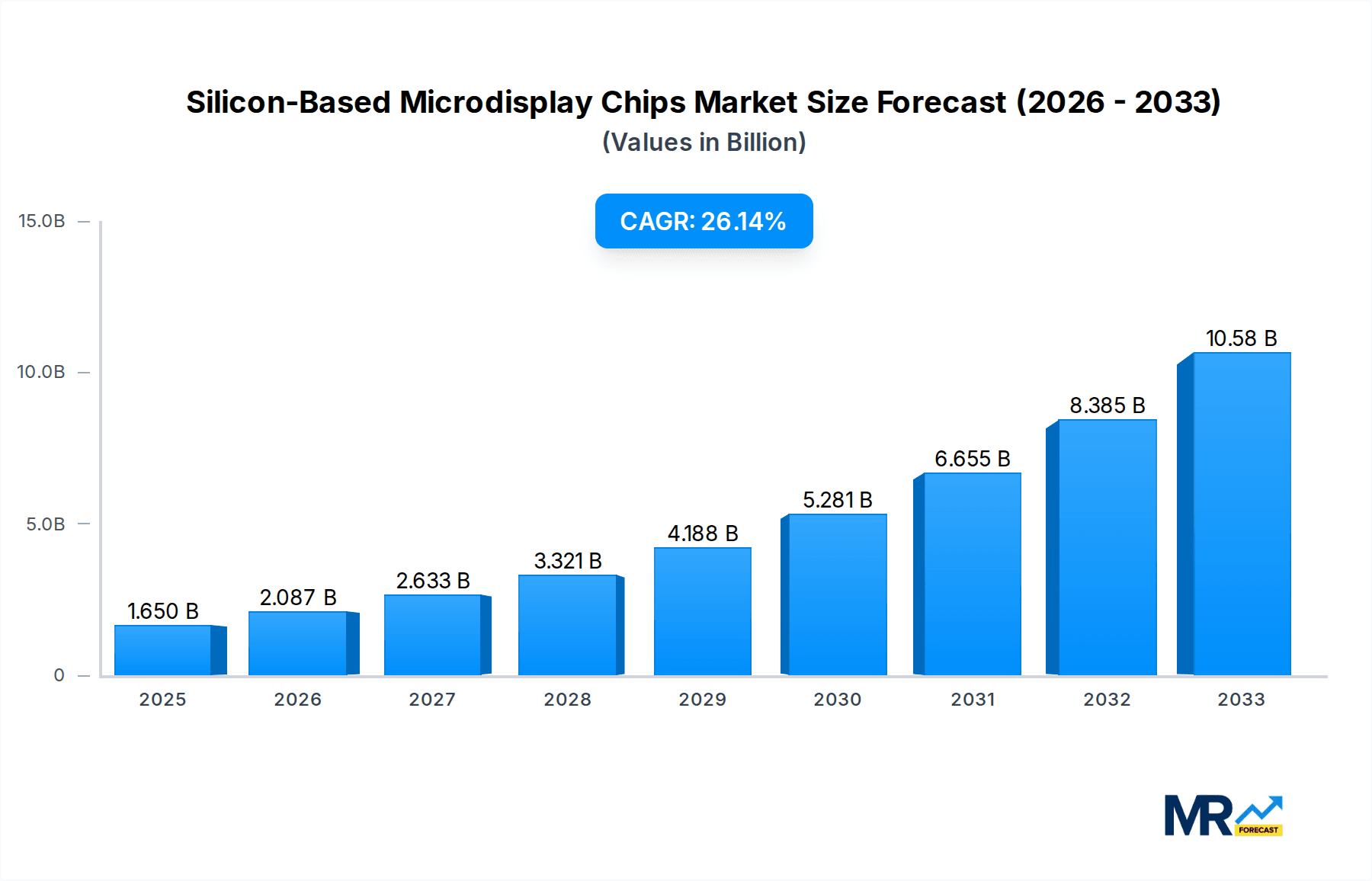

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silicon-Based Microdisplay Chips?

The projected CAGR is approximately 26.4%.

Silicon-Based Microdisplay Chips

Silicon-Based Microdisplay ChipsSilicon-Based Microdisplay Chips by Type (LCoS, OLED, DLP, World Silicon-Based Microdisplay Chips Production ), by Application (VR/AR, Micro-Projector, Wearable Devices, Medical Devices, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global silicon-based microdisplay chips market is poised for remarkable expansion, projected to reach an estimated USD 1.65 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 26.4% anticipated throughout the forecast period of 2025-2033. This explosive growth is primarily fueled by the escalating demand for immersive technologies like Virtual Reality (VR) and Augmented Reality (AR) devices, which rely heavily on the high-resolution and miniaturization capabilities of silicon-based microdisplays. Furthermore, the burgeoning adoption of micro-projectors in smartphones, wearables, and automotive applications, alongside advancements in medical imaging and diagnostic equipment, are significant growth catalysts. Innovations in LCoS (Liquid Crystal on Silicon) and OLED (Organic Light-Emitting Diode) technologies are continuously enhancing performance, reducing power consumption, and driving down costs, making these microdisplay chips increasingly accessible and attractive for a wider range of consumer and industrial applications. The market's trajectory is also influenced by the ongoing miniaturization trend in electronics, pushing for smaller, more efficient display solutions.

Despite the overwhelmingly positive outlook, certain factors could temper the market's full potential. The high initial investment costs associated with advanced manufacturing facilities for silicon-based microdisplay chips can pose a barrier to entry for smaller players, potentially concentrating production among established giants. Additionally, while technology is advancing rapidly, challenges related to pixel density, color gamut, and power efficiency in certain applications still exist, requiring continuous research and development efforts. Nevertheless, the sheer pace of innovation, coupled with strong governmental and private sector investments in next-generation display technologies, indicates that these restraints are likely to be overcome. The competitive landscape features prominent players like Sony Semiconductor Solutions, Himax Technologies, and Texas Instruments, who are actively engaged in developing cutting-edge solutions to capture market share across diverse applications, including VR/AR, micro-projectors, wearable devices, and medical devices, with Asia Pacific, particularly China and Japan, emerging as a dominant manufacturing and consumption hub.

Here's a unique report description on Silicon-Based Microdisplay Chips, incorporating the requested elements:

The global Silicon-Based Microdisplay Chips market is poised for substantial growth, projected to reach an estimated USD 7.2 billion by the end of the forecast period in 2033. The Study Period of 2019-2033, with a Base Year and Estimated Year of 2025, highlights a dynamic evolution driven by technological advancements and the expanding applications of these miniature display solutions. During the Historical Period of 2019-2024, the market witnessed significant foundational growth, fueled by early adoption in niche sectors like specialized industrial equipment and limited consumer electronics. However, the Forecast Period of 2025-2033 signals an inflection point, where widespread adoption across consumer, enterprise, and medical sectors will become the norm.

A key trend shaping the market is the continuous improvement in display resolution, brightness, and power efficiency. Manufacturers are relentlessly pushing the boundaries of pixel density, enabling crisper and more immersive visual experiences, particularly in Augmented Reality (AR) and Virtual Reality (VR) headsets. The miniaturization of components and advancements in silicon fabrication processes are enabling smaller, lighter, and more power-efficient microdisplays, which are crucial for the development of sleek and wearable devices. Furthermore, the increasing demand for high-definition content and interactive experiences across various platforms is directly translating into a greater need for advanced microdisplay technologies. The integration of these chips into a broader range of applications, from smart glasses and heads-up displays (HUDs) in automobiles to sophisticated medical imaging devices, underscores their growing importance. The interplay between innovation in display technology and the evolving needs of end-user industries is creating a fertile ground for sustained market expansion. The market's trajectory is characterized by a shift from specialized use cases to mainstream integration, driven by economies of scale and relentless product development.

The Silicon-Based Microdisplay Chips market is experiencing a powerful surge driven by an amalgamation of technological innovation and burgeoning application demands. The insatiable consumer appetite for immersive and portable digital experiences is a primary catalyst. The escalating adoption of Virtual Reality (VR) and Augmented Reality (AR) devices, for both entertainment and professional training, is creating a significant demand for high-resolution, low-latency microdisplays. As these technologies mature and become more accessible, the need for compact, power-efficient, and visually stunning displays intensifies, directly benefiting the silicon-based microdisplay sector. Beyond consumer electronics, the integration of microdisplays into smart wearables, medical devices, and advanced automotive HUDs further propels market growth. The ability of these chips to deliver bright, clear images in compact form factors makes them indispensable for next-generation portable and integrated technological solutions.

Despite the robust growth trajectory, the Silicon-Based Microdisplay Chips market faces several hurdles that could temper its expansion. One of the most significant challenges revolves around the intricate and costly manufacturing processes. The fabrication of high-performance microdisplays requires advanced semiconductor foundries and specialized techniques, leading to high initial investment and production costs. This can translate into premium pricing for end products, potentially limiting adoption in price-sensitive segments. Furthermore, achieving ultra-high resolutions while maintaining excellent brightness and color accuracy can be technically demanding, requiring ongoing research and development. Power consumption remains a critical factor, especially for battery-powered wearable devices, where maximizing display performance without draining the battery quickly is paramount. Overcoming these manufacturing complexities and optimizing power efficiency are crucial for sustained market penetration.

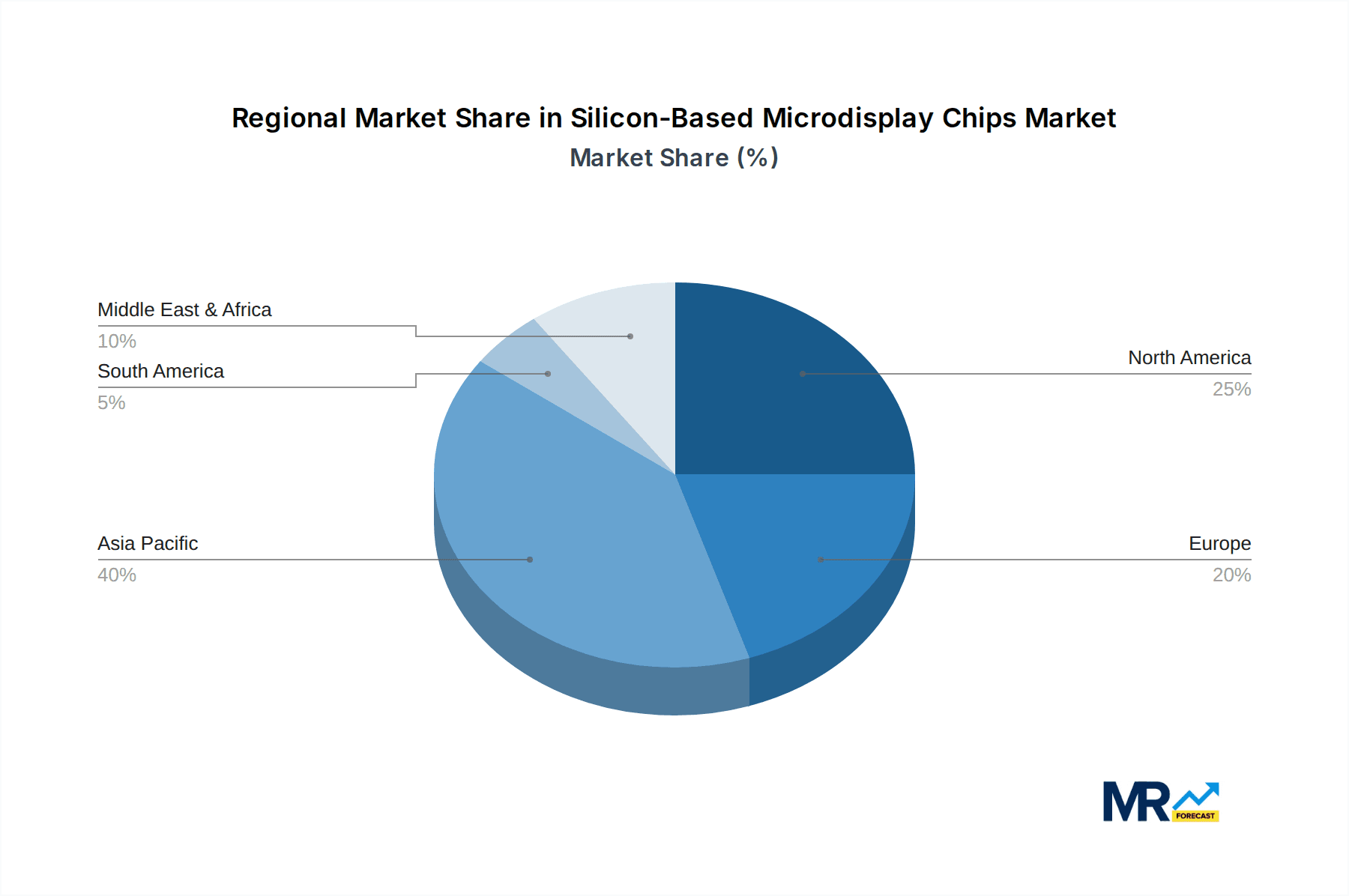

The Asia-Pacific region is emerging as a dominant force in the Silicon-Based Microdisplay Chips market, driven by its robust manufacturing capabilities, significant investments in research and development, and a rapidly growing consumer base for advanced electronic devices. Countries like China, South Korea, and Taiwan are at the forefront of silicon fabrication and display technology innovation, boasting major players and a well-established supply chain. This concentration of technological expertise and manufacturing infrastructure makes the region a critical hub for both production and consumption. The sheer volume of consumer electronics manufacturing and the increasing demand for immersive technologies like VR/AR headsets and smart wearables in this region further solidify its leading position.

Within this dynamic market, the OLED (Organic Light-Emitting Diode) segment, utilizing silicon backplanes, is poised for substantial dominance. OLED technology offers superior contrast ratios, true blacks, faster response times, and greater power efficiency compared to other microdisplay types. This makes it exceptionally well-suited for the demanding requirements of VR/AR applications, where visual fidelity and reduced motion blur are paramount for an immersive experience. The development of advanced silicon backplanes for OLEDs allows for higher pixel densities and improved drive circuitry, further enhancing their appeal.

The synergy between the manufacturing prowess of Asia-Pacific and the inherent advantages of OLED technology, particularly for high-growth applications like VR/AR, positions this region and segment for sustained market leadership throughout the forecast period.

The Silicon-Based Microdisplay Chips industry is experiencing robust growth, significantly fueled by the rapid advancements in Virtual Reality (VR) and Augmented Reality (AR) technologies. The increasing demand for immersive gaming, enhanced training simulations, and novel forms of digital interaction is creating a substantial market for high-resolution, power-efficient microdisplays. Furthermore, the miniaturization trend across consumer electronics, particularly in wearable devices like smart glasses and advanced smartwatches, necessitates compact and sophisticated display solutions that silicon-based microdisplays readily provide. The burgeoning adoption of micro-projectors in smartphones, portable projectors, and automotive heads-up displays (HUDs) also acts as a strong growth catalyst, expanding the application landscape.

This comprehensive report provides an in-depth analysis of the global Silicon-Based Microdisplay Chips market, encompassing detailed insights into market dynamics, technological trends, and competitive landscapes. It offers critical data from 2019 to 2033, with a specific focus on the Base Year of 2025 and the Forecast Period of 2025-2033. The report delves into the driving forces behind market expansion, such as the burgeoning demand from VR/AR applications and the miniaturization of wearable devices. Simultaneously, it addresses the prevailing challenges, including manufacturing complexities and power consumption concerns, providing a balanced perspective. The analysis extends to identifying key regional players and dominant segments, offering actionable intelligence for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 26.4%.

Key companies in the market include Sony Semiconductor Solutions, Himax Technologies, Texas Instruments (TI), Kopin, eMagin, OmniVision, HOLOEYE Photonics, Microoled, AUO, Visionox, BOE Technology, Hongshi Intelligence Tech, VIEWTRIX Technology, Nanjing SmartVision Electronics.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Silicon-Based Microdisplay Chips," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Silicon-Based Microdisplay Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.