1. What is the projected Compound Annual Growth Rate (CAGR) of the Nestable Plastic Pallets?

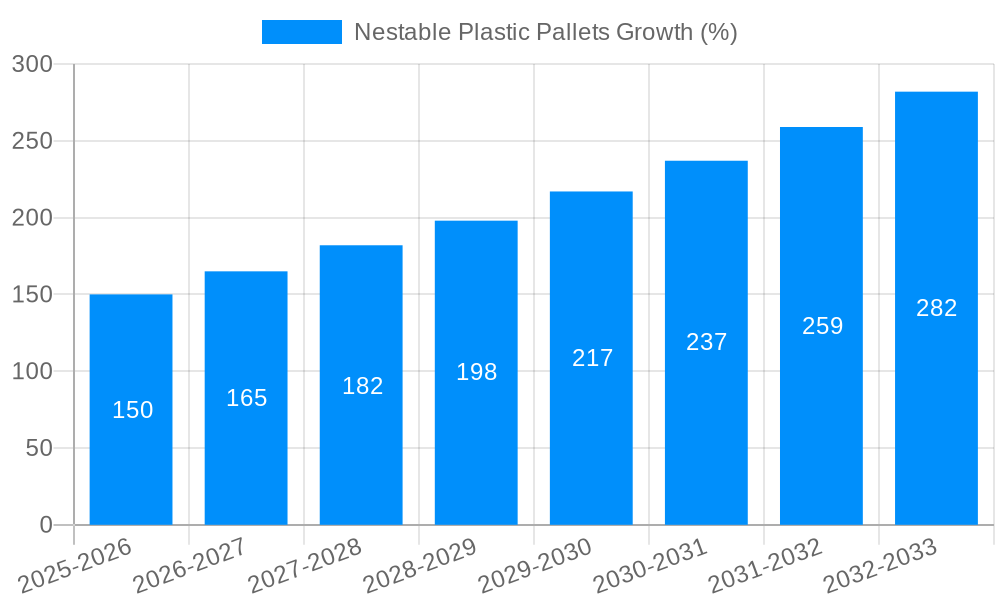

The projected CAGR is approximately 4.42%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Nestable Plastic Pallets

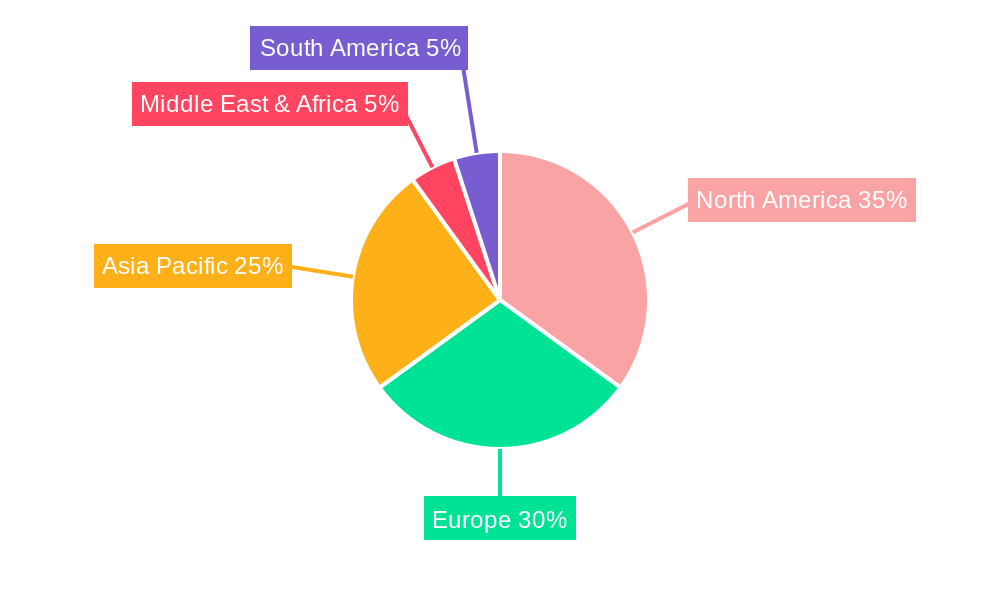

Nestable Plastic PalletsNestable Plastic Pallets by Type (Nestable Pallets, Rackable Pallets, Stackable Pallets, Others, World Nestable Plastic Pallets Production ), by Application (Food & Beverages, Chemicals, Pharmaceuticals, Petroleum & Lubricants, Others, World Nestable Plastic Pallets Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

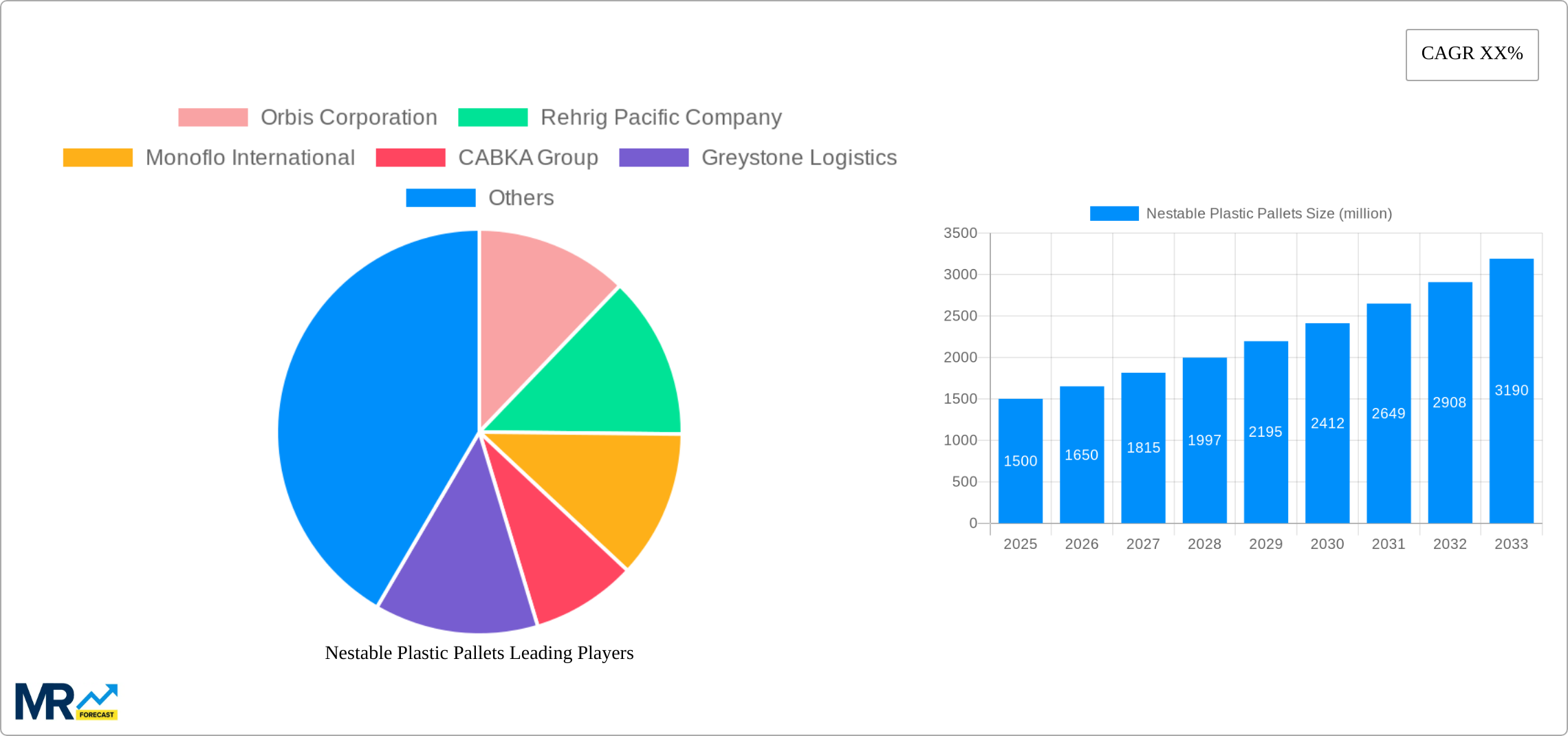

The global Nestable Plastic Pallets market is poised for significant expansion, projected to reach an estimated USD 12,750 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.5% anticipated over the forecast period of 2025-2033. This dynamic trajectory is primarily fueled by the increasing demand for efficient, durable, and sustainable material handling solutions across a multitude of industries. The inherent advantages of nestable plastic pallets, such as their space-saving design when empty, superior hygiene, resistance to moisture and chemicals, and longer lifespan compared to traditional wooden pallets, are driving their adoption. Furthermore, growing environmental consciousness and regulatory pressures favoring sustainable packaging and logistics are accelerating the shift away from less eco-friendly alternatives, making nestable plastic pallets a preferred choice for businesses aiming to reduce their carbon footprint and operational costs. The logistics and supply chain sectors, in particular, are witnessing a surge in demand as companies optimize their warehousing and transportation networks.

The market's expansion is further bolstered by key trends such as the rise of e-commerce, which necessitates efficient and rapid order fulfillment, and the globalization of supply chains requiring standardized and reliable handling equipment. Innovations in plastic pallet design, including the integration of smart features for tracking and inventory management, are also contributing to market growth. While the market exhibits strong positive momentum, certain restraints need to be acknowledged. The initial higher cost of plastic pallets compared to wooden ones can be a barrier for some smaller enterprises. However, the total cost of ownership, considering the longevity, reduced replacement needs, and potential for damage reduction, often favors plastic pallets in the long run. The Food & Beverages, Chemicals, and Pharmaceuticals sectors represent significant application segments due to their stringent hygiene and safety requirements, where plastic pallets offer superior performance. The Asia Pacific region is expected to emerge as a dominant force, driven by rapid industrialization, expanding manufacturing capabilities, and the growing adoption of advanced logistics solutions.

This report provides an in-depth analysis of the global Nestable Plastic Pallets market, spanning the historical period of 2019-2024, the base and estimated year of 2025, and a forecast period extending to 2033. Leveraging extensive data and market intelligence, the study offers critical insights into market dynamics, growth drivers, challenges, regional dominance, and key industry players. The report aims to equip stakeholders with the necessary information to navigate this evolving market landscape and identify strategic opportunities.

The global Nestable Plastic Pallets market is poised for significant expansion, with projections indicating a production volume exceeding 250 million units by the base year of 2025, and further anticipated to surpass 300 million units by 2033. This growth trajectory is underpinned by a confluence of factors, including the inherent advantages of plastic over traditional materials like wood, such as superior durability, hygienic properties, and resistance to moisture and chemicals. The increasing emphasis on supply chain efficiency and sustainability is a major trend, driving the adoption of nestable plastic pallets, which optimize storage and transportation space by allowing them to interlock when empty. This space-saving capability translates directly into reduced shipping costs and a smaller environmental footprint. Furthermore, the e-commerce boom continues to fuel demand across various application segments, notably in Food & Beverages and Pharmaceuticals, where hygiene and product integrity are paramount. The increasing adoption of plastic pallets in automated warehousing systems is also a significant trend, as their consistent dimensions and durability are crucial for reliable robotic handling. Industry developments, such as advancements in recycled plastic utilization and the development of lighter yet stronger pallet designs, are further contributing to the market's positive outlook. The shift away from single-use wooden pallets towards reusable and recyclable plastic alternatives is a fundamental market shift, driven by both economic and environmental considerations. Companies are increasingly investing in R&D to develop innovative pallet solutions that cater to specific industry needs, such as specialized designs for hazardous materials or ultra-hygienic applications. The global market for nestable plastic pallets is not just about volume but also about innovation and specialization, catering to a diverse range of industrial requirements. The market is expected to witness a compound annual growth rate (CAGR) of approximately 4.5% during the forecast period, showcasing a robust and sustained expansion. The ongoing digitalization of supply chains and the growing demand for trackable and traceable logistics solutions are also influencing pallet design and material choices.

The growth of the Nestable Plastic Pallets market is predominantly propelled by the inherent advantages that plastic offers over conventional materials, particularly wood. The superior durability and longevity of plastic pallets translate into a lower total cost of ownership over their lifecycle, as they resist splintering, warping, and decay, thus reducing the need for frequent replacements. Moreover, the hygienic properties of plastic are a critical driver, especially in industries like Food & Beverages and Pharmaceuticals, where contamination control is paramount. Plastic pallets are non-porous and easy to clean, significantly minimizing the risk of bacterial growth and cross-contamination, which is a persistent concern with wooden pallets. The increasing global focus on sustainability and circular economy principles is another potent driving force. The reusability and recyclability of plastic pallets align perfectly with these initiatives, offering a more environmentally responsible alternative to disposable wooden pallets. This eco-conscious shift is further amplified by stringent regulations in many regions concerning waste management and sustainable sourcing, compelling businesses to adopt greener logistics solutions. The exponential growth of e-commerce has also significantly boosted demand for efficient and robust material handling solutions. Nestable plastic pallets, with their space-saving design when empty, are instrumental in optimizing warehouse storage and reducing transportation costs, a crucial factor in the highly competitive e-commerce landscape. The development of increasingly sophisticated automated warehousing systems further favors plastic pallets due to their consistent dimensions and structural integrity, which are essential for seamless robotic operations. The market is expected to produce and utilize over 270 million units in the base year 2025.

Despite the robust growth trajectory, the Nestable Plastic Pallets market faces several challenges and restraints that could temper its expansion. A primary restraint is the higher initial capital investment required for plastic pallets compared to their wooden counterparts. While the total cost of ownership may be lower in the long run, the upfront cost can be a deterrent for smaller businesses or those operating with tight budgets, particularly in developing economies. Fluctuations in the price of raw materials, such as virgin plastic resins, can also impact the profitability and pricing strategies of manufacturers, leading to market volatility. The perception of plastic as less sustainable than wood, despite its recyclability, remains a lingering concern for some consumers and businesses. While recycling infrastructure is improving, the actual rates of plastic pallet recycling are not yet as widespread or efficient as desired, leading to questions about end-of-life management and potential environmental impact if not properly handled. The availability and efficiency of pallet pooling and rental services, which can mitigate the upfront cost issue, are not uniformly developed across all regions, limiting accessibility for some potential users. Furthermore, the development of specific industry standards and certifications for plastic pallets is an ongoing process, and a lack of widespread standardization can create adoption barriers in certain highly regulated sectors. The market is projected to see over 50 million units as a potential gap if these challenges are not adequately addressed.

The Food & Beverages segment, along with the Asia-Pacific region, is anticipated to exhibit significant dominance in the global Nestable Plastic Pallets market throughout the forecast period (2025-2033).

Food & Beverages Segment Dominance:

Asia-Pacific Region Dominance:

Several factors are acting as significant growth catalysts for the Nestable Plastic Pallets industry. The ever-increasing global demand for enhanced supply chain efficiency and reduced operational costs is a primary driver. Nestable plastic pallets, by optimizing storage and transportation, directly contribute to these goals. Furthermore, the growing emphasis on sustainability and environmental responsibility is pushing industries to adopt more eco-friendly logistics solutions, with reusable and recyclable plastic pallets standing out as a superior alternative to disposable wood. The robust growth of the e-commerce sector, necessitating efficient warehousing and rapid delivery, also fuels the demand for durable and space-saving plastic pallets. Finally, advancements in material science and manufacturing processes are leading to the development of lighter, stronger, and more cost-effective plastic pallet solutions, making them increasingly attractive across a wider range of applications.

The Nestable Plastic Pallets market is characterized by the presence of several key players who are instrumental in driving innovation and market growth. These companies are committed to providing high-quality, durable, and sustainable pallet solutions to a diverse range of industries.

The Nestable Plastic Pallets sector has witnessed several significant developments in recent years, reflecting the industry's commitment to innovation and sustainability.

This report offers a comprehensive and holistic view of the global Nestable Plastic Pallets market. It delves into intricate details of market size and forecast, projecting production volumes exceeding 300 million units by 2033. The analysis meticulously dissects the market by type, including Nestable, Rackable, and Stackable Pallets, and by application segments such as Food & Beverages, Chemicals, Pharmaceuticals, and Petroleum & Lubricants. The report further investigates crucial industry developments, identifies key growth catalysts like sustainability initiatives and e-commerce expansion, and highlights the challenges that the market navigates. A detailed examination of leading players and their contributions to market evolution is also provided, ensuring stakeholders gain a well-rounded understanding of the competitive landscape and future trajectory of this vital sector. The study's extensive coverage empowers informed strategic decision-making for all participants in the Nestable Plastic Pallets value chain.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.42% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.42%.

Key companies in the market include Orbis Corporation, Rehrig Pacific Company, Monoflo International, CABKA Group, Greystone Logistics, TMF Corporation, Allied Plastics, Perfect Pallets, Polymer Solutions International, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Nestable Plastic Pallets," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Nestable Plastic Pallets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.