1. What is the projected Compound Annual Growth Rate (CAGR) of the Connected Packaging?

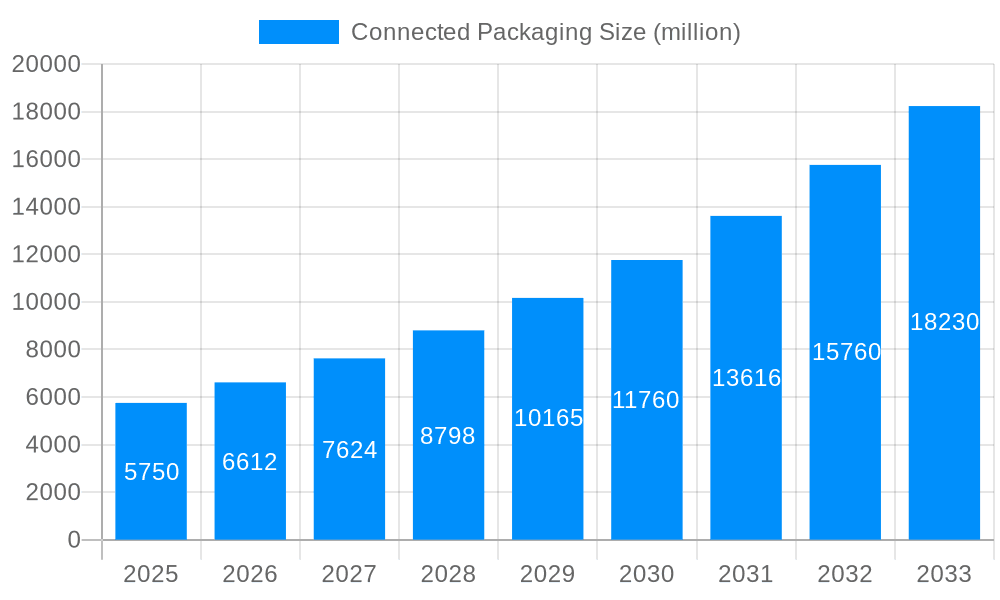

The projected CAGR is approximately 7.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Connected Packaging

Connected PackagingConnected Packaging by Type (Active Packaging, Interactive Packaging), by Application (Food and Beverages, Healthcare, Personal Care, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The connected packaging market is poised for significant expansion, propelled by escalating consumer demand for authentic product verification, enriched brand interaction, and superior supply chain visibility. With a market size of $26.2 billion in the base year 2024, the market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 7.9% through 2032, reaching an estimated value of $45 billion. This growth trajectory is underpinned by several pivotal drivers. Firstly, technological advancements in solutions such as RFID, NFC, and QR codes are enabling sophisticated, interactive packaging experiences. These technologies empower direct consumer engagement via augmented reality, personalized content access, and interactive promotions, thereby fostering brand loyalty and stimulating sales. Secondly, heightened awareness of counterfeit goods and the imperative for supply chain transparency are compelling manufacturers to adopt connected packaging for robust product authentication and end-to-end lifecycle tracking. This emphasis on security and traceability is particularly pronounced within the food & beverage, pharmaceutical, and personal care industries. Lastly, the burgeoning e-commerce landscape and the widespread adoption of omnichannel marketing strategies are further accelerating market growth, as connected packaging seamlessly integrates with digital campaigns and personalized consumer journeys.

Despite this robust outlook, certain market restraints exist. Substantial initial investment costs for implementing connected packaging technologies can present a hurdle for small and medium-sized enterprises. Furthermore, critical concerns surrounding data privacy and security necessitate stringent measures to safeguard consumer information collected through interactive packaging. Nevertheless, the long-term advantages, including enhanced brand equity, increased revenue, and optimized supply chain operations, are anticipated to surmount these challenges, ensuring sustained market expansion. Segmentation analysis indicates a growing preference for active packaging, which integrates sensors to monitor product integrity, followed closely by interactive packaging designed for consumer engagement. The food and beverage sector currently leads in application dominance, succeeded by healthcare and personal care, reflecting the critical need for product safety and authenticity in these domains. Leading industry players are actively investing in research and development, fostering innovation and competitive dynamics within this dynamic market.

The connected packaging market is experiencing explosive growth, driven by the increasing demand for enhanced consumer experiences and improved supply chain traceability. The market, estimated at XXX million units in 2025, is projected to reach XXX million units by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR). This surge is fueled by several converging factors, including the proliferation of smartphones and readily available internet access, advancements in sensor technology enabling real-time product monitoring, and a heightened focus on brand authenticity and anti-counterfeiting measures. Consumers are increasingly seeking interactive experiences that extend beyond the point of purchase, with connected packaging offering opportunities for personalized messages, interactive games, and access to product information and authenticity verification. This trend is particularly pronounced in the food and beverage sector, where consumers are showing a growing preference for traceable and sustainably sourced products. The shift towards e-commerce also plays a vital role, demanding improved packaging solutions that guarantee product integrity throughout the complex shipping process. Furthermore, the ability to gather consumer data through connected packaging offers valuable insights for product development and marketing strategies, improving ROI and allowing brands to create more targeted campaigns. The market’s expansion isn’t uniform; some regions and segments are showing notably faster growth rates compared to others. This variance is influenced by factors such as technological adoption rates, consumer behavior, regulatory frameworks, and the prevalence of relevant infrastructure. The study period (2019-2033) has witnessed several key phases of development, marked by initial slow adoption, accelerating growth fueled by technological breakthroughs, and increasingly sophisticated market applications.

Several key factors are accelerating the growth of the connected packaging market. The rising consumer demand for transparency and traceability in the supply chain is a major driver. Consumers are increasingly concerned about the origin and authenticity of products, and connected packaging offers a solution by providing verifiable information about the product's journey from origin to consumer. This transparency builds trust and enhances brand loyalty. Technological advancements are also playing a crucial role. Miniaturization of sensors and the decreasing cost of RFID tags and near-field communication (NFC) technology make connected packaging increasingly affordable and accessible to a wider range of industries and businesses. The increasing adoption of e-commerce and the associated need for enhanced supply chain visibility further fuel market growth. Tracking packages in real-time and ensuring product integrity throughout the shipping process is critical for e-commerce success, making connected packaging an essential investment for many businesses. Finally, stringent government regulations aimed at reducing food waste and improving product safety are also driving adoption. Connected packaging solutions can help track product shelf life and identify potential contamination issues, leading to improvements in supply chain efficiency and safety.

Despite the promising growth trajectory, the connected packaging market faces several challenges. The high initial investment cost of implementing connected packaging solutions is a major barrier for smaller businesses. The need for specialized infrastructure and software to manage the data generated by connected packages adds to the cost and complexity. Security concerns around data breaches and consumer privacy are also significant issues. Ensuring data security and protecting consumer information is paramount, and any data breach could severely damage the reputation of businesses using connected packaging. The standardization of technologies and protocols across the industry is another challenge. Lack of interoperability between different connected packaging systems can hinder seamless data exchange and integration. Furthermore, consumer education is crucial for widespread adoption. Many consumers are unaware of the benefits of connected packaging, requiring robust marketing and educational campaigns to promote its advantages. Finally, technical complexities in integrating various technologies and ensuring reliable performance can hinder smooth implementation. Overcoming these technical hurdles is vital for the continued growth and success of the connected packaging market.

The Food and Beverages segment is poised to dominate the connected packaging market throughout the forecast period (2025-2033). This is largely due to:

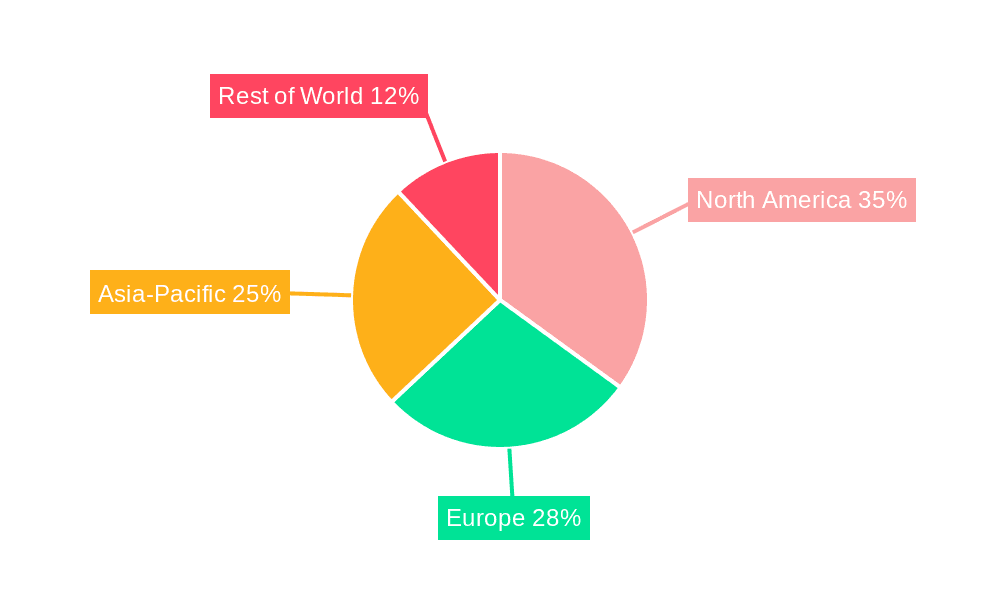

While North America and Europe are expected to maintain significant market share, the Asia-Pacific region is projected to witness the fastest growth. This accelerated growth is attributed to:

Specific countries like China and India are expected to show particularly strong growth, fueled by the expanding middle class and increasing demand for convenience and traceability in food products.

The convergence of several factors is fueling the growth of the connected packaging industry. The increasing consumer demand for transparency and traceability, coupled with advancements in sensor technology, RFID, and NFC, are making connected packaging more affordable and accessible. The rise of e-commerce further boosts market expansion, as businesses prioritize supply chain visibility and product integrity. Government regulations promoting food safety and sustainability are also providing a positive impetus. The ability of connected packaging to enhance brand loyalty through engaging customer experiences adds another crucial dimension to its appeal.

This report provides a comprehensive analysis of the connected packaging market, covering market size, growth drivers, challenges, key players, and future trends. It offers valuable insights for businesses seeking to enter or expand their presence in this rapidly growing market. The study utilizes a robust methodology, incorporating both primary and secondary research data, to deliver an accurate and up-to-date assessment of the market landscape. The detailed segmentation analysis provides a granular view of various aspects of the market, allowing for informed decision-making. The forecast period extends to 2033, offering a long-term perspective on market growth and development.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.9%.

Key companies in the market include BALL CORPORATION, Amcor plc, 3M, Temptime Corporation, CONSTANTIA FLEXIBLES, Klöckner Pentaplast, Graham Packaging Company,, Avery Dennison Corporation, International Paper, R.R. Donnelley & Sons Company, Peacock Bros, .

The market segments include Type, Application.

The market size is estimated to be USD 26.2 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Connected Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Connected Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.