1. What is the projected Compound Annual Growth Rate (CAGR) of the Paper Packaging Box for Food?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Paper Packaging Box for Food

Paper Packaging Box for FoodPaper Packaging Box for Food by Type (Grease Resistant, Kraft Paper, Laminated, Coated Papers, Wax Impregnated, Others), by Application (Bakery Products, Fruit and Vegetable, Fast food, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

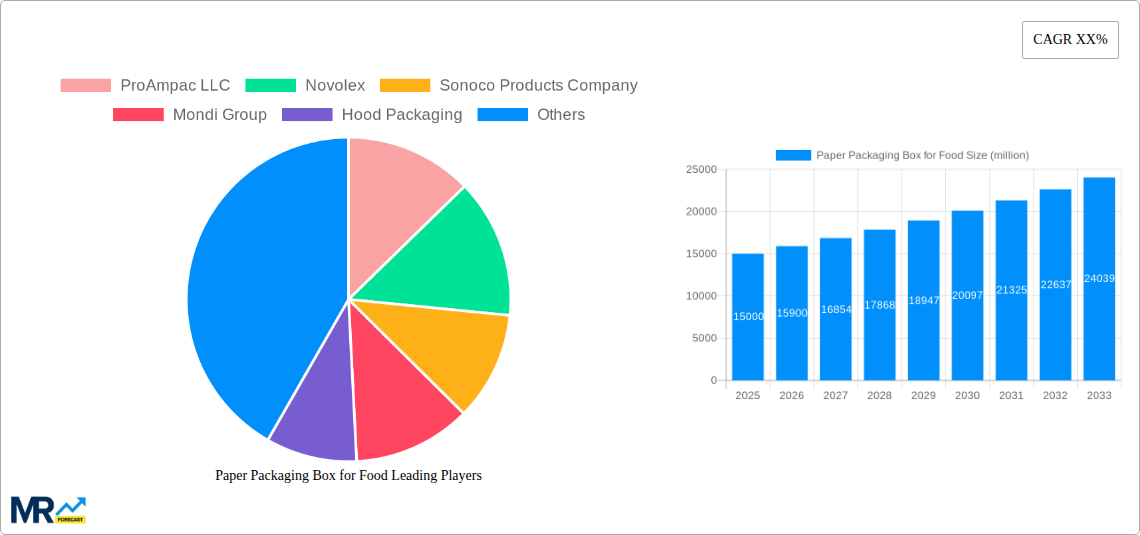

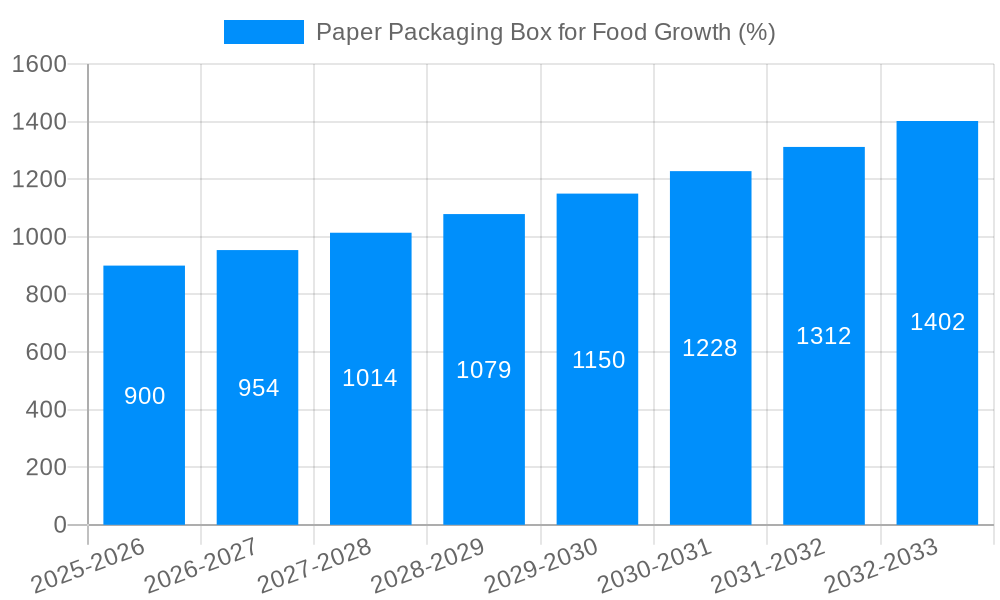

The global Paper Packaging Box for Food market is poised for significant expansion, estimated at $35,000 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This robust growth is primarily fueled by the escalating demand for convenient and sustainable food packaging solutions. Consumers and businesses alike are increasingly prioritizing eco-friendly alternatives to plastic, driving innovation in paper-based packaging. Key segments like Grease Resistant and Kraft Paper are witnessing substantial adoption, owing to their superior performance in protecting food products and their inherent biodegradability. The application sector for Bakery Products and Fast Food is a major contributor to market revenue, reflecting the widespread use of paper packaging in these food service industries. Emerging economies, particularly in the Asia Pacific region, are expected to exhibit the highest growth rates due to rapid urbanization, increasing disposable incomes, and a growing awareness of environmental concerns.

Despite the overwhelmingly positive outlook, certain factors could temper the market's pace. Fluctuations in raw material prices, such as the cost of paper pulp, can impact profit margins for manufacturers. Additionally, stringent regulations concerning food contact materials, while ensuring safety, can add to production costs and necessitate continuous product development. However, the overarching trend towards sustainability and the inherent recyclability of paper packaging continue to outweigh these challenges. Technological advancements in coatings and barrier properties are also enhancing the functionality of paper packaging, enabling it to compete effectively with conventional materials. Companies are actively investing in research and development to create innovative, high-performance paper packaging solutions that meet the diverse needs of the food industry. The market is characterized by intense competition, with established players and new entrants vying for market share through product differentiation and strategic partnerships.

This comprehensive report delves into the intricate landscape of the Paper Packaging Box for Food market, offering a granular analysis of its trajectory from the historical period of 2019-2024, through the base and estimated year of 2025, and extending into the forecast period of 2025-2033. With a meticulous examination of key industry players, evolving trends, driving forces, and inherent challenges, this report provides a 360-degree view of this dynamic sector. Utilizing a robust data-driven approach, the report quantifies market values in the millions, providing actionable insights for stakeholders seeking to navigate and capitalize on opportunities within this burgeoning market. The report's scope encompasses diverse segments such as Grease Resistant, Kraft Paper, Laminated, Coated Papers, Wax Impregnated, and Others for Type, alongside applications including Bakery Products, Fruit and Vegetable, Fast food, and Others.

The global Paper Packaging Box for Food market is experiencing a transformative era, driven by a confluence of consumer preferences, regulatory shifts, and technological advancements, projected to reach multi-million dollar valuations. A paramount trend is the unwavering surge in demand for sustainable and eco-friendly packaging solutions. Consumers are increasingly discerning, actively seeking out brands that align with their environmental values, leading to a significant preference for paper-based packaging over its plastic counterparts. This heightened environmental consciousness is not merely a consumer fad but is deeply ingrained in purchasing decisions, compelling manufacturers to invest heavily in recyclable, compostable, and biodegradable paper packaging options. The report anticipates that this trend will continue to be a dominant force throughout the study period of 2019-2033. Furthermore, the convenience and portability offered by paper packaging boxes are proving instrumental in their widespread adoption, particularly within the rapidly expanding food delivery and takeaway sectors. As food service providers strive to enhance customer experience, the design and functionality of these boxes are being re-imagined. Innovations are focusing on lightweight yet robust constructions, improved sealing mechanisms to maintain food freshness and prevent leakage, and aesthetically pleasing designs that contribute to brand visibility. The study highlights a significant upward trajectory for ‘Kraft Paper’ as a favored material due to its natural aesthetic and inherent strength, coupled with a growing interest in ‘Grease Resistant’ coatings that enhance functionality for a wider range of food products without compromising on sustainability. The integration of smart packaging technologies, though nascent, is another emerging trend, with potential for QR codes and other digital integrations to provide consumers with product information, traceability, and even interactive experiences. This evolving landscape signifies a market ripe with innovation, where the paper packaging box for food is no longer just a container but a crucial element of the brand proposition and a testament to a commitment to a greener future. The estimated market size in 2025 underscores the substantial current value and the projected growth indicates a robust expansion over the forecast period of 2025-2033. The historical data from 2019-2024 provides the foundational understanding of the market's evolution.

The paper packaging box for food market is being propelled by a potent combination of societal shifts and industry imperatives. Foremost among these is the escalating global awareness regarding environmental sustainability. As concerns over plastic pollution intensify, regulatory bodies worldwide are implementing stricter policies to curb single-use plastics, thereby creating a significant tailwind for paper-based alternatives. This regulatory push, coupled with growing consumer demand for eco-conscious products, is compelling food manufacturers and retailers to pivot towards paper packaging. The report underscores that this fundamental shift is a primary driver for the multi-million dollar market growth anticipated from 2019 to 2033. Another significant propellant is the burgeoning food service industry, particularly the rapid expansion of online food delivery and the takeaway segment. These sectors rely heavily on convenient, functional, and presentable packaging solutions that can withstand transit and maintain food quality. Paper packaging boxes, with their inherent strengths in durability and customizability, are perfectly positioned to cater to these evolving needs. The convenience factor extends beyond delivery; consumers also value easy-to-handle and disposable packaging for on-the-go consumption. Furthermore, the growing trend towards artisanal and premium food products is also influencing the packaging choices. Brands are leveraging paper boxes to convey a sense of quality, naturalness, and craftsmanship, thereby enhancing their brand perception and market appeal. The increasing disposable income in emerging economies is also contributing to a rise in demand for packaged food, further fueling the growth of the paper packaging box market.

Despite the robust growth trajectory, the paper packaging box for food market is not without its hurdles. A primary challenge lies in the inherent limitations of paper in certain applications, particularly concerning its barrier properties against moisture and grease. While advancements in coatings and laminations are continuously being made, some food products with high oil content or extended shelf-life requirements might still necessitate alternative packaging materials or advanced paper treatments, thus limiting the universal applicability of standard paper boxes. This constraint is particularly relevant for segments like 'Laminated' and 'Wax Impregnated' papers, where performance needs to be carefully balanced with environmental considerations. The cost of raw materials, especially high-quality virgin pulp, can be subject to significant price fluctuations influenced by global supply and demand dynamics, as well as geopolitical factors. These cost volatilities can impact the profitability of packaging manufacturers and, consequently, the price competitiveness of paper boxes compared to certain plastic alternatives, presenting a restraint on market expansion, especially in price-sensitive segments. Moreover, the infrastructure for effective paper recycling and waste management varies significantly across regions. While paper is generally recyclable, inconsistent collection systems and contamination issues can hinder efficient recycling, potentially impacting the perceived sustainability of paper packaging in some areas. The report acknowledges that overcoming these logistical and infrastructural challenges is crucial for the long-term success and widespread adoption of paper packaging solutions. The need for specialized machinery and processes to produce certain types of paper packaging can also pose a barrier to entry for smaller manufacturers, leading to market consolidation.

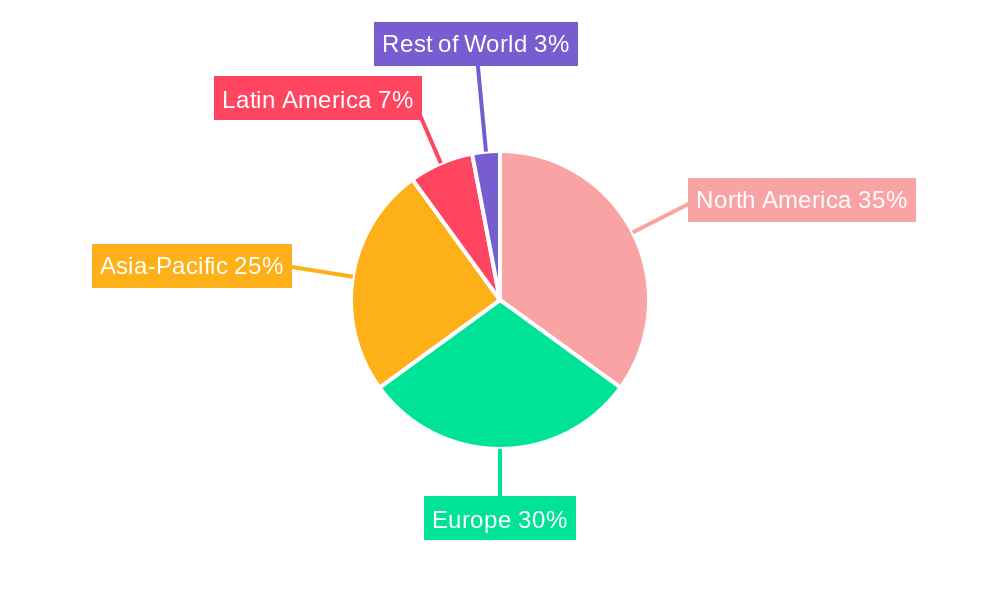

The global Paper Packaging Box for Food market is poised for significant growth, with certain regions and segments exhibiting a pronounced dominance. North America is expected to emerge as a key region, driven by a mature and environmentally conscious consumer base, coupled with stringent regulations against single-use plastics. The strong presence of major food manufacturers and a well-established food service industry, including a substantial fast-food and delivery sector, significantly contributes to this dominance. The demand for convenient and sustainable packaging in Bakery Products and Fast food applications within North America is projected to be exceptionally high, making these segments particularly influential. The region's focus on innovation in biodegradable and compostable packaging further solidifies its leading position.

Concurrently, Europe is another critical region exhibiting strong market performance. Driven by aggressive environmental policies and a deeply ingrained consumer preference for sustainable products, Europe is at the forefront of adopting paper-based packaging solutions. The region's commitment to circular economy principles encourages the use of recyclable and reusable materials, with a particular emphasis on paper packaging for various food applications, including Fruit and Vegetable packaging, where its breathable nature is advantageous. The robust presence of a diverse food industry, from artisanal producers to large-scale manufacturers, further bolsters demand.

Focusing on dominant segments within the Type category, Kraft Paper is anticipated to witness substantial growth and market share. Its inherent strength, natural aesthetic, and perceived eco-friendliness make it a preferred choice for a wide array of food products. The demand for Kraft Paper boxes for artisanal baked goods, organic produce, and premium fast-food offerings is particularly strong. Its versatility allows for excellent printability, enabling brands to showcase their identity effectively.

Another segment expected to dominate is Grease Resistant paper packaging. As the food industry increasingly relies on paper solutions for products with higher fat content, such as fried foods and certain baked goods, the demand for effective grease-resistant coatings and treatments is escalating. Manufacturers are investing in innovative solutions that provide superior grease barrier properties without compromising the recyclability or compostability of the packaging. This is crucial for the sustained growth of the Fast food and Bakery Products application segments.

The Coated Papers segment also plays a pivotal role. These papers offer enhanced functionality, including improved printability, gloss, and a degree of moisture and grease resistance, making them suitable for a broader range of food items. The ability to customize the coating for specific product needs without sacrificing sustainability is a key driver for this segment's dominance.

In terms of Application, Bakery Products and Fast food are projected to be the leading application segments. The increasing popularity of meal kits, home baking trends, and the ever-expanding fast-food delivery market all rely heavily on the convenience, disposability, and aesthetic appeal offered by paper packaging boxes. The ability of paper boxes to be branded and designed to enhance the customer experience further solidifies their dominance in these areas. The projected market values for these segments reflect their substantial contribution to the overall paper packaging box for food market size during the study period of 2019-2033.

The growth catalysts in the paper packaging box for food industry are multifaceted, primarily driven by the intensifying global movement towards sustainability. The increasing consumer awareness about the environmental impact of plastics has led to a significant preference for eco-friendly alternatives, directly benefiting paper packaging. Furthermore, stringent government regulations aimed at reducing plastic waste are compelling businesses to adopt more sustainable packaging solutions, creating a sustained demand. The rapid expansion of the online food delivery and takeaway sector is a critical catalyst, as these services require convenient, durable, and presentable packaging that paper boxes effectively provide. Innovations in paper technology, including advanced coatings for improved grease and moisture resistance and the development of compostable and biodegradable options, are expanding the applicability of paper packaging, further fueling its growth.

This report offers an in-depth and comprehensive analysis of the Paper Packaging Box for Food market, covering its evolution from the historical period of 2019-2024 to the projected future up to 2033. The market's value, expressed in millions, is meticulously detailed for the base year of 2025 and the subsequent forecast period. It provides a thorough examination of the driving forces, such as increasing environmental consciousness and the boom in food delivery services, that are propelling the market forward. Simultaneously, it addresses the challenges and restraints, including material limitations and cost fluctuations, that the industry faces. The report identifies key regions and dominant segments, offering a granular understanding of where and how growth is occurring, with detailed insights into segments like Grease Resistant and Kraft Paper for Type, and Bakery Products and Fast Food for Application. The growth catalysts that are shaping the future of the industry are clearly articulated, and a comprehensive list of leading players, along with their significant developments and innovations, provides strategic insights for stakeholders. This report serves as an indispensable resource for anyone seeking to understand and navigate the complex and dynamic Paper Packaging Box for Food market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ProAmpac LLC, Novolex, Sonoco Products Company, Mondi Group, Hood Packaging, Georgia-Pacific, Winpak, Smurfit Kappa Group, WestRock Company, Sealed Air, Sabert, Pactiv Evergreen, FLAIR Flexible Packaging Corporation, Stora Enso Oyj, C-P Flexible Packaging, SigmaQ, Coveris.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Paper Packaging Box for Food," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Paper Packaging Box for Food, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.