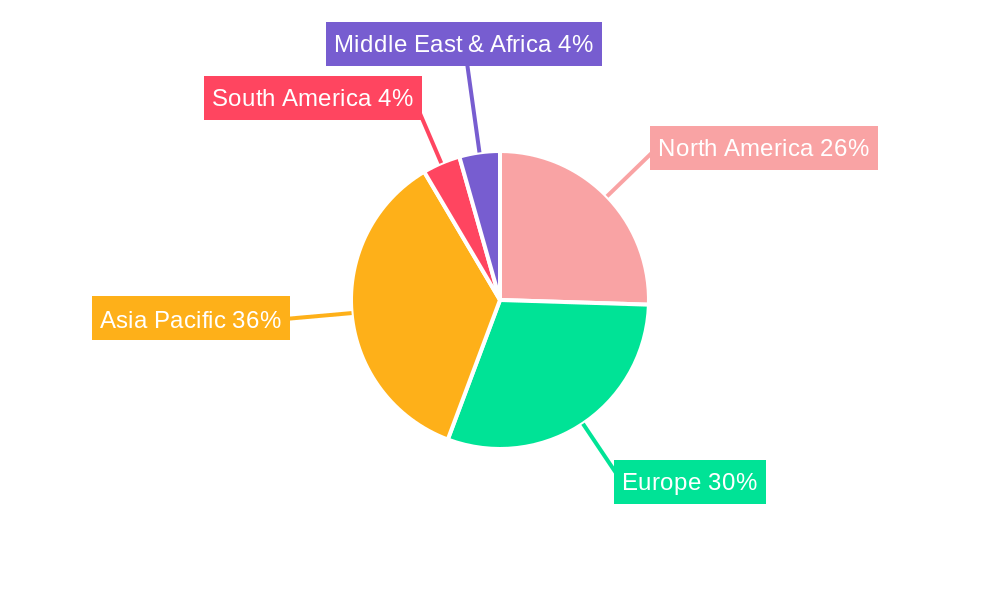

The market's dynamism is further illustrated by its diverse segmentation. The "Type" segment is dominated by materials like Bamboo, Seaweed, and Sugarcane, each offering unique environmental benefits and functional attributes. In terms of "Application," the Food and Beverage Packaging sector stands out as the largest consumer, driven by the urgent need for sustainable alternatives in a high-volume industry. Healthcare and Personal Care Packaging also represent significant growth areas, as these sectors increasingly prioritize brand image and consumer preference for eco-conscious products. Prominent companies such as Loop Industries Inc., Loliware, and Origin Materials are at the forefront of this revolution, investing heavily in research and development and expanding their production capacities. Geographically, Asia Pacific, particularly China and India, is expected to witness the most rapid growth due to favorable government initiatives, a large consumer base, and a growing emphasis on waste management, while North America and Europe remain key established markets with strong demand for sustainable solutions.

Here is a comprehensive report description on Smart Zero Waste Bio-packaging, incorporating your specified elements:

The global smart zero waste bio-packaging market is poised for significant expansion, with projections indicating a robust growth trajectory over the study period of 2019-2033. Driven by escalating environmental consciousness and stringent regulatory landscapes, the demand for sustainable packaging solutions that minimize waste and promote circularity is surging. By the estimated year of 2025, the market is anticipated to witness substantial advancements, with its value projected to reach tens of billions of dollars globally. This growth is underpinned by a paradigm shift in consumer preferences, where eco-friendliness is increasingly becoming a deciding factor in purchasing decisions. Brands are actively seeking packaging that not only protects their products but also aligns with their sustainability commitments, thereby reducing their environmental footprint. The integration of "smart" technologies within bio-packaging, such as embedded sensors for tracking product freshness or indicators for disposal guidance, further enhances its appeal by offering added value and transparency. This trend is particularly evident in the food and beverage sector, where shelf-life monitoring and waste reduction are paramount. The historical period of 2019-2024 laid the groundwork for this transformation, observing a growing adoption of early-stage bio-packaging solutions. The base year of 2025 stands as a critical juncture, marking a period of accelerated innovation and wider market penetration. The forecast period of 2025-2033 is expected to witness the maturation of these technologies, leading to widespread adoption across various industries and a significant reduction in conventional plastic waste. The continuous research and development into novel bio-materials, coupled with advancements in biodegradable and compostable formulations, are critical components of this evolving market. Furthermore, the increasing investment from both private and public sectors in developing sustainable infrastructure, such as advanced composting facilities, is crucial for the successful implementation of zero-waste bio-packaging strategies. This holistic approach, encompassing material innovation, technological integration, and supportive infrastructure, is set to define the future of packaging.

Several powerful forces are acting as catalysts for the burgeoning smart zero waste bio-packaging market. Foremost among these is the global imperative to combat plastic pollution. Mounting evidence of plastic waste accumulating in oceans and landfills has spurred governments worldwide to enact stricter regulations, including outright bans on single-use plastics and incentives for sustainable alternatives. This regulatory pressure directly compels businesses to invest in and adopt bio-packaging solutions. Complementing this is the evolving consumer demand for ethical and environmentally responsible products. Consumers are increasingly aware of their ecological footprint and actively seek brands that demonstrate a commitment to sustainability, often making purchasing decisions based on packaging materials. This conscious consumerism creates a powerful market pull for smart zero waste bio-packaging. Furthermore, technological advancements are playing a crucial role. Innovations in material science are leading to the development of more robust, versatile, and cost-effective bio-packaging materials derived from renewable resources like bamboo, seaweed, and sugarcane. The integration of "smart" features, such as IoT sensors for traceability and spoilage detection, adds significant value, enhancing product safety and reducing food waste, thereby aligning perfectly with the "zero waste" objective. Corporate sustainability goals are also a significant driver, as companies across various sectors are setting ambitious targets to reduce their environmental impact, with packaging being a primary focus area.

Despite the promising outlook, the smart zero waste bio-packaging market faces several hurdles that need to be addressed for widespread adoption. A significant challenge lies in the cost-competitiveness of bio-packaging materials compared to conventional petroleum-based plastics. While production costs are decreasing with scale, initial investments in new manufacturing processes and raw material sourcing can be higher, impacting profit margins for businesses, especially smaller enterprises. Furthermore, the scalability and availability of certain bio-materials can be a concern. Ensuring a consistent and abundant supply chain for raw materials like seaweed or specialized plant-based polymers, especially to meet the demands of large-scale production, requires significant infrastructure development and logistical planning. The performance and functionality of some bio-packaging solutions, particularly in terms of barrier properties, heat resistance, and shelf-life extension, may still lag behind their conventional counterparts for certain applications. This necessitates ongoing research and development to match or exceed existing performance standards. Another crucial restraint is the lack of standardized disposal infrastructure and consumer awareness regarding proper disposal methods. Bio-packaging often requires specific composting or recycling facilities, and confusion among consumers about how to dispose of these materials can lead to them ending up in landfills, negating their environmental benefits. The regulatory landscape, while driving adoption, can also be fragmented and complex across different regions, creating compliance challenges for global companies. Finally, consumer perception and education remain vital; a lack of understanding about the benefits and proper handling of bio-packaging can hinder market acceptance.

The smart zero waste bio-packaging market is anticipated to witness significant dominance from the Asia-Pacific region, particularly China, owing to a confluence of factors driving both production and consumption. China's robust manufacturing capabilities, coupled with substantial government investment in sustainable technologies and a rapidly growing middle class with increasing environmental awareness, positions it as a key player. The region's vast agricultural output also provides readily available raw materials for various bio-packaging types.

Here's a breakdown of dominant segments and regions:

Dominant Type Segment: Sugarcane

Dominant Application Segment: Food and Beverage Packaging

Key Region: Asia-Pacific (especially China)

Other Notable Segments:

Emerging Regions: North America and Europe are also significant markets, driven by strong consumer awareness, advanced research capabilities, and stringent environmental regulations, although their growth might be slightly slower than Asia-Pacific due to higher existing infrastructure for traditional packaging.

The smart zero waste bio-packaging industry's growth is being significantly propelled by increasing government regulations mandating reduced plastic usage and promoting circular economy principles. Consumer demand for eco-friendly products is a potent force, pushing brands to adopt sustainable packaging solutions to enhance their image and market share. Technological advancements in material science are leading to the development of more efficient, cost-effective, and performance-driven bio-packaging options. Furthermore, the growing commitment of large corporations to corporate social responsibility and sustainability targets is creating substantial market opportunities for bio-packaging providers.

This report offers an in-depth analysis of the global smart zero waste bio-packaging market, covering the period from 2019 to 2033, with a base year of 2025. It delves into market trends, driving forces, challenges, and restraints, providing a holistic view of the industry's dynamics. The report meticulously analyzes key regions and dominant segments, including types like Bamboo, Seaweed, Sugarcane, and Others, and applications such as Food and Beverage Packaging, Healthcare Packaging, Personal Care Packaging, and Industrial Packaging. With a focus on the estimated market value in billions and comprehensive industry developments, this report is an invaluable resource for stakeholders seeking to understand the evolving landscape and capitalize on the opportunities within the smart zero waste bio-packaging sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10%.

Key companies in the market include Loop Industries Inc., Loliware, Aarohana Ecosocial Development, PulpWorks, Inc., Lifepack, Avani Eco, Natural Vegan, Agilyx, Evoware, Arekapak, Bioplas, Candy Cutlery, Do Eat, No Waste Technology, Origin Materials, Skipping Rocks Lab, Sulapac, Kelpn, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Smart Zero Waste Bio-packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Smart Zero Waste Bio-packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.