1. What is the projected Compound Annual Growth Rate (CAGR) of the Tablet Computer Image Sensor?

The projected CAGR is approximately 8.2%.

Tablet Computer Image Sensor

Tablet Computer Image SensorTablet Computer Image Sensor by Type (CMOS Image Sensor, CCD Image Sensor, Other), by Application (Consumer Tablet Computers, Industrial Tablet Computers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

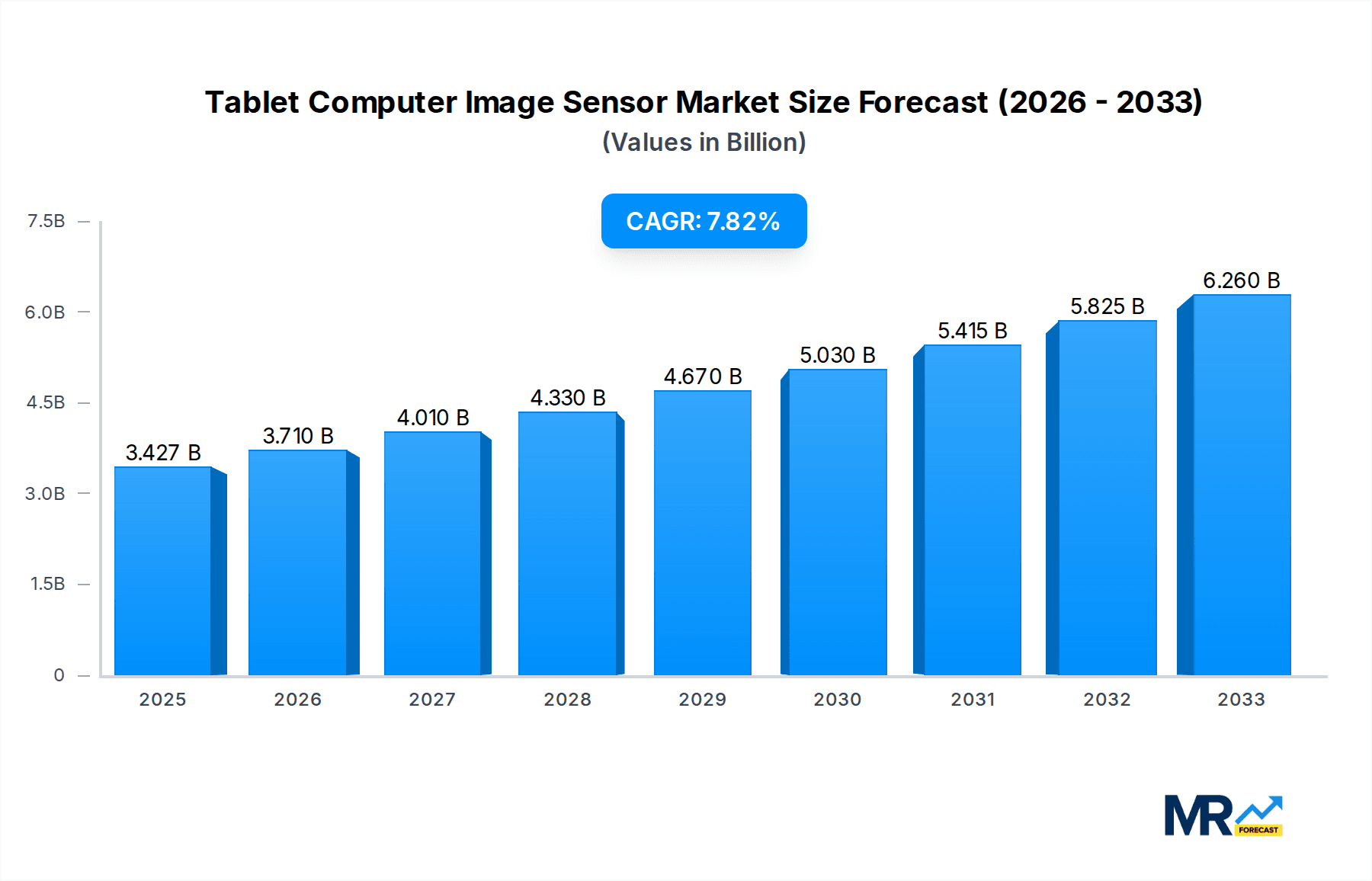

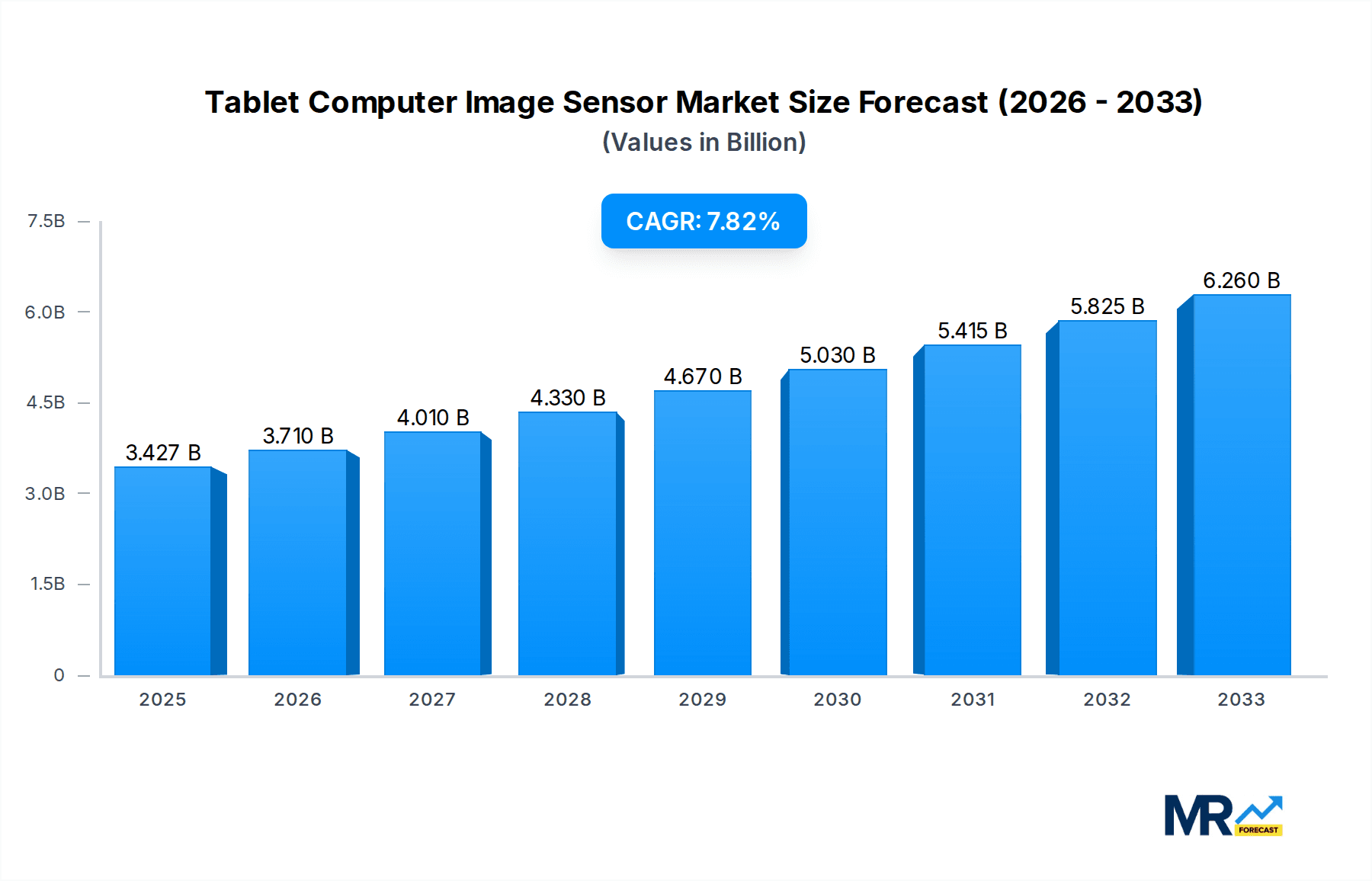

The global Tablet Computer Image Sensor market is poised for substantial growth, projected to reach an estimated USD 3427 million in 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 8.2% through 2033. This upward trajectory is primarily fueled by the escalating demand for high-resolution imaging capabilities in both consumer and industrial tablet devices. The increasing integration of advanced camera functionalities, such as improved low-light performance, faster autofocus, and enhanced image stabilization, is a significant driver. Furthermore, the burgeoning adoption of tablets in enterprise applications, including quality control, remote diagnostics, and field service, where precise visual data capture is critical, is further bolstering market expansion. The consumer segment, driven by advancements in mobile photography and video, along with the growing popularity of augmented reality (AR) and virtual reality (VR) experiences on tablets, continues to be a dominant force.

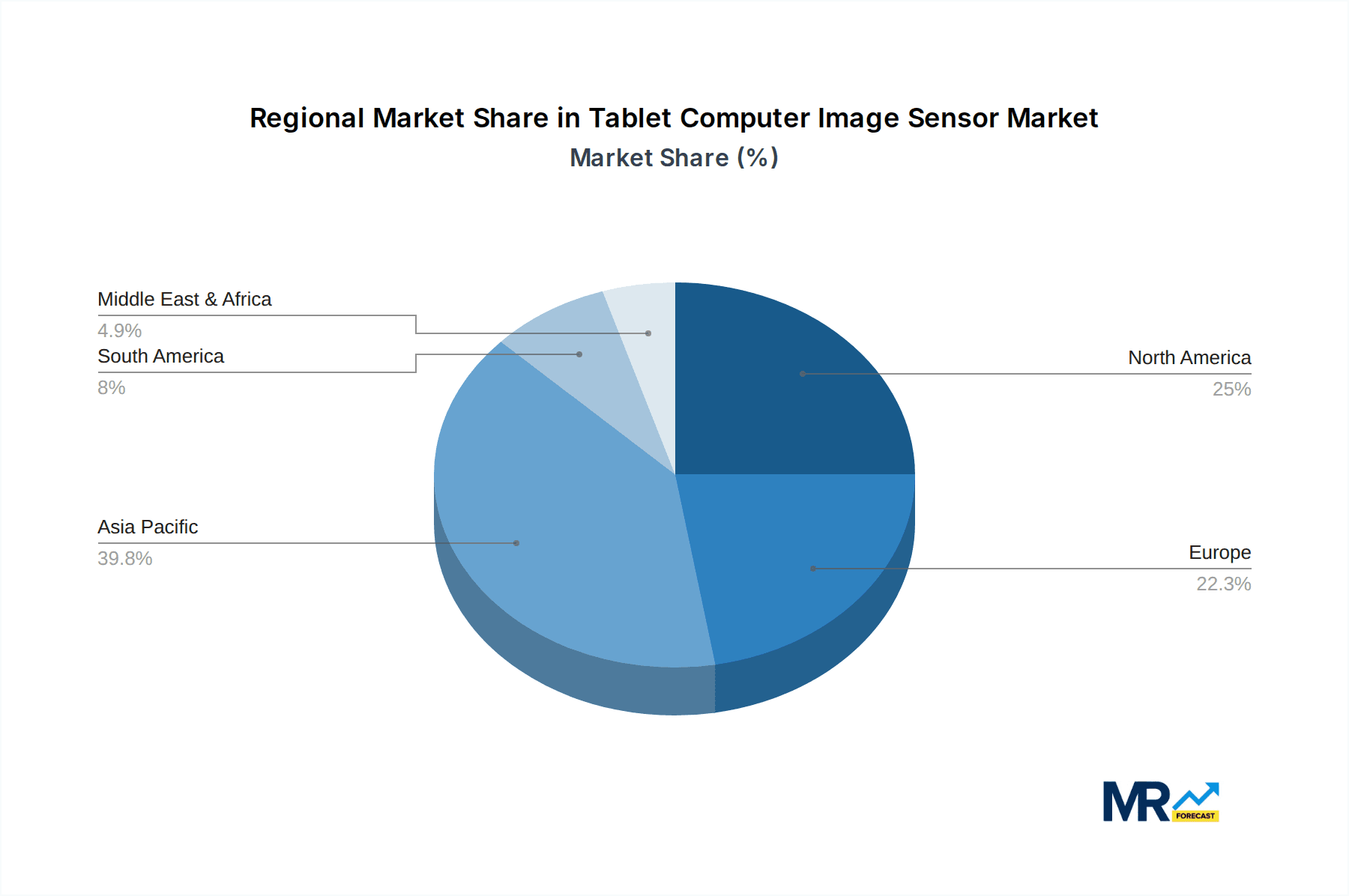

The market landscape is characterized by a strong emphasis on technological innovation, with companies like Sony Semiconductors and Samsung Semiconductor leading the charge in developing next-generation image sensors. The transition towards CMOS image sensors, known for their superior performance, lower power consumption, and cost-effectiveness compared to CCD sensors, is a prominent trend. While the market is largely propelled by these growth factors, certain restraints may influence its pace. These could include the high cost of advanced sensor development and manufacturing, potential supply chain disruptions for critical components, and the increasing commoditization of basic imaging capabilities in lower-end tablet segments. Nonetheless, the overarching demand for enhanced visual data capture, coupled with continuous innovation, positions the Tablet Computer Image Sensor market for sustained and dynamic growth over the forecast period, with Asia Pacific expected to emerge as a leading region due to its large manufacturing base and burgeoning consumer electronics market.

This comprehensive report delves into the dynamic Tablet Computer Image Sensor market, providing an in-depth analysis of trends, drivers, challenges, and future projections from 2019 to 2033. With a base year of 2025 and an estimated year also set for 2025, the report offers a detailed outlook for the forecast period of 2025-2033, building upon a thorough historical analysis of the 2019-2024 period. The market landscape is explored through various lenses, including dominant sensor types, key application segments, and the crucial role of emerging industry developments.

The tablet computer image sensor market is experiencing a significant evolutionary phase, driven by a confluence of technological advancements and evolving consumer and industrial demands. Over the study period of 2019-2033, the market has transitioned from basic image capture capabilities to sophisticated sensing solutions that enhance user experience and enable new functionalities. XXX The increasing adoption of tablets across diverse sectors, from education and entertainment to enterprise and industrial automation, is a primary catalyst. This expansion has spurred a demand for image sensors that offer higher resolution, improved low-light performance, faster frame rates, and enhanced color accuracy. The surge in video conferencing, augmented reality (AR) applications, and advanced photography features on tablets has directly fueled innovation in sensor technology. For instance, the integration of computational photography algorithms is becoming increasingly prevalent, allowing tablets to capture images and videos that rival dedicated cameras. Furthermore, the miniaturization of sensor components, coupled with improvements in power efficiency, is crucial for maintaining the sleek form factor and extended battery life expected by users. As we move towards the forecast period (2025-2033), the trend towards larger sensor formats, albeit within the constraints of tablet design, will likely continue, promising superior image quality. The growing emphasis on AI-powered image processing, such as object recognition and scene understanding directly on the device, is also reshaping the sensor landscape. This will necessitate sensors with enhanced on-chip processing capabilities and improved data bandwidth. The market is also witnessing a diversification of sensor applications beyond simple photography, with image sensors playing a vital role in device security through facial recognition and in industrial settings for quality control and monitoring. The overall market trajectory indicates a move towards smarter, more versatile, and higher-performing image sensors that are integral to the ever-expanding capabilities of tablet computing. The projected market size, considering the millions of units involved, underscores the sheer scale of this technology's integration into our daily lives and professional workflows.

The tablet computer image sensor market is propelled by a multifaceted set of driving forces, each contributing to its sustained growth and technological evolution. Foremost among these is the ever-increasing demand for enhanced visual experiences. Consumers expect their tablets to capture stunning photos and videos, akin to those produced by dedicated cameras, driving the need for higher resolution sensors, superior low-light performance, and wider dynamic range. This is further amplified by the surge in social media sharing and content creation, where high-quality visuals are paramount. Beyond consumer applications, the expansion of industrial and enterprise tablet adoption is a significant propeller. These tablets are increasingly being deployed in sectors like logistics, healthcare, manufacturing, and field services, where robust and reliable imaging capabilities are essential for tasks such as barcode scanning, quality inspection, patient monitoring, and augmented reality-assisted operations. The proliferation of advanced applications such as augmented reality (AR) and virtual reality (VR) on tablets necessitates image sensors with higher frame rates, lower latency, and precise depth sensing capabilities to create immersive and interactive experiences. Furthermore, the advancements in artificial intelligence (AI) and machine learning (ML) are directly influencing image sensor development. The integration of AI-powered image processing, on-device analytics, and intelligent scene recognition demands sensors capable of efficiently handling complex data streams and supporting on-chip processing. Finally, the continuous innovation in semiconductor manufacturing and sensor design, leading to smaller, more power-efficient, and cost-effective image sensors, plays a crucial role in making advanced imaging technology accessible and integrated into a wider range of tablet devices.

Despite the robust growth, the tablet computer image sensor market is not without its challenges and restraints, which can influence the pace of innovation and market penetration. A primary challenge lies in the inherent design limitations of tablet form factors. The thin and light nature of tablets restricts the physical space available for larger, more advanced image sensors, which typically offer superior performance. This often necessitates trade-offs between sensor size, resolution, and other performance metrics. Cost sensitivity remains a significant restraint, particularly in the highly competitive consumer tablet segment. Manufacturers are constantly seeking to balance cutting-edge sensor technology with affordable pricing, which can limit the widespread adoption of the most advanced and expensive sensor solutions. Power consumption is another critical concern. High-resolution sensors and advanced image processing can be power-hungry, impacting tablet battery life, a key selling point for consumers. Developing energy-efficient sensors without compromising performance is an ongoing engineering challenge. Furthermore, the rapid pace of technological obsolescence in the electronics industry means that sensor technologies can quickly become outdated, requiring continuous investment in research and development. This necessitates a careful balance between adopting new technologies and managing product lifecycles. Lastly, supply chain disruptions and geopolitical factors can pose significant risks to the availability and pricing of crucial components, including image sensors, potentially hindering production and market expansion.

The tablet computer image sensor market is characterized by regional strengths and segment dominance, with specific areas exhibiting higher adoption rates and technological leadership.

Key Regions/Countries:

Dominant Segments:

The tablet computer image sensor industry is experiencing significant growth fueled by several key catalysts. The accelerating integration of Artificial Intelligence (AI) and Machine Learning (ML) into tablet functionalities, such as facial recognition for security and advanced image processing, is a major driver. Furthermore, the burgeoning Augmented Reality (AR) and Virtual Reality (VR) markets demand higher-performance image sensors with faster frame rates and enhanced depth perception for immersive experiences. The sustained demand for enhanced visual content creation and consumption, fueled by social media and streaming platforms, also pushes for superior camera capabilities. The increasing adoption of tablets in industrial and enterprise sectors for tasks like quality control, data capture, and AR-assisted workflows presents a substantial opportunity for growth, requiring rugged and specialized image sensors.

This report provides a holistic overview of the tablet computer image sensor market, offering comprehensive insights that extend beyond quantitative data. It meticulously analyzes the Technological Landscape, dissecting the nuances of CMOS and CCD technologies, their respective strengths, and their evolution within tablet applications. The report also examines the Market Dynamics, including the interplay of supply and demand, pricing strategies, and the impact of global economic trends on the market. Furthermore, it delves into the Competitive Landscape, profiling key players, their market share, strategic initiatives, and R&D investments. The report further explores the Regulatory Environment and its potential impact on sensor development and deployment. Ultimately, this comprehensive coverage aims to equip stakeholders with the knowledge necessary to navigate the complexities of the tablet computer image sensor market and make informed strategic decisions for the future.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.2%.

Key companies in the market include Sony Semiconductors, Samsung Semiconductor, OmniVision, ON Semiconductor, Canon, Panasonic, SK Hynix, STMicroelectronics, Teledyne Technologies, Hamamatsu, Infineon Technologies, CMOSIS.

The market segments include Type, Application.

The market size is estimated to be USD 3427 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tablet Computer Image Sensor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tablet Computer Image Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.