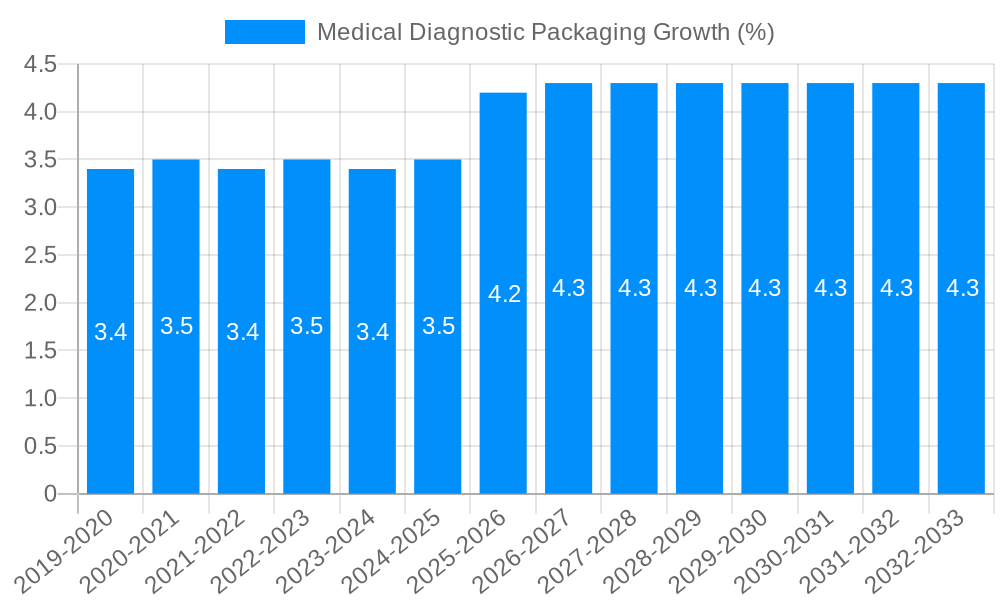

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Diagnostic Packaging?

The projected CAGR is approximately 4.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Diagnostic Packaging

Medical Diagnostic PackagingMedical Diagnostic Packaging by Application (Medical Device Packaging, Medicine Package, Others, World Medical Diagnostic Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Medical Diagnostic Packaging market is poised for significant growth, projected to reach an estimated USD 47.2 billion by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 4.4% through 2033. This expansion is primarily fueled by the escalating demand for advanced diagnostic tools and the increasing prevalence of chronic diseases worldwide. Innovations in packaging materials and designs are crucial for ensuring the integrity, sterility, and safety of diagnostic kits and specimens, directly contributing to patient outcomes and healthcare efficiency. The healthcare industry's continuous investment in research and development for new diagnostic technologies further stimulates the need for specialized, high-performance packaging solutions. Stringent regulatory requirements governing medical device and pharmaceutical packaging also act as a catalyst, driving manufacturers to adopt superior materials and manufacturing processes to meet compliance standards. The growing emphasis on point-of-care diagnostics and the increasing adoption of personalized medicine are expected to create new avenues for market expansion, requiring flexible and innovative packaging approaches.

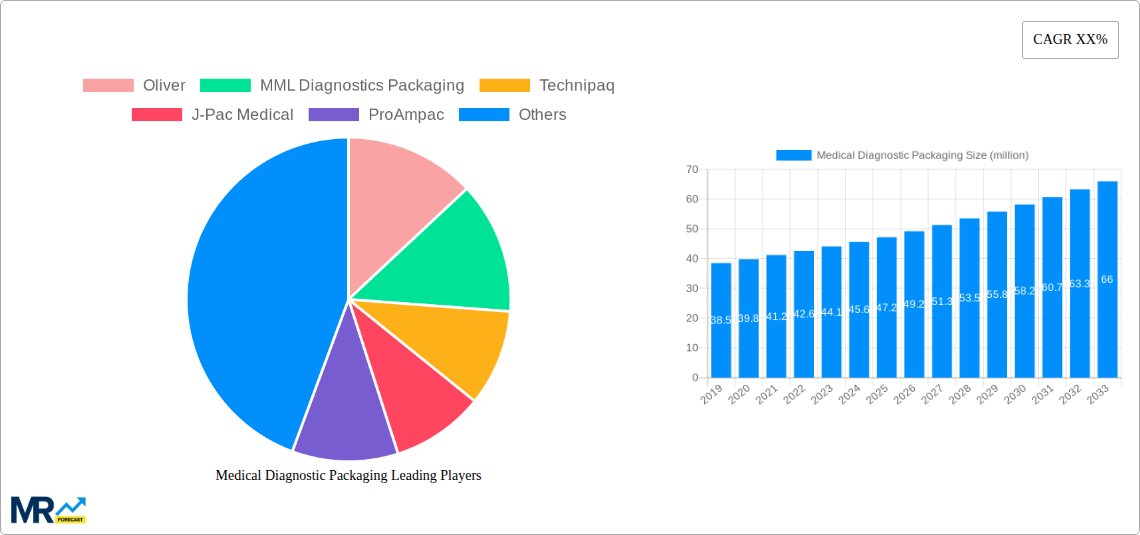

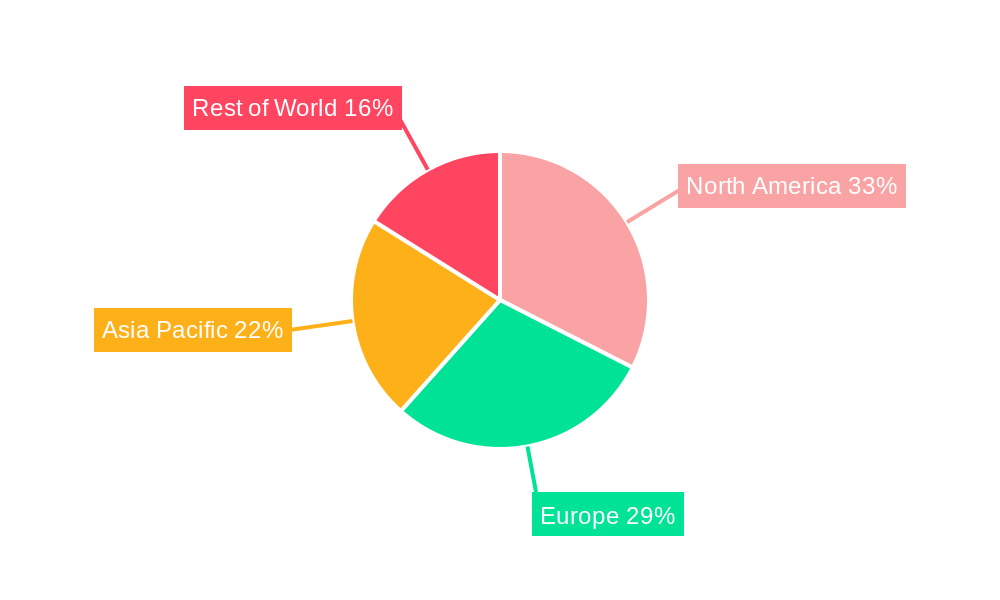

Key market segments include Medical Device Packaging and Medicine Package, with "World Medical Diagnostic Packaging Production" representing the overarching industry. The market is characterized by a competitive landscape with prominent players such as Oliver, MML Diagnostics Packaging, Technipaq, ProAmpac, CCL Healthcare, Sonoco, and Gerresheimer, among others, actively engaged in product innovation and strategic collaborations. Geographically, North America and Europe currently lead the market due to well-established healthcare infrastructures and high healthcare spending. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by a burgeoning population, increasing healthcare access, and a growing number of local diagnostic kit manufacturers. Emerging economies in South America and the Middle East & Africa also present substantial untapped potential as their healthcare systems mature and diagnostic capabilities expand. The market's trajectory is influenced by trends such as the adoption of sustainable packaging materials and the integration of smart technologies for enhanced traceability and data security.

Here's a report description on Medical Diagnostic Packaging, incorporating your provided details and adhering to the requested structure and word counts:

The global medical diagnostic packaging market is poised for substantial expansion, projected to reach an impressive $68.7 billion by 2033, up from an estimated $45.2 billion in 2025. This robust growth is underpinned by a confluence of factors, including the increasing prevalence of chronic diseases, a growing elderly population, and the relentless advancement in diagnostic technologies. The historical period of 2019-2024 witnessed steady progress, driven by heightened awareness of health and hygiene and a burgeoning demand for rapid and accurate diagnostic solutions. Looking ahead to the study period of 2019-2033, with 2025 serving as the base year for this in-depth analysis, the market will continue its upward trajectory. Key trends shaping this landscape include the burgeoning demand for sterile and tamper-evident packaging to ensure product integrity and patient safety, especially critical for diagnostic kits and reagents. The adoption of advanced materials offering superior barrier properties against moisture, light, and oxygen is paramount, safeguarding the efficacy of sensitive diagnostic components. Furthermore, the rise of personalized medicine and point-of-care diagnostics is fueling the need for smaller, more user-friendly, and often disposable packaging solutions. Sustainability is also emerging as a significant trend, with manufacturers increasingly exploring recyclable and biodegradable materials to minimize environmental impact. The integration of smart packaging technologies, incorporating features like temperature indicators and authentication markers, is gaining traction, enhancing traceability and compliance with stringent regulatory requirements. The market's evolution is also characterized by a growing emphasis on serialization and track-and-trace capabilities, crucial for combating counterfeit products and ensuring supply chain integrity. From innovative pouch designs for at-home testing kits to robust vials and containers for laboratory diagnostics, the diverse applications within medical diagnostic packaging reflect the dynamic nature of the healthcare industry. The estimated value of $45.2 billion in 2025 represents a significant market, with projections indicating sustained double-digit growth throughout the forecast period of 2025-2033.

Several powerful forces are propelling the growth of the medical diagnostic packaging market. Foremost among these is the escalating global burden of chronic diseases, such as diabetes, cardiovascular conditions, and cancer, which necessitates more frequent and sophisticated diagnostic testing. This increased demand for diagnostic procedures directly translates into a greater need for reliable and secure packaging solutions for everything from blood collection tubes to advanced molecular diagnostic kits. The aging global population is another significant driver, as older individuals are more susceptible to various health issues and require regular diagnostic monitoring. This demographic shift is creating a sustained demand for a wide array of diagnostic packaging. Furthermore, rapid advancements in diagnostic technology, including the development of novel assays, point-of-care testing devices, and in-vitro diagnostic (IVD) tools, are creating new packaging requirements. These technologies often involve sensitive reagents and complex components that demand specialized packaging to maintain their stability and performance. The growing emphasis on early disease detection and preventative healthcare strategies, encouraged by both healthcare providers and individuals, also contributes to the market's expansion. As diagnostic testing becomes more accessible and integrated into routine healthcare, the demand for its associated packaging escalates. The increasing global healthcare expenditure, particularly in emerging economies, is further bolstering the market by enabling greater access to diagnostic services and products.

Despite the robust growth trajectory, the medical diagnostic packaging market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the stringent and ever-evolving regulatory landscape governing medical devices and diagnostics. Compliance with standards set by bodies like the FDA, EMA, and other national health authorities requires substantial investment in research, development, and rigorous testing, which can increase production costs and time-to-market. The high cost of raw materials and specialized packaging technologies can also act as a restraint, particularly for smaller manufacturers or those operating in price-sensitive markets. The complex supply chains involved in diagnostic packaging, often requiring specialized handling and temperature control, can lead to logistical challenges and increased operational expenses. Moreover, the need for specialized expertise in material science and packaging engineering to develop solutions that meet specific product requirements adds another layer of complexity and cost. The growing pressure for sustainable packaging solutions, while a positive trend, also presents challenges as manufacturers grapple with finding cost-effective and performance-comparable alternatives to traditional materials. Counterfeiting and diversion of diagnostic products remain a persistent concern, necessitating advanced security features in packaging, which can further increase costs. The long lead times associated with procuring specialized packaging materials and achieving regulatory approvals can also slow down the introduction of new diagnostic products, thus impacting market growth.

Region: North America

North America, particularly the United States, is poised to be a dominant region in the medical diagnostic packaging market. This dominance is attributed to several key factors:

Segment: Medical Device Packaging

Within the application segments, Medical Device Packaging is projected to dominate the medical diagnostic packaging market. This segment encompasses the packaging of a vast array of diagnostic instruments, kits, and components.

The medical diagnostic packaging industry is experiencing significant growth, fueled by several key catalysts. The increasing global prevalence of chronic and infectious diseases necessitates more frequent and sophisticated diagnostic testing, directly increasing the demand for associated packaging. Furthermore, rapid technological advancements in diagnostic tools, including point-of-care devices and molecular diagnostics, are creating new opportunities for specialized packaging solutions. The growing emphasis on early disease detection and preventative healthcare strategies worldwide is also a major driver, as it encourages wider adoption of diagnostic screening.

This comprehensive report offers an in-depth analysis of the global medical diagnostic packaging market, covering the study period from 2019 to 2033. With 2025 as the base and estimated year, the report meticulously details the market's trajectory through the historical period of 2019-2024 and projects its evolution through the forecast period of 2025-2033. It provides detailed insights into market trends, driving forces, challenges, and restraints. The report includes a thorough examination of key regional markets and dominant application segments, such as Medical Device Packaging and Medicine Package, offering valuable strategic intelligence. Furthermore, it highlights leading players, significant developments, and the future outlook of the industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.4%.

Key companies in the market include Oliver, MML Diagnostics Packaging, Technipaq, J-Pac Medical, ProAmpac, CCL Healthcare, D Barrier Bags Inc., Gerresheimer, TO Plastics, Nelipak Healthcare Packaging, Borealis, Sonoco, PolyCine GmbH, Cenmed, TECHLAB, Inc., Spartech.

The market segments include Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Medical Diagnostic Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Diagnostic Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.