1. What is the projected Compound Annual Growth Rate (CAGR) of the GaN on Silicon Templates?

The projected CAGR is approximately 7.76%.

GaN on Silicon Templates

GaN on Silicon TemplatesGaN on Silicon Templates by Type (6 inch GaN-on-Si Wafer, 8 inch GaN-on-Si Wafer, 12 inch GaN-on-Si Wafer, Others, World GaN on Silicon Templates Production ), by Application (Consumer Electronics, Industrial, Telecom & Datacom, Automotive Electronics, Defense & Aerospace, Renewable & Energy Storage, Others, World GaN on Silicon Templates Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

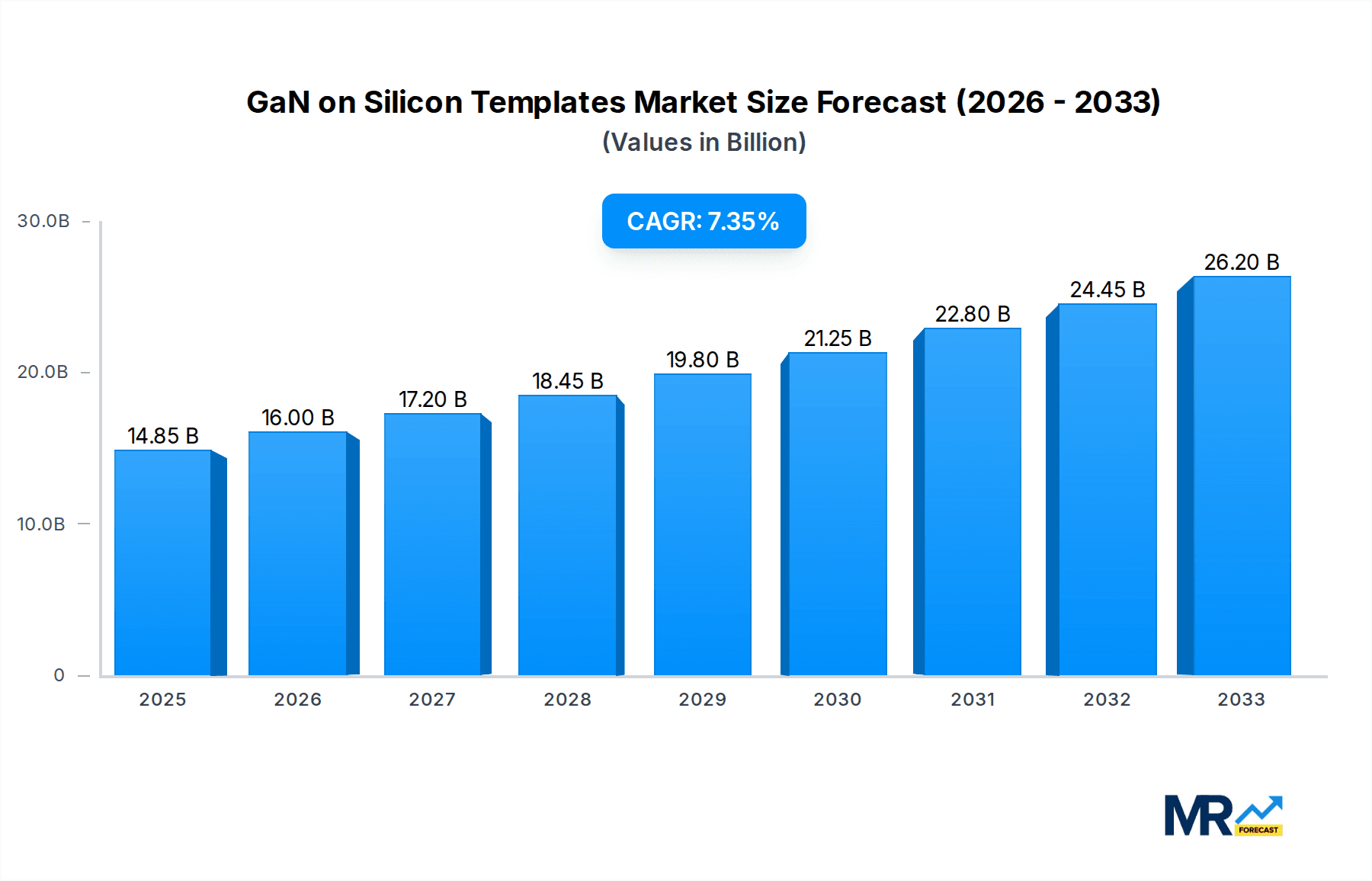

The global GaN on Silicon (GaN-on-Si) templates market is poised for significant expansion, driven by the escalating demand for high-performance electronic devices across various sectors. Valued at an estimated USD 14.85 billion in the base year of 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) of 7.76% throughout the forecast period of 2025-2033. This growth trajectory is primarily fueled by the superior characteristics of GaN-on-Si technology, including its high electron mobility, thermal conductivity, and power efficiency, making it an indispensable material for next-generation applications. The increasing adoption of 5G infrastructure, electric vehicles (EVs), advanced consumer electronics, and sophisticated industrial automation systems are key demand catalysts. These applications necessitate power devices and RF components that can operate at higher frequencies and power densities, areas where GaN-on-Si templates excel. Furthermore, ongoing research and development efforts aimed at improving wafer quality, reducing manufacturing costs, and expanding the application spectrum are expected to further accelerate market penetration.

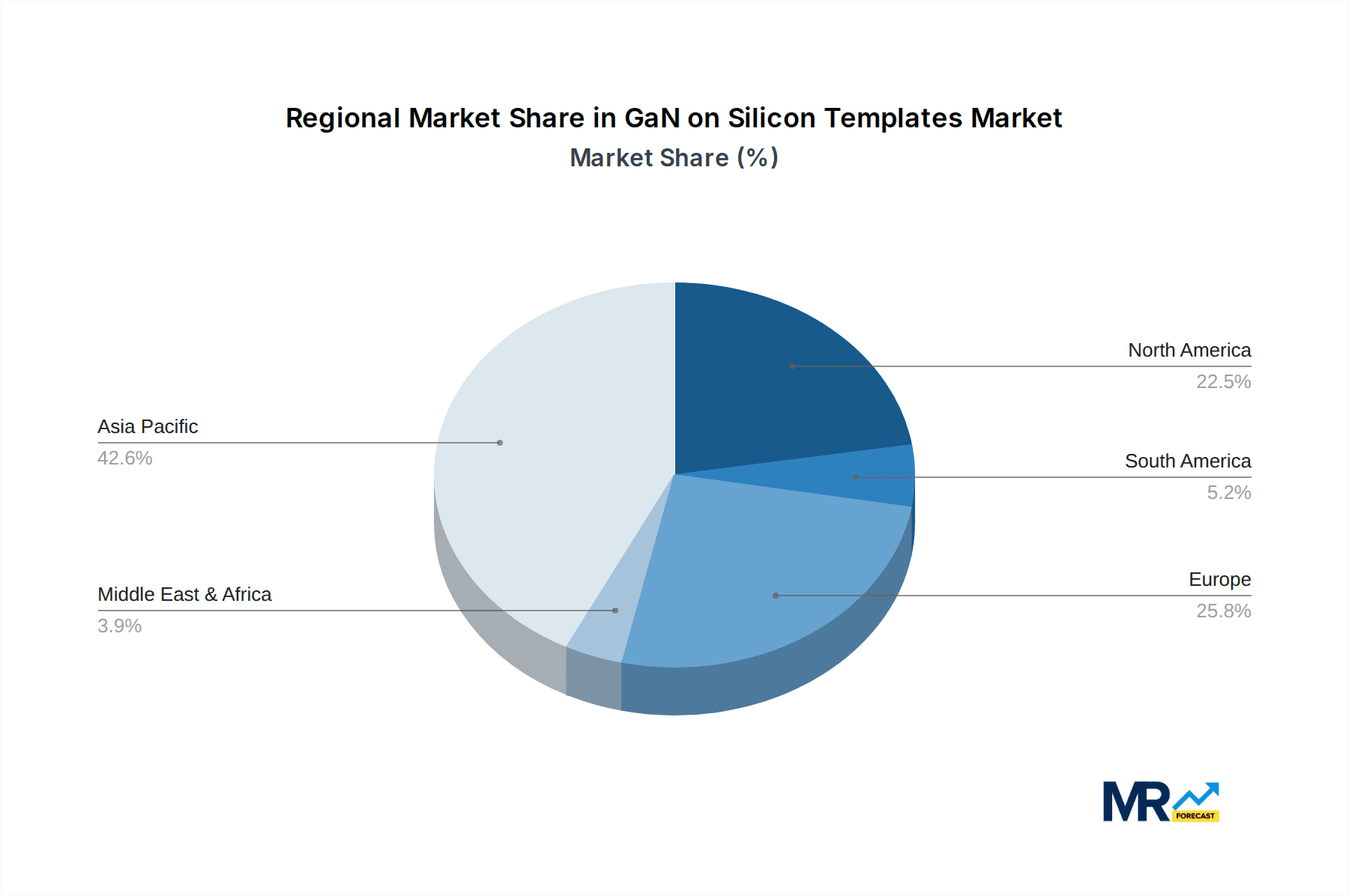

The market's expansion is not without its challenges, however. While the inherent advantages of GaN-on-Si are clear, factors such as the initial high cost of manufacturing, the need for specialized equipment, and the ongoing efforts to achieve larger wafer diameters (like 12-inch) without compromising performance, represent significant restraints. Nevertheless, the relentless innovation from key players like IQE, Soitec (EpiGaN), and Transphorm Inc., coupled with strategic investments in production capacity and technological advancements, are steadily addressing these hurdles. The market is segmented by wafer size, with 8-inch GaN-on-Si wafers currently dominating due to their optimal balance of performance and cost-effectiveness, though the emergence of 12-inch wafers promises greater economies of scale. Application-wise, consumer electronics and industrial sectors are leading the charge, followed closely by the burgeoning demand from telecom & datacom and automotive electronics. Geographically, the Asia Pacific region, particularly China, is expected to lead market growth due to its strong manufacturing base and significant government support for semiconductor innovation.

The GaN on Silicon (GaN-on-Si) templates market is experiencing an unprecedented surge, driven by the insatiable demand for higher performance, energy efficiency, and miniaturization across a spectrum of electronic applications. As we move into the projected landscape of 2025 and beyond, the global GaN on Silicon Templates Production is poised for substantial expansion, with projections indicating a market size that could easily reach tens of billions of dollars by 2033. This growth is not merely incremental; it represents a fundamental shift in semiconductor manufacturing, leveraging the cost-effectiveness and scalability of silicon substrates for the fabrication of Gallium Nitride (GaN) devices. The historical period from 2019 to 2024 has laid the groundwork, showcasing consistent advancements in epitaxial growth techniques and substrate preparation, leading to improved device yields and performance metrics. The base year of 2025 is critical, marking a point where the technology has matured enough to overcome previous limitations and is ready for widespread adoption. The forecast period, extending to 2033, anticipates sustained innovation, including the development of larger wafer diameters (12-inch GaN-on-Si Wafers) and enhanced integration capabilities, further solidifying GaN-on-Si's position as a dominant technology for power electronics and radio frequency (RF) applications. The increasing power density requirements in sectors like electric vehicles, 5G infrastructure, and renewable energy storage are directly fueling this trend, creating a powerful virtuous cycle of demand and technological progress. Moreover, the reduction in manufacturing costs associated with using silicon as a substrate, compared to traditional GaN-on-sapphire or GaN-on-SiC, is a significant catalyst, making GaN devices more accessible for a broader range of applications and consumers. This cost-efficiency is crucial for enabling the proliferation of GaN technology in price-sensitive markets. The report delves deep into these evolving trends, providing granular insights into wafer sizes, regional dynamics, and application-specific adoption rates, painting a comprehensive picture of this dynamic and rapidly evolving market.

The exponential growth of the GaN-on-Silicon (GaN-on-Si) templates market is underpinned by a confluence of powerful drivers that are reshaping the semiconductor landscape. Foremost among these is the relentless pursuit of higher energy efficiency and power density in electronic devices. GaN technology, when epitaxially grown on silicon substrates, offers superior performance characteristics compared to traditional silicon-based semiconductors, enabling faster switching speeds, lower power losses, and increased operational frequencies. This translates directly into smaller, lighter, and more efficient power converters, inverters, and RF components. The booming adoption of electric vehicles (EVs) stands as a monumental driver, with GaN-on-Si power devices being critical for improving EV range, reducing charging times, and enhancing overall vehicle performance. Similarly, the global rollout of 5G and next-generation wireless communication technologies is creating an insatiable demand for high-frequency, high-power RF components, an area where GaN-on-Si excels. The increasing focus on sustainability and renewable energy solutions also plays a pivotal role. GaN-on-Si devices are essential for efficient power conversion in solar inverters, wind turbine converters, and energy storage systems, contributing significantly to the global energy transition. Furthermore, the cost-effectiveness and scalability offered by silicon substrates, when compared to alternative GaN substrates like sapphire or SiC, are democratizing access to GaN technology, making it viable for a wider array of consumer electronics and industrial applications. This cost advantage, coupled with ongoing improvements in wafer production yields, makes GaN-on-Si a compelling proposition for manufacturers seeking to innovate and gain a competitive edge.

Despite the significant advancements and burgeoning demand, the GaN on Silicon (GaN-on-Si) templates market is not without its hurdles and constraints. A primary challenge revolves around wafer bowing and stress management inherent in the heteroepitaxial growth of GaN on silicon. The significant lattice and thermal expansion coefficient mismatch between GaN and silicon can lead to wafer warpage, impacting device yield and uniformity, especially as wafer diameters increase to 12-inch GaN-on-Si Wafers. Achieving high-quality, defect-free GaN layers on large-diameter silicon wafers remains a technically demanding and costly endeavor. Furthermore, the integration of GaN-on-Si devices into existing silicon fabrication infrastructure presents its own set of complexities. Specialized processing steps and equipment are often required to handle the unique properties of GaN materials, necessitating significant investment from foundries. The development and standardization of manufacturing processes for high-volume production, particularly for advanced segments like Automotive Electronics and Defense & Aerospace, are ongoing. While cost reduction is a key advantage, the initial capital expenditure for setting up GaN-on-Si production lines can still be a barrier for some smaller players. Moreover, the reliability and long-term performance of GaN-on-Si devices under extreme operating conditions are continuously being scrutinized and improved, especially for mission-critical applications. Ensuring consistent product quality and robust performance across different manufacturing sites and device types is paramount. Finally, a skilled workforce with expertise in GaN material science and device fabrication is essential but currently in limited supply, posing a potential bottleneck for rapid market expansion.

The GaN on Silicon (GaN-on-Si) templates market is characterized by a dynamic interplay of regional dominance and segment-specific growth. Asia Pacific, particularly China, is emerging as a formidable force, driven by substantial government support, a rapidly expanding domestic semiconductor industry, and a burgeoning demand from its vast manufacturing base across various applications. China's commitment to technological self-sufficiency and its leading role in 5G infrastructure deployment, electric vehicle production, and consumer electronics manufacturing are directly fueling the growth of its GaN-on-Si capabilities. Companies like Sanan Optoelectronics, Innoscience, and China Resources Microelectronics Limited are at the forefront, investing heavily in R&D and expanding production capacities.

Within this dominant region and globally, the Consumer Electronics segment is projected to be a significant market driver, propelled by the increasing integration of GaN technology into power adapters, chargers, and solid-state drives (SSDs). The demand for faster charging, higher energy efficiency, and smaller form factors in smartphones, laptops, and gaming consoles directly translates into a growing need for GaN-on-Si solutions.

However, the Automotive Electronics segment is poised for unparalleled growth and dominance in the long term. The electrification of vehicles is a megatrend, and GaN-on-Si devices are critical enablers of efficient power conversion in electric powertrains, onboard chargers, battery management systems, and advanced driver-assistance systems (ADAS). The stringent requirements for reliability, performance, and cost-effectiveness in the automotive sector are pushing innovation in GaN-on-Si technology, making it a cornerstone of next-generation vehicles. Companies like Transphorm Inc. are making significant inroads in this segment.

Furthermore, the Telecom & Datacom sector, with its ever-increasing bandwidth demands and the proliferation of data centers, is another major contributor. GaN-on-Si is indispensable for high-frequency RF components used in 5G base stations and for efficient power management in data center infrastructure, where energy savings are paramount.

In terms of wafer size, the 8-inch GaN-on-Si Wafer segment is likely to see the most substantial growth and adoption in the near to medium term. This size offers a favorable balance between cost-effectiveness and throughput, allowing for the production of more devices per wafer compared to 6-inch wafers, while still being manageable from a manufacturing perspective. As the technology matures and challenges related to wafer bowing are further addressed, the adoption of 12-inch GaN-on-Si Wafers will accelerate, promising even greater economies of scale and further cost reductions. The "Others" category, encompassing specialized applications within Defense & Aerospace and Renewable & Energy Storage, will also contribute significantly to the overall market value, albeit with smaller unit volumes. The continuous innovation in epitaxy and substrate technologies by players like Soitec (EpiGaN) and IQE is crucial for unlocking the full potential of these segments.

The GaN on Silicon (GaN-on-Si) templates industry is experiencing robust growth, propelled by several key catalysts. The accelerating trend of electrification across various sectors, most notably in Automotive Electronics with the widespread adoption of electric vehicles, is a primary growth engine. The superior power efficiency and miniaturization capabilities of GaN-on-Si devices are essential for enhancing EV range, reducing charging times, and improving overall vehicle performance. Concurrently, the global expansion of 5G and advanced telecommunications infrastructure is creating a significant demand for high-frequency, high-power RF components where GaN-on-Si technology excels. Furthermore, the increasing focus on energy efficiency and sustainability across industrial and consumer applications is driving the adoption of GaN-on-Si for power conversion solutions, contributing to reduced energy consumption and carbon footprint. The ongoing cost reductions in GaN-on-Si wafer manufacturing, driven by advancements in epitaxy and the utilization of cost-effective silicon substrates, are making GaN technology more accessible for a wider range of applications, from consumer chargers to industrial power supplies.

This comprehensive report offers an in-depth analysis of the GaN on Silicon (GaN-on-Si) templates market, providing critical insights for stakeholders. The study encompasses a detailed historical analysis from 2019-2024, with a base year of 2025, and extends to a robust forecast period up to 2033. It meticulously examines the World GaN on Silicon Templates Production, identifying key market trends, including the evolution of wafer diameters from 6-inch to 12-inch GaN-on-Si Wafers and the increasing adoption of 8-inch GaN-on-Si Wafers as a sweet spot for cost-effectiveness and throughput. The report delves into the critical Driving Forces, such as the demand for energy efficiency in Consumer Electronics, Automotive Electronics, and Renewable & Energy Storage, alongside the growth in Telecom & Datacom driven by 5G deployment. It also thoroughly investigates the Challenges and Restraints, including wafer bowing and integration complexities, and identifies Key Region or Country & Segment to Dominate the Market, with a particular focus on Asia Pacific's growing influence and the dominance of segments like Automotive Electronics and Consumer Electronics. Furthermore, the report highlights Growth Catalysts, such as technological advancements and cost reductions, and profiles the Leading Players in the GaN on Silicon Templates industry, along with their recent Significant Developments. This report serves as an indispensable resource for understanding the current landscape and future trajectory of this rapidly evolving and strategically important semiconductor market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.76% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.76%.

Key companies in the market include IQE, Soitec (EpiGaN), Transphorm Inc., Sumitomo Electric Device Innovations (SEDI) (SCIOCS), NTT Advanced Technology (NTT-AT), DOWA Electronics Materials, BTOZ, Episil-Precision Inc, Epistar Corp., Enkris Semiconductor Inc, Innoscience, China Resources Microelectronics Limited, CorEnergy, Suzhou Nanowin Science and Technology, Qingdao Cohenius Microelectronics, Shaanxi Yuteng Electronic Technology, Sanan Optoelectronics, IVWorks, A-PRO Semicon, Beijing Zhongboxin Semiconductor Technology, Suzhou Han Hua Semiconductor, Apro semi, GaNcool.

The market segments include Type, Application.

The market size is estimated to be USD 14.85 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "GaN on Silicon Templates," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the GaN on Silicon Templates, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.