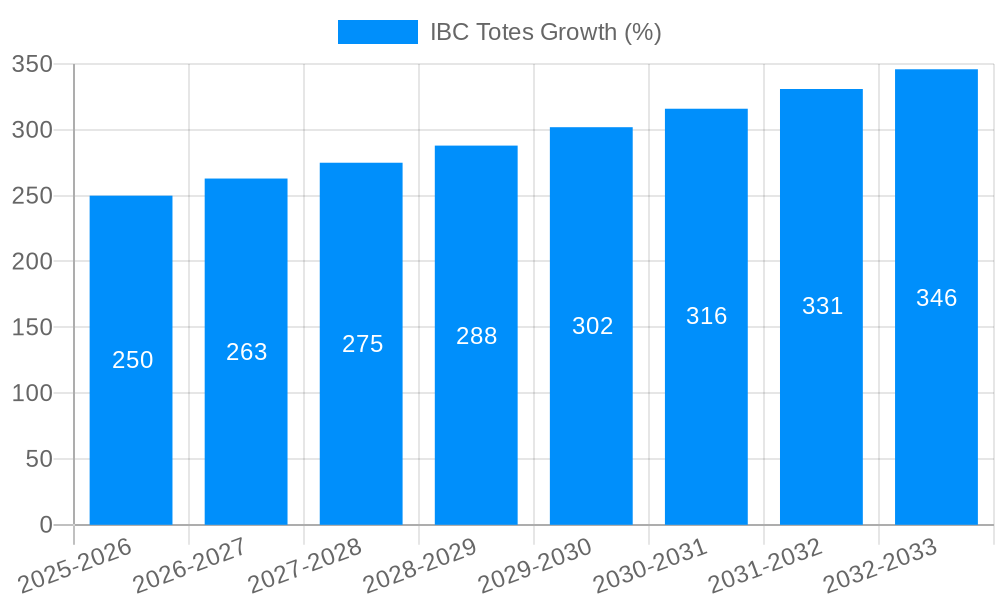

1. What is the projected Compound Annual Growth Rate (CAGR) of the IBC Totes?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IBC Totes

IBC TotesIBC Totes by Type (Ring Shape, Square Shape, U Shape), by Application (Food, Pharmaceutical, Chemical Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global market for Intermediate Bulk Containers (IBC Totes) is poised for significant expansion, currently valued at an estimated $19.3 billion in 2025. This robust growth trajectory is fueled by a Compound Annual Growth Rate (CAGR) of 5.6% projected through 2033. The increasing demand for efficient and safe material handling solutions across diverse industries is the primary driver. The food and beverage sector, in particular, is a major consumer of IBC totes due to their hygienic design and suitability for bulk ingredient storage and transportation. Similarly, the pharmaceutical industry relies on these containers for their ability to maintain product integrity and comply with stringent regulatory standards. The chemical industry also contributes significantly to market growth, utilizing IBC totes for the secure containment and movement of various chemicals, ranging from raw materials to finished products.

Further augmenting this market's potential are emerging trends such as the development of more sustainable and reusable IBC tote designs, incorporating advanced materials and smart tracking technologies. These innovations address environmental concerns and enhance operational efficiency for end-users. However, certain restraints, including the initial capital investment for acquiring IBC totes and the logistical challenges associated with their return and cleaning in some applications, could temper immediate adoption rates. Despite these hurdles, the inherent advantages of IBC totes – their space-saving design, reusability, and cost-effectiveness compared to drums or smaller containers – continue to solidify their indispensable role in modern supply chains, ensuring continued market dominance and innovation.

This comprehensive report delves into the dynamic IBC Totes Market, offering an in-depth analysis of its trajectory from the Historical Period (2019-2024) through the Study Period (2019-2033). With a Base Year (2025) and Estimated Year (2025) firmly established, and a robust Forecast Period (2025-2033), this study provides actionable insights for stakeholders. The market, valued in the billions, is characterized by its essential role in the safe and efficient transportation of bulk liquids and semi-liquids across a myriad of industries. We will meticulously examine market size projections, projected revenue figures, and compound annual growth rates (CAGR), all quantified in the billions, to paint a clear financial picture of this vital sector.

XXX The global IBC Totes market is poised for significant expansion, projected to reach values in the billions of dollars by the end of the forecast period. This growth is fueled by an increasing demand for efficient and sustainable bulk liquid handling solutions across various industries. The evolution of IBC tote design is a key trend, with manufacturers continuously innovating to enhance durability, safety, and ease of use. Square-shaped IBCs continue to dominate due to their superior space utilization during transportation and storage, optimizing logistics and reducing overall shipping costs. Ring-shaped IBCs are also gaining traction, particularly in applications requiring enhanced stability and robust containment. The report will dissect these evolving design preferences, correlating them with specific application needs and regional market demands. Furthermore, the growing emphasis on environmental sustainability is driving the adoption of reusable and recyclable IBC totes, contributing to a circular economy model within the packaging sector. This shift is not only driven by regulatory pressures but also by a growing consumer and corporate awareness of environmental responsibility. The integration of smart technologies, such as RFID tags and sensor integration, is another burgeoning trend, enabling real-time tracking of contents, monitoring of temperature and humidity, and providing enhanced supply chain visibility. This technological advancement is particularly critical for industries dealing with sensitive materials like pharmaceuticals and certain food products, where product integrity is paramount. The report will thoroughly explore these emerging technological integrations and their impact on market dynamics, including potential shifts in market share and the emergence of new competitive advantages for innovative players. We will also examine the influence of evolving trade policies and global supply chain disruptions on the demand and production of IBC totes, highlighting how these external factors are shaping market trends and investment strategies. The interplay between cost-effectiveness, performance, and sustainability will continue to be a central theme, guiding both manufacturer innovation and end-user purchasing decisions.

The surge in demand for IBC totes, contributing to a market valued in the billions, is primarily driven by the expanding global chemical industry. The sheer volume of chemicals transported annually necessitates robust and secure containment solutions, making IBCs an indispensable part of the supply chain. Concurrently, the growing food and beverage sector, with its increasing reliance on bulk ingredient transportation and ready-to-consume liquid distribution, further bolsters market growth. The inherent advantages of IBCs, such as their reusability, durability, and cost-effectiveness compared to traditional drums or smaller containers, are fundamental drivers. They offer superior handling efficiency, reducing labor costs and improving operational workflows. Moreover, the increasing awareness and implementation of stringent safety regulations for the transportation of hazardous materials globally are compelling industries to adopt certified and reliable packaging solutions like IBC totes. This regulatory push ensures product integrity and minimizes environmental risks, indirectly fueling market expansion. The rise of e-commerce and the subsequent demand for efficient logistics solutions for a wider range of liquid products also contribute significantly to the sustained growth of the IBC tote market.

Despite the promising growth trajectory, the IBC Totes market, despite its multi-billion dollar valuation, faces several challenges and restraints. One significant hurdle is the initial capital investment required for some advanced or specialized IBC tote designs, which can be a deterrent for smaller businesses or those operating on tighter margins. The logistical complexities associated with the return and refurbishment of reusable IBCs also pose a significant operational challenge, impacting efficiency and potentially increasing costs if not managed effectively. Furthermore, the increasingly stringent environmental regulations regarding waste disposal and the lifecycle management of packaging materials, while also a driver for sustainability, can impose compliance burdens and necessitate investment in new technologies or processes for manufacturers and users alike. The volatility in raw material prices, particularly for plastics and metals used in IBC construction, can directly impact production costs and profit margins, creating price instability in the market. Finally, competition from alternative bulk liquid packaging solutions, though less prevalent for certain applications, can still exert pressure on market share, especially in niche segments or for specific product types.

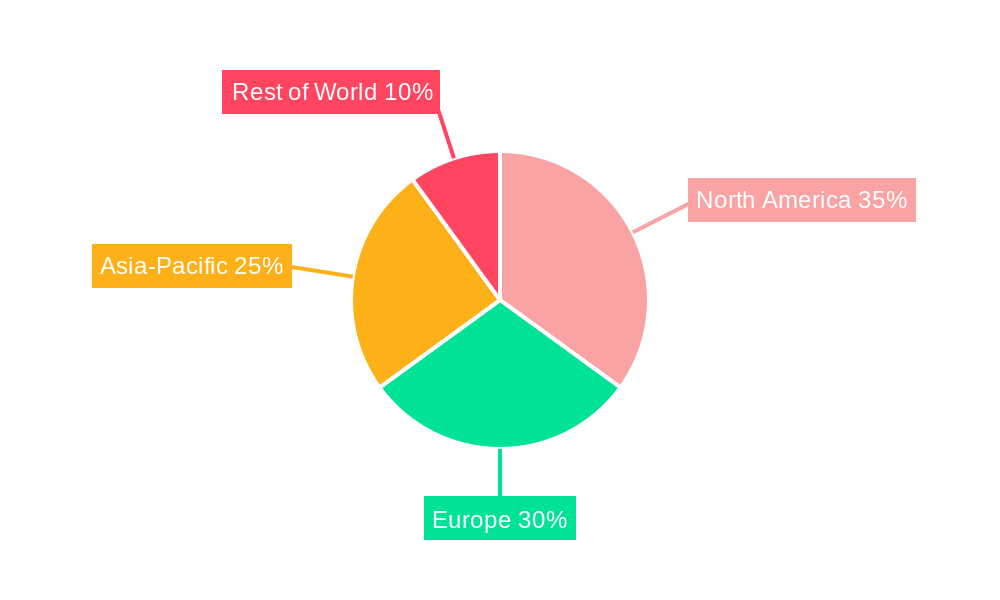

The global IBC Totes market, projected to reach substantial billions in valuation, is experiencing significant dominance and growth across specific regions and segments.

Dominant Segments:

Application: Chemical Industry: This segment is a cornerstone of the IBC tote market. The chemical industry's inherent need for safe, reliable, and compliant containment for a vast array of raw materials, intermediates, and finished products makes IBCs indispensable. The sheer volume of chemicals transported globally, ranging from hazardous to non-hazardous substances, necessitates packaging solutions that offer superior protection against leaks, contamination, and environmental exposure. The stringent regulatory landscape governing chemical transportation, including international accords and national safety standards, further reinforces the demand for robust and certified IBC totes. The Square Shape IBC is particularly prevalent in this segment due to its optimized space utilization during transit and storage, allowing for greater density on pallets and in shipping containers, thereby reducing logistical costs. Manufacturers are continuously innovating in this space, developing IBCs with enhanced chemical resistance, antistatic properties, and specialized lining materials to cater to the diverse and often aggressive nature of chemical substances. The Asia-Pacific region, with its rapidly expanding chemical manufacturing base, particularly in countries like China and India, is a key driver for this segment's dominance, accounting for a significant portion of the global demand.

Type: Square Shape: As highlighted above, the Square Shape IBC stands out due to its inherent logistical advantages. Its design maximizes cube utilization in transportation and warehousing, a critical factor for cost-efficiency in the multi-billion dollar global logistics network. This design facilitates easier stacking and handling, leading to reduced labor requirements and quicker turnaround times. For industries where space is at a premium, such as urban distribution centers or large-scale manufacturing facilities, the square shape offers unparalleled efficiency. This dominance is further solidified by the versatility of square IBCs, which can be adapted for a wide range of applications, from food and beverage to industrial chemicals, making them a preferred choice for many end-users.

Key Regions/Countries for Market Domination:

The synergy between these dominant segments and regions, driven by both established needs and emerging trends, is shaping the multi-billion dollar IBC tote market, with the Chemical Industry and the Square Shape IBC emerging as key pillars of its current and future growth.

The IBC Totes industry, a multi-billion dollar sector, is experiencing robust growth driven by several key catalysts. The escalating global demand for efficient and secure bulk liquid transportation across sectors like chemicals, food, and pharmaceuticals is a primary driver. Increasing regulatory mandates for safe handling of hazardous materials globally are compelling industries to adopt compliant IBC solutions. Furthermore, the growing emphasis on sustainability and circular economy principles is boosting the demand for reusable and recyclable IBC totes, aligning with corporate environmental goals and governmental initiatives.

This report offers a comprehensive overview of the IBC Totes market, estimated to be valued in the billions. It meticulously analyzes market dynamics, providing in-depth insights into trends, growth drivers, and challenges from the Historical Period (2019-2024) through the Forecast Period (2025-2033), with a firm Base Year (2025). The report delves into key segments such as Type (Ring Shape, Square Shape, U Shape) and Application (Food, Pharmaceutical, Chemical Industry, Others), and examines significant Industry Developments. This detailed examination will equip stakeholders with the knowledge necessary to navigate this evolving market landscape and capitalize on future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Snyder Industries, Greif, Global-Pak, Flexi-tuff, Isbir, BAG Corp, AmeriGlobe, LC Packaging, Sackmaker, Langston, RDA Bulk Packaging, Rishi FIBC, Halsted Corporation, Kanpur Plastipack, Pyramid Technoplast, DENIOS, The Cary Company, Titan, Fluid-Bag, Hangzhou Huanshen Package New Material, Qingdao Qinyi, Qingdao Global Flexitank Logistics, Hangzhou East Plastic, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "IBC Totes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IBC Totes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.