1. What is the projected Compound Annual Growth Rate (CAGR) of the Glass Milk Bottles?

The projected CAGR is approximately 6.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Glass Milk Bottles

Glass Milk BottlesGlass Milk Bottles by Type (With Deposit, No Deposit), by Application (Commercial, Home), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

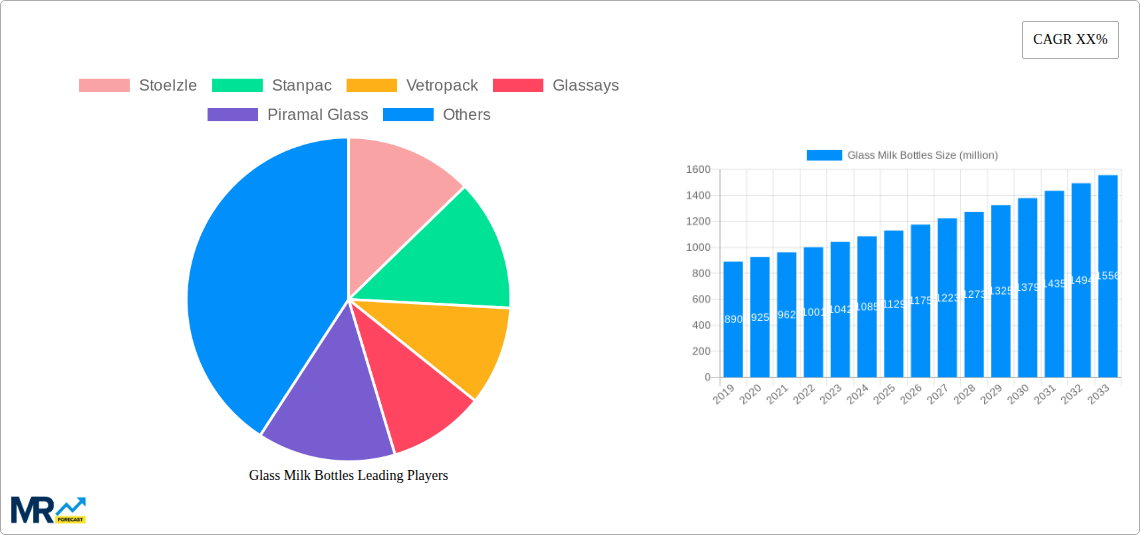

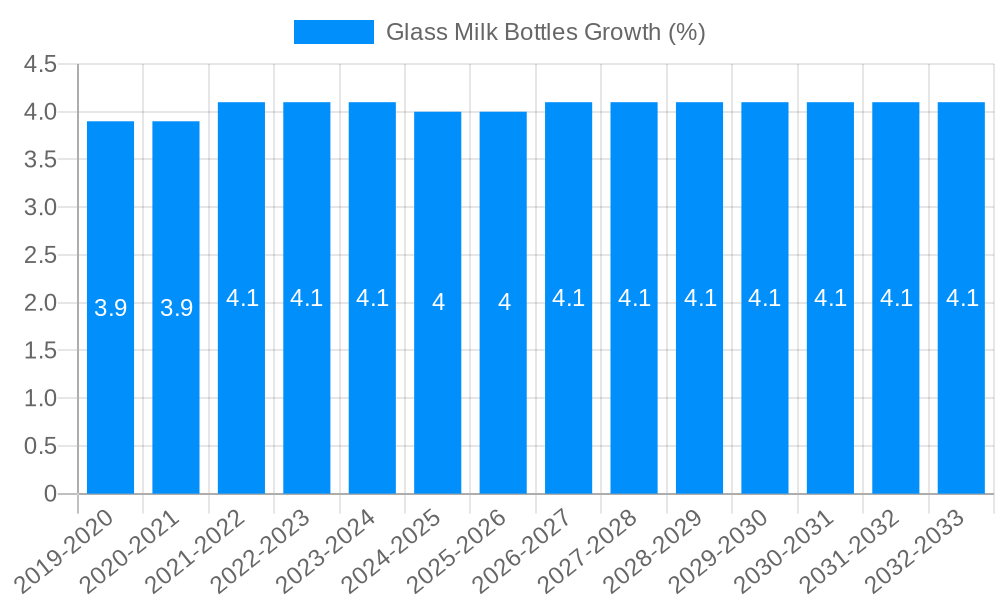

The global Glass Milk Bottles market is poised for robust expansion, projected to reach approximately \$1.2 billion by 2025. This growth is fueled by a Compound Annual Growth Rate (CAGR) of 6.2% from 2019 to 2033, indicating sustained demand for these eco-friendly and premium packaging solutions. The resurgence of milk consumption in traditional glass bottles, driven by a growing consumer preference for sustainable and reusable packaging, is a primary catalyst. Consumers are increasingly associating glass with higher quality and a commitment to environmental responsibility, leading to a premiumization of milk products. Furthermore, the inherent inertness of glass ensures no leaching of chemicals into the milk, preserving its taste and nutritional integrity, a factor highly valued by health-conscious individuals and families. The market is segmented into 'With Deposit' and 'No Deposit' types, with 'With Deposit' models likely to dominate due to their established recycling infrastructure and cost-effectiveness for consumers and dairies alike. The 'Commercial' and 'Home' application segments both present significant opportunities, with commercial use by dairies and food service providers forming the larger share, while home use reflects a growing trend in direct-to-consumer sales and home delivery services.

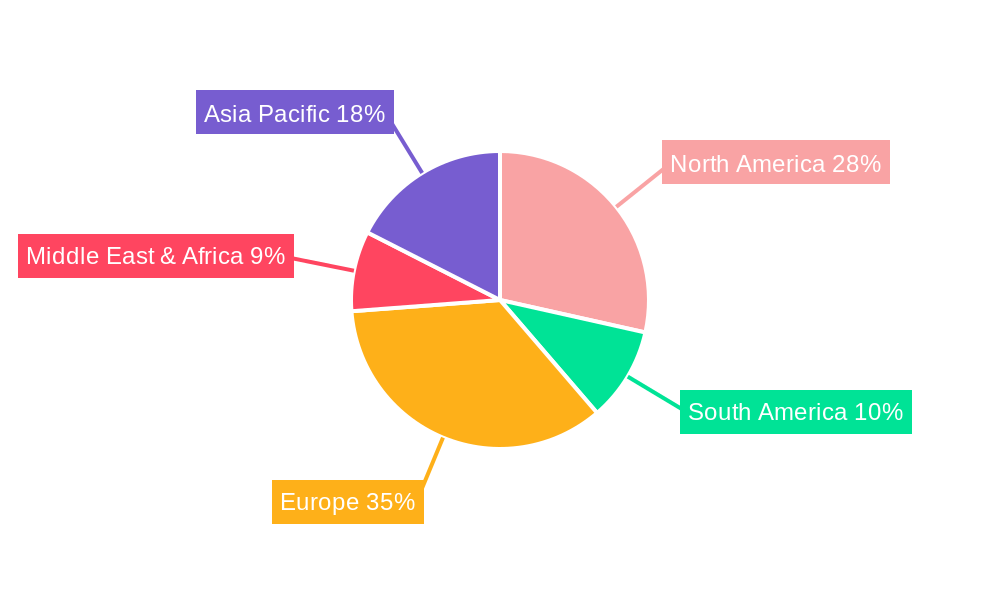

Key players like Stoelzle, Stanpac, and Vetropack are actively investing in innovation to meet evolving market demands. While the market benefits from strong consumer preference and environmental consciousness, it faces certain restraints. The primary challenges include the higher cost of glass production compared to plastic alternatives, the weight and fragility of glass bottles leading to increased transportation costs and potential breakage, and the availability and cost of raw materials. However, the industry is actively addressing these through advancements in glass manufacturing technology and the development of lighter yet durable glass formulations. The Asia Pacific region, particularly China and India, is expected to emerge as a significant growth engine due to rapid urbanization, rising disposable incomes, and increasing awareness of health and environmental benefits associated with glass packaging. North America and Europe, with their established dairy industries and strong consumer focus on sustainability, will continue to be major markets, driven by the 'With Deposit' segment and a rising demand for premium milk products.

The global glass milk bottle market is on an upward trajectory, driven by a confluence of factors that underscore a renewed appreciation for traditional packaging and a growing awareness of sustainability. During the Study Period (2019-2033), with a Base Year of 2025 and an Estimated Year of 2025, the market has witnessed a significant shift, moving beyond its nostalgic appeal to embrace a practical and environmentally conscious choice. The Historical Period (2019-2024) laid the groundwork for this resurgence, characterized by a gradual but steady increase in demand. As we look towards the Forecast Period (2025-2033), projections indicate robust growth, with market value anticipated to reach several billion dollars. This expansion is not uniform, however, and is influenced by regional preferences, regulatory landscapes, and evolving consumer behavior. The "With Deposit" segment, historically a strong performer, continues to hold its ground, bolstered by circular economy initiatives and consumer willingness to participate in return and reuse schemes. Conversely, the "No Deposit" segment is also experiencing growth, particularly in markets where convenience and single-use, albeit recyclable, options are favored.

The application spectrum further illustrates this dynamism. The Commercial application, encompassing dairy producers, artisanal dairies, and food service providers, remains a dominant force, leveraging the premium perception and superior preservation qualities of glass. However, the Home application is showing promising growth, as individuals increasingly opt for healthier, sustainable alternatives and embrace the aesthetic appeal of glass milk bottles for personal consumption and home use. The market's evolution is further shaped by technological advancements in glass manufacturing, leading to lighter yet more durable bottles, and improved logistics for handling and refilling. This trend towards innovation ensures that glass milk bottles remain competitive against other packaging materials. The overall market sentiment points towards a sustained and significant expansion, with the total market value poised to cross the tens of billions mark within the forecast period. This growth signifies a lasting commitment to a packaging solution that is both functional and responsible, aligning with broader global trends of sustainability and conscious consumption.

The resurgence and projected growth of the glass milk bottle market are propelled by a powerful combination of consumer preferences, environmental consciousness, and industry-led initiatives. A primary driver is the growing consumer demand for premium and artisanal products. Glass milk bottles often lend themselves to a perception of higher quality, purity, and a more traditional, wholesome product, appealing to consumers willing to pay a premium for such attributes. This is particularly evident in the Commercial application, where brands leverage glass packaging to differentiate themselves in a crowded marketplace. Furthermore, the undeniable environmental benefits of glass play a pivotal role. As global awareness of plastic pollution intensifies, consumers are actively seeking sustainable alternatives. Glass is infinitely recyclable and can be reused multiple times, aligning perfectly with the principles of a circular economy. This has led to a significant boost in demand for glass milk bottles, especially in regions with robust recycling infrastructure and strong environmental regulations.

The "With Deposit" segment, in particular, is experiencing renewed interest as businesses and consumers embrace the economic and environmental advantages of bottle return schemes. These schemes not only reduce waste but also offer cost savings over the long term. Moreover, advancements in glass manufacturing technology have made these bottles lighter, stronger, and more energy-efficient to produce, addressing some of the historical cost and weight concerns associated with glass. The inherent inertness of glass is another crucial factor, ensuring that milk retains its natural flavor and nutritional integrity without leaching chemicals, a significant concern with some plastic alternatives. This commitment to product quality and consumer health further solidifies the position of glass milk bottles in the market. Collectively, these forces are creating a favorable environment for sustained market expansion, pushing the value of the global glass milk bottles market into the billions.

Despite the optimistic outlook, the glass milk bottle market faces several inherent challenges and restraints that temper its growth potential. One of the most significant hurdles remains the cost of production and transportation compared to lighter, less fragile alternatives like plastic or cartons. The weight of glass bottles contributes to higher shipping costs and can necessitate reinforced packaging, adding to the overall expense. This cost factor can be a deterrent for smaller dairies or price-sensitive consumers, particularly in the Home application segment. Furthermore, breakage and fragility remain a persistent concern throughout the supply chain, from manufacturing and filling to distribution and consumer handling. While advancements have led to more robust glass, the risk of breakage still exists, leading to potential product loss and increased operational complexities.

The energy-intensive nature of glass production also presents an environmental challenge, though this is being mitigated by increasing use of recycled glass and advancements in furnace technology. However, the initial carbon footprint of manufacturing virgin glass is still a factor. Another restraint is the lack of widespread and efficient return and refill infrastructure in many regions, particularly for the "With Deposit" segment. Consumers may be hesitant to embrace deposit systems if returning bottles is inconvenient or if the infrastructure for collection and cleaning is not readily available. This can limit the full potential of the circular economy model for glass milk bottles. Finally, competition from established and rapidly evolving alternative packaging materials, such as PET bottles and aseptic cartons, which often offer lower price points and greater convenience in certain applications, continues to pose a significant competitive threat, requiring glass manufacturers to continuously innovate and demonstrate their unique value proposition.

The global glass milk bottle market is characterized by regional variations in demand, driven by differing consumer preferences, regulatory landscapes, and the presence of key industry players. Among the segments, the "No Deposit" type is poised to significantly dominate the market, particularly within the Commercial application. This dominance is fueled by the evolving consumer lifestyle that prioritizes convenience and efficiency.

Key Segments and Regions Driving Market Domination:

"No Deposit" Type: This segment is experiencing a surge in popularity due to its perceived convenience. Consumers, especially in urbanized areas and within the younger demographic, are increasingly drawn to the ease of use and disposal associated with "no deposit" bottles. While "With Deposit" models are environmentally superior and foster a circular economy, the initial hurdle of returning bottles can be a deterrent for busy lifestyles. The "No Deposit" segment, while requiring robust recycling infrastructure, offers an immediate convenience factor that appeals to a broader consumer base. The growth in this segment is further supported by dairies and beverage companies that are looking to offer a premium yet accessible product without the complexities of managing a returnable system. The total market value attributed to this segment alone is projected to reach several billions within the study period.

Commercial Application: The Commercial application continues to be the bedrock of the glass milk bottle market and is expected to maintain its leading position. This is largely due to the inherent benefits of glass for preserving the quality, taste, and nutritional value of milk and dairy products. For dairy producers, glass bottles offer a premium packaging solution that enhances brand perception and allows for differentiation in a competitive market. The superior barrier properties of glass protect milk from light and oxygen, extending shelf life and reducing spoilage, which is a critical factor for businesses. Furthermore, the growing trend of artisanal and craft dairies, which often emphasize natural ingredients and traditional production methods, finds glass packaging to be an ideal fit for their brand narrative. These producers often market their products as organic, farm-fresh, and of high quality, and glass bottles reinforce this image effectively. The ability of glass to be endlessly recycled also aligns with the growing corporate social responsibility initiatives of many commercial entities. The value generated by the commercial sector will contribute significantly to the overall market size, expected to be in the tens of billions.

Dominant Regions (Example: Europe and North America):

These segments and regions, by virtue of their consumer preferences, infrastructure, and regulatory support, are expected to account for a substantial share of the global glass milk bottles market value, which is projected to reach several billions by the end of the study period.

The glass milk bottle industry is experiencing a significant growth spurt fueled by several key catalysts. A primary driver is the escalating consumer demand for sustainable and eco-friendly packaging solutions, directly impacting the preference for infinitely recyclable glass over single-use plastics. This environmental consciousness is amplified by increasing global awareness of plastic pollution. Furthermore, the premium perception associated with glass, particularly for artisanal and organic milk products, encourages brands to opt for this packaging to enhance their market appeal and differentiate their offerings. Advancements in manufacturing technology, leading to lighter yet more durable glass bottles, are also mitigating previous cost and logistical concerns, making glass a more viable option across various applications.

This comprehensive report offers an in-depth analysis of the global glass milk bottle market, spanning the Study Period (2019-2033) with a Base Year of 2025. It delves into the intricate dynamics shaping the market, including key trends, driving forces, and the challenges that influence its trajectory. The report provides granular insights into market segmentation by Type (With Deposit, No Deposit) and Application (Commercial, Home, Industry), alongside a detailed examination of key regional markets and their growth potential. Furthermore, it highlights significant developments and identifies the leading players influencing market dynamics. The report's scope ensures that stakeholders gain a holistic understanding of the market's present state and future prospects, enabling strategic decision-making within this evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.2%.

Key companies in the market include Stoelzle, Stanpac, Vetropack, Glassays, Piramal Glass, Ajanta Bottle, Hulian Bottle, Maidao Glass, Roetel, Guru Overseas.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Glass Milk Bottles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Glass Milk Bottles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.