1. What is the projected Compound Annual Growth Rate (CAGR) of the 2-Piece and 3-Piece Cans?

The projected CAGR is approximately 4.2%.

2-Piece and 3-Piece Cans

2-Piece and 3-Piece Cans2-Piece and 3-Piece Cans by Application (Food Packaging, Beverage Packaging, Chemical Packing, Others, World 2-Piece and 3-Piece Cans Production ), by Type (2-Piece Cans, 3-Piece Cans, World 2-Piece and 3-Piece Cans Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

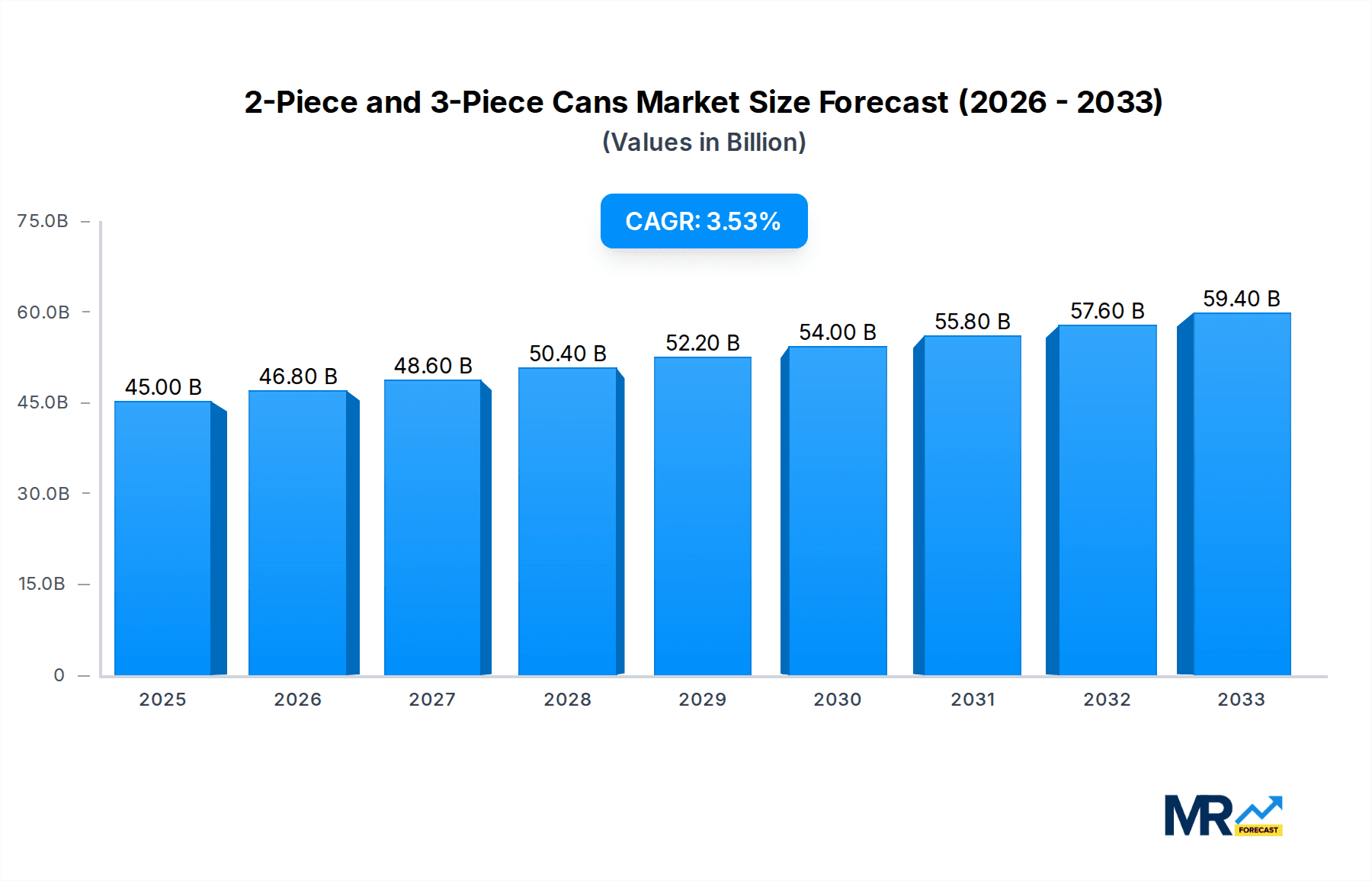

The global market for 2-piece and 3-piece cans is projected to reach approximately $45 billion by the end of 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of 4.2% anticipated over the forecast period extending to 2033. This expansion is primarily driven by the increasing demand for convenient and sustainable packaging solutions across various sectors, most notably in food and beverage packaging, which represent significant application segments. The shift towards lighter and more eco-friendly packaging materials continues to favor aluminum cans, particularly the 2-piece variant, due to its recyclability and reduced material usage compared to traditional 3-piece cans. The beverage industry, in particular, is a substantial consumer of these cans, driven by the popularity of ready-to-drink (RTD) beverages, carbonated soft drinks, and craft beers. The convenience offered by cans for single-serving portions and their durability during transportation further bolster their market position.

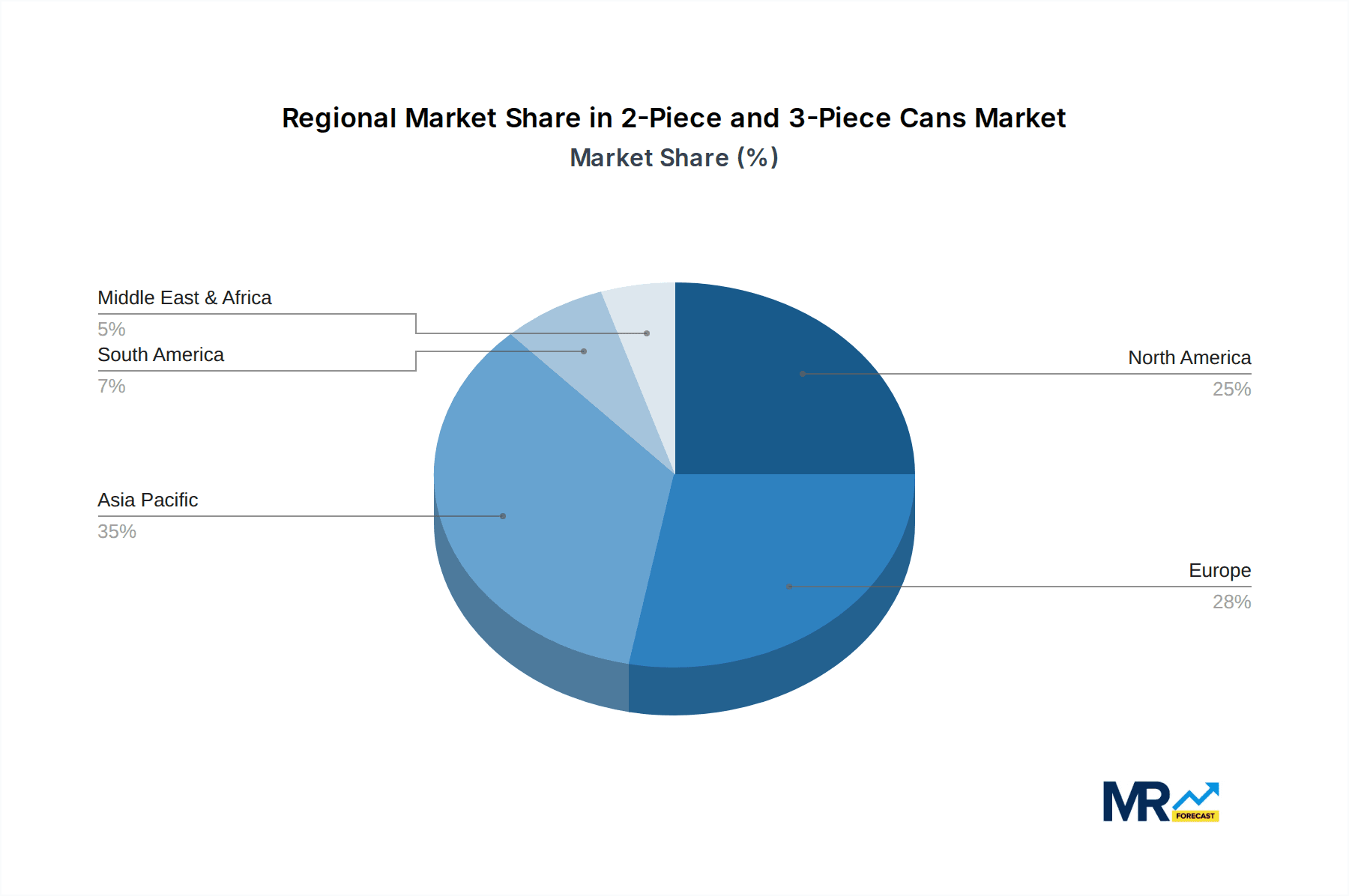

Key trends shaping the market include advancements in can manufacturing technologies that enhance efficiency and reduce production costs, alongside a growing consumer preference for recyclable packaging. The rising disposable income in emerging economies, coupled with urbanization, is also contributing to increased consumption of packaged goods, thereby fueling demand for cans. However, the market faces certain restraints, including fluctuating raw material prices, particularly for aluminum, and the increasing competition from alternative packaging formats like plastic bottles and cartons. Regulatory pressures concerning environmental sustainability and waste management also play a crucial role, pushing manufacturers towards adopting more circular economy principles. Geographically, Asia Pacific is expected to emerge as a significant growth region, driven by its large population and expanding middle class, while North America and Europe remain mature yet substantial markets due to established consumption patterns and stringent environmental regulations.

The global market for 2-piece and 3-piece cans, a critical segment of the packaging industry, is undergoing a significant transformation driven by evolving consumer preferences, technological advancements, and a growing emphasis on sustainability. During the study period of 2019-2033, with a base and estimated year of 2025, this market has witnessed dynamic shifts. Historically, from 2019 to 2024, the demand for both can types remained robust, supported by their inherent durability, barrier properties, and recyclability. However, the forecast period of 2025-2033 is expected to see a more nuanced growth trajectory. 2-piece cans, characterized by their seamless construction formed through drawing and ironing processes, are gaining traction, particularly in the beverage sector. Their production efficiency, lighter weight, and aesthetic appeal contribute to their rising popularity. The global production of 2-piece cans is projected to exceed USD 60 billion by 2025. Conversely, 3-piece cans, traditionally manufactured by forming a body cylinder, seaming a bottom end, and then attaching a top end, continue to hold a significant market share, especially in food packaging applications such as canned fruits, vegetables, and pet food. The established infrastructure and suitability for a wider range of product chemistries ensure their continued relevance. The global market for 3-piece cans is estimated to reach USD 45 billion by 2025.

The industry is experiencing a notable shift towards lighter-weight cans to reduce material costs and transportation emissions, benefiting 2-piece can designs. Furthermore, advancements in printing and decoration techniques are enhancing the visual appeal of both can types, enabling brands to create more engaging packaging. The integration of smart packaging solutions, such as QR codes for traceability and interactive content, is also beginning to influence market dynamics. While aluminum remains the dominant material for 2-piece beverage cans, steel continues to be a primary material for 3-piece cans, particularly in food applications, due to its robustness and cost-effectiveness. Emerging trends also include the development of enhanced barrier coatings for 3-piece cans to extend shelf life and preserve product integrity. The overall market value for both 2-piece and 3-piece cans is anticipated to surpass USD 105 billion by 2025, reflecting a steady growth driven by these multifaceted trends and industry innovations. The continuous evolution of manufacturing processes, focusing on energy efficiency and waste reduction, further shapes the landscape, positioning the can packaging industry for sustained relevance in the coming years.

Several powerful forces are driving the sustained growth and evolution of the 2-piece and 3-piece cans market. Paramount among these is the ever-increasing global demand for convenient and portable packaging solutions across a spectrum of applications. Consumers, leading increasingly busy lifestyles, seek products that are easy to open, consume, and dispose of, a need that both 2-piece and 3-piece cans effectively fulfill. The beverage industry, in particular, is a major driver, with the immense popularity of carbonated soft drinks, energy drinks, and ready-to-drink beverages consistently fueling the demand for aluminum beverage cans, predominantly the 2-piece variety, which offers optimal performance and aesthetic appeal. Similarly, the food packaging sector continues to rely heavily on the robust and protective qualities of both 2-piece and 3-piece cans for preserving a wide array of products, from fruits and vegetables to processed meats and pet food, ensuring product safety and extending shelf life, contributing to an estimated global food packaging can market value of over USD 25 billion.

Beyond convenience, the inherent sustainability attributes of metal cans are a significant growth catalyst. Both aluminum and steel are highly recyclable materials, and the circular economy initiatives being promoted globally are greatly benefiting the metal packaging sector. Consumers are increasingly making purchasing decisions based on environmental consciousness, and the high recycling rates of metal cans make them an attractive option. The development of lighter-weight cans, a key innovation particularly in the 2-piece segment, further enhances their sustainability profile by reducing material usage and transportation-related carbon emissions. Furthermore, technological advancements in manufacturing processes are leading to improved efficiency, reduced production costs, and enhanced product quality, making cans a more competitive packaging choice. This includes innovations in deep drawing, necking, and end-making technologies that allow for more intricate designs and optimized material usage. The chemical packing segment, though smaller, also contributes to demand, with cans offering excellent protection against corrosion and chemical degradation for a variety of industrial and household products, estimated at USD 5 billion in market value.

Despite the robust growth drivers, the 2-piece and 3-piece cans market is not without its challenges and restraints that could temper its expansion. One of the most significant hurdles is the intense competition from alternative packaging materials, particularly flexible packaging and rigid plastic containers. These alternatives often boast lower material costs, greater design flexibility, and perceived lighter weight, posing a constant threat, especially in segments where the premium on recyclability and durability is less pronounced. The fluctuating prices of raw materials, primarily aluminum and steel, also present a considerable challenge for can manufacturers. Volatility in global commodity markets can significantly impact production costs and profit margins, necessitating careful price management and hedging strategies. The market for 2-piece and 3-piece cans, valued at over USD 105 billion in 2025, is susceptible to these price swings.

Furthermore, stringent environmental regulations and evolving waste management policies in various regions can impose additional operational costs and compliance burdens on manufacturers. While metal cans are highly recyclable, the infrastructure for collection and reprocessing needs continuous improvement to maximize their circularity potential. The capital-intensive nature of establishing and maintaining modern can manufacturing facilities also acts as a restraint, particularly for smaller players looking to enter the market. The development and adoption of new technologies, while a driver, also requires substantial investment. Moreover, certain product categories might face specific challenges. For instance, in the chemical packing segment, the need for highly specialized linings and coatings to handle corrosive or sensitive substances can add complexity and cost. The perception of energy consumption during the manufacturing of metal cans, although often offset by their recyclability, can also be a point of contention for some environmentally conscious consumers and brands. The global production of 3-piece cans, estimated at USD 45 billion in 2025, is particularly sensitive to steel price fluctuations.

The global landscape of the 2-piece and 3-piece cans market is characterized by significant regional dominance and segment specialization. Among the key regions, Asia Pacific is poised to emerge as the most dominant force, driven by its burgeoning population, rapid industrialization, and expanding middle class. Countries like China, India, and Southeast Asian nations are witnessing substantial growth in demand for packaged goods across food, beverages, and chemicals. China, in particular, is a powerhouse in both production and consumption, with its vast manufacturing capabilities and a massive domestic market. The World 2-Piece and 3-Piece Cans Production in this region is expected to represent a substantial portion of the global output, exceeding USD 35 billion by 2025. The increasing adoption of western consumption patterns, coupled with a growing preference for convenient and safe packaging, further bolsters the demand for cans in this region.

Within the segments, Beverage Packaging is anticipated to be the undisputed leader, driven by the immense and ever-growing global thirst for beverages. This segment encompasses a vast array of products, including carbonated soft drinks, beer, energy drinks, juices, and ready-to-drink teas and coffees. The 2-piece aluminum can, with its inherent advantages of being lightweight, infinitely recyclable, and offering excellent product protection and brand display capabilities, is the preferred choice for most beverage applications. The global beverage can market alone is projected to be worth over USD 70 billion by 2025. The convenience and portability of cans make them ideal for on-the-go consumption, aligning perfectly with modern lifestyles. The continuous innovation in can designs, such as sleek designs and extended shelf-life coatings, further strengthens the dominance of this segment.

While Beverage Packaging leads, Food Packaging remains a critical and sizable segment, particularly for 3-piece cans and to some extent, 2-piece cans for specific applications. The demand for preserved foods, ready-to-eat meals, pet food, and culinary ingredients ensures a steady consumption of cans. Steel cans, with their superior strength and cost-effectiveness for larger volumes and a wider range of food products, continue to hold their ground. The global food packaging can market is estimated to be over USD 25 billion. The emphasis on food safety, extended shelf life, and convenient storage solutions by consumers and food manufacturers alike solidifies the position of this segment.

Several key factors are acting as potent growth catalysts for the 2-piece and 3-piece cans industry. The escalating global population and urbanization trends are directly translating into increased demand for packaged goods across all applications, from beverages to food and chemicals. Furthermore, the increasing disposable incomes in emerging economies are fueling a higher consumption of branded products, many of which are packaged in cans. The unwavering consumer preference for convenience and portability, coupled with the inherent durability and safety offered by metal cans, continues to solidify their market position. Crucially, the rising environmental consciousness among consumers and the strong push towards a circular economy are major growth enablers, as metal cans are among the most recycled packaging materials globally.

This report offers a comprehensive and in-depth analysis of the global 2-piece and 3-piece cans market, providing a granular view of its dynamics from the historical period of 2019-2024 through to the forecast period of 2025-2033. With 2025 serving as the base and estimated year, the report meticulously examines market trends, driving forces, challenges, and the pivotal role of key regions and segments in shaping the industry's trajectory. It delves into the intricate details of both 2-piece and 3-piece can production, application segmentation (Food Packaging, Beverage Packaging, Chemical Packing, Others), and type segmentation. Furthermore, the report highlights the significant developments and growth catalysts that are poised to propel the industry forward, supported by an exhaustive list of leading players. The comprehensive coverage ensures stakeholders gain actionable insights into market opportunities, competitive landscapes, and future growth prospects within this vital packaging sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.2%.

Key companies in the market include Ball Corporation, Crown Holdings, Ardagh group, Toyo Seikan, Can Pack Group, Silgan Holdings Inc, Daiwa Can Company, Baosteel Packaging, ORG Technology, ShengXing Group, CPMC Holdings, Hokkan Holdings, Showa Aluminum Can Corporation, Trivium Packaging, United Can (Great China Metal), Kingcan Holdings, Jiamei Food Packaging, Jiyuan Packaging Holdings, .

The market segments include Application, Type.

The market size is estimated to be USD 45 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "2-Piece and 3-Piece Cans," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 2-Piece and 3-Piece Cans, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.