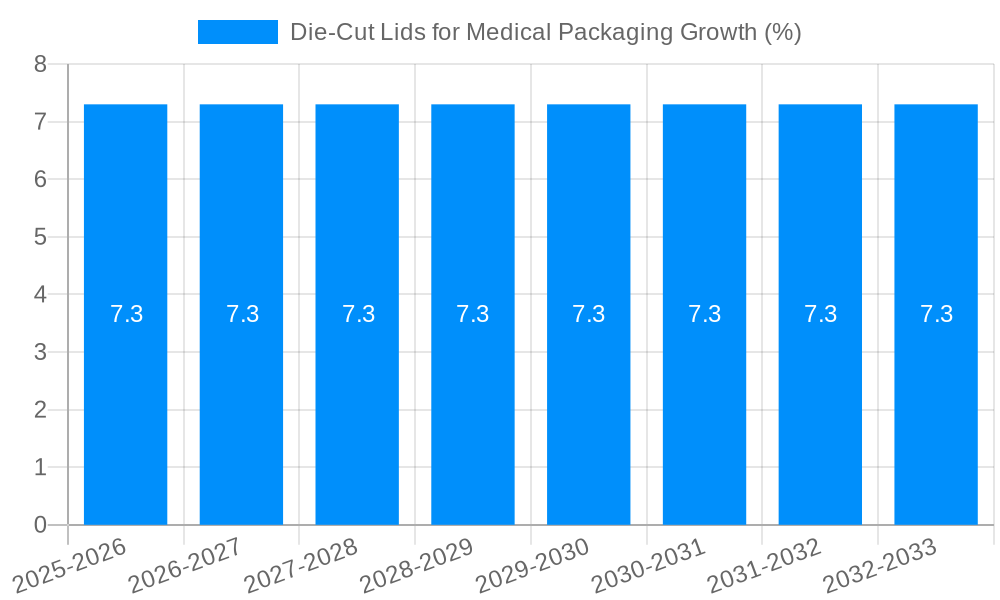

1. What is the projected Compound Annual Growth Rate (CAGR) of the Die-Cut Lids for Medical Packaging?

The projected CAGR is approximately 7.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Die-Cut Lids for Medical Packaging

Die-Cut Lids for Medical PackagingDie-Cut Lids for Medical Packaging by Type (Paper Die Cut Lids, Plastic (PET) Die Cut Lids, Metals (Aluminium Foil) Die Cut Lid), by Application (Syringe Manufacturing and Filling, Implants, On-body Wearables, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

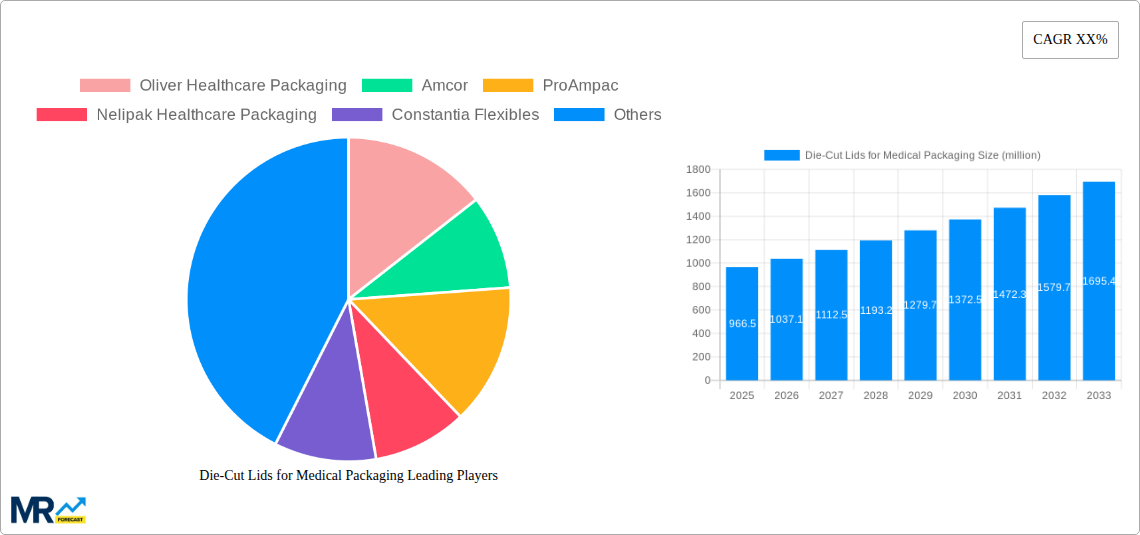

The global market for Die-Cut Lids for Medical Packaging is experiencing robust growth, projected to reach an estimated market size of $966.5 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 7.3% through 2033. This expansion is fueled by the increasing demand for sterile and secure packaging solutions across various medical applications. Key drivers include the burgeoning pharmaceutical industry, a surge in the manufacturing of advanced medical devices, and a heightened focus on patient safety and product integrity. The growing prevalence of chronic diseases and an aging global population further contribute to the demand for effective medical packaging, where die-cut lids play a crucial role in ensuring the sterility and tamper-evidence of vials, syringes, and other critical medical products.

The market is characterized by a diverse range of product types, with Plastic (PET) Die Cut Lids and Metals (Aluminium Foil) Die Cut Lids holding significant sway due to their excellent barrier properties and suitability for sterilization methods. Syringe manufacturing and filling, along with implantable devices, represent major application segments, reflecting the stringent packaging requirements for these sensitive medical products. Innovations in material science and packaging technology are continuously shaping the market, with a growing emphasis on sustainable and recyclable materials. Leading companies such as Oliver Healthcare Packaging, Amcor, and ProAmpac are investing in research and development to offer advanced solutions that meet evolving regulatory standards and customer needs, thereby solidifying their positions in this dynamic and essential sector of the healthcare industry.

This comprehensive report delves into the dynamic global market for die-cut lids used in medical packaging. Spanning a study period from 2019 to 2033, with a base year of 2025, the analysis provides in-depth insights into market trends, driving forces, challenges, regional dominance, and key players. The report leverages historical data from 2019-2024 and forecasts future market trajectories from 2025-2033, offering a robust understanding of market evolution and opportunities. The market is meticulously segmented by product type (Paper Die Cut Lids, Plastic (PET) Die Cut Lids, Metals (Aluminium Foil) Die Cut Lid) and application (Syringe Manufacturing and Filling, Implants, On-body Wearables, Others). Key industry developments and growth catalysts are highlighted, supported by an exhaustive list of leading companies and significant market events. The estimated market size, detailed in millions of units, provides quantifiable data for strategic decision-making.

XXX The global market for die-cut lids in medical packaging is poised for significant expansion, driven by an escalating demand for sterile, secure, and tamper-evident containment solutions for a wide array of medical devices and pharmaceuticals. The historical period (2019-2024) witnessed a steady uptake, amplified by the heightened focus on infection control and product integrity during the global health crisis. The base year of 2025 marks a pivotal point, with the market anticipated to reach a substantial volume of several hundred million units, reflecting the established need for reliable packaging. Looking ahead to the forecast period (2025-2033), the market is projected to exhibit a Compound Annual Growth Rate (CAGR) that underscores its robust growth trajectory. This expansion is largely fueled by advancements in material science, leading to the development of innovative lid solutions offering superior barrier properties, enhanced functionality, and improved sustainability. The increasing complexity and sensitivity of medical products, from advanced drug delivery systems to sophisticated implantable devices, necessitate packaging that can maintain product sterility throughout its lifecycle, from manufacturing to patient use. Furthermore, stringent regulatory landscapes globally mandate stringent packaging standards, compelling manufacturers to adopt high-quality die-cut lid solutions that comply with international safety and efficacy requirements. The rise of personalized medicine and the growing adoption of single-use medical devices also contribute to the demand for specialized and precisely engineered die-cut lids. The market is also seeing a trend towards greater customization, with manufacturers offering lids tailored to specific product shapes, sizes, and sterilization requirements. This evolution signifies a move beyond generic packaging to highly specialized solutions that optimize product protection and user convenience. The increasing integration of smart technologies, such as RFID tags embedded in lids for track-and-trace capabilities, is another emerging trend that will shape the future of this market. The growing emphasis on recyclability and the use of bio-based materials are also becoming increasingly important considerations for packaging providers, reflecting a broader industry shift towards environmental responsibility. The continued innovation in sealing technologies and lid designs, aimed at improving ease of opening for healthcare professionals while maintaining robust barrier functions, will also play a crucial role in market growth.

The die-cut lids for medical packaging market is experiencing a robust surge propelled by a confluence of critical factors. Foremost among these is the escalating global demand for sterile and safe medical products. The increasing prevalence of chronic diseases and an aging global population are directly contributing to a higher volume of medical devices, pharmaceuticals, and diagnostic kits requiring secure containment, thereby fueling the demand for reliable die-cut lids. Moreover, stringent regulatory mandates across the healthcare industry worldwide, emphasizing product integrity, sterility assurance, and tamper evidence, are compelling manufacturers to invest in high-quality packaging solutions. Die-cut lids, with their precision engineering and customizability, effectively meet these stringent requirements, ensuring that medical products remain uncontaminated and safe for patient use. The rapid advancements in healthcare technology, including the development of more complex and sensitive medical devices, also play a significant role. These innovations often require specialized packaging that can provide specific barrier properties and protection against environmental factors, a need that is effectively addressed by sophisticated die-cut lid designs. Furthermore, the growing emphasis on single-use medical devices, driven by infection control protocols and the desire for improved patient safety, has further amplified the demand for disposable and sterile packaging components like die-cut lids. The convenience and cost-effectiveness associated with single-use solutions contribute to their widespread adoption, directly benefiting the die-cut lids market. The increasing focus on efficient supply chain management and the need for clear product identification and traceability also support the adoption of well-designed die-cut lids that can accommodate various printing and labeling requirements.

Despite the promising growth trajectory, the die-cut lids for medical packaging market is not without its hurdles. A primary challenge revolves around the stringent regulatory landscape, which, while driving demand, also imposes rigorous compliance standards. Manufacturers must continually invest in research and development to ensure their lid materials and designs meet evolving global regulations concerning biocompatibility, sterilization compatibility, and extractables/leachables, which can lead to increased operational costs and development timelines. The cost sensitivity of healthcare providers and medical device manufacturers also presents a restraint. While quality and performance are paramount, there is constant pressure to manage packaging costs, making it challenging for premium, innovative die-cut lid solutions to gain widespread adoption in price-sensitive segments. Furthermore, the complexity of sourcing and qualifying specialized raw materials, particularly for advanced barrier films and medical-grade adhesives, can lead to supply chain disruptions and price volatility, impacting the overall cost-effectiveness of die-cut lid production. The potential for material compatibility issues with diverse medical products and sterilization methods also poses a significant challenge. Ensuring that the chosen lid material does not interact negatively with the packaged product or degrade during sterilization processes like autoclaving or gamma irradiation requires extensive testing and validation. The need for specialized manufacturing equipment and expertise to produce high-precision die-cut lids can also act as a barrier to entry for smaller players, limiting market competition in some niches. Finally, the environmental impact of certain packaging materials, particularly non-recyclable plastics, is coming under increasing scrutiny. While many die-cut lids are essential for product safety, the industry faces pressure to develop more sustainable alternatives, which requires significant investment in research and material innovation.

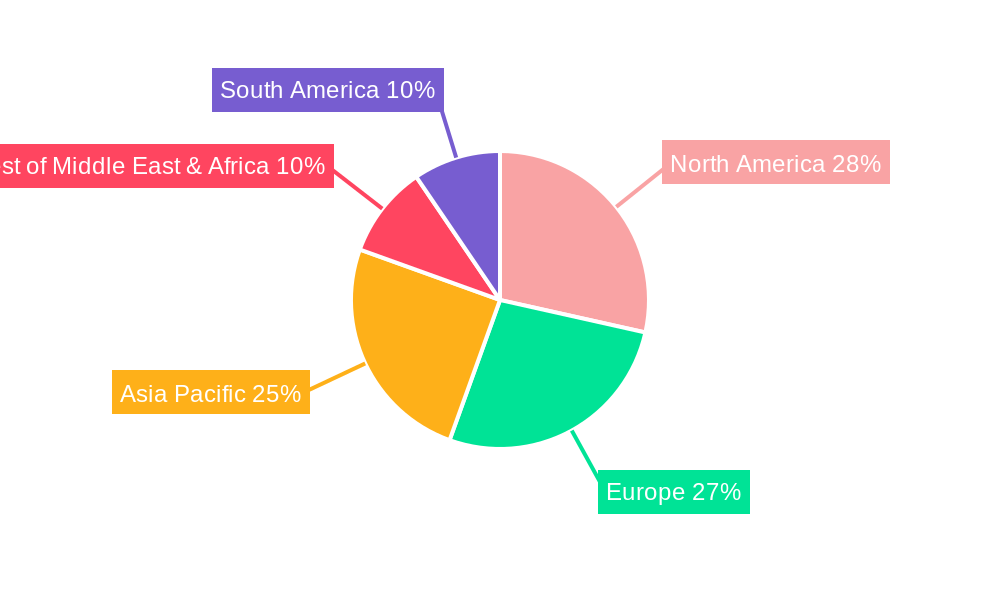

The global die-cut lids for medical packaging market is characterized by regional nuances and segment dominance, with North America and Europe historically leading in terms of value and adoption.

North America: This region is projected to maintain its leading position due to a strong presence of major pharmaceutical and medical device manufacturers, a highly developed healthcare infrastructure, and a proactive approach towards adopting innovative packaging solutions. The region's robust R&D capabilities and high healthcare spending contribute to a sustained demand for high-quality, sterile packaging. The strict regulatory framework, emphasizing patient safety and product integrity, further fuels the market for compliant die-cut lids. The growing focus on advanced therapies and biologics also necessitates sophisticated packaging solutions.

Europe: Similar to North America, Europe boasts a mature healthcare market with a high concentration of leading pharmaceutical and medical device companies. Stringent quality standards and a growing awareness of sustainable packaging practices are key drivers. The region’s strong commitment to regulatory compliance, particularly through directives from the European Medicines Agency (EMA), ensures a steady demand for reliable die-cut lid solutions. The presence of key players and a well-established supply chain further solidify Europe's dominance.

Segment Dominance:

Plastic (PET) Die Cut Lids: This segment is anticipated to dominate the market, driven by PET's excellent clarity, barrier properties, and its compatibility with various sterilization methods. PET die-cut lids offer a good balance of performance and cost-effectiveness, making them a preferred choice for a wide range of medical applications, including primary packaging for sterile medical devices and pharmaceutical formulations. Their versatility in terms of formability and printability also contributes to their widespread adoption. The increasing demand for single-use devices and diagnostic kits further boosts the consumption of PET die-cut lids.

Syringe Manufacturing and Filling Application: This application segment is a significant revenue generator and is expected to witness continued growth. The sheer volume of syringes manufactured globally for drug delivery, vaccination programs, and diagnostic purposes necessitates a constant supply of sterile and precisely fitting die-cut lids. The stringent requirements for maintaining the sterility of injectable medications and the need for tamper-evident seals make die-cut lids an indispensable component in syringe packaging. The increasing trend towards pre-filled syringes further amplifies the demand within this application. The ability of die-cut lids to provide a reliable seal and protection against microbial contamination throughout the product's shelf life is crucial for this segment. The development of specialized lids with features like easy-peel functionality tailored for healthcare professionals is also a significant trend within this application.

The die-cut lids for medical packaging industry is propelled by several key growth catalysts. The rising global healthcare expenditure and the increasing demand for sterile medical devices and pharmaceuticals are fundamental drivers. Furthermore, stringent regulatory requirements worldwide, emphasizing product safety and integrity, mandate the use of high-quality, tamper-evident packaging solutions, thereby boosting the demand for precision-engineered die-cut lids. The continuous innovation in healthcare, leading to the development of more complex and sensitive medical products, also necessitates advanced packaging.

This comprehensive report provides an exhaustive analysis of the die-cut lids for medical packaging market, offering valuable insights for stakeholders. It delves into the intricate dynamics of market segmentation by product type and application, alongside a detailed examination of industry developments. The report quantifies market opportunities and challenges, supported by expert analysis of key growth drivers and restraints. Furthermore, it profiles leading market participants and forecasts future market trends and regional dominance through 2033, empowering businesses to make informed strategic decisions and capitalize on emerging opportunities within this critical segment of the healthcare supply chain.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.3%.

Key companies in the market include Oliver Healthcare Packaging, Amcor, ProAmpac, Nelipak Healthcare Packaging, Constantia Flexibles, Wiicare, Beacon Converters, Südpack, NYCO, Spectrum Plastics, Placon.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Die-Cut Lids for Medical Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Die-Cut Lids for Medical Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.