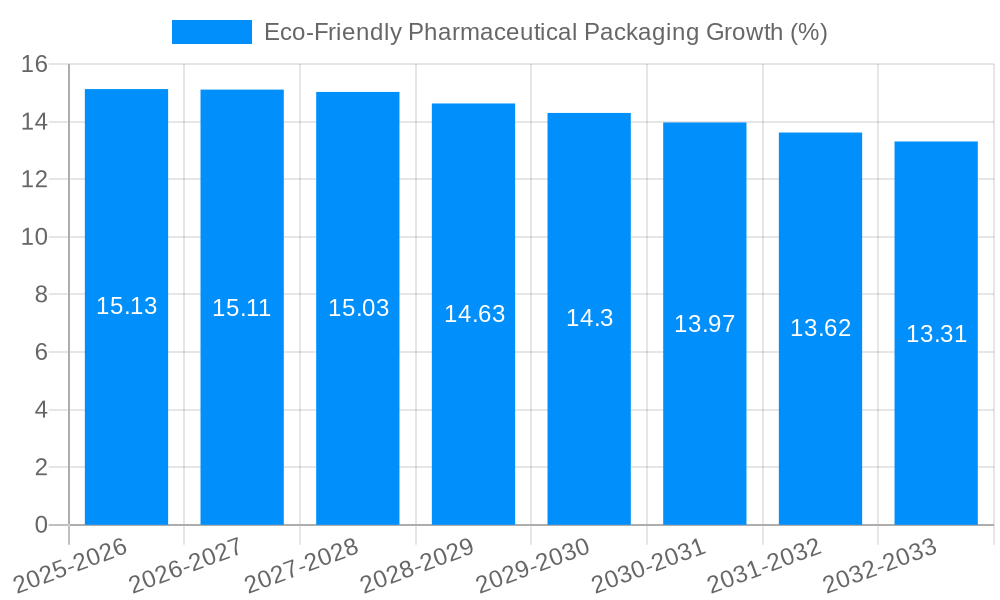

1. What is the projected Compound Annual Growth Rate (CAGR) of the Eco-Friendly Pharmaceutical Packaging?

The projected CAGR is approximately 15.13%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Eco-Friendly Pharmaceutical Packaging

Eco-Friendly Pharmaceutical PackagingEco-Friendly Pharmaceutical Packaging by Type (Plastics, Paper, Glass, Metal), by Application (Recyclable, Reusable, Biodegradable), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

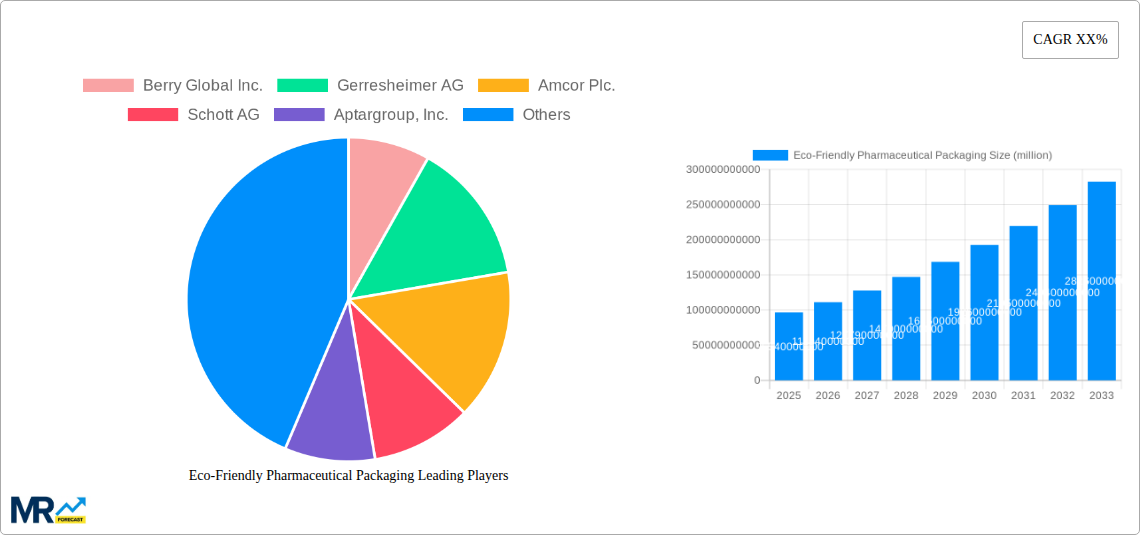

The global Eco-Friendly Pharmaceutical Packaging market is poised for significant expansion, projected to reach an impressive USD 96.54 billion by 2025. This robust growth is propelled by a compelling compound annual growth rate (CAGR) of 15.13%, indicating a dynamic and rapidly evolving industry. The increasing global emphasis on sustainability, coupled with stringent environmental regulations, is a primary driver for this surge. Pharmaceutical companies are actively seeking packaging solutions that minimize environmental impact, reduce waste, and align with corporate social responsibility initiatives. This shift is not merely a trend but a fundamental restructuring of the market, prioritizing materials and designs that are recyclable, reusable, and biodegradable. Innovations in bioplastics, advanced paper-based packaging, and improved glass and metal recycling technologies are fueling this transition, offering viable alternatives to traditional, less sustainable options. The heightened consumer awareness regarding environmental issues also plays a crucial role, influencing purchasing decisions and encouraging the adoption of eco-conscious pharmaceutical products.

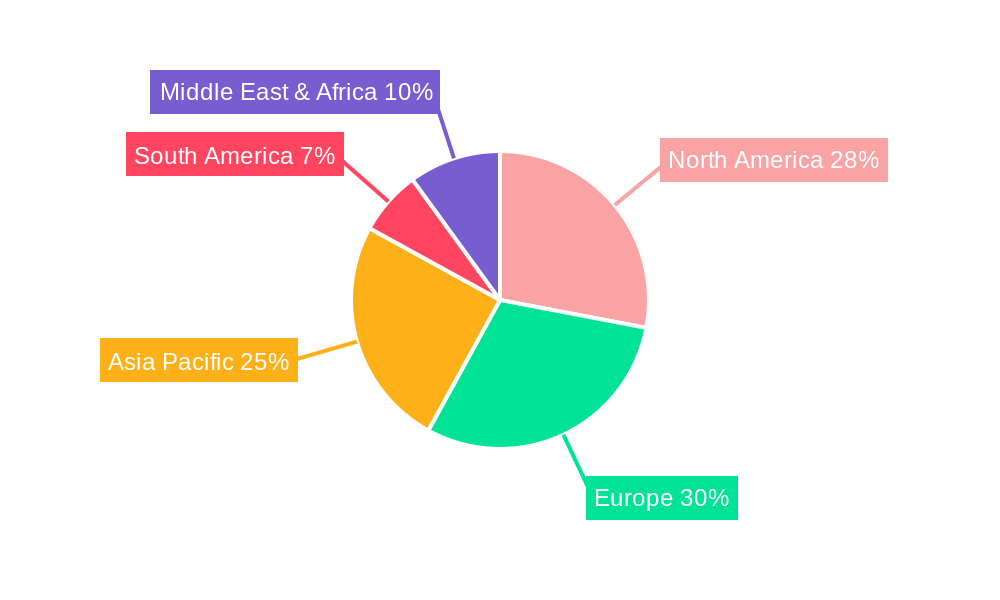

Further analysis reveals that the market is segmented by material type, with Plastics, Paper, Glass, and Metal each carving out their niches, alongside key applications such as Recyclable, Reusable, and Biodegradable packaging. The demand for these segments is driven by their specific environmental benefits and suitability for various pharmaceutical products, from sensitive biologics requiring specialized protection to high-volume generics demanding cost-effective and sustainable solutions. Key industry players like Berry Global Inc., Amcor Plc., and Westrock Company are at the forefront of this transformation, investing heavily in research and development to innovate and expand their eco-friendly product portfolios. Regional dynamics are also significant, with North America and Europe leading in adoption due to established environmental policies and consumer demand. However, the Asia Pacific region, particularly China and India, is expected to witness substantial growth, driven by rapid industrialization and increasing environmental consciousness. The challenges of cost-effectiveness for some eco-friendly materials and the need for robust supply chain integration are being addressed through ongoing technological advancements and strategic partnerships, ensuring the sustained momentum of this vital market.

This comprehensive report delves into the dynamic and rapidly evolving landscape of eco-friendly pharmaceutical packaging, a critical sector driven by increasing environmental consciousness and stringent regulatory demands. The study period spans from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, followed by a robust forecast period from 2025 to 2033. The historical period of 2019-2024 provides valuable context for understanding the trajectory of this green shift. We anticipate the global market for eco-friendly pharmaceutical packaging to witness significant growth, with projections reaching into the billions of units annually by the end of the forecast period. This report will dissect the market by Type (Plastics, Paper, Glass, Metal) and Application (Recyclable, Reusable, Biodegradable), providing granular insights into their respective market shares and growth potentials.

XXX The pharmaceutical packaging industry is at a pivotal juncture, undergoing a significant transformation towards sustainable practices. This shift is not merely a trend but a fundamental reorientation driven by a confluence of factors including growing consumer demand for environmentally responsible products, increasing governmental regulations targeting waste reduction and the use of hazardous materials, and a proactive stance by pharmaceutical companies to align with Environmental, Social, and Governance (ESG) principles. The global market for eco-friendly pharmaceutical packaging is projected to surge, with key market insights revealing a substantial increase in the adoption of materials that minimize environmental impact. During the historical period of 2019-2024, we observed the initial hesitant steps towards sustainability, primarily through the exploration of recyclable plastics and the increased use of paperboard for secondary packaging. However, the base year of 2025 marks a significant acceleration, with investments in research and development for novel biodegradable polymers and advanced recycling technologies gaining momentum. The forecast period of 2025-2033 is expected to witness the widespread commercialization and adoption of these innovative solutions. A crucial trend emerging is the move towards a circular economy model within pharmaceutical packaging, emphasizing not just recyclability but also reusability and the reduction of single-use packaging. This includes the development of innovative dispensing systems and multi-dose packaging designed for extended use and minimized waste. Furthermore, the integration of smart packaging solutions that also incorporate eco-friendly materials is gaining traction, offering enhanced product integrity and patient safety while adhering to sustainability mandates. The increasing emphasis on reducing the carbon footprint associated with the entire packaging lifecycle, from raw material sourcing to end-of-life disposal, will continue to shape the market's direction. We anticipate a substantial growth in demand for packaging solutions that offer a lower environmental impact throughout their lifecycle, prompting manufacturers to invest in greener alternatives and more efficient production processes. The market's trajectory indicates a move away from traditional, less sustainable materials towards innovative and responsible packaging options, reflecting a global commitment to environmental stewardship within the pharmaceutical sector.

The surge in the adoption of eco-friendly pharmaceutical packaging is propelled by a multifaceted array of driving forces, fundamentally reshaping the industry's operational paradigms. Chief among these is the escalating global awareness concerning environmental degradation and the urgent need for sustainable practices across all sectors. Consumers, increasingly informed and concerned about their ecological footprint, are actively seeking products from companies demonstrating a commitment to environmental responsibility, thereby creating market pressure on pharmaceutical manufacturers. Regulatory bodies worldwide are also playing a pivotal role, enacting stricter legislation and policies aimed at reducing plastic waste, promoting circular economy principles, and setting ambitious targets for carbon neutrality. These regulations incentivize the development and adoption of greener packaging alternatives. Moreover, pharmaceutical companies themselves are increasingly integrating sustainability into their core business strategies, driven by a desire to enhance their brand reputation, attract environmentally conscious investors, and mitigate long-term operational risks associated with resource scarcity and environmental compliance. The pursuit of cost efficiencies through reduced material usage and optimized supply chains also indirectly fuels the adoption of sustainable packaging solutions. Technological advancements in material science and manufacturing processes are making eco-friendly alternatives more viable, cost-effective, and performance-comparable to traditional materials, further accelerating their market penetration. The growing emphasis on ESG (Environmental, Social, and Governance) criteria by investors is also compelling companies to prioritize sustainability initiatives, including their packaging choices.

Despite the compelling drivers, the eco-friendly pharmaceutical packaging market faces several significant challenges and restraints that can impede its growth trajectory. A primary hurdle is the stringent regulatory landscape governing pharmaceutical packaging, which prioritizes patient safety, product integrity, and barrier properties above all else. Any shift to eco-friendly materials must demonstrably meet these exacting standards, often requiring extensive and costly validation processes. The perceived higher cost of some sustainable materials and manufacturing processes, at least in the initial stages of adoption, can also act as a significant restraint for cost-sensitive pharmaceutical manufacturers. Furthermore, the availability of consistent, high-quality, and scalable supply chains for novel eco-friendly materials is still developing in many regions, posing logistical challenges. The infrastructure for collecting, sorting, and effectively recycling or composting certain biodegradable or compostable materials is also not universally established, leading to concerns about end-of-life management and the potential for increased litter or landfill waste if not properly handled. Consumer education and awareness also play a role; a lack of understanding regarding the proper disposal of eco-friendly packaging can lead to contamination of recycling streams or incorrect waste management. Resistance to change within established supply chains and manufacturing processes, often deeply entrenched due to long product lifecycles and rigorous quality control, can also slow down the adoption of new, sustainable packaging solutions. The compatibility of eco-friendly materials with existing pharmaceutical filling and sealing machinery also needs to be thoroughly assessed and addressed.

The Paper segment, encompassing a range of materials from recycled cardboard to innovative bio-based papers, is poised for substantial dominance within the eco-friendly pharmaceutical packaging market, particularly in the North America region. This region's leadership is driven by a powerful combination of proactive regulatory frameworks, robust consumer demand for sustainable products, and significant investment in circular economy initiatives.

North America's Dominance:

Paper Segment's Ascendancy:

While other segments like recyclable plastics and glass will continue to play crucial roles, the inherent sustainability, versatility, and growing technological advancements in paper-based materials, coupled with strong regional drivers, position it to be a dominant force in the eco-friendly pharmaceutical packaging market, particularly in North America, throughout the forecast period of 2025-2033.

The growth of the eco-friendly pharmaceutical packaging industry is significantly catalyzed by increasing governmental mandates promoting sustainability, rising consumer demand for environmentally responsible products, and a proactive approach from pharmaceutical companies to enhance their ESG credentials. Furthermore, continuous innovation in material science, leading to the development of high-performance, cost-effective, and truly biodegradable or recyclable alternatives, is a key catalyst. Investments in advanced recycling technologies and the establishment of robust circular economy frameworks for pharmaceutical packaging materials are also crucial growth enablers.

This report offers a holistic and in-depth analysis of the eco-friendly pharmaceutical packaging market, providing unparalleled insights for stakeholders. We meticulously examine the market dynamics, from the historical period of 2019-2024 to the projected landscape through 2033, anchored by a detailed analysis of the base year 2025. The report dissects the market by Type (Plastics, Paper, Glass, Metal) and Application (Recyclable, Reusable, Biodegradable), offering granular data on market share, growth rates, and future potential. Beyond quantitative analysis, the report delves into the driving forces, challenges, and emerging growth catalysts that shape this evolving sector. It also identifies key regions and countries poised for significant market expansion, alongside a comprehensive overview of leading industry players and their strategic initiatives. The report's unique contribution lies in its detailed exploration of significant industry developments, offering a forward-looking perspective on technological advancements and regulatory impacts. This comprehensive coverage ensures that businesses, investors, and policymakers are equipped with the essential intelligence to navigate and capitalize on the green revolution in pharmaceutical packaging.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.13% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.13%.

Key companies in the market include Berry Global Inc., Gerresheimer AG, Amcor Plc., Schott AG, Aptargroup, Inc., Becton, Dickinson and Company, Westrock Company, Nipro Corporation, Catalent, Inc., Sealed Air Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Eco-Friendly Pharmaceutical Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Eco-Friendly Pharmaceutical Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.