1. What is the projected Compound Annual Growth Rate (CAGR) of the Specimen Insulator?

The projected CAGR is approximately 9.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Specimen Insulator

Specimen InsulatorSpecimen Insulator by Type (Package, Box, World Specimen Insulator Production ), by Application (Logistics, Food Industry, Others, World Specimen Insulator Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

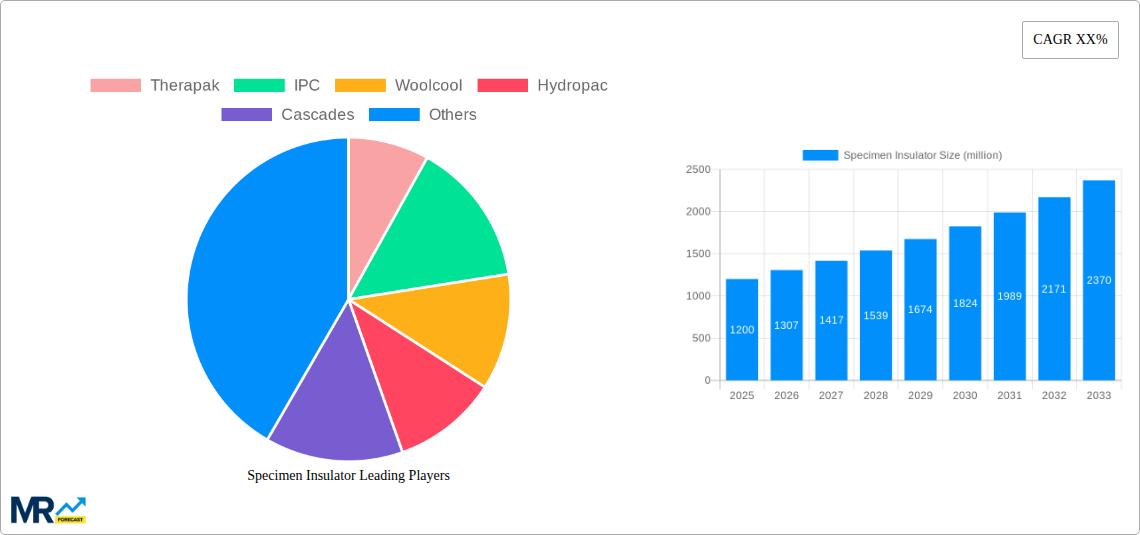

The global specimen insulator market is experiencing robust expansion, projected to reach $1.2 billion by 2025. This growth is driven by an anticipated Compound Annual Growth Rate (CAGR) of 9.2% from 2019 to 2033, indicating a dynamic and expanding sector. The increasing demand for reliable temperature-controlled transportation solutions for sensitive biological samples, pharmaceuticals, and medical supplies is a primary catalyst. Advancements in material science, leading to more efficient and sustainable insulation materials, are further fueling market penetration. The logistics and food industries represent significant application areas, leveraging specimen insulators to maintain product integrity and safety throughout the supply chain. Regulatory mandates and a heightened global focus on biosecurity also contribute to the sustained demand for these specialized packaging solutions, ensuring the viability and accuracy of transported specimens.

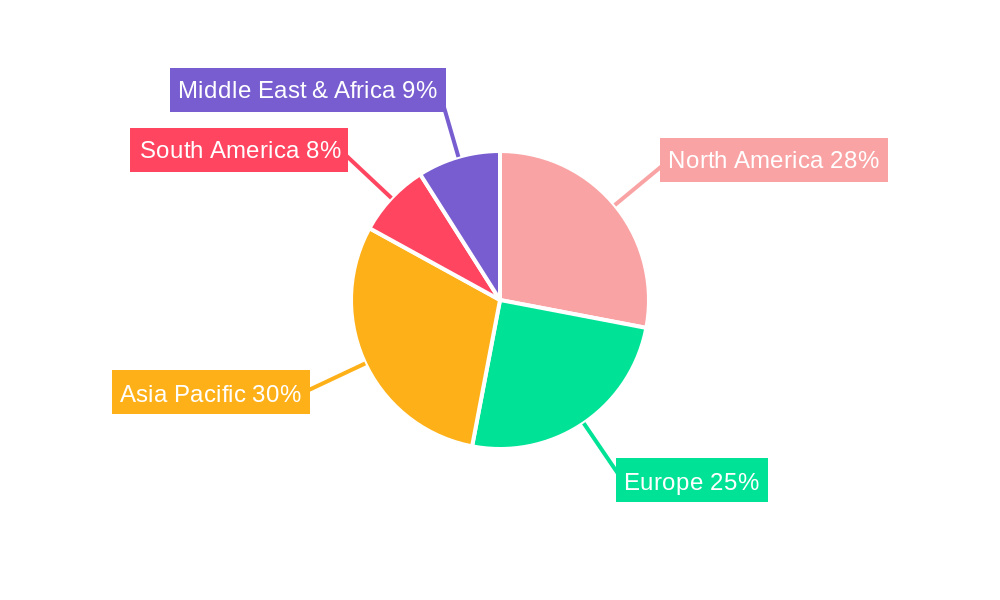

The market is segmented into 'Package' and 'Box' types, with 'World Specimen Insulator Production' being a key descriptor reflecting its global reach and the nature of the product. Emerging trends include the development of eco-friendly and reusable insulation materials, alongside smart packaging solutions that offer real-time temperature monitoring. While the market exhibits strong growth, potential restraints could include the initial cost of advanced insulation technologies and logistical complexities in certain underdeveloped regions. Key players such as Therapak, IPC, and Woolcool are actively innovating and expanding their product portfolios to cater to diverse application needs across North America, Europe, and the rapidly growing Asia Pacific region, particularly China and India, underscoring the global nature of specimen insulator demand.

This comprehensive report delves into the intricate global market for specimen insulators, providing an in-depth analysis of trends, drivers, challenges, and future projections from the historical period of 2019-2024 to the forecast period of 2025-2033, with 2025 serving as the base and estimated year. The study encompasses a vast market landscape, valued in the billions, exploring various product types including Package and Box configurations, and applications spanning Logistics, the Food Industry, and Others. Our analysis of World Specimen Insulator Production and emerging Industry Developments aims to equip stakeholders with actionable insights for strategic decision-making.

The global specimen insulator market is poised for significant expansion, driven by a confluence of factors that underscore its increasing importance across diverse sectors. The historical period of 2019-2024 witnessed a steady rise in demand, fueled by the escalating need for reliable temperature-controlled transportation solutions. As we move into the forecast period of 2025-2033, this growth trajectory is expected to accelerate, with the market projected to reach a valuation in the billions of USD. A key trend is the increasing sophistication of specimen insulator designs, moving beyond basic insulation to incorporate advanced materials and smart technologies. This evolution caters to the stringent requirements of sensitive biological samples, pharmaceuticals, and perishable goods, where maintaining precise temperature ranges is paramount to preserving integrity and efficacy. The logistical sector, in particular, is a major beneficiary, with a growing reliance on these insulators for the secure and compliant transport of medical specimens, vaccines, and organs. The report highlights a notable shift towards sustainable and eco-friendly insulation materials. As global environmental consciousness rises, manufacturers are investing in research and development to offer biodegradable and recyclable options, aligning with corporate social responsibility initiatives and regulatory pressures. This trend is not merely an ethical consideration but also a strategic advantage, attracting environmentally conscious clients and potentially reducing long-term disposal costs. Furthermore, the proliferation of e-commerce in specialized sectors, such as online pharmacies and direct-to-consumer food delivery of temperature-sensitive items, is creating new avenues for market growth. The need for reliable last-mile delivery of temperature-sensitive products necessitates robust and efficient specimen insulation solutions. The report identifies a growing segment of customized and specialized insulation solutions tailored to specific product requirements and transportation durations. This includes a focus on lightweight yet highly effective materials that minimize shipping costs and environmental impact while maximizing thermal performance. The increasing globalization of supply chains also plays a crucial role, demanding standardized and high-performance insulation products capable of withstanding diverse climatic conditions during international transit. The market's evolution is also being shaped by advancements in material science, leading to the development of thinner, more efficient insulation materials that offer superior thermal resistance without compromising on volume or weight, thereby optimizing logistics and reducing overall transportation footprints. The continuous innovation in insulation technology, coupled with an expanding application spectrum, firmly positions the specimen insulator market for sustained and substantial growth in the coming years, with market insights suggesting a compound annual growth rate (CAGR) that will see its valuation reaching tens of billions of USD by the end of the study period.

The specimen insulator market is experiencing robust growth, propelled by a multifaceted interplay of economic, technological, and societal factors. At the forefront is the undeniable expansion of the global healthcare and pharmaceutical industries. The increasing complexity of medical treatments, coupled with a rise in chronic diseases, necessitates the frequent and secure transportation of a vast array of biological specimens, diagnostic kits, and temperature-sensitive medications. This surge in demand directly translates into a higher requirement for dependable specimen insulators that can maintain strict temperature integrity throughout the supply chain. Furthermore, the ongoing advancements in biotechnology and personalized medicine are generating a growing need for the transportation of highly specialized and often temperature-sensitive research materials and cell cultures. The burgeoning life sciences sector, with its focus on innovative therapies and diagnostics, acts as a significant catalyst for the market. Beyond healthcare, the Food Industry plays an equally critical role. The increasing consumer demand for fresh, high-quality, and often exotic food products, coupled with the globalization of food supply chains, mandates efficient cold chain logistics. Specimen insulators are instrumental in preserving the freshness, safety, and nutritional value of perishable food items during transit, from farm to fork. The report also highlights the growing awareness and regulatory emphasis on maintaining product integrity during transportation. Governments and international bodies are implementing stricter guidelines for the transportation of temperature-sensitive goods, thereby creating a mandatory market for compliant insulation solutions. This regulatory push is ensuring a consistent demand for high-performance and reliable specimen insulators across various applications. The increasing adoption of advanced manufacturing techniques and material science innovations is also contributing significantly. Manufacturers are continuously developing lighter, more durable, and more thermally efficient insulation materials, which not only enhance performance but also reduce transportation costs and environmental impact. This technological evolution makes specimen insulators more accessible and attractive to a wider range of businesses. The growth of e-commerce, particularly in the pharmaceutical and food sectors, is another potent driver. The ability to deliver temperature-sensitive products directly to consumers reliably relies heavily on effective insulation solutions, expanding the market reach and creating new distribution channels. The market is projected to reach in the billions of USD within the forecast period, underscoring the collective impact of these driving forces.

Despite the promising growth trajectory, the specimen insulator market is not without its hurdles. A significant challenge lies in the cost of advanced insulation materials and technologies. While innovative materials offer superior performance, their higher production costs can translate into premium pricing, potentially limiting adoption for budget-conscious businesses or in price-sensitive market segments. This can be particularly restrictive for smaller enterprises or in regions with developing economies, where the upfront investment might be prohibitive. Furthermore, the market faces stringent regulatory compliance and standardization demands. Different regions and industries have varying requirements for temperature control, packaging integrity, and documentation. Navigating this complex regulatory landscape, ensuring adherence to international standards (such as those set by the World Health Organization for vaccine transport or by food safety agencies), and obtaining necessary certifications can be time-consuming and resource-intensive for manufacturers. The disposal and environmental impact of traditional insulation materials also present a considerable challenge. Many conventional insulation solutions, while effective, are made from non-biodegradable or difficult-to-recycle materials. As environmental regulations tighten and corporate sustainability goals become more ambitious, there is increasing pressure to develop and utilize eco-friendly alternatives. This necessitates significant investment in research and development for sustainable materials and improved end-of-life management strategies. The logistical complexities and infrastructure limitations in certain regions can also act as a restraint. In areas with underdeveloped cold chain infrastructure, power outages, or unreliable transportation networks, even the most advanced specimen insulators may struggle to maintain required temperature conditions. This requires a holistic approach to cold chain management, beyond just the insulation itself. Finally, the fierce competition and price sensitivity within the market can exert downward pressure on profit margins. The presence of numerous players, ranging from established giants to smaller niche providers, often leads to intense competition, making it challenging for companies to differentiate their offerings and command premium prices solely based on performance. The market's projected valuation in the billions of USD is a testament to its overall strength, but addressing these challenges is crucial for unlocking its full potential.

The global specimen insulator market is characterized by distinct regional strengths and segment dominance, with North America and Europe emerging as significant powerhouses due to their advanced healthcare infrastructure, robust pharmaceutical industries, and stringent regulatory frameworks. These regions exhibit a consistently high demand for sophisticated and reliable specimen insulation solutions for the transportation of a wide array of medical supplies, diagnostic samples, and research materials. The Logistics segment, encompassing the entire supply chain for temperature-sensitive goods, is a dominant application area within these regions. This includes not only the transportation of pharmaceuticals and biological samples but also the increasingly important cold chain logistics for perishable food items. The presence of major pharmaceutical companies, research institutions, and well-developed distribution networks in North America and Europe fuels a continuous demand for high-performance insulation products that can meet rigorous temperature control requirements and international shipping standards. Furthermore, the strong emphasis on quality control and product integrity within these developed economies necessitates the use of advanced insulation technologies.

In parallel, the Food Industry application segment is experiencing substantial growth globally, with a notable impact on market dominance. As consumer preferences shift towards higher quality, longer shelf-life, and ethically sourced food products, the demand for effective cold chain solutions has skyrocketed. The increasing globalization of food supply chains means that fresh produce, dairy products, seafood, and specialized gourmet items need to be transported across vast distances while maintaining their optimal temperature and quality. This necessitates the use of advanced specimen insulators that can withstand varied climatic conditions and extended transit times. The report highlights that countries with significant agricultural exports and a strong domestic food processing industry are leading this segment.

The Type: Box configuration within the specimen insulator market is poised for significant dominance. While "Package" represents a broader category, the "Box" format offers a standardized, robust, and easily handled solution for a multitude of applications. These insulated boxes are particularly crucial for the reliable transport of medical specimens, vaccines, and temperature-sensitive drugs, as well as for the shipping of perishable food items. Their structured design facilitates stacking, handling, and integration into existing logistics systems, making them a preferred choice for many businesses. The report indicates that the demand for reusable and eco-friendly insulated boxes is also on the rise, reflecting broader sustainability trends and regulatory pressures. This segment’s versatility and adaptability to various shipping requirements across both the Logistics and Food Industry segments contribute to its leading position. The market's estimated valuation in the billions of USD is significantly influenced by the strong performance of these key regions and dominant segments. The continuous innovation in materials and design for these boxed solutions, coupled with their widespread adoption in critical industries, solidifies their position in the global specimen insulator market.

The specimen insulator industry is experiencing significant growth, largely fueled by the expanding global healthcare sector and the increasing demand for temperature-sensitive pharmaceutical and biological product transportation. The rise of biotechnology and personalized medicine, requiring specialized cold chain logistics, acts as a powerful catalyst. Furthermore, the growing consumer awareness and regulatory push for food safety and quality in the Food Industry are driving the adoption of effective cold chain solutions. Advancements in material science, leading to lighter, more efficient, and sustainable insulation materials, are also reducing costs and enhancing performance, making these products more accessible. The increasing reach of e-commerce for pharmaceuticals and perishable goods further amplifies the need for reliable specimen insulators, creating new market opportunities and propelling the industry's expansion towards a valuation in the billions of USD.

This report offers an all-encompassing examination of the global specimen insulator market, providing invaluable insights into its dynamics and future trajectory. From historical performance (2019-2024) to forward-looking projections (2025-2033), the analysis is meticulously structured to cover every critical aspect. We delve into market segmentation by Type (Package, Box) and Application (Logistics, Food Industry, Others), alongside a detailed exploration of World Specimen Insulator Production methodologies and emerging Industry Developments. The report meticulously analyzes driving forces, challenges, and restraints, offering a nuanced understanding of the market's complexities. Key regional and segmental dominance is identified, supported by robust data and expert analysis, with a projected market valuation reaching billions of USD. This comprehensive coverage ensures that stakeholders, including manufacturers, distributors, and end-users, are equipped with the knowledge necessary to navigate this evolving market and capitalize on future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.2%.

Key companies in the market include Therapak, IPC, Woolcool, Hydropac, Cascades, Krautz-Temax, Cambro, Beijing Peirong Biotechnology.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Specimen Insulator," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Specimen Insulator, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.