1. What is the projected Compound Annual Growth Rate (CAGR) of the Confectionery and Bakery Packaging?

The projected CAGR is approximately 3.6%.

Confectionery and Bakery Packaging

Confectionery and Bakery PackagingConfectionery and Bakery Packaging by Type (Paper packaging, Glass Packaging, Plastic Packaging, Others, World Confectionery and Bakery Packaging Production ), by Application (Confectionery, Bakery, World Confectionery and Bakery Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

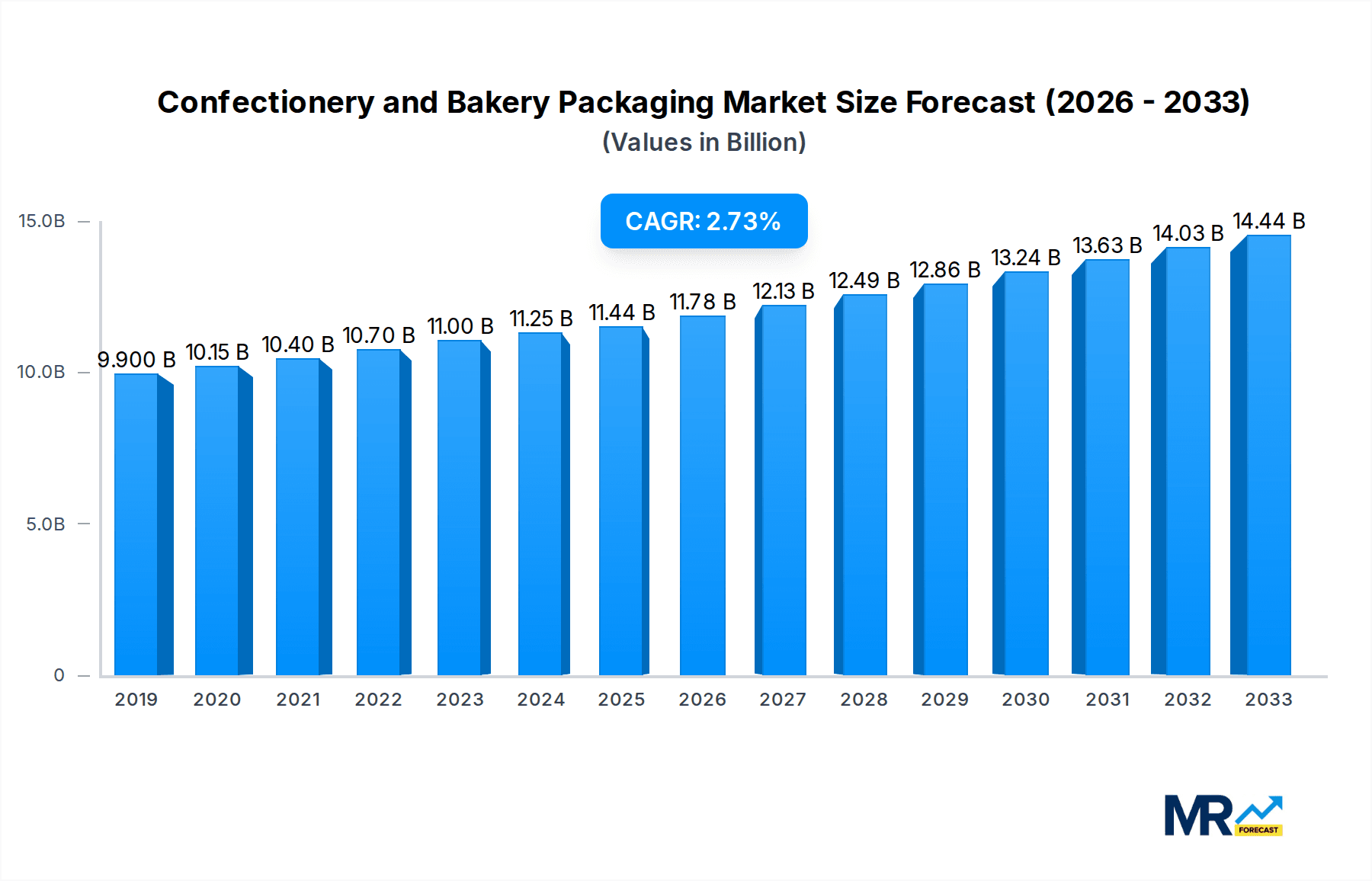

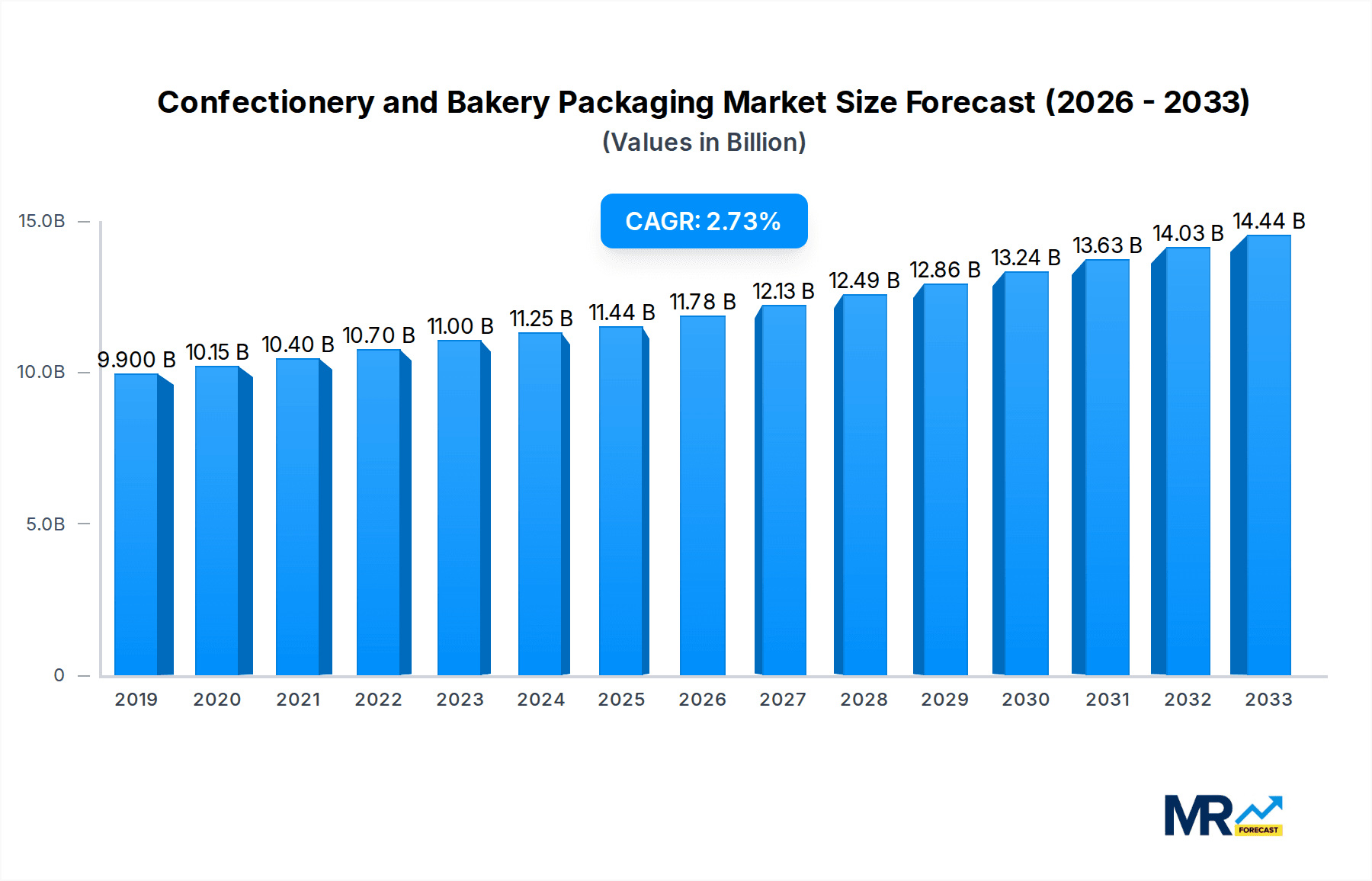

The global confectionery and bakery packaging market is poised for robust growth, projected to reach an estimated $11.44 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.6% expected to persist through 2033. This expansion is primarily fueled by the escalating consumer demand for convenience, premiumization, and aesthetically appealing packaging solutions within these rapidly evolving food sectors. The confectionery segment, driven by impulse purchases and gifting occasions, is a significant contributor, while the bakery segment benefits from the rising popularity of artisanal and health-conscious baked goods requiring specialized protective and visually appealing packaging. Key growth drivers include the increasing disposable incomes in emerging economies, leading to higher spending on treat items, and the continuous innovation in packaging materials and designs that enhance product shelf-life, portability, and brand differentiation.

The market's dynamism is further shaped by emerging trends such as the growing emphasis on sustainable packaging, with a noticeable shift towards recyclable, compostable, and biodegradable materials like paper and advanced bioplastics, driven by both consumer preferences and stringent environmental regulations. This trend presents both opportunities for innovation and challenges for manufacturers to balance sustainability with cost-effectiveness and performance. While plastic packaging continues to hold a significant market share due to its versatility and cost, the pressure to reduce its environmental footprint is intensifying. The market also witnesses a surge in demand for smart packaging solutions that offer enhanced traceability, authenticity, and consumer engagement. However, significant restraints include fluctuating raw material prices, particularly for paper and certain plastics, and the complex regulatory landscape surrounding food-grade packaging materials across different regions, which can impact production costs and market access for various packaging types.

This comprehensive report delves into the dynamic global confectionery and bakery packaging market, forecasting significant growth and evolution. With a study period spanning from 2019 to 2033, and a base and estimated year of 2025, this analysis provides in-depth insights into the historical trajectory (2019-2024) and future projections (2025-2033). The report meticulously examines production, applications, and industry developments, offering a crucial roadmap for stakeholders navigating this multi-billion dollar industry.

The global confectionery and bakery packaging market is experiencing a multifaceted transformation, driven by evolving consumer preferences, technological advancements, and an increasing focus on sustainability. XXX, the market is projected to reach a significant valuation in the billions by 2025 and continue its upward trajectory throughout the forecast period. A key trend is the escalating demand for convenience and portability. Consumers, particularly younger demographics, seek on-the-go options and single-serving packs that are easy to open, resealable, and minimize mess. This translates into a surge in demand for innovative flexible packaging solutions, such as pouches and sachets, offering excellent barrier properties to preserve freshness and extend shelf life. Furthermore, the rise of premiumization is deeply influencing packaging design. Brands are investing in visually appealing and tactile packaging that communicates quality and exclusivity. This includes the adoption of sophisticated printing techniques, unique shapes, and the incorporation of premium materials, often reflecting a desire for a more luxurious unboxing experience, especially for gifting occasions.

Another significant trend is the profound impact of sustainability. The environmental consciousness among consumers and regulatory pressures are compelling manufacturers to adopt eco-friendly packaging solutions. This encompasses a shift towards recyclable and compostable materials, with paper and cardboard packaging regaining prominence alongside advanced bioplastics. The focus is not just on the material itself but also on reduced material usage through lightweighting and optimized designs. For instance, the increasing use of thinner films in flexible packaging or the elimination of unnecessary layers in multi-material constructions are key strategies. The digital age has also ushered in the era of smart packaging, which integrates technologies like QR codes and NFC tags to enhance consumer engagement, provide product information, track authenticity, and even offer personalized promotions. This trend is particularly relevant for premium confectionery and specialty bakery items. Finally, the demand for customization and personalization is on the rise. Brands are exploring packaging that can be tailored for specific events, seasons, or even individual consumers, fostering a deeper connection and enhancing perceived value. This could involve personalized messages, unique graphics, or limited-edition designs that resonate with niche consumer groups. The interplay of these trends is shaping a market that is both innovative and responsible, catering to the diverse needs of a global consumer base.

The global confectionery and bakery packaging market is experiencing robust growth, propelled by a confluence of powerful factors. At its core, the ever-increasing global demand for confectionery and bakery products is the primary engine. As populations grow and disposable incomes rise in emerging economies, so does the appetite for these indulgence categories. This directly translates into a greater need for effective and appealing packaging to house and present these goods. Furthermore, the evolving consumer lifestyle plays a crucial role. Modern consumers often lead busier lives, prioritizing convenience and portability. This has fueled the demand for single-serving packs, resealable options, and packaging that is easy to consume on the go, directly benefiting flexible packaging formats like pouches and sachets. The growing influence of e-commerce and direct-to-consumer (DTC) sales is another significant propellant. Online channels require packaging that can withstand the rigors of shipping, protect the product's integrity, and still offer an attractive presentation upon arrival. This has spurred innovation in protective and aesthetically pleasing secondary packaging.

The escalating emphasis on brand differentiation and product appeal in a highly competitive market compels manufacturers to invest in innovative packaging. Packaging is no longer just a protective shell; it’s a powerful marketing tool that captures consumer attention on crowded shelves and online platforms. This drives investment in attractive graphics, unique structural designs, and premium finishes. Additionally, technological advancements in packaging materials and machinery are enabling the creation of more functional, sustainable, and cost-effective solutions. Innovations in barrier technologies, printing capabilities, and automation in the packaging process are continuously pushing the boundaries of what is possible. Finally, growing consumer awareness and demand for sustainable packaging is not just a trend but a significant driving force. Brands that proactively adopt eco-friendly materials and practices are gaining a competitive edge, resonating with environmentally conscious consumers and navigating stricter environmental regulations. These combined forces create a dynamic and expanding market for confectionery and bakery packaging.

Despite the promising growth trajectory, the confectionery and bakery packaging market faces several significant challenges and restraints that could temper its expansion. A primary concern is the escalating cost of raw materials. The prices of key components for various packaging types, such as plastics, paper pulp, and aluminum, are subject to global market fluctuations, geopolitical events, and supply chain disruptions. Volatility in these costs directly impacts the profitability of packaging manufacturers and can lead to increased prices for end-users, potentially affecting consumer purchasing decisions. Furthermore, stringent and evolving regulatory landscapes, particularly concerning food safety, material compliance, and waste management, present a constant challenge. Manufacturers must invest heavily in research and development to ensure their packaging meets diverse national and international standards, which can be complex and time-consuming. The increasing pressure to adopt sustainable packaging solutions, while a growth driver, also poses a challenge. Developing and implementing truly sustainable alternatives that offer comparable functionality, shelf life, and cost-effectiveness to traditional materials can be technically demanding and require significant upfront investment in new technologies and infrastructure.

The inherent complexities of the supply chain, particularly for specialized ingredients and packaging components, can lead to delays and inefficiencies. The global nature of the industry means that disruptions in one region can have ripple effects worldwide, impacting production timelines and availability. Moreover, consumer perception and acceptance of new packaging formats can be a restraint. While innovation is encouraged, consumers may be resistant to unfamiliar materials or designs, especially if they are perceived as less functional or less premium. The waste management infrastructure in many regions is still developing, and the ability to effectively collect, sort, and recycle advanced packaging materials can be limited, hindering the widespread adoption of certain eco-friendly solutions. Finally, the intense competition within the packaging sector itself can lead to price wars and reduced profit margins for manufacturers, forcing them to continuously innovate and optimize their operations to remain competitive. Addressing these challenges effectively will be crucial for sustained growth in the confectionery and bakery packaging market.

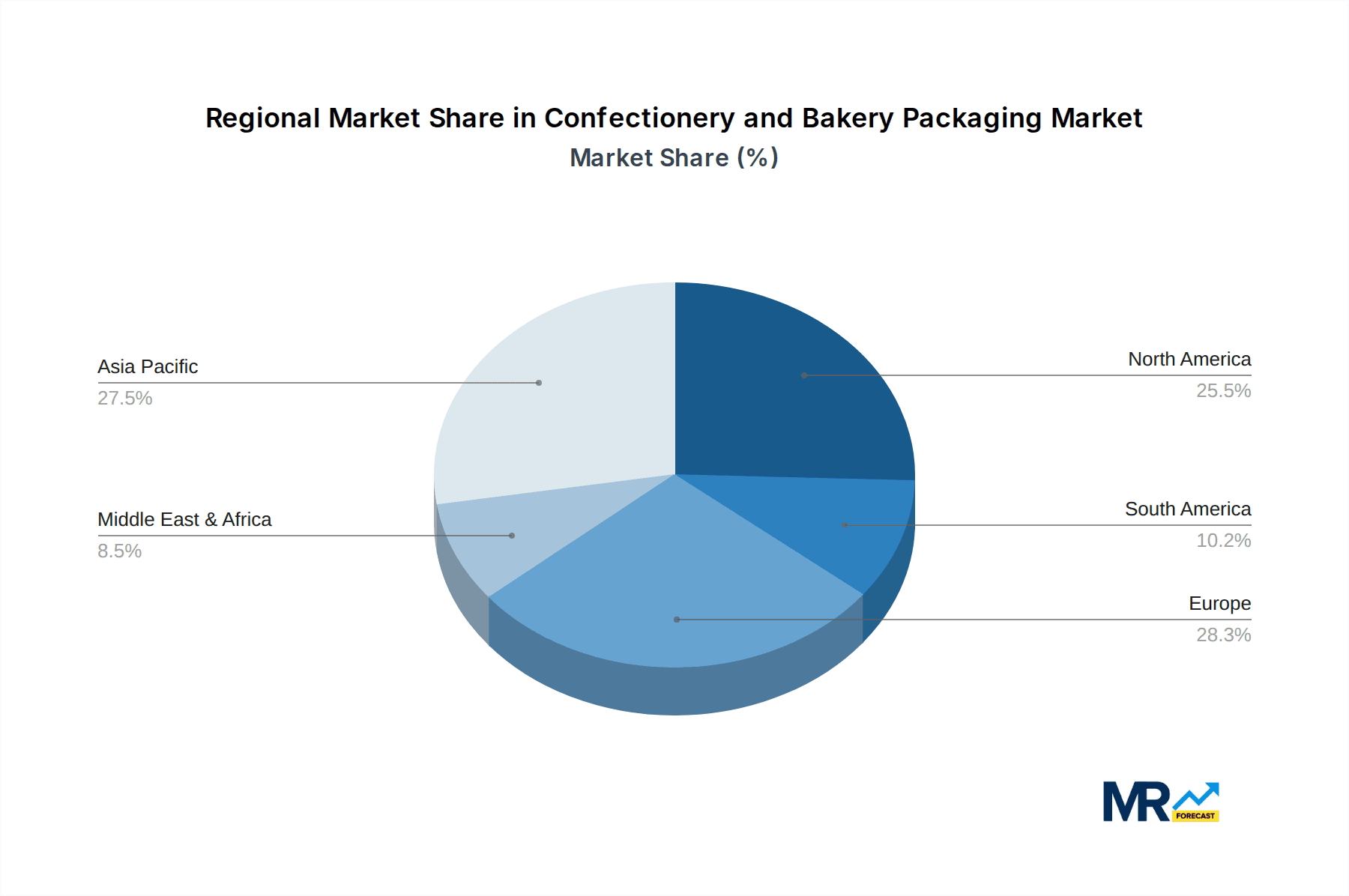

The global confectionery and bakery packaging market is characterized by significant regional variations and segment dominance, driven by distinct economic, cultural, and regulatory factors. Among the key regions, Asia Pacific is poised to emerge as a dominant force in the confectionery and bakery packaging market. This dominance is fueled by several interconnected factors. Firstly, the region boasts a massive and rapidly growing population, translating into a perpetually expanding consumer base for both confectionery and bakery products. As disposable incomes rise across countries like China, India, and Southeast Asian nations, so does the demand for convenience foods and indulgent treats, directly translating into a higher volume requirement for packaging.

Within Asia Pacific, China stands out as a particularly influential market. Its vast manufacturing capabilities, coupled with a burgeoning middle class that exhibits a growing preference for both Western-style bakery goods and traditional confectionery, makes it a significant consumer and producer of packaging. The increasing adoption of sophisticated retail formats and the strong growth of e-commerce in China further necessitate advanced and visually appealing packaging solutions.

When considering segments, Plastic Packaging is expected to maintain a significant leadership position within the confectionery and bakery packaging market. This is primarily due to its inherent versatility, cost-effectiveness, and superior barrier properties. Plastic materials, such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), are highly adaptable to various packaging formats, including flexible pouches, rigid containers, and films. Their ability to provide excellent protection against moisture, oxygen, and light is crucial for maintaining the freshness and shelf life of delicate confectionery and bakery items. Furthermore, the ongoing advancements in plastic packaging technology, including the development of thinner films and enhanced barrier coatings, allow for reduced material usage while maintaining performance, aligning with some sustainability goals.

The Application segment of Confectionery is also a significant driver of market dominance. Confectionery products, ranging from chocolates and candies to biscuits and cookies, often require specialized packaging to preserve their taste, texture, and aroma. The intricate nature of many confectionery items, such as delicate chocolates, necessitates packaging that offers robust protection against damage during transit and handling, while also providing an appealing visual display. The high purchase frequency of many confectionery items, especially during festive seasons and as impulse buys, further contributes to the substantial demand for their packaging. The premiumization trend within the confectionery sector also drives demand for high-quality, visually striking packaging that enhances the perceived value of the product.

In terms of Type, Paper Packaging is anticipated to witness substantial growth and is projected to hold a considerable share of the market, particularly in response to the global push for sustainability. Paper and paperboard are renewable resources, often recyclable and biodegradable, making them an attractive alternative to plastics for many applications. Brands are increasingly opting for paper-based solutions, such as folding cartons, boxes, and bags, for cookies, cakes, pastries, and even chocolates, especially for premium offerings. The aesthetic appeal and tactile qualities of paper packaging also contribute to its desirability, allowing for high-quality printing and embossing that can enhance brand perception. The development of coated and treated papers offering improved moisture and grease resistance further expands their applicability in the bakery and confectionery sectors.

Several key growth catalysts are propelling the confectionery and bakery packaging industry forward. The rising global demand for convenience foods and indulgent treats is a fundamental driver, as a growing population with increasing disposable incomes seeks readily available and appealing snacks. The e-commerce boom and the rise of direct-to-consumer (DTC) models necessitate robust and attractive packaging capable of withstanding shipping while maintaining consumer appeal. Furthermore, the increasing emphasis on sustainability and eco-friendly packaging solutions is forcing innovation, leading to the adoption of recyclable, compostable, and biodegradable materials, which opens new market opportunities. Finally, advancements in packaging technology and design, such as enhanced barrier properties, smart packaging features, and innovative structural designs, are enabling manufacturers to meet evolving consumer needs and regulatory requirements more effectively.

This report provides an exhaustive analysis of the confectionery and bakery packaging market, offering a comprehensive overview of its current landscape and future trajectory. It delves into intricate details of market segmentation, including types of packaging materials like plastic, paper, and glass, as well as key application segments such as confectionery and bakery products. The report meticulously analyzes historical data from 2019-2024 and provides robust forecasts for the period 2025-2033, with a specific focus on the base and estimated year of 2025. It examines the interplay of macro-economic factors, technological innovations, consumer behavior, and regulatory influences that shape market dynamics. Furthermore, the report identifies and profiles leading companies, analyzes their strategic initiatives and market shares, and highlights significant developments and emerging trends, such as the growing demand for sustainable and smart packaging solutions. This comprehensive coverage equips stakeholders with the essential knowledge and insights needed to navigate the complexities and capitalize on the opportunities within this vital global industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.6%.

Key companies in the market include Amcor, Crown Holdings, Tetra Pak International, American International Container, Ardagh Group, Berry Plastics, Bomarko, Consol Glass, Huhtamak, ITC, Jiangsu Zhongda New Material Group, MeadWestvaco, Novelis, Solo Cup Company, Sonoco Products, Stanpac.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Confectionery and Bakery Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Confectionery and Bakery Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.