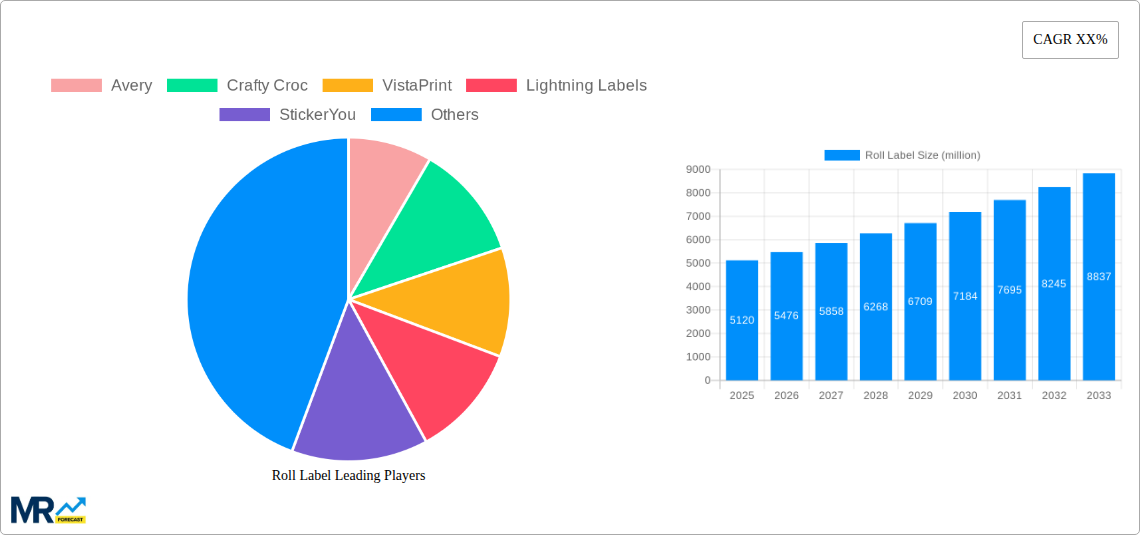

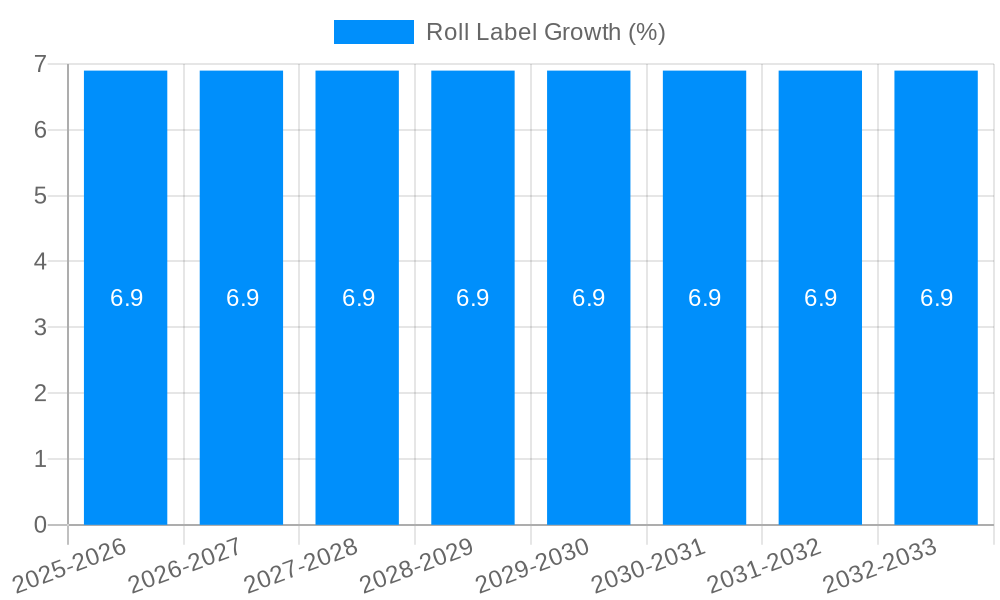

1. What is the projected Compound Annual Growth Rate (CAGR) of the Roll Label?

The projected CAGR is approximately 6.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Roll Label

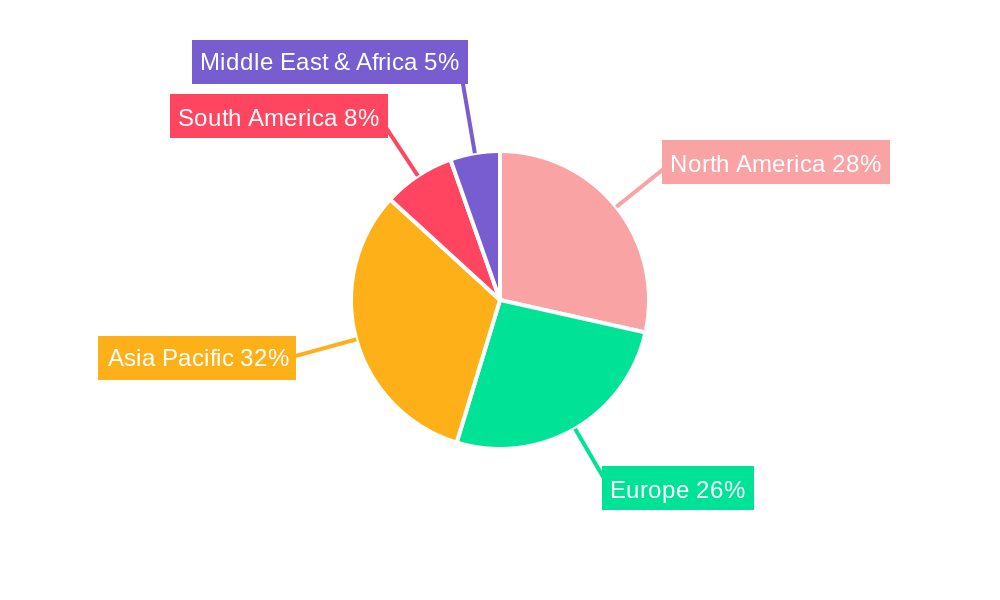

Roll LabelRoll Label by Type (Rectangle Labels, Circle Labels, Square Labels, Oval Labels), by Application (Food, Consumer Goods, Pharmaceutical, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global roll label market is poised for substantial growth, projected to reach an estimated USD 7.25 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.9% from a base year of 2025. This expansion is primarily fueled by the escalating demand for product differentiation and enhanced branding across diverse industries. The food and beverage sector, a consistent leader, continues to drive significant consumption due to the sheer volume of packaged goods and the need for eye-catching labels that convey essential information and marketing messages. Similarly, the burgeoning consumer goods market, encompassing everything from electronics to personal care items, relies heavily on roll labels for packaging, product identification, and regulatory compliance. The pharmaceutical industry also presents a strong growth avenue, with increasing regulatory requirements and the demand for high-quality, tamper-evident labels contributing to market expansion.

The market's dynamism is further shaped by several key trends, including the increasing adoption of sustainable and eco-friendly labeling materials as consumer awareness and corporate responsibility initiatives gain momentum. Advancements in printing technologies, such as digital printing, are enabling greater customization, shorter print runs, and faster turnaround times, catering to the evolving needs of businesses seeking agile supply chains. The rise of e-commerce has also significantly boosted the demand for roll labels as online retailers require effective and durable packaging to protect products during transit and to reinforce brand identity. While the market presents numerous opportunities, potential restraints include fluctuating raw material costs, particularly for paper and adhesives, which can impact profit margins. Nevertheless, the overall outlook remains highly positive, with continuous innovation and expanding applications ensuring sustained growth in the roll label market.

This report provides an in-depth examination of the global roll label market, spanning the historical period of 2019-2024, the base year of 2025, and projecting growth through the forecast period of 2025-2033. The analysis leverages extensive data to offer actionable insights into market dynamics, key drivers, potential challenges, and future opportunities. Our findings are presented in billion-dollar units, reflecting the substantial economic impact of this vital sector.

XXX The global roll label market is experiencing a period of robust expansion and transformative innovation, driven by a confluence of evolving consumer preferences, technological advancements, and increasing demand across a multitude of industries. Throughout the historical period of 2019-2024, the market witnessed steady growth, fueled by the foundational need for product identification, branding, and regulatory compliance. As we enter the base year of 2025, this trajectory is not only sustained but accelerated, with the market poised for significant value creation in the coming years. A key trend shaping the market is the increasing emphasis on sustainability and eco-friendly labeling solutions. Consumers and businesses alike are actively seeking labels made from recycled materials, biodegradable substrates, and those produced using energy-efficient processes. This has spurred innovation in material science and manufacturing, leading to a rise in demand for compostable labels, water-based inks, and reduced packaging footprints. Furthermore, the digitalization of printing technologies, including inkjet and laser printing, has democratized label production, making it more accessible and cost-effective for small and medium-sized enterprises (SMEs). This trend is particularly evident in the customization and short-run production of labels, allowing businesses to adapt quickly to changing market demands and create highly personalized branding experiences. The e-commerce boom has also played a pivotal role, necessitating a surge in shipping labels, product identification labels for online marketplaces, and tamper-evident seals. This segment alone represents a significant portion of the market's value, with an ongoing need for high-volume, durable, and easily scannable labels. The pharmaceutical industry, with its stringent regulatory requirements for product traceability and authenticity, continues to be a major driver of the roll label market. The demand for specialized labels with anti-counterfeiting features, temperature indicators, and advanced tracking capabilities is consistently high. Similarly, the food and beverage sector relies heavily on roll labels for branding, nutritional information, ingredient lists, and promotional messaging. The ability to create visually appealing and informative labels that resonate with consumers is crucial for brand differentiation in this competitive landscape. As we look towards the forecast period of 2025-2033, the market is expected to witness further diversification in label types, applications, and technological integration. The rise of smart labels, incorporating NFC or QR codes for enhanced consumer engagement and supply chain transparency, is an emerging trend with substantial growth potential. The continued growth in the consumer goods sector, encompassing everything from cosmetics and personal care to electronics and household items, will also sustain the demand for a wide array of roll labels. The interplay of these trends—sustainability, digitalization, e-commerce, and industry-specific needs—is painting a picture of a dynamic and evolving roll label market, projecting a future of sustained and potentially accelerated growth.

The global roll label market is experiencing a considerable uplift, propelled by a multifaceted array of driving forces that are reshaping its landscape and creating new avenues for growth. A primary impetus is the unprecedented expansion of the e-commerce sector. With the ongoing shift in consumer purchasing habits towards online channels, the demand for shipping labels, product identification labels for fulfillment centers, and tamper-evident seals has skyrocketed. This surge directly translates into a higher volume of roll label consumption, especially for durable and easily scannable varieties. Furthermore, the increasingly stringent regulatory requirements across various industries, particularly in pharmaceuticals and food & beverages, act as a significant catalyst. These regulations mandate clear, accurate, and compliant labeling for product safety, traceability, and consumer information. This necessitates specialized labels with enhanced features like anti-counterfeiting measures, temperature indicators, and detailed ingredient or dosage information, thereby driving demand for high-quality roll labels. The growing emphasis on branding and product differentiation in a highly competitive marketplace is another crucial driver. Companies are investing heavily in visually appealing and informative labels to capture consumer attention, communicate brand values, and enhance product appeal. This trend fuels the demand for innovative designs, specialized finishes, and premium label materials, pushing the boundaries of what roll labels can achieve in terms of aesthetic and functional impact. Moreover, advancements in printing technology and automation have significantly lowered production costs and increased efficiency. Digital printing, in particular, allows for greater customization, faster turnaround times, and cost-effective production of short print runs, catering to the evolving needs of businesses of all sizes. This technological democratization has made sophisticated labeling solutions more accessible, fostering wider adoption. Finally, the diversification of consumer goods and the introduction of new product categories continuously create new markets for specialized roll labels, ensuring a sustained demand across a broad spectrum of applications.

Despite the robust growth and promising future of the roll label market, several challenges and restraints could potentially impede its trajectory. A significant concern revolves around the fluctuating raw material costs, particularly for paper pulp, plastic resins, and inks. Global supply chain disruptions, geopolitical events, and environmental factors can lead to price volatility, impacting the profitability of label manufacturers and potentially leading to price increases for end-users. This could dampen demand, especially in price-sensitive segments. Furthermore, the increasingly stringent environmental regulations and waste disposal norms present a challenge, particularly for conventional non-recyclable label materials. While there is a growing demand for sustainable options, the development and widespread adoption of cost-effective and high-performing eco-friendly alternatives are still ongoing. The transition to these new materials can involve significant investment in research and development and manufacturing processes. The intense competition within the roll label market also poses a restraint. With numerous players, ranging from large multinational corporations to smaller specialized manufacturers, the market is characterized by price wars and the constant need for innovation to maintain a competitive edge. This can put pressure on profit margins for smaller businesses. Another area of concern is the potential for disruption from emerging digital technologies. While digital printing has been a growth driver, the rise of entirely digital product information delivery, where physical labels become less critical for certain types of information, could pose a long-term threat to traditional label markets. However, this is a more distant concern and currently outweighed by the benefits digital printing offers. Lastly, complex international trade regulations and tariffs can create hurdles for manufacturers and distributors operating across borders, impacting supply chain efficiency and increasing operational costs. Navigating these varying regulatory landscapes requires significant expertise and can add to the overall cost of doing business.

The global roll label market is poised for significant dominance by both specific regions and particular segments, driven by distinct economic, industrial, and consumer trends.

Dominant Regions/Countries:

Dominant Segments:

Application: Food

Type: Rectangle Labels

The roll label industry is experiencing significant growth catalysts that are shaping its future. The relentless expansion of the e-commerce sector demands a continuous supply of shipping and product identification labels. Furthermore, increasing consumer awareness regarding sustainability is driving the adoption of eco-friendly label materials and manufacturing processes. Advancements in digital printing technology are enabling greater customization, faster turnaround times, and more cost-effective production, particularly for small and medium-sized enterprises. The stringent regulatory landscape in industries like pharmaceuticals and food & beverage necessitates specialized and compliant labeling, boosting demand for high-quality, secure labels.

This report offers a comprehensive analysis of the global roll label market, projecting its trajectory from the historical period of 2019-2024 through the base year of 2025 and into the forecast period of 2025-2033. It delves deep into the market's intricate dynamics, providing an extensive overview of trends, driving forces, and potential challenges. The report utilizes a data-driven approach, presenting key market insights in billion-dollar units to reflect the economic significance of this sector. It meticulously examines dominant regions and segments, offering detailed explanations of their growth drivers and unique characteristics. Furthermore, the report highlights significant industry developments and identifies the leading players shaping the market's future, making it an indispensable resource for stakeholders seeking a thorough understanding of the roll label industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.9%.

Key companies in the market include Avery, Crafty Croc, VistaPrint, Lightning Labels, StickerYou, Fastlabels, Inkable Label, Primoprint, Sticker Mule, Wausau Coated, ULINE, Hickman Label Company, Printing Shark, Mactac, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Roll Label," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Roll Label, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.