1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Ingredients Encapsulation?

The projected CAGR is approximately 9.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Ingredients Encapsulation

Food Ingredients EncapsulationFood Ingredients Encapsulation by Type (Microencapsulation, Nanoencapsulation, Hybrid Encapsulation, World Food Ingredients Encapsulation Production ), by Application (Food, Beverages, Others, World Food Ingredients Encapsulation Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

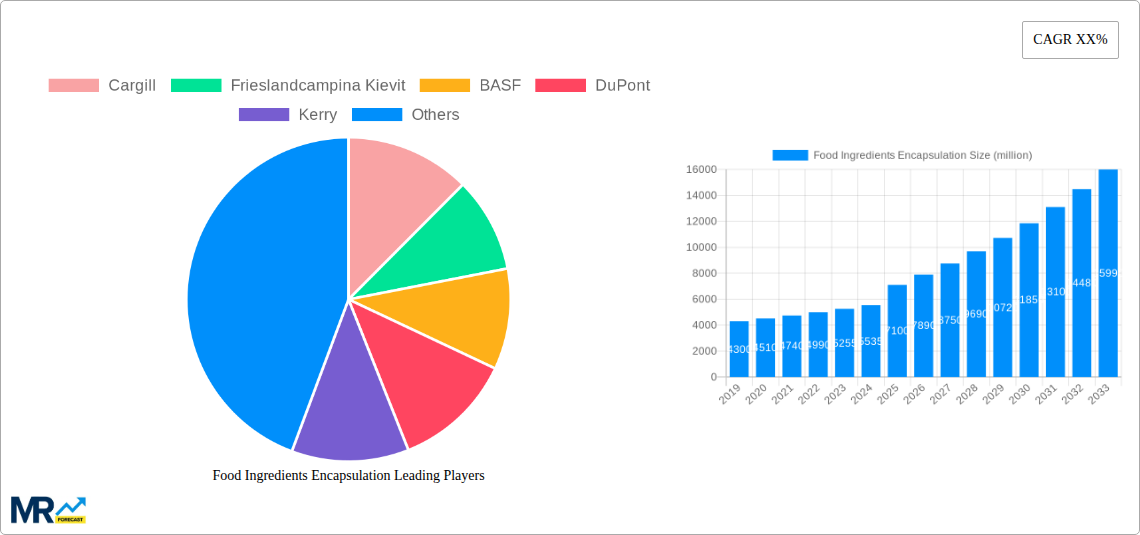

The global market for food ingredients encapsulation is experiencing robust expansion, projected to reach approximately $7.1 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 9.8% anticipated through 2033. This substantial growth is underpinned by several key drivers. Consumers' increasing demand for healthier and more functional food products fuels the need for encapsulated ingredients that enhance bioavailability, stability, and controlled release of active compounds like vitamins, minerals, probiotics, and omega-3 fatty acids. Furthermore, advancements in encapsulation technologies, particularly microencapsulation and nanoencapsulation, are offering innovative solutions for ingredient protection, masking undesirable flavors and odors, and improving product shelf-life. The food and beverage industry's continuous pursuit of product differentiation and novel formulations also contributes significantly to market dynamism.

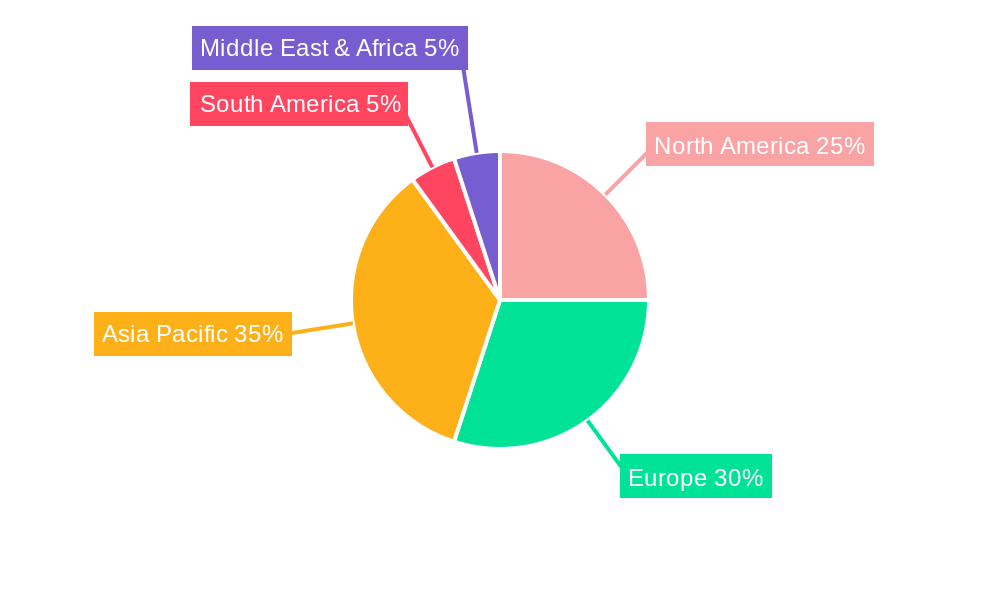

The market is segmented by encapsulation type, with microencapsulation holding a dominant share due to its versatility and cost-effectiveness. However, nanoencapsulation is emerging as a significant trend, enabling enhanced delivery of sensitive ingredients. Hybrid encapsulation techniques are also gaining traction, combining the benefits of different methods. In terms of application, the food sector leads, followed closely by beverages, with other applications showing potential for growth. Key players like Cargill, Frieslandcampina Kievit, BASF, DuPont, and Kerry are actively investing in research and development, strategic collaborations, and capacity expansions to capture market share. Geographically, the Asia Pacific region is expected to witness the fastest growth, driven by a large and burgeoning consumer base, increasing disposable incomes, and a growing awareness of health and wellness trends.

Here's a unique report description on Food Ingredients Encapsulation, incorporating the requested elements:

The global Food Ingredients Encapsulation market is poised for substantial expansion, projected to reach a valuation of approximately $15 billion by 2033, showcasing a robust Compound Annual Growth Rate (CAGR) of over 8.5% during the forecast period of 2025-2033. This surge is driven by an increasing demand for enhanced product quality, extended shelf life, and novel functional attributes in food and beverage applications. The study period from 2019 to 2033, with the base year of 2025, provides a comprehensive outlook on market dynamics. In recent years, particularly within the historical period of 2019-2024, the market has witnessed a steady upward trajectory, fueled by growing consumer awareness regarding health and wellness, leading to a greater preference for fortified and functional foods. Encapsulation technologies are instrumental in delivering sensitive ingredients like vitamins, minerals, probiotics, and omega-3 fatty acids in a protected and bioavailable form, thereby addressing these evolving consumer needs. Furthermore, the pursuit of cleaner labels and reduced reliance on artificial preservatives and flavorings is steering manufacturers towards encapsulation as a natural and effective solution. The ability of encapsulation to mask undesirable tastes and odors, improve ingredient stability against heat, light, and oxygen, and enable controlled release of active compounds is a significant market driver. Innovations in encapsulation techniques, such as spray drying, coacervation, and extrusion, are continuously improving efficiency and cost-effectiveness, making these technologies more accessible to a wider range of food manufacturers. The burgeoning interest in personalized nutrition and the development of specialized dietary products further contribute to the growing importance of encapsulation in delivering precise nutrient profiles and targeted functionalities. The estimated year of 2025 highlights a strong foundation for continued growth, with the market already demonstrating significant momentum.

The food ingredients encapsulation market is experiencing a powerful surge, propelled by a confluence of factors that cater to evolving consumer demands and industry advancements. A primary driver is the escalating consumer interest in health and wellness, which translates into a heightened demand for functional foods and beverages fortified with beneficial ingredients such as vitamins, minerals, probiotics, and omega-3 fatty acids. Encapsulation plays a crucial role in protecting these sensitive compounds, ensuring their stability, bioavailability, and effective delivery within food matrices. This ability to preserve ingredient integrity and optimize their impact is a key differentiator. Furthermore, the pursuit of cleaner labels and natural solutions is pushing manufacturers to reduce artificial additives and preservatives. Encapsulation offers a sophisticated method to achieve this, enabling the masking of off-flavors, the protection of delicate flavors and colors from degradation, and the controlled release of active components, thereby enhancing sensory appeal and shelf life without relying heavily on synthetic alternatives. The growing trend towards convenience foods and ready-to-eat meals also benefits from encapsulation, as it can improve the stability and sensory properties of ingredients within these products, ensuring a consistent and enjoyable consumer experience.

Despite its promising trajectory, the food ingredients encapsulation market faces several hurdles that temper its growth potential. One of the most significant challenges is the cost of implementation and scalability, particularly for advanced encapsulation techniques. The research and development, specialized equipment, and premium raw materials often associated with these processes can lead to higher production costs, which may be prohibitive for smaller manufacturers or for applications where ingredient cost is a critical factor. Consumer perception regarding "processed" ingredients can also pose a restraint, with some consumers exhibiting skepticism towards encapsulated products, often associating them with artificiality, even when natural encapsulation materials are used. This necessitates robust consumer education and transparent labeling to build trust. Furthermore, the complexity of encapsulation processes themselves can be a challenge. Achieving optimal encapsulation efficiency, ensuring the desired release profile, and maintaining ingredient compatibility within a specific food matrix require extensive expertise and rigorous quality control. Incompatibility issues between the core ingredient and the encapsulating material, or between the encapsulated ingredient and the food matrix, can lead to premature release, loss of efficacy, or undesirable changes in product texture and flavor. Regulatory hurdles and the need for extensive testing to ensure the safety and efficacy of encapsulated ingredients in different food applications also add to the complexity and cost of market entry.

The global Food Ingredients Encapsulation market exhibits a dynamic regional and segmental landscape, with specific areas and technologies poised for significant dominance during the study period of 2019-2033, with a sharp focus on the forecast period of 2025-2033.

Dominant Segments:

Microencapsulation: This technique is anticipated to continue its reign as the most dominant segment within the Food Ingredients Encapsulation market. Its versatility, relatively established technological base, and cost-effectiveness make it the go-to method for a wide array of applications.

Food Application Segment: The Food application segment is projected to be the largest revenue-generating segment within the broader Food Ingredients Encapsulation market.

Dominant Regions:

North America: This region is expected to maintain its position as a dominant force in the Food Ingredients Encapsulation market.

Europe: Europe is another pivotal region, characterized by a mature yet continuously evolving food market and a strong emphasis on product quality and safety.

While Asia-Pacific is expected to witness the highest growth rate due to its rapidly expanding population and increasing disposable incomes, North America and Europe are projected to hold the largest market shares in terms of value during the forecast period due to their established markets and higher adoption rates of advanced technologies.

The Food Ingredients Encapsulation industry is fueled by several key growth catalysts. The surging global demand for functional foods and beverages, driven by increasing health consciousness, is a primary catalyst. Consumers are actively seeking products that offer enhanced nutritional benefits and improved well-being, with encapsulation being vital for delivering sensitive bioactives like vitamins, minerals, probiotics, and omega-3 fatty acids. Furthermore, the growing preference for clean-label products and natural ingredients is another significant catalyst, as encapsulation allows for the masking of off-flavors and odors, thereby reducing the need for artificial additives and preservatives, appealing to consumers seeking simpler ingredient lists.

The Food Ingredients Encapsulation market is characterized by the presence of several prominent global players. These companies are at the forefront of innovation and market development, consistently introducing new technologies and solutions.

The Food Ingredients Encapsulation sector has seen numerous strategic advancements and innovations over the past few years, shaping its current landscape and future trajectory.

This report offers an exhaustive examination of the Food Ingredients Encapsulation market, providing deep insights into its present state and future potential. It meticulously analyzes market trends, key drivers, and emerging challenges, offering a nuanced understanding of the forces shaping the industry. The report includes in-depth regional analysis, identifying dominant markets and growth opportunities, and provides a detailed breakdown of the market by encapsulation type (Microencapsulation, Nanoencapsulation, Hybrid Encapsulation) and application (Food, Beverages, Others). With a study period spanning from 2019 to 2033, and a detailed outlook for the forecast period of 2025-2033, it empowers stakeholders with the data needed for informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.8%.

Key companies in the market include Cargill, Frieslandcampina Kievit, BASF, DuPont, Kerry, DSM, International Flavors and Fragrances, Symrise, Sensient Technologies, Balchem, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Food Ingredients Encapsulation," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Ingredients Encapsulation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.