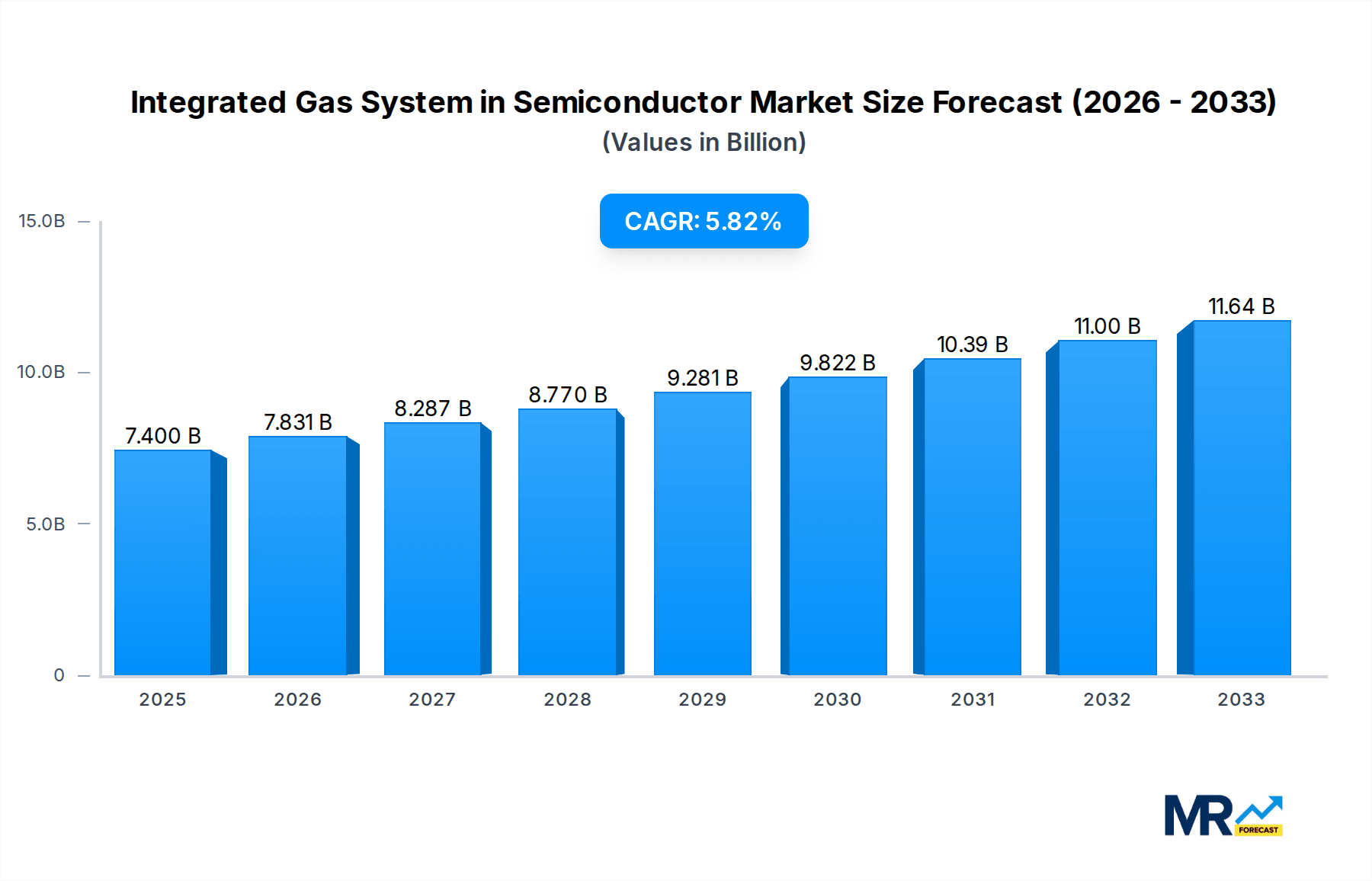

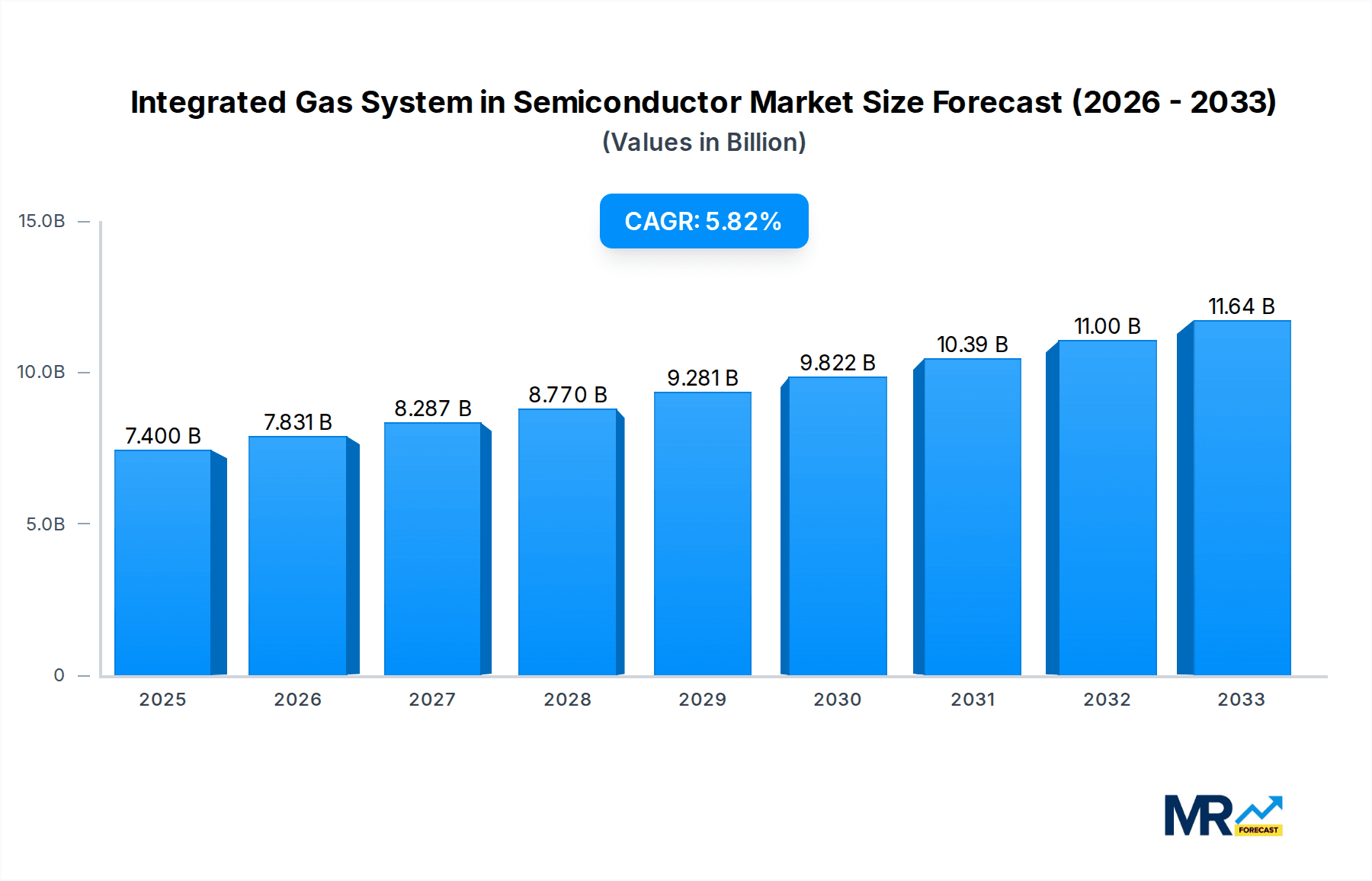

1. What is the projected Compound Annual Growth Rate (CAGR) of the Integrated Gas System in Semiconductor?

The projected CAGR is approximately 5.9%.

Integrated Gas System in Semiconductor

Integrated Gas System in SemiconductorIntegrated Gas System in Semiconductor by Type (W-Seal, C-Seal, World Integrated Gas System in Semiconductor Production ), by Application (CVD Equipment, Etcher, Diffusion Equipment, Others, World Integrated Gas System in Semiconductor Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global Integrated Gas System in Semiconductor Production market is poised for substantial growth, with an estimated market size of $7.4 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 5.9% through 2033. This robust expansion is primarily fueled by the escalating demand for advanced semiconductors across diverse sectors, including artificial intelligence, 5G technology, IoT devices, and automotive electronics. The increasing complexity and miniaturization of semiconductor manufacturing processes necessitate highly precise and reliable gas delivery systems to ensure product quality and yield. Key market drivers include the continuous innovation in wafer fabrication technologies, the growing investment in semiconductor manufacturing facilities globally, and the rising need for ultra-high purity (UHP) gases in cutting-edge chip production. The market's trajectory is further bolstered by the expanding applications of semiconductors in emerging technologies and the ongoing efforts by governments worldwide to strengthen domestic semiconductor supply chains, thus driving increased production volumes and, consequently, the demand for sophisticated integrated gas systems.

The market landscape for Integrated Gas Systems in Semiconductor Production is characterized by a dynamic interplay of technological advancements and evolving industry needs. W-Seal and C-Seal technologies represent crucial segments, offering enhanced leak prevention and operational efficiency vital for sensitive semiconductor processes. The adoption of these systems is particularly pronounced in critical applications such as Chemical Vapor Deposition (CVD) equipment, etching processes, and diffusion equipment, where precise control over gas flow and composition is paramount. Leading companies like CKD Corporation, Fujikin Group, Ichor Systems, and Fitok Group are at the forefront of innovation, continually developing advanced solutions to meet stringent industry standards and customer requirements. While growth is strong, potential restraints may include the high initial investment costs associated with these sophisticated systems and the intense competition within the market, driving price pressures. However, the sustained demand for high-performance semiconductors and the continuous push for manufacturing excellence are expected to outweigh these challenges, ensuring a positive outlook for the integrated gas system market.

This report offers an in-depth analysis of the Integrated Gas System (IGS) in Semiconductor Production market, a critical component driving the advancements in semiconductor manufacturing. The study meticulously examines market trends, key growth drivers, prevalent challenges, and future projections for the period of 2019-2033, with a focus on the Base Year of 2025. We delve into the intricate landscape of IGS, dissecting its segments such as W-Seal and C-Seal technologies, and its diverse applications across CVD Equipment, Etcher, and Diffusion Equipment, amongst others. The report quantifies the market size, anticipating it to reach tens of billions of dollars by the end of the forecast period, highlighting the significant investment and innovation within this sector. Furthermore, we explore the strategic initiatives of major players like CKD Corporation, Fujikin Group, Ichor Systems, and Fitok Group, providing valuable insights into their contributions and market positioning.

The global Integrated Gas System (IGS) in Semiconductor Production market is experiencing robust expansion, poised to reach an impressive valuation in the tens of billions of dollars by 2033, reflecting its indispensable role in advanced chip manufacturing. This growth is underpinned by an escalating demand for sophisticated semiconductor devices across a multitude of industries, including consumer electronics, automotive, telecommunications, and high-performance computing. The relentless pursuit of smaller, faster, and more power-efficient chips necessitates the utilization of highly precise and ultra-pure gas delivery systems, which are the core of IGS. Emerging technologies such as Artificial Intelligence (AI), 5G, and the Internet of Things (IoT) are creating an unprecedented demand for cutting-edge semiconductors, thereby directly stimulating the IGS market. The report identifies a significant trend towards miniaturization and increased integration within IGS solutions. Manufacturers are developing more compact, modular, and intelligent systems that offer enhanced control, improved efficiency, and greater flexibility in semiconductor fabrication environments. This is particularly evident in the evolution of sealing technologies, with W-Seal and C-Seal systems constantly being refined to meet the stringent purity and leak-tightness requirements of advanced processes. The increasing complexity of semiconductor manufacturing processes, such as Atomic Layer Deposition (ALD) and advanced etching techniques, is also a key driver. These processes demand extremely precise control over gas flows and compositions, pushing the boundaries of IGS capabilities. Furthermore, the geopolitical landscape and the drive for supply chain resilience are influencing market dynamics. Companies are increasingly looking for localized manufacturing and supply of critical components like IGS, which can present both opportunities and challenges for global market participants. The adoption of smart manufacturing principles and Industry 4.0 concepts is also permeating the IGS sector, with a focus on data analytics, predictive maintenance, and automated process control, further enhancing the value proposition of integrated gas systems. The ongoing research and development into novel materials and precursor gases for next-generation semiconductor nodes also necessitates continuous innovation in gas delivery and management systems.

The Integrated Gas System (IGS) in Semiconductor Production market is being propelled by several powerful forces that are fundamentally reshaping the semiconductor manufacturing landscape. At the forefront is the insatiable global demand for advanced semiconductors, driven by rapid technological advancements across consumer electronics, automotive, 5G infrastructure, and artificial intelligence applications. As chip designs become more intricate and manufacturing processes more sophisticated, the need for ultra-high purity gas delivery, precise flow control, and reliable system integration becomes paramount. This directly translates into a heightened requirement for advanced IGS solutions capable of meeting these exacting specifications. Furthermore, the ongoing push towards smaller wafer nodes and more complex chip architectures, such as those employed in high-performance computing and AI accelerators, mandates increasingly precise and consistent gas compositions and delivery. This necessitates the development and adoption of next-generation IGS that can handle a wider range of specialized and often hazardous gases with unparalleled accuracy and safety. The significant investments being made by leading semiconductor manufacturers in expanding their fabrication capacities, particularly in response to growing market demand and geopolitical considerations, are also a major impetus. These capacity expansions directly translate into increased demand for IGS equipment and services across new and existing fabs. Moreover, the increasing complexity of semiconductor manufacturing processes, including advanced etching and deposition techniques like Atomic Layer Deposition (ALD), requires highly specialized and integrated gas delivery solutions. These processes are highly sensitive to gas purity, flow rates, and temporal control, making robust IGS essential for achieving desired yield and performance. The relentless pursuit of greater manufacturing efficiency, reduced waste, and improved process yields by semiconductor companies also drives the adoption of more integrated and intelligent IGS solutions that offer better process monitoring and control capabilities.

Despite the robust growth trajectory, the Integrated Gas System (IGS) in Semiconductor Production market is not without its considerable challenges and restraints. One of the most significant hurdles is the extreme purity and precision requirements demanded by advanced semiconductor manufacturing. Even minute contamination or fluctuations in gas flow can lead to wafer defects, drastically impacting yields and driving up manufacturing costs. Achieving and maintaining these ultra-high purity levels throughout complex gas delivery pathways requires sophisticated materials, rigorous manufacturing processes, and extensive quality control, all of which contribute to higher system costs and longer lead times. The increasing complexity of semiconductor fabrication processes, such as the use of novel precursor gases for advanced node technologies, poses another significant challenge. These new materials often come with specific handling, safety, and compatibility requirements, necessitating continuous research and development from IGS manufacturers to adapt their systems and ensure safe and effective delivery. Furthermore, the high cost of advanced IGS components and systems can be a restraint, particularly for smaller or emerging semiconductor manufacturers. The specialized alloys, precision valves, mass flow controllers, and sophisticated control software involved in IGS are inherently expensive, making significant upfront investment a prerequisite for adopting state-of-the-art solutions. The evolving regulatory landscape concerning hazardous gas handling and environmental compliance also presents a continuous challenge. Manufacturers must ensure their IGS solutions not only meet performance requirements but also adhere to increasingly stringent safety and environmental regulations, which can necessitate costly system modifications or the adoption of new technologies. The global supply chain complexities and potential disruptions are also a concern, particularly for critical components and specialized materials required for IGS. Geopolitical tensions, trade disputes, and unforeseen events can impact the availability and cost of these essential elements, potentially hindering production and delivery timelines. Finally, the short product lifecycles in the semiconductor industry mean that IGS manufacturers must constantly innovate and adapt their offerings to keep pace with the rapidly evolving demands of chip manufacturers, requiring substantial and continuous investment in research and development.

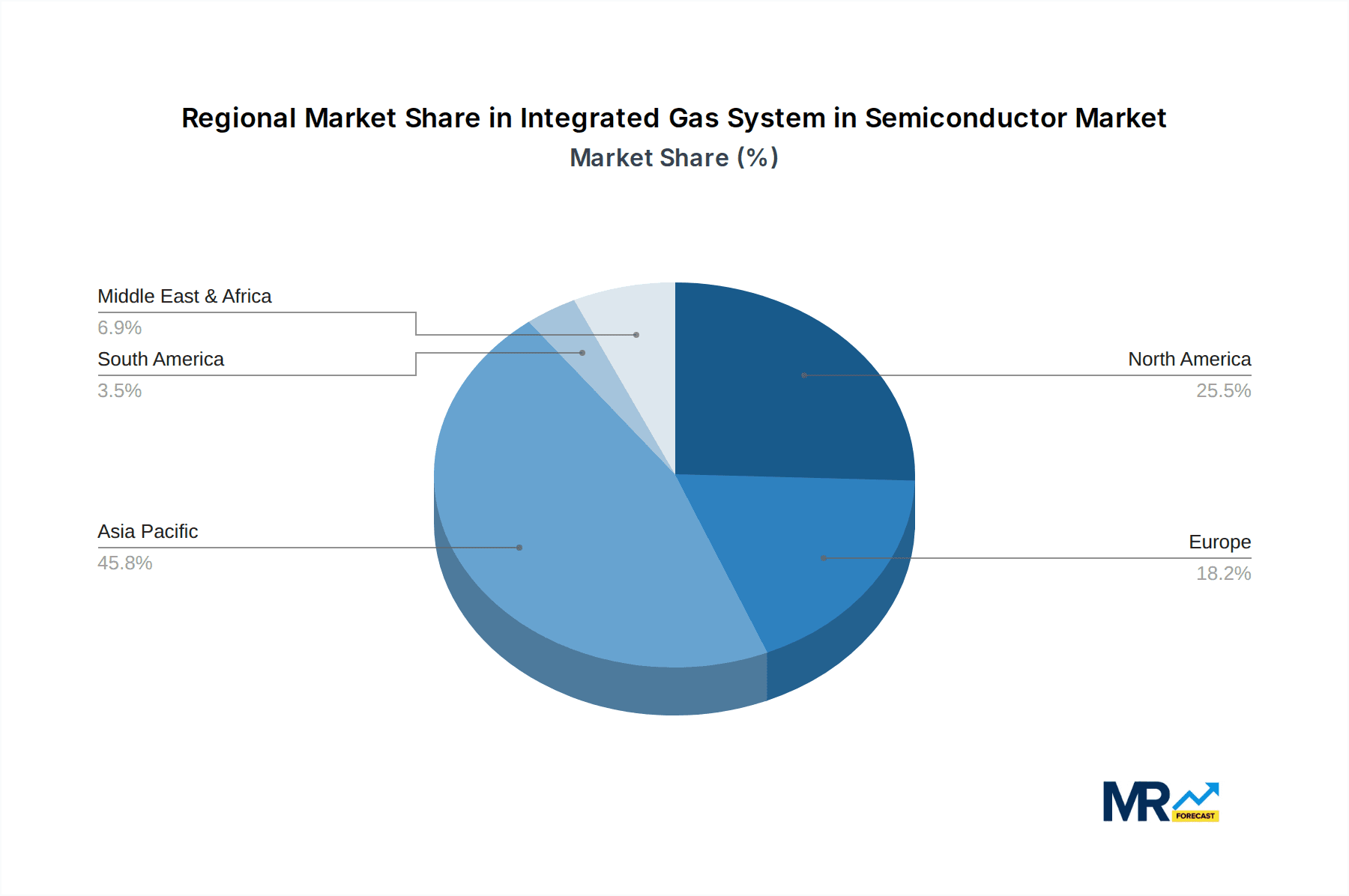

The global Integrated Gas System (IGS) in Semiconductor Production market is characterized by distinct regional strengths and segment dominance, with the Asia-Pacific (APAC) region emerging as the undisputed leader, driven primarily by the burgeoning semiconductor manufacturing capabilities of countries like Taiwan, South Korea, and China. This dominance is a direct consequence of the concentration of major semiconductor foundries and integrated device manufacturers (IDMs) within APAC, where significant investments are continuously being poured into expanding production capacity for advanced logic and memory chips. The region's leadership is further bolstered by government initiatives aimed at promoting domestic semiconductor ecosystems and attracting foreign investment, creating a fertile ground for IGS adoption.

Within this dynamic market, the W-Seal segment is poised for significant growth and is expected to exert considerable influence. W-Seal technology, known for its superior sealing performance and inherent leak-tightness, is crucial for handling the ultra-high purity and often toxic gases used in advanced semiconductor fabrication processes. As semiconductor manufacturers push the boundaries of miniaturization and move towards smaller process nodes (e.g., 3nm, 2nm, and below), the demand for extremely precise and reliable gas delivery systems that minimize contamination becomes paramount. W-seal systems are ideally suited to meet these stringent requirements, offering a higher level of assurance against gas leaks and purity degradation, which are critical for achieving high yields in complex processes like CVD (Chemical Vapor Deposition) and ALD (Atomic Layer Deposition).

The CVD Equipment application segment also plays a pivotal role in driving the market's growth and is expected to see substantial expansion. CVD processes are fundamental to semiconductor manufacturing, used for depositing thin films of various materials onto wafers. The quality and uniformity of these deposited films are highly dependent on the precise control of precursor gas flows and mixtures, which are managed by the IGS. As wafer complexity increases and new material deposition techniques are developed, the demand for sophisticated and highly integrated gas delivery systems for CVD applications will continue to surge. The advancements in deposition technologies for next-generation memory and logic devices will further fuel the need for specialized IGS solutions tailored for these demanding CVD processes.

Furthermore, the Etcher segment is another critical application area that will significantly contribute to market expansion. Etching is a crucial step in creating intricate patterns on semiconductor wafers, and it relies heavily on the precise delivery of etchant gases. The move towards finer feature sizes and more complex 3D structures requires highly selective and controllable etching processes, which in turn necessitate advanced IGS solutions capable of delivering a wide range of specialized etchant gases with extreme precision and safety. The development of advanced dry etching techniques, such as reactive ion etching (RIE), is particularly dependent on the performance and reliability of the integrated gas systems.

The overall dominance of the APAC region, coupled with the significant contributions of the W-Seal technology and the CVD and Etcher application segments, paints a clear picture of the key growth drivers and market leaders within the global Integrated Gas System in Semiconductor Production market. These areas represent significant opportunities for innovation and market penetration for IGS manufacturers.

The Integrated Gas System (IGS) in Semiconductor industry is experiencing significant growth catalysts, primarily fueled by the relentless demand for high-performance semiconductors across burgeoning sectors like AI, 5G, and IoT. The continuous push for smaller, more powerful, and energy-efficient chips necessitates advanced manufacturing processes that rely heavily on ultra-pure and precisely controlled gas delivery, a core function of IGS. Furthermore, increasing global investments in semiconductor fabrication facilities, driven by supply chain diversification and national security concerns, are directly translating into expanded demand for IGS solutions. The evolution of new materials and complex deposition techniques for next-generation semiconductor nodes also acts as a significant catalyst, pushing the boundaries of IGS technology and driving innovation in precision and purity.

This comprehensive report provides an exhaustive analysis of the Integrated Gas System (IGS) in Semiconductor Production market, offering unparalleled insights into its current state and future trajectory. Spanning a detailed study period of 2019-2033, with a keen focus on the Base Year of 2025, the report meticulously dissects key market trends, technological advancements, and the intricate dynamics shaping this vital sector. It quantifies market opportunities, projecting a valuation in the tens of billions of dollars, underscoring the significant economic impact and growth potential of IGS. The report delves into the core technologies, examining segments like W-Seal and C-Seal, and their critical applications in CVD Equipment, Etcher, and Diffusion Equipment, among others, providing a granular understanding of market segmentation. Moreover, it offers strategic intelligence on leading players such as CKD Corporation, Fujikin Group, Ichor Systems, and Fitok Group, outlining their contributions and market positioning. Through in-depth analysis of growth catalysts, challenges, and regional dominance, this report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving landscape of integrated gas systems in semiconductor manufacturing.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.9%.

Key companies in the market include CKD corporation, Fujikin Group, Ichor systems, Fitok group.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Integrated Gas System in Semiconductor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Integrated Gas System in Semiconductor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.